Clawback

Clawback is the recoupment of wages or bonuses previously given to a manager or executive due to malfeasance or subpar work.

Clawback is the recoupment of wages or bonuses previously given to a manager or executive due to malfeasance or subpar work. This practice serves as a deterrent against harmful behavior and aims to motivate employees to act in the company's best interests.

Clawback provisions are often included in employment contracts or compensation agreements and can take various forms.

When an employee's performance is below a predetermined threshold, some claw-back clauses allow firms to return a portion of their investment. Meanwhile, moral or legal transgressions like insider trading or accounting fraud trigger others.

The Securities and Exchange Commission has also implemented several regulations, one of which would oblige publicly listed corporations to establish guidelines allowing them to recoup incentive-based compensation from senior officers who engage in misconduct resulting in financial restatements.

Certain groups have criticized the proposed regulation, saying that putting it into effect would be too challenging and complicated.

For instance, some CEOs might be reluctant to take chances or make courageous judgments if they worry that their pay will be withheld in the case of failure. This may inhibit innovation and make it harder for a business to compete.

Another concern is that these provisions may unfairly punish employees not involved in the misconduct or inferior performance that triggered the provision.

Even people who did not participate in the crime but earned remuneration based on incentives during that period might be vulnerable to such a clause.

However, despite these criticisms, many advocates of these provisions argue that they are a crucial tool for promoting accountability and restoring investor confidence.

They cite several notable instances where claw-back clauses were effectively used, such as the recovery of more than $ 180 million in salary from officials at Fannie Mae and Freddie Mac after their government takeover.

Clawback clauses are becoming more typical in financial institutions and other sectors like technology and healthcare.

The Affordable Care Act contains a provision that permits the government to recover overpayments made to healthcare providers, and some IT companies have put provisions in place that let them recover stock options or incentives from departing workers.

Clawback provisions are a controversial but increasingly common tool for promoting accountability and preventing misconduct in the financial industry and beyond.

While some contend they are excessively punitive and can stifle innovation, others think they are crucial for ensuring that executives and employees act in the company's and its stakeholders' best interests.

Discussions regarding the effectiveness of claw-back provisions and their unintended consequences are expected to persist as their usage continues to expand.

- Clawback provisions allow for recovering previously paid compensation or benefits in certain circumstances, such as misconduct or poor performance.

- They typically apply to incentive-based compensation, such as bonuses and stock options, received by senior executives and key employees.

- Clawback provisions can help align the interests of employees with those of the company and its shareholders.

- They promote accountability and discourage misconduct or poor performance.

- Critics argue that claw-back provisions can be challenging to enforce and may have overly punitive effects. They may also discourage risk-taking and impede innovation.

- Laws and regulations, such as the Dodd-Frank Act and SEC rules, govern claw-back provisions.

- A court decision invalidated the SEC's attempt to adopt rules requiring claw-backs of incentive-based compensation, but disclosure requirements for claw-back policies and practices are being proposed.

- Companies may adopt claw-back provisions in their employment agreements or compensation plans.

- The ongoing focus on corporate governance and accountability emphasizes the importance of claw-back provisions in ensuring responsible behavior.

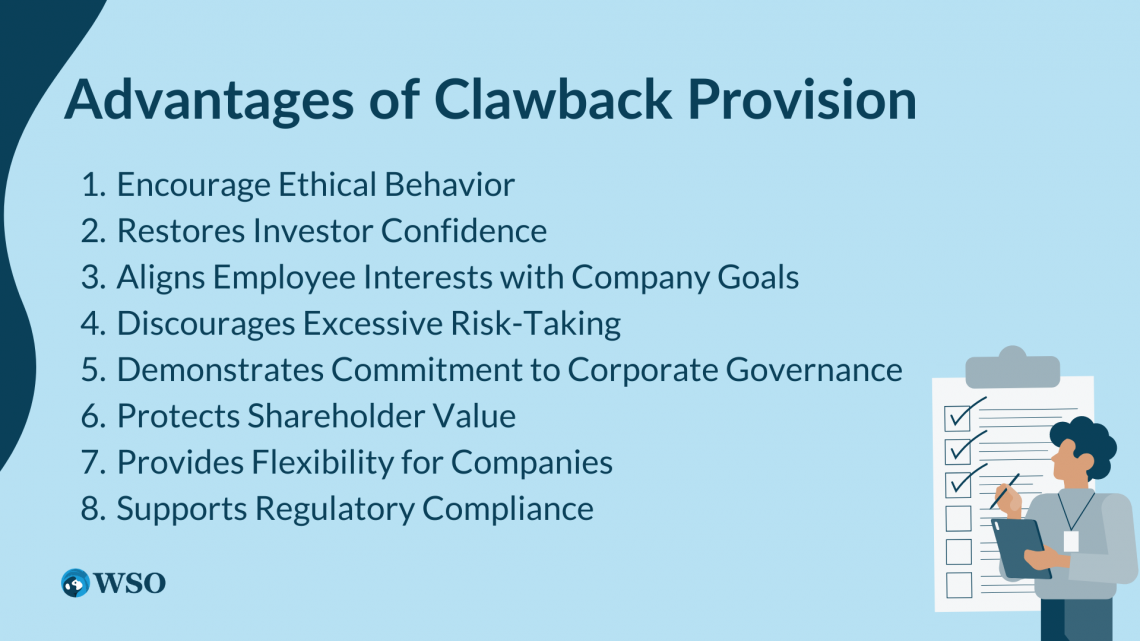

Advantages of Clawback Provision

Clawback provisions have become increasingly common in the financial industry and other industries and are a tool for promoting accountability and preventing misconduct. While these provisions are criticized, their use also has several advantages.

1. Encourage Ethical Behavior

Clawback provisions incentivize employees to act in the company's best interest by linking compensation to ethical behavior and performance.

2. Restores Investor Confidence

They can also restore investor confidence in a company. For example, investors are more inclined to believe in a business implementing measures to deter wrongdoing and hold staff accountable. This can lead to increased investment and support for the company.

3. Aligns Employee Interests with Company Goals

They can help align employee interests with the company's goals. For example, tying compensation to performance and behavior aligns employee interests with the company's objectives, encouraging employees to work towards achieving those goals.

4. Discourages Excessive Risk-Taking

They can also discourage excessive risk-taking by employees. For example, employees may be more careful in their decision-making if they know that their pay may be returned in the case of failure or wrongdoing.

By doing this, the business may avoid taking on unnecessary risks that could cost it money or hurt its reputation.

5. Demonstrates Commitment to Corporate Governance

Implementing such provisions demonstrates a company's commitment to corporate governance.

It shows that the company is serious about preventing misconduct and holding employees accountable for their actions. This can help attract investors and customers who value ethical behavior and corporate responsibility.

6. Protects Shareholder Value

These provisions can also protect shareholder value. For example, a company's stockholders may suffer large losses if it is compelled to restate its financial accounts due to malfeasance.

These provisions can help recover some losses by reclaiming compensation from employees responsible for the misconduct.

7. Provides Flexibility for Companies

These clauses can be tailored to a company's needs, allowing for customization and risk management. For instance, a business can impose a clause only for specific executives or staff members. This gives the business the ability to handle any potential risks or problems.

8. Supports Regulatory Compliance

Clawback provisions can also support regulatory compliance.

Dodd-Frank Act, the Wall Street Reform, and Consumer Protection Act require public firms to set up systems that allow them to recover incentive-based pay from senior officials in the event of a financial restatement brought on by fraud.

By implementing these provisions, companies can ensure they comply with applicable regulations.

Disadvantages of Clawback Provision

While there are advantages to using these provisions, there are also several criticisms of their implementation. These criticisms primarily center around issues of fairness, effectiveness, and practicality.

1. Unfair to Employees

One of the main criticisms of such provisions is that they can be unfair to employees. These provisions allow companies to reclaim compensation from employees responsible for misconduct, even if the misconduct was committed unknowingly or by someone else.

Employees who may not have known about the misbehavior or who may not have been directly at fault may be punished.

2. Difficulty in Enforcement

These provisions can also be difficult to enforce. Identifying the wrongdoer and determining the extent of their liability could be challenging.

This may lead to arguments regarding using these provisions between employers and workers, which may be time-consuming and expensive.

3. Effectiveness in Preventing Misconduct

Another criticism of these provisions is their effectiveness in preventing misconduct. However, they may not necessarily prevent misconduct, as employees may still engage in unethical behavior even if they know their compensation can be reclaimed.

4. Limited Scope

They may have a limited scope, as they only apply to specific types of compensation, such as bonuses or stock options.

This can incentivize employees to focus on these specific types of compensation and neglect other aspects of their job. Additionally, such provisions may only apply to some employees, which can create disparities in the organization's accountability level.

5. Inconsistent Application

They may also need to be more consistently applied. Companies may be selective in enforcing such provisions, which can create perceptions of unfairness among employees and investors.

Different companies may have different provisions, creating confusion and inconsistency across the industry.

6. Effects on Hiring and Retention

They may also impact recruitment and retention, as individuals may be reluctant to work for companies implementing such provisions as they may perceive them as punitive and unfair.

7. Administrative Costs

Finally, implementing and enforcing provisions can be costly and time-consuming. As a result, companies may need to invest in additional resources, such as legal or accounting staff, to manage these provisions.

To assess the severity of the misbehavior and the proper amount of pay that should be withheld, businesses may also need to undertake audits and investigations.

SEC's Proposed Rules on Clawback Provisions

The Securities and Exchange Commission proposed regulations in 2015 that would mandate the use of clawback provisions by publicly listed corporations.

These regulations were designed to ensure accountability and fair compensation for CEOs who engage in financial wrongdoing.

According to the proposed regulations, businesses must create plans that include senior officers who earned incentive-based pay, such as bonuses, and stock options, in the three fiscal years before the deadline for preparing an accounting restatement.

The policies would require the recovery of any excess incentive-based compensation paid to executives if the company is required to prepare an accounting restatement due to material noncompliance with financial reporting requirements.

However, the SEC's proposed rules on these provisions faced criticism from some quarters. According to some, the new regulations were excessively broad and would unfairly punish CEOs not involved in financial malfeasance.

Others countered that the new regulations would be challenging to implement, resulting in high business administrative expenses.

The proposed rules were also subject to legal challenges. The court held that the Dodd-Frank Act authorized the SEC to adopt rules requiring clap back of incentive-based compensation only in cases where executives had engaged in misconduct.

Following the court's decision, the SEC had several options: appeal the ruling, revise the proposed rules to address the court's concerns, or abandon the rules altogether.

In 2018, the SEC announced that it would not appeal the court's ruling and would instead concentrate on other steps to enhance corporate transparency and governance. For example, the SEC suggested new regulations in 2019 that would mandate that businesses publish their plans and procedures.

Under the proposed regulations, companies will have to reveal if they have a policy, its broad parameters, and any measures taken in accordance with it during the most recent fiscal year under the proposed regulations.

The proposed rules would also require companies to disclose the amount of excess compensation clawed back, if any.

The SEC's proposed rules on these provisions reflect the agency's ongoing efforts to improve corporate governance and accountability.

While the SEC's previous attempt to pass regulations requiring claw-back of incentive-based pay was unsuccessful, the proposed regulations on disclosure aim to increase transparency and accountability in executive compensation.

By enhancing transparency and providing stakeholders with information about claw-back policies and practices, the SEC aims to promote greater accountability and responsible behavior in corporate settings.

Clawback Provision FAQ

Bonuses, stock options, and other types of incentive-based remuneration are frequently subject to clauses.

These provisions typically apply to senior executives and key employees who receive significant incentive-based compensation. Board of Director members may also be subject to them.

Various events, such as financial restatements, accounting errors, or fraudulent activity, may trigger provisions. They may also be triggered by deficient performance or other types of misconduct.

These provisions can help to align the interests of executives and other employees with those of the company and its shareholders. They can also help to promote accountability and discourage misconduct or deficient performance.

Critics of such provisions argue that they can be difficult to enforce and may be overly punitive. They may discourage executives and employees from taking risks or pursuing ambitious goals.

The Dodd-Frank Act and SEC rules, among other laws and regulations, control these clauses.

Although the SEC's attempt to pass regulations requiring incentive-based pay was unsuccessful, the agency's proposed regulations on disclosure of policies and practices may increase executive compensation's transparency and accountability.

Companies may also adopt provisions as part of their employment agreements or compensation plans.

or Want to Sign up with your social account?