Common Equity Tier 1 (CET1)

It is the highest form of regulatory capital and immediately absorbs losses when they occur.

What Is Common Equity Tier 1 (CET1)?

Common Equity Tier 1 Capital is a new term coined after the Basel III accords were implemented, a mitigating measure after the financial crisis resolved itself. More specifically, in 2014, regulators could better impose and define what banks would need to hold.

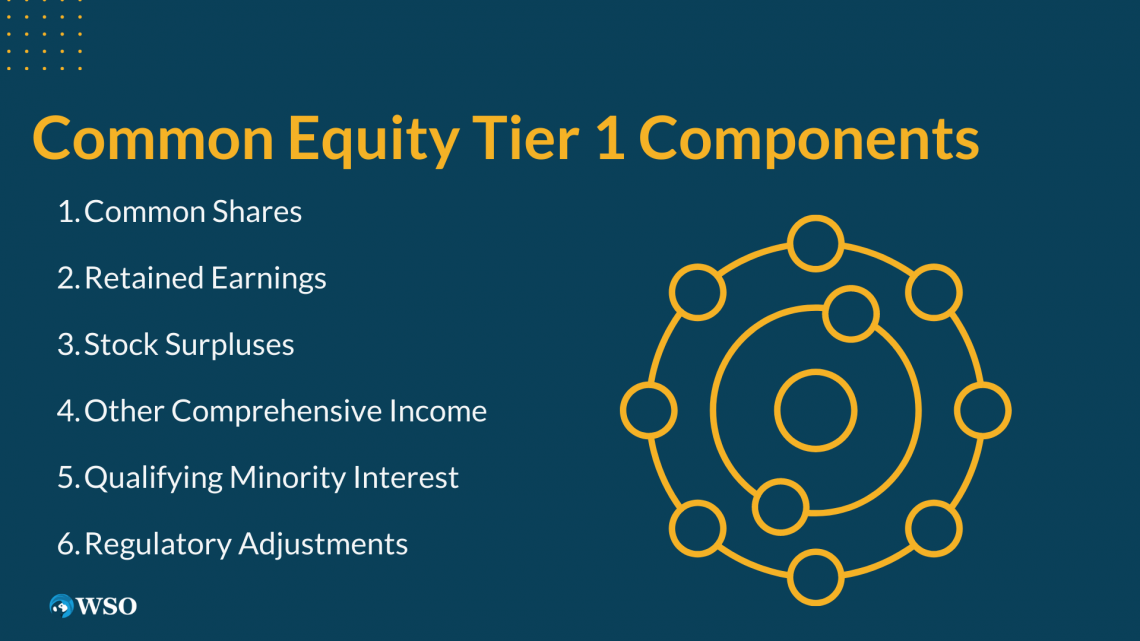

Common Equity Tier 1(CET1) and Additional Tier 1 (AT1) capital are part of ‘going concern’ Tier 1 Bank Capital. This comprises:

- Common equity

- Retained earnings

- Stock surpluses

- Other comprehensive income

- Qualifying minority interest

- Regulatory adjustments

As part of Basel III, banks must have more than 4.5% of CET1 in their reserves. Along with AT1 and another type of capital (Tier 2 Capital), they make up regulatory capital that banks are required to keep as a result of the accord.

CET1 is important as this is the highest form of regulatory capital because it absorbs losses immediately when they occur. AT1, a form of capital that does not meet all the criteria to be a CET1 capital, can only provide loss absorption on a going-concern basis.

Key Takeaways

- Common Equity Tier 1 (CET1) and Additional Tier 1 (AT1) capital are important components under the Basel III accords of Tier 1 Bank Capital.

- CET1 capital is the highest form of regulatory capital and immediately absorbs losses when they occur.

- AT1 capital provides loss absorption on a going-concern basis, supporting a bank's ability to continue operating without facing bankruptcy or liquidation.

- Basel III mandates banks to maintain CET1 capital of at least 4.5% and Tier 1 capital (CET1 + AT1) exceeding 6% of their reserves.

- Non-viability events trigger the conversion or write-off of AT1 and Tier 2 capital to absorb losses before taxpayers are exposed to them.

- CET1 capital comprises common shares, retained earnings, stock surpluses, other comprehensive income, qualifying minority interest, and regulatory adjustments.

Role and Implications of CET1 in “Going” and “Gone Concern” Capital Frameworks

“Going Concern” is an accounting term that accounts for resources required for the company to continue operating indefinitely until it can no longer sustain itself or hits bankruptcy.

Businesses will mainly be in a state of “going concern,” which is an expectation that the business will not undergo an event of bankruptcy/liquidation in the near future.

Business in the state of “gone concern” implies that the business is already in a state of liquidation or will likely enter this state soon.

Tier 1 equity (of CET1 and AT1) are both considered “going concern” capital, meaning that this would be the equity that would be impacted if the company sustains losses but has expectations that it will not undergo bankruptcy/liquidation in the near future.

Tier 2 equity is considered “gone concern” capital, meaning that the business is using tier 2 capital only to pay off losses and is expected to enter an event of bankruptcy/liquidation currently/ near future.

The Basil III regulatory accords CET1 as more than 4.5 % of the bank's capital. Along with this, tier 1 capital (CET1 +AT1) must be more than 6% of a bank's capital.

All regulatory capital (CET1+AT1+Tier 2) must be above 8%. Therefore, other types of capital (risk-weighted assets) would be 92% at a minimum.

Lastly, the point of non-viability (PoNV) is defined as a situation where banks or financial institutions experience financial stress due to insufficient liquidity or capital, triggering seizure and resolution by regulators.

Basil III states that banks/financial institutions must fully absorb losses at this PoNV before taxpayers are exposed to loss.

When the PoNV condition is hit, AT1 and tier 2 capital must either:

- Convert into CET1 capital

- Written off

PoNV requires these conversions dependent on financial regulators deeming institutions as non-viable or a decision to inject public funds to prevent the bank’s failure, depending on authority powers or contractual features of these capital investments (such as CoCo).

How to Calculate the Tier 1 Capital Ratio

Tier 1 capital ratio is calculated through:

[Tier 1 Capital/ lRisk Weighted Assets] * 100

Where:

- Tier 1 capital includes both CET1 capital and AT1 capital.

- Risk-weighted assets reflect the level of risk associated with a bank's assets, which are assigned specific weights based on their credit risk, market risk, and operational risk.

The Tier 1 capital ratio measures a bank's core equity capital in relation to its risk-weighted assets. Tier 1 capital ratio is calculated by dividing a bank's Tier 1 capital by risk-weighted assets, then multiplying the result by 100 to express it as this tier 1 capital ratio.

Since CET1 capital must be at least 4.5% and tier 1 capital (CET1 +AT1) must be at least 6%, the tier 1 capital ratio must be at least 6%.

Understanding the regulatory requirements for the Tier 1 capital ratio is important. The regulatory framework for banks-- Basel III, sets a minimum capital requirement to ensure the stability and solvency of financial institutions.

By calculating the Tier 1 capital ratio and ensuring it is at least 6%, banks can demonstrate their ability to absorb losses and maintain a strong capital position relative to their risk exposure.

Additional Tier 1 Capital

AT1 has conditions that limit is based on precepts of:

1. Perpetual with no interest to redeem

AT1 instruments have no redeemable maturity date, meaning financial institutions are not obligated to repay the original principal. Investors receive dividends/interest indefinitely.

2. Financial institutions cannot invest or guarantee the investment

Financial institutions and related businesses cannot invest in or guarantee AT1 securities. Credit enhancement features are not allowed as they would deplete the institution's CET1 capital.

3. Payments on the principal are not guaranteed

The financial institution is not required to make dividend or interest payments on AT1 securities. The FED must initiate principal repayments. Any payment gaps do not result in accumulated payments to buyers.

4. Convertible and loss-absorbing upon non-viability events

AT1 capital can be fully written down or converted into common equity during non-viability events. This process is permanent and aims to restore CET1 to the required level.

5. Deeply subordinated

AT1 securities rank below deposit obligations, general creditors, and bank-subordinated debt. They cannot be elevated in terms of seniority.

6. Fully paid-up

AT1 instruments must be issued and fully paid in cash by the buyer/investor from the beginning. They include preferred shares and convertible contingent bonds (CoCos) with no fixed maturity and no redemption incentives for the issuer.

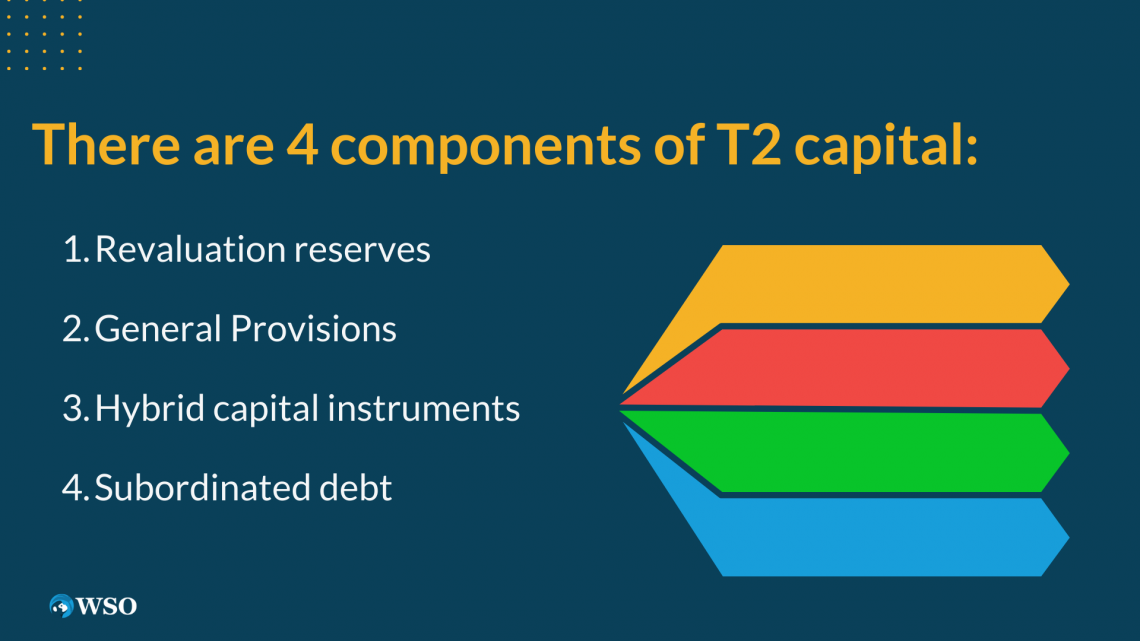

Tier 2 Capital

The lowest tiered regulatory capital is considered for “gone concern” banks. It comprises items such as revaluation reserves, hybrid instruments, or subordinated term debt. Tier 2 capital is also harder to liquidate than tier 1 capital.

There are four components of T2 capital, which are:

1. Revaluation reserves

When assets are revalued to price higher, some reserves are created that can be counted as T2 capital, although they are hard to liquidate.

For instance, if a bank owns the property on which its building is on, and the market price of the property increases, there is an increase in revaluation reserves.

2. General Provisions

Savings the bank has in anticipation of paying off future losses. The specific amount here is dependent on how much the company estimates losses to be in the future.

The bank is required to put aside these general provisions when it loans money to others in the event that the borrower defaults. Banks treat these as high-risk assets as it is automatically assumed the borrower will default.

3. Hybrid capital instruments

Debt and equity instruments are used here, such as preferred stock (that does not meet the criteria to be T1). If these instruments are sufficiently similar to equity, losses will be taken on the principal of these instruments.

Note

Liquidation will not yet be triggered if these instruments are converted.

4. Subordinated debt

This debt has a minimum term of 5 years. It is unsecured and ranks below in seniority; senior loans have claims on assets/securities as backing. These subordinated debts are those that did not meet T1 requirements.

Common Equity Tier 1 components

There are various components to CET1 equity. The following examples briefly describe what they are.

Ordinary shareholders would hold the most common type of shares as ownership stakes in a company. Voting rights are assigned to these shareholders for issues such as takeover bids or changes to the board of directors.

The stock’s price has unlimited upside potential as the market could value the stock infinitely high (despite the company's inherent value).

However, it has the lowest preference in capital structure, which means that if the company defaults, common shares will price at $0 faster than other senior capital.

2. Retained Earnings

The dollar sum of money the business retains after paying out all its profits through direct and indirect costs, income taxes, and dividends to shareholders.

This portion of profits that is retained is counted as company equity. Moreover, the company may choose to reinvest retained earnings through R&D, new equipment, or the like.

This is usually found in the equity section of the balance sheet and can also be used to buy further investments. This helps the business scale in the hope of increasing revenue.

3. Stock Surpluses

Stock, or capital surpluses, is the surplus value attached to a stock sold higher than its original listed par value. The delta between the price the stock is sold at and its par is taken and counted as “stock surpluses.”

This is found in the balance sheet under “shareholder’s equity” as “additional paid-in capital.”

Note

Stock surpluses do not count as capital stock or retained earnings, which exist as different concepts.

4. Other Comprehensive Income

Other comprehensive income (OCI) is defined as revenues, expenses, gains, or losses that have yet to be realized in the area of being translated into profits/cash/earnings.

For instance, if the company holds a portfolio of bonds that have yet to mature, gains or losses in the bond cannot be counted as profits/cash/earnings and will be counted as OCI instead.

OCI also represents the delta between net income and comprehensive income in the balance sheet.

Note

OCI is found under the “shareholder’s equity” component. It is often referred to as “accumulated other comprehensive income.”

5. Qualifying Minority Interest

This refers to any ownership stake in another company that is less than 50% of its ownership/interest. Ownership is counted as common shares, which would entitle the investor/owner to vote on discretionary matters the company faces.

This would be found in the ‘balance sheet’ in the firm's 10k/10q and would be under ‘shareholder’s equity’ or ‘liabilities.’ This means that this amount that is found attributed in the balance sheet is the amount the business earns that relates to minority holders of the company.

Note

Minority holders, as per GAPP standards, would refer to parent companies holding less than 50% control in subsidiary companies.

6. Regulatory Adjustments

This refers to any such adjustments to the company’s revenue with effect to federal, state, or governmental regulations, specifically, the change of these policies and its effect on the accounting standards of the business.

This could result in credits/losses/surcharges or refunds as a result of the rescinding of such policies or the additional implementation of them.

Conclusion

In conclusion, Common Equity Tier 1 (CET1) capital and Additional Tier 1 (AT1) capital play crucial roles in the banking industry, particularly under the Basel III regulatory framework.

CET1 capital is the highest form of regulatory capital and serves as a buffer against losses, absorbing them immediately when they occur.

On the other hand, AT1 capital provides loss absorption on a going-concern basis, supporting the bank's ability to continue operating without facing bankruptcy or liquidation in the near future.

The Basel III accord mandates that banks maintain CET1 capital of at least 4.5% of their reserves, while Tier 1 capital (comprising CET1 and AT1 capital) must exceed 6% of the bank's capital.

Additionally, all regulatory capital, including Tier 2 capital, must be above 8%, with the remaining 92% composed of other types of capital or risk-weighted assets.

The concept of non-viability comes into play when banks or financial institutions face financial stress due to insufficient liquidity or capital.

In such situations, AT1 and Tier 2 capital can be converted into CET1 capital or written off to absorb losses before taxpayers are exposed to any losses.

AT1 capital has unique characteristics, such as being perpetual with no fixed maturity and not guaranteeing dividends or interest payments. It is also convertible and loss-absorbing in non-viability events, allowing the principal to be written down or converted into common equity.

Tier 2 capital, the lowest tier of regulatory capital, consists of revaluation reserves, general provisions, hybrid capital instruments, and subordinated debt. These components provide additional loss-absorbing capacity for banks but are harder to liquidate than Tier 1 capital.

CET1 capital includes various components, such as common shares, retained earnings, stock surpluses, other comprehensive income, qualifying minority interest, and regulatory adjustments.

Each component represents a specific aspect of the bank's equity and helps strengthen its capital position.

Overall, the Basel III regulations ensure that banks maintain adequate capital to withstand financial shocks, protect depositors and creditors, and minimize the need for taxpayer bailouts.

By defining and enforcing the requirements for CET1, AT1, and Tier 2 capital, the regulations enhance the stability and resilience of the global banking system.

Researched and Authored by Jo Vial | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?