The liquidity premium is the additional compensatory tool paid to investors for investments with liquidity risks.

Fixed-income security investors bear a level of exposure to credit risk. The credit risk and the asset returns primarily determine the risk-reward relationship in financial markets.

Investors wish to receive a positive risk premium for the exposure to systematic credit risk. Therefore, for assets that bear higher credit risk, the investors demand a higher percentage of interest rates.

Intuitively, investors would dodge their exposure to credit risk by eliminating all the securities in their portfolio featured by it. This phenomenon is represented by the term 'Flight to Quality.

It represents herd mentality as a shift to bonds or quality investments bearing low risk. Bonds are safer financial instruments as compared to stocks or equity. Economic distress and uncertainty in the markets usually trigger such an event.

Flight to Liquidity is a very similar concept adapted from flight to quality. It represents investors' herd behavior as they shift from less-liquid securities to highly liquid ones.

The investor's motive, in both phenomenons, is to limit their exposure to the risks of the bonds. In Flight to Quality, an investor attempts to reduce credit risk. In Flight to Liquidity, an investor attempts to reduce the liquidity risk.

Liquidity risk is the probability that the investor cannot easily find a counterparty to complete their transactions. To avert this risk, investors demand extra compensation as a liquidity premium.

The liquidity premium is primarily in the interest rates or prices offered for illiquid assets. These assets are particularly concerning during a bearish market as they could result in more significant losses when the investor cannot sell the asset immediately.

- Liquidity premium compensates an investor for holding an illiquid investment.

- The magnitude of the premium depends on the liquidity and the term to maturity of an asset. Some long-term assets that cannot be sold immediately are illiquid so the premium demanded is significant.

- It can be calculated by comparing two similar investment options with different maturities. The difference is the liquidity premium.

- The premium is included in the determination of the bond's interest rate.

- Bonds that have longer terms have higher premiums making the yield curve upward-sloping. The yield curve could be flattened or inverted.

- Liquidity premiums can attract long-term investors by rewarding them with safer returns. It can also increase the demand for the bond and helps in identifying the liquidity risk of an asset.

- On the other hand, liquidity premiums are lower during economic distress. Other factors like creditworthiness, risk-reward parity, and the term structure are limitations for the premium.

What Is The Liquidity Premium?

The liquidity premium is the additional compensatory tool investors demand to reduce their liquidity risk. For example, financial instruments that cannot be sold easily are usually priced higher to compensate for their illiquidity.

This concept can be associated with the term 'higher risk, higher reward.' It indicates that a bond's price is based on its risk-reward characteristics. It can also be called the illiquidity premium.

The premium is linked to the investment return, such as a higher interest rate or payout at maturity. The LP also depends on an instrument's term to maturity.

Instruments with a lower maturity, or short-term securities, are more liquid and have a lower liquidity premium. At the same time, long-term devices have a higher liquidity premium.

Here is an example of Liquidity Premium - treasury bills with maturities equal to or less than a year possess lower liquidity premiums. In comparison, treasury bonds, having longer-term maturities, have a higher return than a treasury bill.

Liquidity premium generally applies to bonds and other fixed-income securities with different liquidity levels.

An asset that can be bought or sold quickly at its fair value is highly liquid. For example, cash, marketable securities, and money market instruments are liquid assets. They can be converted to cash within a short span.

On the other hand, an asset that cannot be sold immediately is considered illiquid. Unconventional assets in the market, which have fewer buys, are primarily illiquid.

With time, due to the unavailability of a buyer, the assets would lose their value. Assets with significant price volatility, like cars, real estate, property, and jewelry, are illiquid assets.

Furthermore, long-term illiquid assets must be held in the financial market for extended periods and could incur termination penalties if prematurely closed. An example is the Certificates of Deposits (CDs).

The buyers and sellers ratio could be more stable when economic distress dawns on the market. However, this adds risk to the illiquid assets.

Thus, an investor may lose part of or the whole value of an investment when they trade with illiquid security. This risk increases the security value by an amount equivalent to the LP that an investor demands.

The presence of market liquidity is an essential characteristic of the smooth functioning of the financial markets. However, during the 2008 Global Financial Crisis, it was observed that liquidity had fallen to a great extent.

It isn't easy to accurately estimate the LP provided as it is a part of the asset return. In addition, the asset's return is structured as a reward for many other risks an investor undertakes.

The liquidity premium can be calculated by comparing two investment options with similar characteristics but different liquidities.

For example, two identical bank bonds can be compared, with one offered only on the OTC and the other on public markets. The difference between the bond yield is the liquidity premium. Therefore, the non-traded bond would have a higher yield than the publicly traded bond.

Another way to infer the LP is by comparing the yields from a treasury and non-treasury bond.

The LP determines the bond's term structure or the yield curve. Therefore, it is one of the theories that explain the behavior of the interest rates mapped on a yield curve.

Liquidity Premium And The Yield Curve

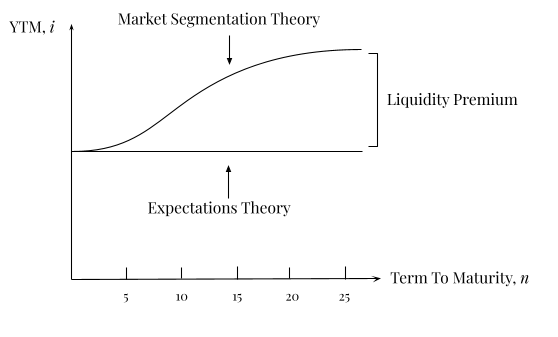

The term structure of interest rates is the relationship between the interest rates offered for bonds with different maturities. It maps the varying relationship between maturity and Yield to Maturity (YTM).

An analyst uses Yield to Maturity to accurately measure the cost of borrowing. As a result, the YTM is a significant determinant of the bond price.

Principally, the YTM differs for a bond based on its maturity. The yield curve, or the term structure of interest rates, measures this factor while keeping all other considerations like risk, liquidity, and tax constant.

The U.S. Treasury Par Yield Curve Rates can be found here. You can view your preferred data using the drop-down list.

The yield curve is created by plotting the YTMs on the y-axis with their associated time/maturity on the x-axis.

The interest rates for all kinds of bonds are measured in the yield curve. Therefore, investors examine the yield curve before making their investment decision, as it can indicate interest rate patterns.

The LP is the best determinant of the different bond yields. The underlying concept is that investors demand a higher rate for longer-term maturity bonds.

Thus, the yield for longer-term bonds increases as per maturity. By this, the yield curve is upward-sloping.

When the maturity rises, the yield associated with the bond also rises to compensate the investor for the liquidity risk. The difference is the LP.

The yield curve cannot always be upward-sloping. It could either be flat or inverted. When this is the case, the other theories, i.e., expectations and market segmentation, can be used to explain the slope.

Theories of Term Structure

Three theories underline the term structure of interest rates. The collective application of these theories is widely used to predict yield curve behavior.

1. Liquidity Premium Theory

This theory aims to adjust the interest rates for investors' liquidity preferences. According to the theory, an investor is likelier to invest in a short-term bond than a long-term one.

Investors would demand a higher rate of return if they hold a longer-term bond as a change in the interest rate would cause a significant loss, and the opportunities for an exit are limited.

2. Expectations Theory

Based on this theory, forward or long-term rates are considered empirical estimates of future spot rates. It predicts the short-term future interest rates.

The theory proves that the investor would be indifferent between purchasing one bond with a four-year maturity or four bonds consecutively with a one-year maturity. It would provide the same return.

3. Segmented Markets Theory

According to this theory, investors invest in bonds based on their preferred investments and income. Therefore, investors should prefer bonds with a long maturation period if they aim for long-term instruments, and vice versa.

Based on this theory, the yield curve is determined by the supply and demand of the various bonds. Low maturities have a lower interest rate, and higher maturities have a higher interest rate to accommodate the likelihood of a risk.

Merits of Liquidity Premium

The merits of LP are mentioned below:

1. Long-term investors

The investor benefits from keeping illiquid assets long-term, even though illiquid assets cannot be sold quickly. Investors are retained for a long period in this manner.

They can yield higher returns that can help them satisfy their commitments. Otherwise, the returns can be used to reinvest in other opportunities and gain a higher return, similar to compounding.

2. Safe Returns

Investors purchasing long-term bonds issued by the government can provide a predictable income flow for the following years till their maturity. The risk associated with them is also significantly less than that associated with corporate bonds.

3. Investors' reward

An investor would prefer a bond that provides a lower risk. However, riskier bonds usually trade at lower prices to attract more investors.

The riskier bonds provide a higher compensation by the LP. So, the investor would be rewarded by undertaking highly risky instruments.

4. Increased demand for fixed-income securities

Investing in instruments that offer a higher risk premium is more attractive to investors.

Corporations issue bonds to raise additional funds for the business. If more investors purchase the bonds with a high premium, the company would not have to raise funds through other methods. It saves time and costs for a company.

5. Identification of liquid assets

An investor would always prefer to own liquid assets so that they would be able to exit a trade whenever the interest rates are falling. It helps prevent a bigger loss and losing most of their capital.

With the help of identifying the LP, the investor can identify the highly liquid instruments and stay away from the illiquid ones.

Demerits of Liquidity Premium

The demerits of liquidity premium are mentioned below:

1. Economic distress

When there is economic distress, a debt issuer might only sometimes be able to offer very high liquidity premiums because it may not always be possible for them to do so. As a result, the difficulty in gaining new investors would be increased due to this.

2. Limitations on the term structure

While creating a yield curve, it is assumed that the liquidity risk is always higher for the higher maturities. It is also assumed that the future spot prices are equal to the forecasted rates.

These assumptions may not always hold during times of economic distress. For example, there is a high LP during a boom. However, the LP may be altered during a recession. As a result, the yield curve would shift to flat or inverse.

3. Risk-reward parity

An investor may assume a level of risk different from the rewards reaped from the investment. So, the investment would have low demand and greater illiquidity.

4. Creditworthiness fluctuations

Whether a corporation or the government issues the bond, every issuer is graded based on credit abilities. For example, issuers will be graded a higher credit rating if they have a long period of stability in earnings and payments.

However, if the issuer is suddenly in a tight spot and cannot repay their obligations, it affects their ratings negatively. This could cause a potential downside to long-term investors.

or Want to Sign up with your social account?