Money-Weighted Rate of Return (MWRR)

A total-return index that captures the duration and magnitude of cash flows over time to educate investors on how their assets evolved over the analyzed period. It is one of the key financial indicators in evaluating the performance of a portfolio.

What is the Money-Weighted Rate of Return (MWRR)?

Money-Weighted Rate of Return (MWRR) is a total-return index that captures the duration and magnitude of cash flows over time to educate investors on how their assets evolved over the analyzed period. It is one of the key financial indicators in evaluating the performance of a portfolio.

The Money Weighted Rate of Return differs from traditional measures by considering the impact of an investor's actions and cash flow timing on investment performance.

This makes it a vital instrument for analyzing an investor's true earnings, free from the influence of deposits and withdrawals—also known as the Internal Rate of Return.

Investors need to comprehend MWRR as it creates a better picture of their financial decisions and helps determine whether the investor’s strategy was successful.

This measure is particularly effective in analyzing the success of retirement money, mutual funds, or any asset that experiences regular contribution withdrawals.

In the next section of this article, we will take a closer look at the definition, calculation, significance, and practical aspects of Money-Weighted Rate of Return as compared to other return measures and how it differs from them.

Key Takeaways

- Money Weighted Rate Of Return incorporates investor actions. It considers timing and amounts of cash flows during a specific period.

- MWRR is significantly impacted by when and how much an investor contributes or withdraws.

- Tailored for personal assessments, MWRR precisely mirrors an investor's decisions.

- MWRR finds the rate where the present value of cash flows equals the current portfolio value, balancing contributions and withdrawals over time.

- MWRR evaluates investment strategy success by considering the financial choices made, offering practical insights into portfolio performance.

Understanding Money-Weighted Rate of Return

The Money-Weighted Rate of Return (MWRR) is a method used to measure the performance of an investment over a specific period, accounting for the timing and amount of cash flows into and out of the investment.

Unlike simple numerical calculations, it focuses on the investor's exact contributions and withdrawals in his investment path. MWRR is obtained by finding the rate at which the present value of all cash flows equals the current value of the entire investment portfolio.

It explains how money relates to life and deals with situations when people constantly receive or spend cash, like retirement pensions and investment trusts.

MWRR directs investors on decision-making and perfects their plans so they understand what their money is saying to them.

Calculating Money-Weighted Rate of Return

MWRR, or IRR, is derived by taking the point whereby the discounted net asset value (NAV) equals its current NAV. Using calculators and financial software, this becomes a trial-and-error process.

This is the rate expressed as a percentage that sums up the present value of all the cash flows, including contributions and withdrawals equal to the current value of the portfolio.

Put simply, MWRR is the rate at which it should be discounted so that the NPV of all cash flows equals the current value of the portfolio.

How does the calculation work?

1. Gather Cash Flow Data: Collect data on all contributions (deposits) and withdrawals (withdrawals) made to the portfolio. Each cash flow is associated with a specific date.

2. Set up the Equation: Create an equation that represents the net present value (NPV) of the cash flows. The equation should equate the sum of the present values of all contributions and withdrawals to the current portfolio value.

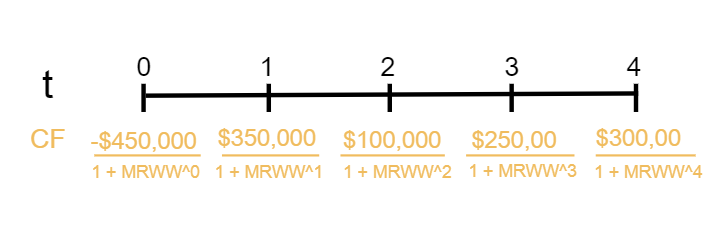

0 = NPV = rΣ=0 CFt/ (MWRR)^t

The equation should look like this:

PV (CF1) +PV (CF2) +...+PV (CFn)= Portfolio Value

- PV(CF) represents the present value of each cash flow,

Which is calculated as:

CF/(1+r) ^t

Where:

- CF is the cash flow amount (positive for contributions, negative for withdrawals).

- r is the rate you're trying to find

- t is the period from the investment's inception to the date of the cash flow.

Note

Solving for Rate(r): The trial-and-error process involves adjusting the rate (r) until the current value of the portfolio equals the sum of present cash flows. This rate represents the investment's Money Weighted Rate of Return, reflecting the overall investor's return.

3. Interpret the Rate

Once you find the rate (r), it represents the money-weighted rate of return for the given investment. This rate reflects the overall return experienced by the investor, considering the timing and magnitude of their contributions and withdrawals.

Money-Weighted Rate of Return Example

The money-weighted rate of return is difficult to calculate by hand as it requires a lot of trial-and-error plugging. Many programs can solve it easily, such as the =IRR () function on Microsoft Excel or Google Sheets.

Here’s an example to understand how the calculation works

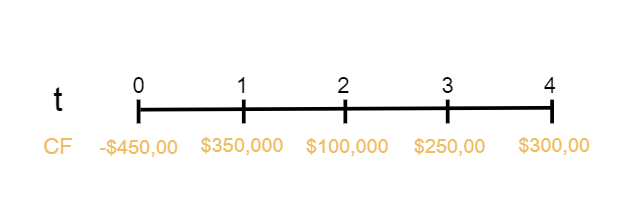

An investor comes across an investment opportunity with expected cash flows, as shown above.

To finance the initial investment of -$450,000, the investor can borrow at 5% interest. Should she be willing to invest?

By entering the cash flows into Excel or Sheets and applying =IRR(), we arrive at an MWRR of 30%. Considering her MWRR is more than her cost of capital (8%), the project is extremely profitable and should be undertaken (after considering other aspects).

Common Misconceptions Around Money Weighted Rate of Return

Misconceptions about the Money Weighted Rate of Return can arise due to its unique approach to evaluating investment performance. Here are some common misconceptions about MWRR:

- Similarity to Time Weighted Rate of Return (TWRR)

- Misconception: Some may mistakenly believe that MWRR is similar to TWRR.

- Clarification: While both are metrics used to assess investment performance, they focus on different aspects. MWRR considers the impact of cash flows, providing a more personalized view, whereas TWRR assesses the performance of the portfolio independent of investor actions.

- Always Reflects Poor Performance in Volatile Markets

- Misconception: Some investors may mistakenly believe that MWRR will consistently reflect poor performance in volatile markets.

- Clarification: In reality, it considers the timing of cash flows, and strategically timed withdrawals during market downturns could positively influence it, challenging the notion of consistently poor performance.

- Assumed Equal Weighting of Cash Flows

- Misconception: Some assume that all cash flows are weighted equally in the MWRR calculation.

- Clarification: The magnitude and timing of each cash flow significantly affect the final rate, making it crucial for investors to understand the impact of their contributions and withdrawals.

- Difficulty in Interpretation

- Misconception: Investors may think MWRR is difficult to interpret due to its mathematical complexity.

- Clarification: While the calculation involves finding the rate that equalizes the present value of cash flows and the portfolio's current value, the interpretation is relatively straightforward – it represents the actual return experienced by the investor.

- Applicability Only to Certain Investments

- Misconception: Some investors may wrongly assume that MWRR is only relevant to specific types of investments, such as retirement accounts or mutual funds.

- Clarification: MWRR can be applied to any investment where cash flows, contributions, or withdrawals occur.

- Incompatibility with Benchmarking

- Misconception: Some may think MWRR cannot be used to benchmark against a market index or compare it to other investments.

- Clarification: While MWRR is more personal and reflects individual experiences, it can still be compared to benchmarks to gauge relative performance.

- Neglecting the Impact of External Factors

- Misconception: Investors might overlook external factors, assuming that MWRR solely depends on their actions.

- Clarification: MWRR incorporates external influences like changes in interest rates or economic conditions, recognizing the broader context of investment returns.

Conclusion

MWRR is a metric that encompasses more than just arithmetics in enabling investors to have a sense of perspective on their financial affairs journeys.

It helps understand the role timing and magnitude play when it comes to investment returns. This makes the study findings presented in MWRR useful in guiding further actions by investors on these matters.

One needs to have a sharp eye and understand the overall macroeconomic environment in order to interpret the MWRR result.

It helps make an educated investment choice, determine risk and return patterns, and provide guidelines on how investments fit into your financial goals.

Investors continuously monitor MWRR relative to other metrics to make adjustments in the trading strategy, which is aimed at managing risks to adapt to dynamic markets and get maximum profitability for the portfolio.

Investors can make their financial trips with confidence and clarity through this tool, provided that they use it accordingly.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?