Risk Aversion

The inclination of a financial agent to favor certainty over uncertainty, regardless of the value associated with taking a risk.

What is Risk Aversion?

Risk can be defined as a situation involving potential exposure to a hazard or loss. Aversion can be defined as a feeling of dislike or lack of inclination towards something. In combining these two definitions, we arrive at a description of risk aversion.

In economic terms, it can be defined as the inclination of a financial agent to favor certainty over uncertainty, regardless of the value associated with taking a risk.

It can be seen in everyday instances. However, it typically relates to investments and the reduction of risk. It is never really the complete removal of security or market risk, as there are always financial risks.

When an economic agent practices risk aversion, they are considered risk-averse. Another common name for investors who avoid risk is conservative investors.

They prefer to keep and maintain their existing capital over having the potential for a greater-than-average return, which means that they are far more impacted by the loss caused by losing than by the gain of winning, which is why they often play it safe.

On the opposite side of the spectrum, a risk-loving or risk-seeking individual is willing to take on additional risks or chances for a comparatively high expected return.

Understanding Risk Averse

Suppose a risk-averse individual is given a choice between two scenarios. The first scenario has complete certainty, and the other involves a risk of some degree.

In the first scenario, the individual can get $100 upfront; in the second scenario, they can pick an individual's left or right hand, with one of them holding $200. If they choose right, they get the $200; otherwise, they are left empty-handed.

Both situations return the same expected utility, and a risk-neutral individual would have no preference. However, someone who strays away from risk would go with the first scenario and avoid the uncertainty of the second option.

This is because, in the first scenario, they know they will walk away with a profit ($100). However, when allowed to double that in a situation with a 50/50 chance, they avoid it and play it safe.

Risk Aversion Real Life application

An example is a young, healthy individual acquiring life insurance even though their chances of premature death are very slim.

Life insurance is acquired to help those close to you from the financial impact of your possible death. Kids and young individuals are the most common parties protected by a parent or guardian's life insurance.

These conservative investors favor expected value. Expected value is a method used to predict the uncertainty of the risk. It is calculated by summing the probabilities of an event multiplied by the gain or loss received if said event occurs.

A formula is available to determine the odds of an event happening. The formula below can calculate this value, which is also the expected result. It is frequently used when playing poker.

The expected value of a gamble = Probability of 1 outcome * payoff of that income + probability of 2nd outcome * payoff of that outcome

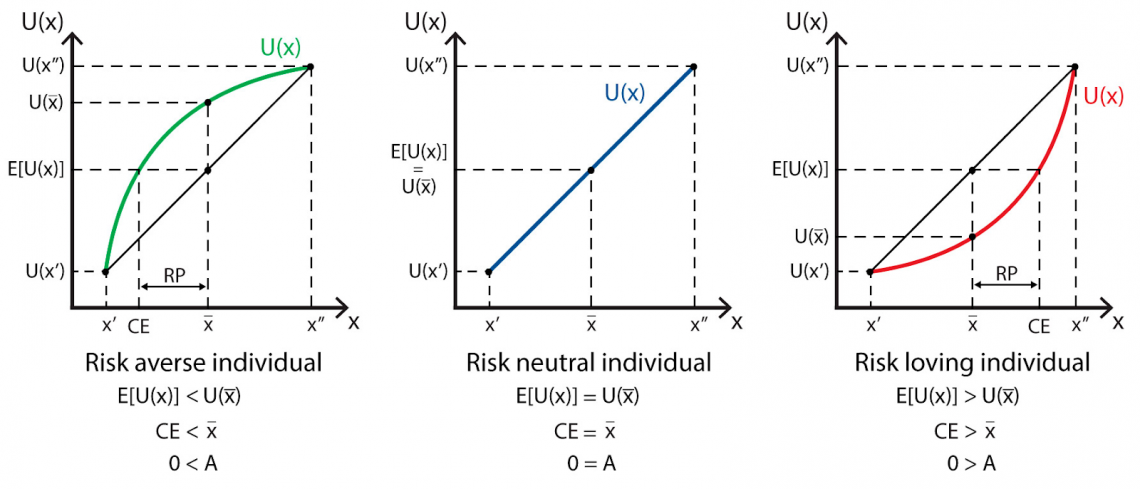

The utility functions of individuals with varying preferences for risk differ and, in turn, display a different graph with unique utility functions.

Risk aversion is demonstrated on the left graph above with a concave form below the utility function. The concavity is caused by the origin of the utility function relating to Bernoulli. Bernoulli’s utility function resembles that of a logarithmic utility function.

- A risk-loving individual is displayed on the right and has a concave utility function. However, it is hollow from above.

- A risk-neutral individual is indifferent between the expected utility and the actual utility received, as demonstrated in the graph in the center.

- A risk-neutral graph has the utility function set equal to the expected utility of x, again showing no preference between the two.

The risk premium is calculated as the difference between the expected value and the certainty equivalent. The sum of money a risk-averse agent will spend to eliminate all risks is known as the risk premium.

Investments for Risk-Averse Investors

Risk-Averse investors will typically target investments that offer a guaranteed return or, at the very least little to no potential for loss.

Joint investments that risk-averse individuals take part in include treasury bonds, dividend-paying stocks, certificates of deposits, life insurance, conservative allocation funds, and savings accounts.

There are distinct characteristics that make these investments so appealing to risk-averse individuals.

- Treasury Bonds typically receive a steady rate of interest payments and are governed by the US government. They are known for being one the safest investments you can make.

- Dividend-Paying Stocks had anticipated dividend payments that helped to offset the loss when and if the stock were to decrease.

- Conservative Allocation Funds allocate your funds between stocks, bonds, and cash conservatively.

- Savings Accounts are known for offering a stable, consistent rate of return.

Due to the nature of risk-averse individuals, they prefer more liquid investments (having the ability to access their money no matter the market conditions at any given moment without causing drastic changes to its value).

Typically, these investors are older, have invested a lifetime, and are unwilling to risk what they spent years building up.

Liquid investments are known for being easier to cash in and receive total value. The commonly known and most liquid asset is cash. An asset's liquidity is determined by how easily it can be converted into cash.

An example of a liquid asset is a bank account like your checking and/or savings account, as they are straightforward to convert into cash since you can get it at any point in time. Other examples include accounts receivable, stocks, and money market accounts.

On the other hand, an example of a non-liquid asset would be land or real estate investments. They are considered non-liquid as they must be sold to be converted into cash and require a transfer of ownership, which can take a long time.

Understanding Risk-Taking Behavior

Today’s youth often gets a bad rep for being reckless and poor decision-makers. Many older individuals often attribute kids and teenagers to poor financial responsibility and careless acts.

However, there may be science behind why young individuals are more likely to take risks.

It is a common assumption to associate careful behavior with knowledge and wisdom.

Many link that to the cause of older people proceeding with caution in investments or everyday tasks. That may be true to a degree, however. There might be more to it.

Note

Many studies have been done on the actions and attitudes dealing with risk aversion corresponding to the right inferior frontal gyrus, which is currently being studied by neuroeconomics in the behavioral economics sector.

Many of these studies even link risk aversion to the amount of gray matter within someone's brain. Studies have proven the more gray matter within someone's brain, the more likely that individual is to be taking risks.

Gray matter is the area in the brain with the most neurons found in the amygdala and ventral striatum areas. These areas are commonly known as the areas controlling risk and decision-making.

As we age, the volume of gray matter decreases, which is why younger people are more inclined to take risks, and older people are more risk-averse. However, this varies from person to person, and risky behavior is generally more prevalent in males.

The idea that women are more risk-averse can be argued, however. Some say that men and women are equal regarding risk aversion or risky behavior. However, some studies say that women are more likely to be penalized, which is why they avoid risk.

It can also be argued that the way risk is measured favors more female-predominated activities. For example, gymnastics and cheerleading are hazardous sports that are female-dominated. Even giving birth comes with an extreme risk that many women face.

Methods of Risk Aversion

The most popular method for measuring was named after economists Kenneth Arrow and John Pratt and is called the Arrow-Pratt measure of absolute risk aversion.

It can be calculated by the following:

Arrow Pratt measure (x) = -(U’’(x))/(U’(x))

We can see that to get the Arrow Pratt Measure value, this method divides the negative value of the utility function's second derivative by its positive value, which is the first derivative.

There is also something called the Arrow Pratt Relative Risk Aversion. This can be applied universally because it is a dimensionless quantity. This is expressed in the formula below involving the first and second derivatives.

R(c)=(-cu’’(c))/(u’(c))

The use of relative or absolute risk aversion is most prevalent in forming portfolios involving one risky and a risk-free asset.

For example, if an individual somehow acquires an influx of income or wealth, they have to decide the magnitude by which they would like to alter the risky asset in the portfolio or whether they want to change it all.

Economists, in turn, will refrain from using utility functions involving functions that demonstrate patterns of increasing absolute risk aversion, as this is unrealistic.

Modern Portfolio Theory is used to assemble a portfolio of assets so that the expected value is maximized at any given level of risk.

Note

Modern Portfolio Theory is commonly used by financial advisors investing in stocks and bonds on behalf of someone else, typically their clients. It is also known for just reducing overall volatility.

In essence, it is the general idea that it is safer to own various financial assets as opposed to only owning one kind. This theory follows the assumption that investors are risk-averse.

Navigating Investment Risks

These conservative individuals try to avoid high-risk investments. High-risk investments are classified as investments with a greater chance of loss of capital or a more fantastic opportunity for a devastating loss.

Higher-risk investments include stocks, crowdfunding, mutual funds, derivatives, commodities, and sometimes EFTs (typically inversed and leveraged).

- Stocks: They are especially risky because many factors influence a company's stock value. A company's stock value has a lot to do with the supply and demand of the market. Stocks offer no guarantee of profits, which is why they are considered one of the riskiest investments.

- Crowdfunding: It can be classified as risky as there is no income and fewer protections. This means these funds rarely pay dividends, have no interest, and offer no approval and minimal legal rights. Therefore, there needs to be approval being done by a security regulator.

- Mutual Funds: It can be viewed as risky because the securities held by a fund can depreciate, and you can lose some or all of the money you have invested.

- Derivatives: They are considered risky investments because of counterparty risk. Counterparty risk arises when a party involved in a derivatives trade backs out of the contract. The risk is more significant in over-the-counter markets as they are far less regulated.

- Commodities: They are risky simply because their market is influenced by factors that are near impossible to predict. Some of these factors are weather and extreme worldwide circumstances, etc.

- EFTs: They are relatively safe investments but can be involved in higher-risk securities. Although risk-averse individuals do and try to avoid risks at all costs, they may partake if the payoff is high enough and worth their while, but sometimes not even then.

Risk Aversion Real-Life Examples

In general, the sector of health and safety is risk-averse. They require that all risks be minimized within legal requirements. It is important to consider the opportunity cost when mitigating risk and ensure the general public understands the importance of limiting risk.

A large priority for avoiding risk in public is dealing with children and safety. A great example of this is children's playgrounds having absorbent floors to prevent kids from potentially fatal falls.

The new floors have shock-absorbing properties enabling them to move, resulting in displacement to lessen the severity of the fall. This increases the overall safety of the structure reducing risk.

Even though it is quite pricey to avoid life-threatening injuries for children, it is worth not taking that risk. Some argue that increasing the level of safety of children's playground equipment increases the child's likelihood of partake in more dangerous play.

For example, the padded floor reduces the child's risk of injury. It is put in place as a preventative measure. This helps relieve some stress from worried parents or guardians and allows the kid to enjoy their time better.

Some even say that children must participate in risk-taking activities for developmental growth and problem-solving skills. Adolescents face many instances of uncertainty as they still have not experienced many of their firsts. This is crucial for building confidence.

Many policies have been implemented since the rise of the Covid-19 pandemic to help mitigate risk. However, the virus spread exponentially, and the world needed to take action to help protect the safety and well-being of all citizens.

To help prevent the spread, non-essential services and businesses were shut down, and rules were put in place involving masks, positive cases, and how everyone should react and respond to the crisis. Everyone was trying to do their part to protect themselves and each other.

This took a toll on the overall economy and the general public (price inflation, closing of local businesses, decline in mental health). Still, the government felt it necessary to stay safe from the virus, so they were willing to give up that loss.

Risk is all around us. Every day we face decisions involving risk, and depending on the individual's tolerance to risk, the consequences of our decisions vary. People in the same situations could live very different lives; it all depends on one's values.

You should check out the free course below to gain more knowledge about valuations and risk.

Researched and Authored by Patricia Brutto

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?