16 Important Steps When Starting Your Own Financial Consulting Business

From defining your niche to prioritizing client experience, build a thriving consultancy business and establish yourself as a trusted expert in the field.

Are you thinking about starting your own financial consulting business to help other people meet their financial goals? Financial consultants assist clients with their assets, debts, income and expenses. They also manage their clients' investments and offer them personalized advice.

However, launching a financial consulting business is no small undertaking that demands careful planning, dedication, and in-depth knowledge of the sector. Following are 10 steps designed to guide budding consultants towards success: from finding your niche and writing an actionable business plan through to cultivating resilience and adaptability.

1. Establish your niche and develop a business plan

The key to starting out on your entrepreneurial path is defining your area of expertise within financial consulting - this could range from tax planning, investment advice, retirement planning, or wealth management - creating your niche will distinguish you and attract clients searching for specific services.

Next, create an extensive business plan. Your plan must address your mission statement, services, target market identification, and effective marketing strategies, as well as creating an accurate financial projection that includes income projections for possible income sources and expenses and profitability projections.

A strategic business plan not only guides but can attract potential investors by showing that your venture offers sound investment opportunities.

2. Establish credentials and legal structure

Professional credibility in financial consulting is of utmost importance, so obtaining certifications like Certified Financial Planner or Chartered Financial Analyst is invaluable for building client trust and standing out among competitors. Conduct a detailed search to learn which credentials are needed in your region before devising an action plan to obtain them.

Establishing an appropriate legal structure for your business is also of critical importance, with sole proprietorship, partnership, LLC and corporation all having distinct legal, tax and financial implications - it's best to consult a financial or legal adviser when weighing these options against each other in terms of business goals and risk tolerance.

3. Establish your office infrastructure

In order to foster a professional image and efficient workflow, create an office that fits the requirements of your business model and client expectations. Depending on which route is taken, choosing either a traditional brick-and-mortar location, home office or virtual workspace might work best; either way it's essential that quality equipment and software investments ensure smooth operations.

Communication systems are another critical element of financial consulting businesses. You will require dedicated business phone lines equipped with features such as call forwarding, voicemail and professional greetings in order to enhance professionalism while supporting excellent customer service and being reachable for clients at any given moment. Refer to Vonage's guide on business phone numbers to explore the best options available for your financial consulting business.

In today's digital environment, it might also make sense incorporating video conferencing tools and secure instant messaging systems to facilitate real time collaboration with them.

4. Create your brand and marketing strategy

A unique brand identity will set your financial consulting practice apart in the competitive financial consulting market. Focus on crafting one that effectively communicates its core values, expertise, and unique selling proposition through logo creation, color scheme selection and website development.

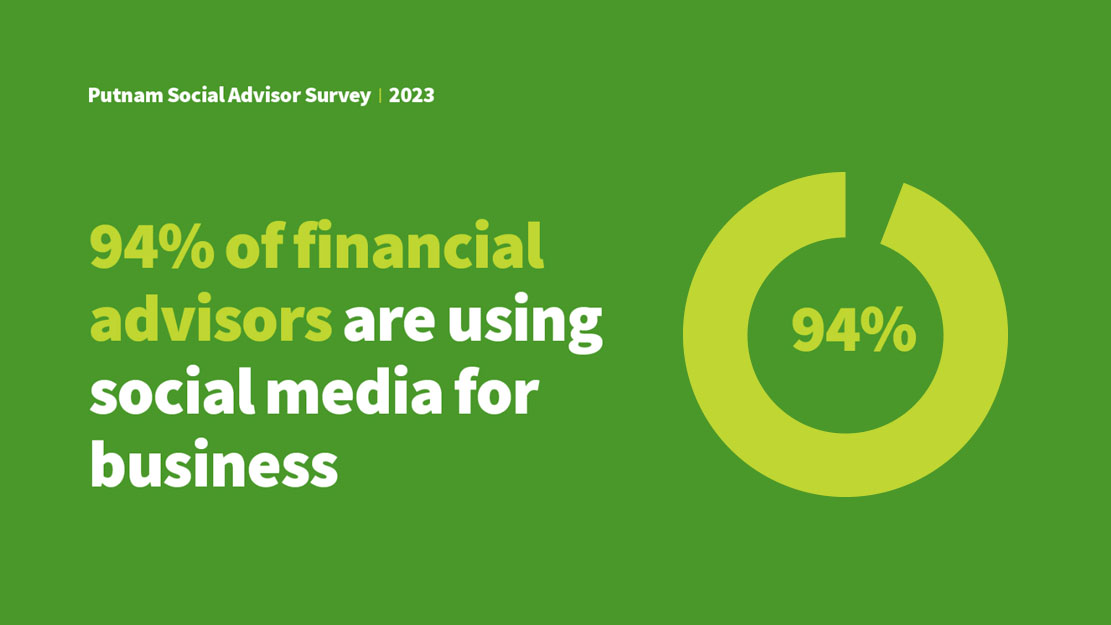

Your marketing strategy should aim to build brand recognition and engage your target market, using both online and offline methods such as content marketing, SEO, social media engagement, networking events, email marketing and strategic collaborations. In order to expand further, you should create virtual phone number in various geographic locations since they can increase accessibility and, at the same time, reduce costs.

5. Build your professional network and determine pricing

Cultivating an effective professional network is central to the growth and sustainability of any financial consulting business. Networking opens doors for partnerships, client referrals, and market expertise - so don't underestimate its power. Attend industry conferences and join professional organizations; use online platforms such as social media channels such as LinkedIn to connect with peers as well as potential clients.

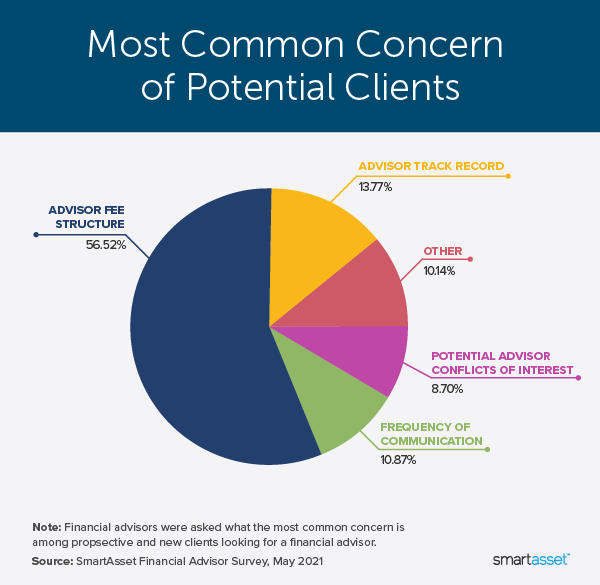

Pricing plays a key part in any successful business model. It's essential to create a pricing structure based on your expertise, market trends, and competitors' pricing structures. As a financial consultant, your pricing should reflect the value you bring to your clients, while also remaining competitive within the market.

Consider offering service packages tailored specifically to different client needs, such as for individuals, small businesses, or corporate clients. In addition to having a variety of pricing options, it's important to clearly communicate the value of each service you offer, so clients are assured they're getting top quality care at a reasonable cost.

6. Optimize client experience: Onboarding, financial management systems and technology tools

Enhancing client experience begins with smooth onboarding processes. Outline clear steps and expectations for new clients to ensure an effortless engagement from day one. Implement robust financial management systems for tracking income, expenses and taxes which not only ensure business efficiency but also build client trust.

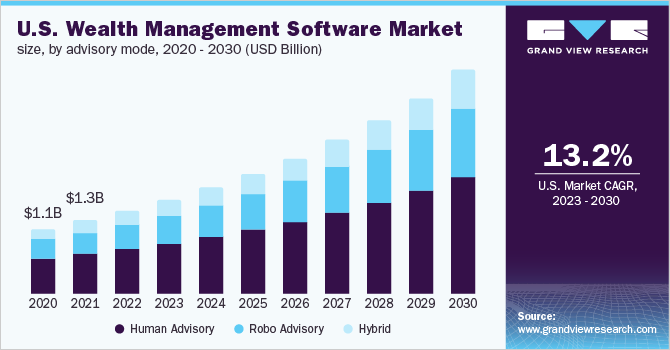

Make use of technology tools to elevate the client experience and business operations. Use CRM software for seamless communication, project management tools for optimized workflows, and secure platforms to facilitate document sharing.

In today's digital era, adopting technology into services is vital to remaining competitive while meeting client expectations.

7. Investment for professional growth and insurance

Financial consulting is an ever-evolving field; to stay current on trends, regulations, and best practices, invest regularly in professional development by taking courses, obtaining certifications, or participating in networking events to expand and strengthen your skill-set and capabilities.

Insurance can provide your business with invaluable protection. Speak with an insurance professional in order to identify which coverage best meets the needs of your enterprise - professional liability, general liability or business property insurance may all help your clientele trust and rely on you as professionals.

8. Compliance with regulatory requirements

Financial consultants must ensure they adhere to all applicable regulatory frameworks affecting their operations - this may include national or state regulations as well as industry rules or ethical standards that pertain specifically to them.

Depending on the services that you offer, regulatory bodies such as Securities and Exchange Commission (SEC) or Financial Industry Regulatory Authority (FINRA) may require registration with regulatory organizations like SEC or FINRA in order to be in compliance with disclosure, reporting and ethical conduct rules designed to protect investors while maintaining fair financial markets.

Compliance goes beyond simply avoiding penalties - it is also about building relationships. Being upfront with clients about qualifications, services provided, fees charged and potential conflicts of interest that might exist can build your professional credibility and create trust with potential clients.

Remain up-to-date on changing regulatory requirements with regular learning courses or subscriptions to industry updates from respected legal experts as needed.

9. Prioritize client experience and cultivate referrals

Deliver exceptional service and prioritize client experience as the cornerstone of your financial consulting business. Build strong and lasting relationships by providing personalized attention, clear communication, and timely responsiveness to client needs and inquiries.

Strive to exceed expectations and go the extra mile in delivering value. Delighted clients are more likely to become loyal advocates who refer your services to others, serving as a powerful source of organic growth for your business.

10. Cultivate resilience and adaptability

Running your own financial consulting practice can be an enormously demanding feat, necessitating you to deal with market fluctuations, the latest regulations and trends as well as different client needs and expectations. As an entrepreneur in this sector, you need resilience and adaptability in abundance in order to be successful.

Resilience will enable you to navigate tough times, learn from setbacks, and maintain an optimistic perspective through developing problem-solving abilities, building supportive networks, and practicing self-care techniques to manage stress effectively.

Adaptability in financial services refers to being open and accepting of change and innovation. With technology advances, regulatory changes, market developments and trends constantly shifting, the financial industry is ever evolving, and adaptability means being willing to update skill-sets as required, adopt new tools or approaches, and adapt your business model when necessary to keep pace with a continuously shifting industry.

Final thoughts

Launching your own financial consulting business can be both exciting and fulfilling, but requires meticulous preparation, thorough planning, and an understanding of all key steps involved.

Your niche will allow you to establish yourself as an authority in your market, while your business plan serves as the road map that leads there. By building credentials, clients will trust your expertise while setting up professional office systems will facilitate smooth business operations.

Remember, following these 10 important steps, you can lay a solid foundation for success and establish yourself as a trusted and reputable financial consultant in your chosen niche.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?