Average Annual Growth Rate

Refers to the arithmetic average of the yearly growth rates of cash flows, presented as a percentage

What Is Average Annual Growth Rate (AAGR)?

The average annual growth rate (AAGR) is the arithmetic average of the yearly growth rates of cash flows, presented as a percentage. These cash flows come from things like investment assets or portfolios, among other sources. This metric presents the average yearly return.

The Average Annual Growth Rate formula is as follows:

AAGR = (growth rate1 + growth rate2 + … + growth rate𝑛) / n

Where,

- "n" is the number of entries (years)

The AAGR is used in identifying long-term trends. It can describe the growth rates of nearly any financial metric, such as:

- Profits

- Revenue

- Cash flow

- Expenses

This provides investors with a sense of the direction the business is moving. This rate is also used in other fields besides finance.

For example, economic performance can also be summarized with AAGR to get an overview of shifts in something like the GDP growth rate of a country.

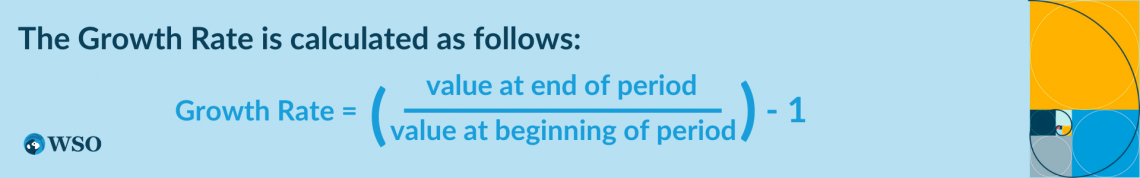

Since the AAGR depends on the growth rate per year, these would have to be determined if unknown. The growth rate is simply the percent change from one year to the next. It’s calculated as follows:

These periods should be equal in length when determining the growth rate. For example, if the period starts in March, it should end the following March. This gives a better calculation for the AAGR.

Key Takeaways

-

The Average Annual Growth Rate (AAGR) is the arithmetic average of the yearly growth rates of cash flows, presented as a percentage. It is calculated by summing the growth rates for each year and dividing by the number of years.

-

The AAGR is used to identify long-term trends and can describe the growth rates of nearly any financial metric, such as profits, revenue, cash flow, expenses, etc. It can also be used in fields beyond finance, such as summarizing economic performance.

-

The AAGR does not consider compounding and cannot indicate the potential risks of the investment. It also does not accurately reflect how cash flows are changing and can occasionally overestimate the rate of return on investment.

-

The Compound Annual Growth Rate (CAGR) is a better alternative for more reliable analyses as it considers compounding and smooths the growth rate. However, it also has limitations, such as not reflecting investment risk and requiring equal time periods.

Calculating Average Annual Growth Rate

As previously mentioned, the growth rates for each pertinent period are required to calculate the AAGR. However, they’re easily calculated by the percent change from period to period. Here’s an example:

| Year | End Value |

|---|---|

| 1 | $10,000 |

| 2 | $11,000 |

| 3 | $12,500 |

| 4 | $12,300 |

| 5 | $13,000 |

The value at the end of a period is the starting value for the following period. This way, we can determine the growth rate between these periods.

growth rate1 = ($11,000 / $10,000) - 1 = 0.1 = 10%

growth rate2 = ($12,500 / $11,000) - 1 ≈ 0.136 = 13.6%

growth rate3 = ($12,300 / $12,500) - 1 = -0.016 = -1.6%

growth rate4 = ($13,000 / $12,300) - 1 ≈ 0.057 = 5.7%

Now that the growth rates have been determined, the AAGR of these cash flows can be determined for this 4-year period.

AAGR = (0.1 + 0.136 + (-0.016) + 0.057) / 4 = 0.06925 ≈ 6.93%

While there were 5 years in this period, the growth from the beginning can’t be determined without the previous year (year 0) or an initial value. Therefore, the AAGR is determined from the end of year 1 to the end of year 5, which represents 4 years of growth.

This is the utility of the AAGR. It predicts what could happen at the end of year 6.

In this example, if the AAGR of these 5 years is approximately 6.93%, the value at the end of year 6 is expected to be $13,897.

$13,000 × (1 + 0.06925) = $13,900

If the initial values are already known along with the growth rates per year, then AAGR can be determined as before. Here’s another example (source: ycharts.com):

| Year | Inflation |

|---|---|

| 28-Feb-19 | 1.52% |

| 29-Feb-20 | 2.33% |

| 28-Feb-21 | 1.68% |

| 28-Feb-22 | 7.87% |

| 28-Feb-23 | 6.04% |

This can be calculated in Excel using the =AVERAGE() formula using the data in the inflation column as its parameters. If this table was started in cell A1, you could put =AVERAGE(B2:B6) in any cell to get 3.888%, just as with using the formula.

Limitations of Average Annual Growth Rate

It should be noted that being an arithmetic average means that it doesn’t consider compounding. Therefore, it’s used more as a way to quickly assess growth rate than providing an accurate measure of it.

This means that it can’t indicate the potential risks of the investment, as in the case of portfolios and investment assets. To do so, you’d need to apply a rate derived from a geometric mean, such as:

It is used to evaluate a manager's performance regardless of the size or timing of the investment funds. Investors consider this to be a true indicator of portfolio performance.

2. Money-weighted return (MWRR)

Measures an account's performance, including the timing and amount of cash flows as well as the performance of the underlying investments.

Both of these rates measure an investment's performance by considering compounding, which gives a better assessment.

NOTE

These metrics are also used in forecasting and reporting. Global Investment Performance Standards (GIPS) require that they be included in the financial reports of GIPS-compliant firms.

Another disadvantage of AAGR is that fluctuations within the periods are not considered. It does not accurately reflect how cash flows are changing. It occasionally overestimates the rate of return on investment.

This could lead to inaccurate analyses and mistaken projections.

Alternatives to Average Annual Growth Rate

The compound annual growth rate (CAGR) is the yearly rate of return necessary for a measure to increase from its starting balance to its ending balance. It considers compounding and smooths the growth rate, unlike AAGR, which is a linear metric.

While the AAGR has its uses for providing a quick summary of growth, relying solely on it is not recommended. Therefore, the CAGR is a much better alternative for more reliable analyses.

The CAGR has the better formula for comparing the performance of various investments over time.

It aids in addressing the AAGR's shortcomings. Investors can assess a stock's performance against other stocks in a peer group or against a market index by comparing the CAGR.

The historical returns of stocks, bonds, or savings accounts can also be contrasted using CAGR. The success of many business metrics for one or more organizations can also be monitored using the CAGR. Same with comparing various investment types as well.

It is also possible to assess the competitive advantages and disadvantages of different organizations by comparing the CAGRs of their business activities.

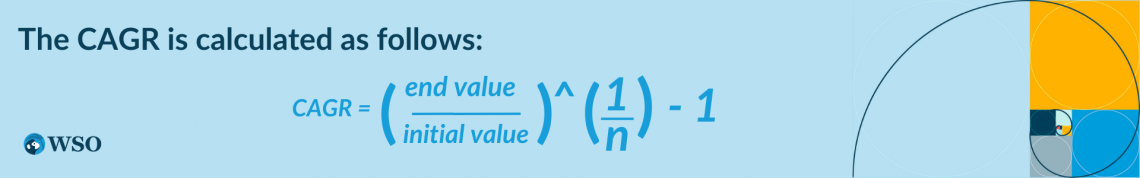

The CAGR is calculated as follows:

CAGR = (end value / initial value)^(1/n) - 1

Where,

- n is the number of years.

Let’s use the previous examples to calculate their CAGR.

First example:

CAGR = ($13,000 / $10,000) ^ (1 / 4) - 1 ≈ 0.0678 = 6.78%

Notice that this value is close to the AAGR of 6.93%, but it’s not exactly 6.93%. This reflects what is “lost” by discounting compounding.

Second example:

CAGR = (6.04% / 1.52%) ^ (1 / 5) - 1 ≈ 0.3178 = 31.78%

Notice that this value is nowhere near the AAGR of 3.888%. This is a better reflection of what happens in between. A significant jump from 2021 to 2022 can’t be appreciated in the AAGR. The CAGR shows that there was a significant change from beginning to end.

That being said, the CAGR isn’t without its disadvantages, either. For one thing, it does not reflect investment risk. Investing returns are erratic, which means they might differ greatly from year to year. CAGR, however, does not account for this volatility.

To do this, analysts need to use a risk-adjusted CAGR, which considers the standard deviation.

Another drawback is requiring the time periods to be the same, similar to the AAGR.

Average Annual Growth Rate FAQ

The average annual growth rate (AAGR) is the arithmetic average of the yearly growth rates of cash flows, presented as a percentage.

AAGR = (growth rate1 + growth rate2 + … + growth rate𝑛) / n

Where n is the number of entries (years)

The pros of AAGR are

- ease of calculation

- can be used in multiple fields

- identifies long-term trends

- presents a summary of growth

The cons of AAGR are

- the times periods should be equal in length

- it does not consider compounding

- can present inaccurate forecasting if it is the only metric used in analysis

- is not a valid reporting metric per GIP

The compound annual growth rate (CAGR) is the yearly rate of return necessary for a measure to increase from its starting balance to its ending balance, which does take compounding into account. It can be improved with a risk-adjusted version that uses the standard deviation.

or Want to Sign up with your social account?