Defensive Stock

These are safeguarding stocks that tend to carry low risk and have shown stable performance, even during market downturns.

What is a Defensive Stock?

Defensive stocks, as the name suggests, are safeguarding stocks that tend to carry low risk and have shown stable performance, even during market downturns.

Such stocks are typically found in sectors with indispensable products and services to everyday life, such as consumer staples and energy. These stocks also tend to have a lower beta than the broader financial market.

The companies' significance, stability, and related products are the exact reasons these stocks are an effective hedge during recessions.

The average consumer isn't typically eager to purchase an automobile, or a new collection of clothes, or book a lavish vacation during a recession. However, they will still have to spend their disposable income on essential goods like food, household, and health products.

For the reason above, such stocks are typically less susceptible to downward movements in business cycles.

Although similar in wording, defensive and defense stocks are two completely different concepts. Defense stocks suggest stocks concerned with military, security, and weapons, with examples such as Lockheed Martin and Northrop Grumman.

Defensive Stock advantages

The advantages are:

1. Ability to hedge and diversify

The diversification provided by the defensive stocks is one of the reasons to have them as a part of the portfolio to offset growth equities with a more stable and recession-proof investment.

During market downturns, these stocks are negatively impacted, but they are far less susceptible to drastic drawdowns than non-defensive stocks in share price loss.

2. Dividends as a revenue stream

They are commonly associated with solid dividend yields. This suggests that investors can still rely on dividends as a stable revenue source in either bull or bear markets.

As of today, some of the highest dividend yields are found in such stocks, such as Altria Group Inc's 7.95% dividend yield (Consumer Staples) and ONEOK's Inc 7.01% dividend yield (Energy)

Of course, a high dividend yield does not ensure a company's profitability or financial health. Still, it requires analysis to determine if a stock's high yield is within healthy limits.

3. Appealing to all levels of investing

These stocks tend to be an effective hedge during recessions and regularly imply a relatively stable performance. This allows inexperienced investors to dip their feet into investing without worrying about substantial volatility.

Many stocks in this section, mainly within consumer staples, are companies with business models that the average investor understands.

Pairing existing consumer knowledge with technical/financial details such as dividend yield can ensure risk-averse investors that their funds are well implemented.

Defensive Stock Disadvantages

The disadvantages include:

1. Less room for growth during bull markets

Recession-proof stocks are a double-edged sword due to their low volatility. Although they don't suffer as much from non-optimistic markets, they also don't tend to gain much when the markets are robust.

2. Reliance and overvaluation

At slight hints of a potential recession, many investors jump on the hedging stock categories, which creates an overvaluation compared to their intrinsic value.

The Motley Fool recently released an article on this, suggesting such stocks like Coca-Cola and Costco are trading more than 25x and 30x earnings, despite their mature businesses and projected modest growth.

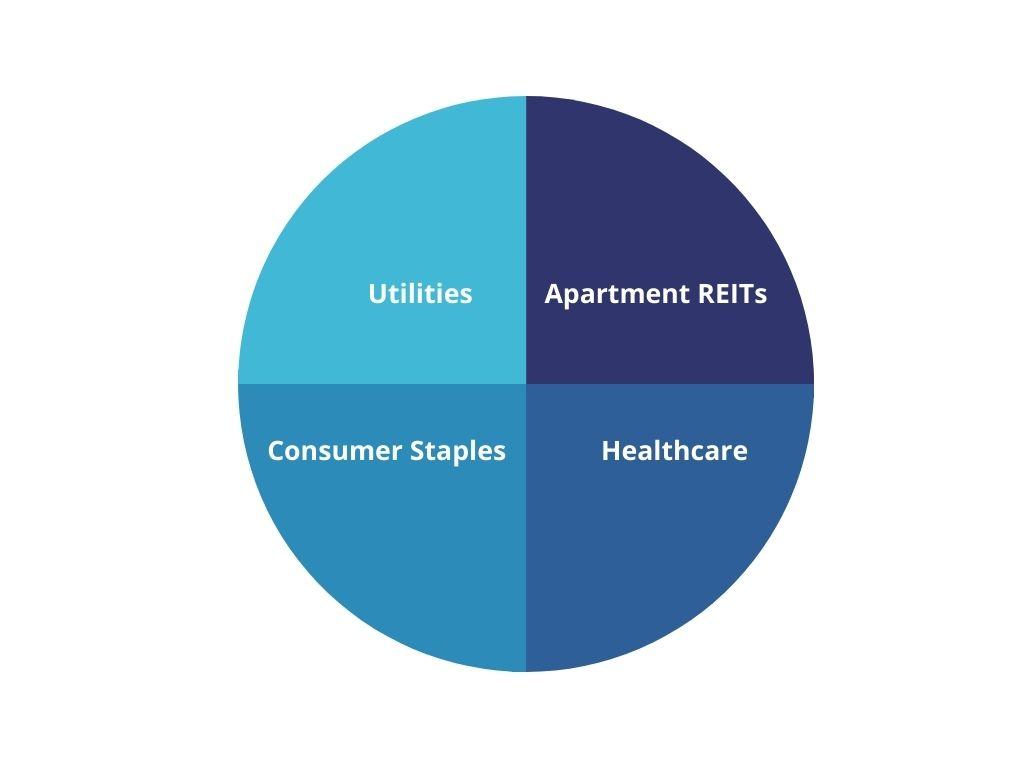

Defensive Stock Main categories

Beyond its advantages, it's time to look at what hedging stocks consist of.

But, again, these are guides to conventional categories, which may experience change under the circumstances.

1. Consumer staples stocks

The most self-explanatory category in the list. People can't live without the necessities such as food, beverages, hygiene products, and even tobacco to specific populations.

These goods are considered recession-proof because their demand stands no matter the state of economic conditions. In times of low market confidence, consumer staples fare much better than consumer discretionaries.

Examples include: Walmart, Tyson Foods, Procter & Gamble

2. Healthcare stocks

Recessions do not impact the number of people getting sick, needing health insurance, or using prescription drugs. Many healthcare stocks tend to differ in offerings, and not all are considered defensive.

Healthcare stocks focused more on R&D may not perform as well compared to those focused on selling prescription drugs and retail medical goods.

Examples include: CVS, Walgreens, UnitedHealth Group

3. Utilities (Energy) stocks

Utility stocks are effective hedges and cover essentials such as water, gas, and electricity. Therefore, utilities are another indispensable area and will be paid for no matter the performance of the financial markets.

Examples include: NRG Energy, Exelon, and Chevron

4. Apartment REITs stocks

The apartment real estate investment trusts are defensive to a certain extent, as consumers still need homes and shelters. REITs accounting for the average consumer income can be deemed a potential hedge during recessions.

It is essential to avoid high-end luxury REITs and industrial-related REITs, as those categories may have a higher chance of default.

Examples include Equity Residential and Mid-America Apartments Communities.

Recent trends in defensive stock categorization: A smart investor's portfolio may consist of perceived aggressive and defensive investments. Using the conventional categories of recession-resistant stocks used to be transparent in determining the suitable defensive investments, but things have shifted.

Yes, the conventional categories still exist, but they are becoming harder to classify as steady investments. Research has shown that pharma stocks, for example, have become very volatile due to regulatory and demand factors.

This reiterates the point of picking the right stock in each defensive category. A company's brand name could be utilized as a qualitative measure. Companies with substantial brand names can leverage their brand power as a recession-proof mechanism.

Why Invest in Defensive Stocks?

In a current state of stagflation, investors are pouring their funds into consumer staples stocks, making their prices soar like the high-tech stocks for the past few years. It is reported that staples have outperformed their discretionary peers by a wide margin.

Nevertheless, as the fight against inflation continues, other measures will impact different staples. While the wealthy population will keep spending on luxury labels, average consumers may opt to switch to cheaper private label products.

That said, prominent manufacturers and supermarkets that carry cheap private labels, such as Walmart, Costco, and Target, look to be high gainers from the current situation. Other winners include dollar stores such as Dollar Tree. Inc.

According to Bloomberg, the current situation emphasizes the squeezed middle of investments rather than the bargain basement. This impact is felt by industries such as clothing and food.

Corporations like TJX Companies Inc. (owner of T.J.Maxx and Marshalls) and Chipotle Mexican Grill Inc. have also seen their business and share price increase recently, as many consumers step away from buying luxury clothing or meals during this time.

Where do I start to build a defensive stock portfolio?

Investors should keep specific patterns and critical details in mind when looking to buy recession-resistant stocks and build their portfolios.

1. Examining a company's business model is critical. Investors should identify companies that offer always-in-demand products, as they will fare well no matter the situation of the economy.

During recessions, a great example would be the slowdown in designer and high fashion brands while a rise in value for discount apparel stores.

2. Defensive investments do not necessarily have to come from the categories discussed above. Any sector contains comparatively defensive assets compared to its competitors, and technology is an example.

Some tech companies rely on economic growth to propel purchase sentiments. In contrast, other tech companies will have products in demand no matter how the economy is doing, such as computer hardware and portable electronic devices.

3. Review the company's financial statements. Make sure the company is consistently profitable and constantly creating cash flow. For example, a company could have substantial debt but needs consistent cash flow to service it.

4. Refer to a company's historical performance. A good strategy to identify defensive equities could be to dig up their performance for past recessions and market downturns, such as during the 2008 financial crisis.

This information gives you an idea of how a company's management reacts under pressure and should be used as a referencing factor for hedging.

5. Valuation and brand power are essential. For defensive investing, an established company such as Apple will always be a better option than a newer company with greater projected earnings.

Valuations can sometimes be deceiving and account for factors that haven't' been priced into an investment. Companies with a solid brand name are the better bets when in doubt.

Summary

When building an investment portfolio, investors can benefit from combining cyclical and non-cyclical stocks for diversification. This way, they can see earnings when the economy is doing well and still experience stable performance during downturns.

Investors cannot control economic cycles but can use their knowledge and decision-making to hedge against potential recession.

or Want to Sign up with your social account?