Sustainable Investing

Combines investors' financial objectives with environmental, social, and governance (ESG) considerations to achieve both financial returns and positive societal or environmental impacts

What is Sustainable Investing?

Sustainable Investing combines investors' financial objectives with environmental, social, and governance (ESG) considerations to achieve both financial returns and positive societal or environmental impacts.

A few years ago, this was only a niche section going towards the mainstream market.

Sustainable Investing is an investment strategy that aligns with Corporate Social Responsibility (CSR) principles, aiming to generate financial returns while considering environmental, social, and governance factors.

Sustainable Investing and CSR are based on social, ecological, ethical, and governance elements. These elements are also impacting the business's financial performance.

It is also called:

- Sustainable investment

- Sustainable and Responsible Investing

- Socially Responsible Investing (SRI)

- Responsible Investment (RI)

- ESG Investing

Key Takeaways

- Sustainable Investing integrates financial objectives with environmental, social, and governance (ESG) considerations, aiming for both financial returns and positive societal or environmental impacts. It has transitioned from a niche to a mainstream investment strategy.

- It aligns with Corporate Social Responsibility (CSR) principles, emphasizing both financial performance and considerations of environmental, social, and governance elements.

- Also known as Sustainable and Responsible Investing, Socially Responsible Investing (SRI), or Responsible Investment (RI), it includes social, ecological, ethical, and governance considerations influencing financial outcomes.

- Sustainable Investing considers the planet (environmental impact), people (social implications), and governance (ethical management), recognizing their interconnectedness with financial success.

- Environmental, Social, and Governance (ESG) criteria evaluate non-financial performance, which is crucial for asset selection. They incorporate indicators like carbon emissions and labor management.

Understanding Sustainable Investing

There are several definitions of this term. It appears in the UN Principles of Responsible Investment. The Global Sustainable Investment Alliance (GSIA) and Eurosif define sustainable Investing.

They define sustainable Investing as an investment strategy or approach incorporating environmental, social, and governance (ESG) factors in the investment process and active ownership.

Sustainable Investing considers both the short-term financial gains and the long-term societal impact. The traditional measure for investors is risk-adjusted returns. The additional indicators for sustainable investors are the ESG factors.

ESG is not the only concept connected to Sustainable Investing. Some definitions use a triple bottom line or SEE (social, environmental, and economic impact).

The triple bottom line, also known as TBL, 3BL, 3P, or SEE, is a framework for assessing a company's performance in terms of its economic, environmental, and social impacts, integrating profit with the planet and people.

Sustainable Investing Components

Some of the main components include:

1. Profit

Profit is an indicator of a successful company. The business strategy focuses on increasing financial performance and decreasing the risks.

While profit is indeed important for a company's success, sustainable investing involves considering environmental, social, and governance (ESG) factors alongside financial performance.

2. Planet

If our planet is not doing well, our economy cannot do well either. Companies are responsible for ensuring that their activities do not harm the environment.

Negative environmental impacts can potentially affect financial results. The industry is responsible for driving positive change in our world and has the required resources to do so.

3. People

The traditional theory of organizational management, the shareholder theory, suggests that the main aim of a company is to maximize profits. The theory is also called a shareholder primacy theory, as it puts shareholders at the center of the company's interest.

The managers focus only on increasing shareholders' wealth within the constraints of the law. On the other hand, the most recent organizational management theory, the stakeholder theory, suggests that there are other company beneficiaries, not only the shareholders.

Note

The other stakeholders are employees, customers, and the community. The stakeholder theory is closely related to the development of the ESG concept.

Environmental, Social, and Governance (ESG)

ESG incorporates environmental, social, and governance factors or criteria to evaluate a company's non-financial performance.

TESG evaluates environmental, social, and governance factors to assess a company's non-financial performance. By doing this, it supports the development of sustainable investing.

The table below shows some examples of concrete ESG indicators used in practice.

| Environmental | Social | Governance |

|---|---|---|

| Carbon emissions | Labor management | Tax transparency |

| Product carbon footprint | Health & Safety | Business Ethics |

| Climate change vulnerability | Chemical safety | Board independence |

| Financing environmental impact | Consumer financial protection | Conflict of interest |

| Water stress | Privacy & Data Security | Executive compensation |

| Waste management | Community relationship | Ownership & Control |

The ESG is crucial for the sustainable Investing asset selection and allocation process. The concrete selection process depends on the type of investor and the type of asset.

Investors can get sustainability-related data from the companies' reports. Growing pressure on sustainability reporting makes the data more comprehensive and accessible.

Several sustainability-related data providers are currently on the market, and comprehensive sustainability ratings and scores are available.

Green Investing

Green Investing is a subcategory of Sustainability Investing. It primarily focuses on environmental factors while also considering elements of social and governance factors. Companies and projects with an environmentally related mission are considered green investments.

Also, green bonds, green mutual, index, or ETF funds are available on the market.

ESG ratings and scores

ESG ratings and scores measure companies' ESG performance. They use a specific method to identify the best-in-class performers based on ESG factors. Morningstar introduced the first sustainability rating for funds in 2016.

Since then, many smaller sustainability-related rating agencies and consultancies have developed, with big consultancies and rating agencies gradually acquiring smaller providers. Seven leading ESG ratings/scores are the following:

- MSCI ESG rating and MSCI Implied Temperature rise

- Moody's ESG

- Sustainalytics ESG risk rating

- ISS ESG Corporate rating

- S&P Global ESG

- Refinitiv

- CDP Climate Change and Water

Recently, there has been a lot of academic and public interest in the ESG rating divergence. In May 2022, Elon Musk disagreed with excluding Tesla from the S&P ESG index on Twitter. After this event, the discussion about the inconsistencies in the ESG approach heated up.

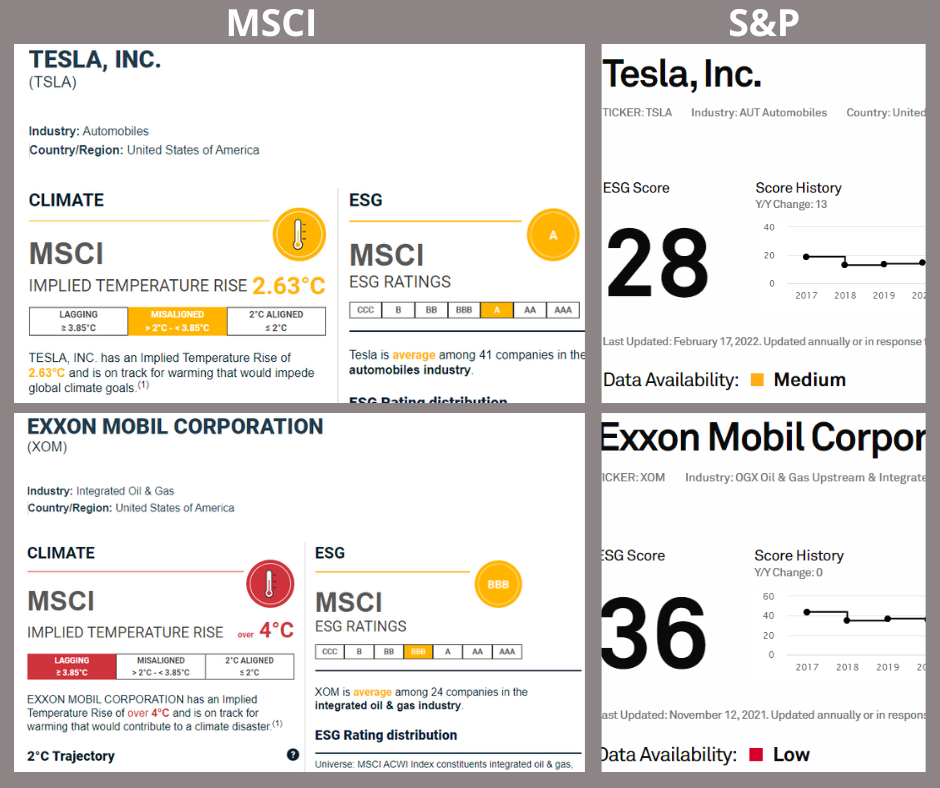

The example below demonstrates Tesla and Exxon Mobile ESG scores and ratings in May 2022. The MSCI gives Tesla an A score and Exxon a BBB score, while S&P gives Tesla a lower score than Exxon, indicating a mismatch in ESG evaluation methodology.

Different ESG scores and ratings vary as they lack standardization. Recent research (MIT Sloan) suggests that the correlation among the ESG ratings is 0.52. The variations are a result of

- Different methods

- Frameworks

- Measures

- Key indicators and metrics

- Qualitative judgment

- Weights

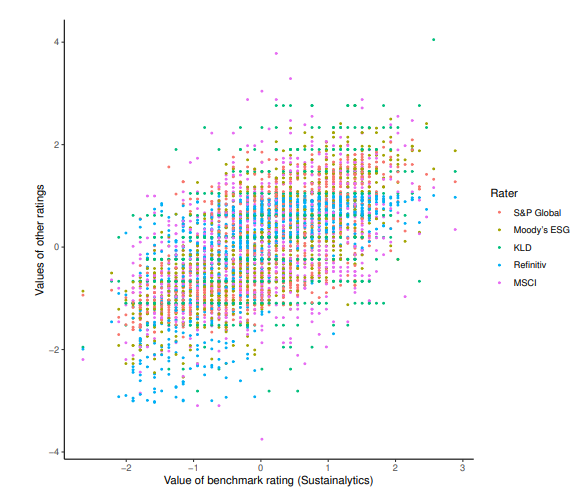

The chart below illustrates the ESG ratings and score variations.

Regulators want to standardize the ESG approach. Several countries defined sustainable activities in their taxonomies. A dedicated working group was set up to compare the taxonomies comprehensively.

sustainable investment strategies

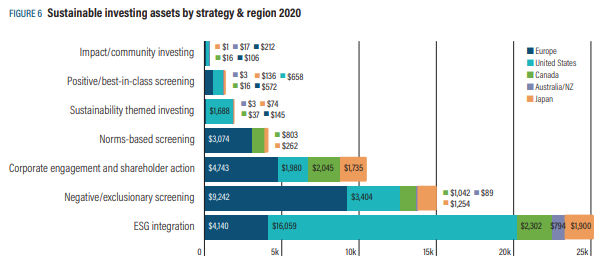

There are eight sustainable investment strategies, also called ESG approaches. They enable sustainable Investing and are applied throughout the investment process.

1. ESG Integration

The investment manager integrates the ESG factors into the usual financial analysis.

2. Norm-based screening

The manager is screening the instrument against relevant international standards and guidelines. Such standards and guidelines are issued by the

- United Nations (UN)

- International Labor Organisation (ILO)

- OECD

- Related non-governmental organizations (NGOs), such as Transparency International

3. Exclusion (negative) screening

A company, sector, or country is excluded from the portfolio based on set criteria. It becomes non-investable. This criterion can be norm or value-based. The criteria can refer to the:

- Product category

- Company's action

- Some controversy related to the company or country

Examples of non-investable companies:

- Producing tobacco products

- Producing and distributing weapons

- Pursuing animal testing

- Not accepting the human rights of their employees or suppliers

Note

Investors can exclude a country facing international human rights or war-related sanctions.

4. Best-in-class (positive) screening

Investors choose companies, sectors, or projects with positive or outstanding ESG evaluation. A minimal threshold is set based on the selected ESG rating or scoring as part of the selection process. Some investment managers use their in-house rating or outsource it.

5. Sustainability-themed investing

The investor chooses the asset based on the sustainability theme selected. Here are some examples:

- Sustainable agriculture

- Climate change mitigation

- Climate change adaptation

- Clean energy

- Energy efficiency

- Sustainable transportation

- Green buildings

- Green-tech

- Low carbon

- Gender equality

- Diversity

- Mitigation of deforestation and reforestation, and others

6. Impact Investing

This investing approach focuses on selecting companies and projects with sustainability-linked purposes. Such companies' main goal is to have a social or environmental impact. Examples of such objectives could be:

- Access to education

- Affordable housing

- Access to healthcare

- Access to finance (such as microfinance).

Investors aim to achieve measurable environmental and social impact while generating profit.

7. Community Investing

The Community Investing approach is a case of Impact Investing. The selected asset has a clear environmental and social impact on the community. These approaches are the so-called ESG incorporation approaches.

8. Stewardship (Active Ownership)

While ESG Incorporation impacts the issuers indirectly, stewardship influences the issuers directly. Investors can practice their direct influence on issuers using the following tools:

- Engagement

- Voting

- Litigation

- As investee board members and committee members

- Filling shareholders' resolutions.

Furthermore, investors can influence other stakeholders using the following tools:

- Engagement with policymakers and standard-setters

- Cooperating with research institutions

- Monitoring and engaging other investors

The following chart illustrates which strategy is mainly used in sustainable investing. It shows the data per region and asset values in billions of US Dollars.

Sustainable investment instruments

Sustainable Investing is becoming the norm in the market. The number and variety of available investment products are growing. Investors can choose from sustainability-related versions of almost all investment instruments.

1. Stocks

Sustainability investment stocks pass the investor's financial and ESG criteria. Examples:

- Shares of Tesla (electric vehicles, solar roofs, and panels)

- NextEra Energy (wind and solar energy)

- United Natural Foods (organic produce) are sustainability investment stocks

2. Bonds

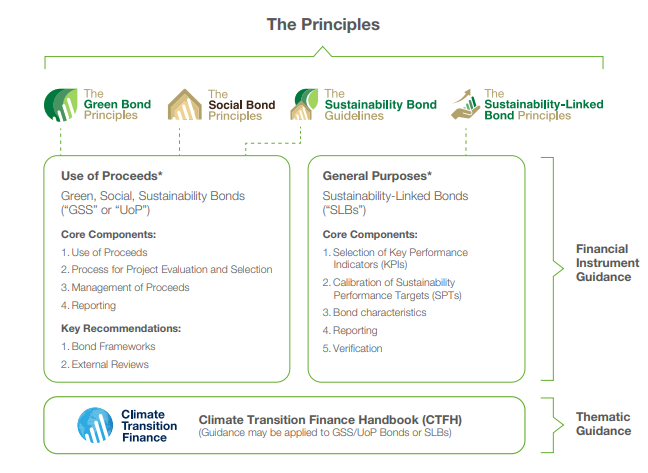

There are several categories of sustainable bonds, each with distinct characteristics and purposes:

- Climate-aligned bonds are issued by the issuer whose revenues are from climate-aligned activities

- Green bonds are issued to finance only eligible green activities

- Social bonds are issued to finance only eligible social projects

- Sustainability bonds are financing only a mix of green and social projects

- Sustainability-linked bonds are not based on the procedure. They can include any project or activity. The achievement of the selected sustainability objectives will incentify the issuer

The goals measure the key performance indicators against the sustainability performance targets. The picture illustrates the universe of sustainability-related bonds and their principles and guidelines.

3. Mutual, index funds, and ETFs

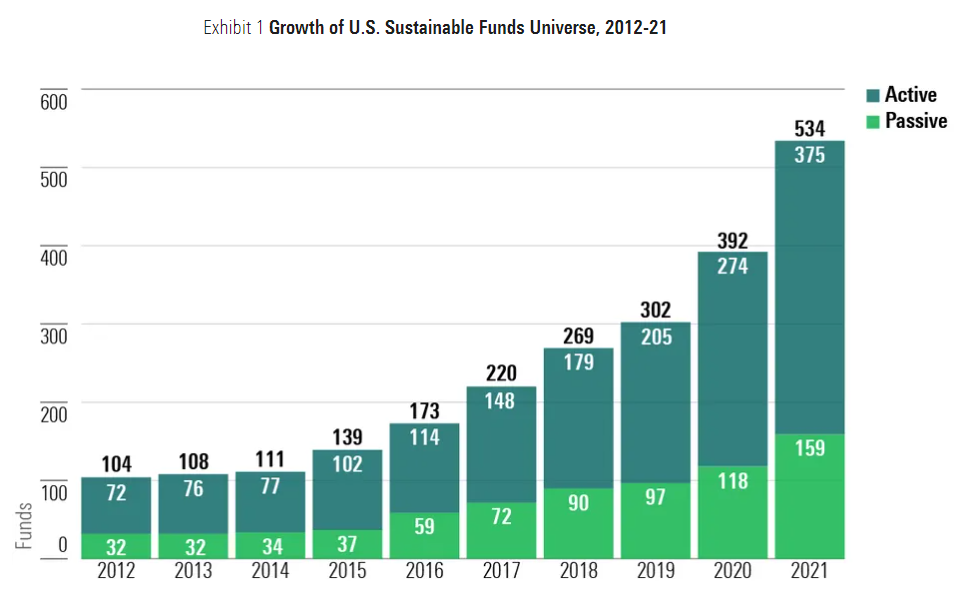

These instruments are accessible and convenient, making them the most common investment product among individual investors. Assets of active and passive sustainable funds in the US totaled over 530 billion US dollars in 2021, an increase from 392 billion US dollars in 2020.

Sustainable Investing benefits

There are three benefits of sustainable Investing :

- Influence on the sustainable development of the economy

- Enhanced returns

- Reinforced risk management

Firstly, sustainable Investing enables investors to impact sustainable development positively.

Their influence can be either direct or indirect. The direct impact happens through engagement and voting. Sending signals to the market enables investors to influence the issuer indirectly.

The allocation of resources can promote responsible behaviors among the companies. It also reflects which responsible businesses and ideas are supported.

Sustainable investors support sustainable development, which is the primary goal of sustainable investing. Secondly, it pays off for investors. Several academic research papers have studied the performance of sustainable assets.

The research results are inconclusive regarding the performance of sustainable assets, although some studies suggest a lower cost of capital for good ESG and CSR performers (Deutsche Bank Group).

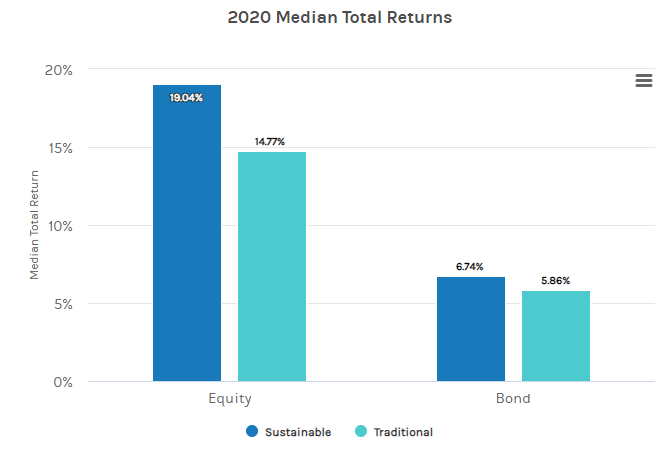

Many studies suggest that companies with high ESG evaluation achieved market-based outperformance and accounting-based outperformance. Also, sustainable equity and bonds outperformed their traditional peers in 2020 (Morgan Stanley).

Thirdly, companies with firm ESG profiles are more resilient to future reputational risk. Risk resulting from briberies, corruption, or fraud has a lower impact on these companies.

Companies observe the impact of ESG-related risks. The related reputation risk or risk of litigation can have a negative effect. So, focusing on the ESG aspects will strengthen risk management.

Note

The impact of investors on sustainable development is significant. In 2020, almost 36% of the assets under management were sustainable investment assets. The shift from a 25% share in 2016 is a remarkable change in the global asset management market.

Sustainable Investing History and Recent Developments

Sustainable Investing is shifting from a niche to becoming a typical investment strategy. The market is also responding to the increasing pressure from all stakeholders, such as the:

- Regulators

- Investors

- Customers

- Educators

- NGOs and others

The thematic investment strategy based on ethical, social, or environmental factors is now gaining traction, shifting from a niche to a typical investment strategy. The divestment of South African companies is an example of an ethically themed strategy.

Investors have avoided assets related to South Africa since the 1960s. In 1986, they managed to force the government to change the law.

Later, the financial crisis in 2007-2008 shed light on sustainable investing. During that time, Paul Krugman declared the assumption that the private pursuit of profit always leads to good results wrong.

An example of the environmental investment strategy is a fall in the share price of BP plc. after the Deepwater Horizon rig disaster in April 2010. President Obama declared BP plc responsible for the oil spill. This event made the environmental aspects more relevant for investors.

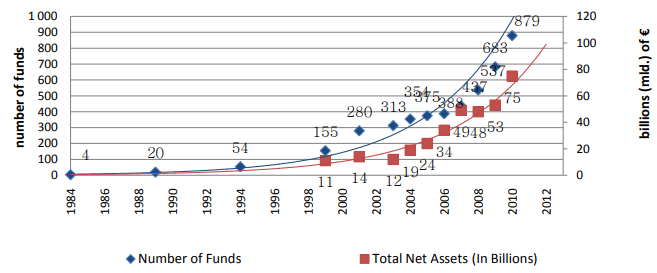

The number of funds and the total net assets grew exponentially in Europe between 1984 and 2011.

The recent growth of Sustainable Investing

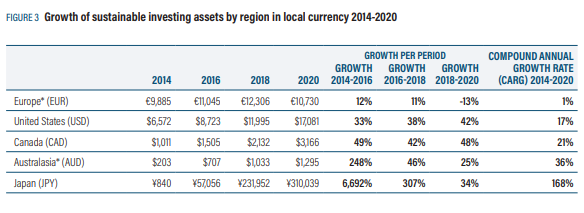

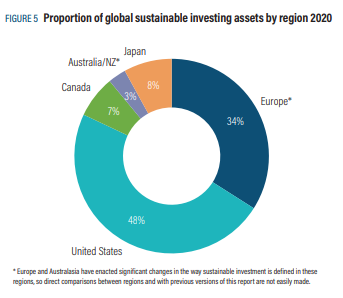

Sustainable investing is becoming increasingly prominent in the financial market. At the start of 2020, it reached 35.3 trillion US dollars in Europe, Canada, the USA, Australasia, and Japan, a 55 % increase since 2016 (GSIR 2020).

The growth continues in most regions, with a slight decrease in Europe due to regulatory adjustments to promote sustainable investment, such as implementing the EU Taxonomy.

At the beginning of 2020, sustainable investments accounted for around 35% of total global assets under management. The highest proportion of Sustainable investing assets against total assets was in the EU at 34%, followed by the USA at 48% in 2020.

Sustainable Investing Principles and Guidelines

Standardization is necessary in the fast-growing field of sustainable investing. International institutions and governments are developing related policies, guidelines, and tools.

These are examples of well-established guidelines and principles:

- UNEP FI Principles for RI

- Green bond principles

- Social bond principles

- Sustainability bond guidelines

- Sustainability-linked bond principles

- Climate bond taxonomy

- The EU Taxonomy for Sustainable Activities

Other related topics

- Sustainable Development Goals

- Sustainable finance

- Sustainability and climate risk

- Just Transition

- Decarbonization

- Net-zero

- Nature Capital

- Carbon trading, carbon price, and carbon tax

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?