Vega (ν)

Measures the sensitivity of an option's premium to a 1% change in implied volatility.

Vega falls under a series of option sensitivity measures called the Greeks and is denoted by the Greek letter nu (𝝂).

This measures the sensitivity of an option's premium to a 1% change in implied volatility. It is a derivative of implied volatility, defined as the market's forecast of a likely movement in the underlying security.

Implied volatility is used to price option contracts, and its value is reflected in the option's premium. Should the market anticipate a more significant movement in a security, the implied volatility will be higher, making the option more expensive, and vice versa.

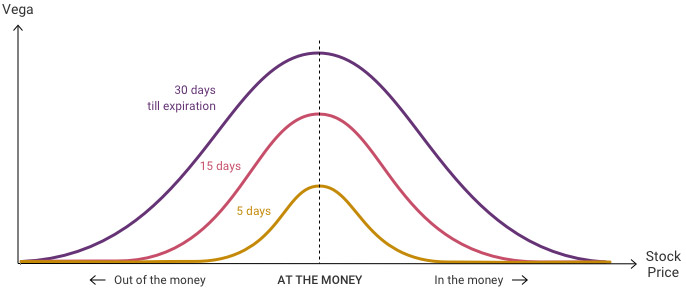

The longer an option contract has until expiry, the more volatility affects the price.

It increases as the underlying moves closer to the strike and falls as the option gets closer to expiration. In other words, it is centered around at-the-money options and falls as it moves out of the money or in the money.

Longer-dated options have a higher vega value. But, again, this is a reflection of its sensitivity to time.

The more time an option has to be above or below its strike, the more sensitive it will be to changes in implied volatility. It does not affect the intrinsic value of an option's premium, only the extrinsic value or time value.

The Greeks assess derivatives, often referred to as risk sensitivities, risk measures, or hedge parameters.

How Is this Used?

This greek is used for the following:

1. Long and Short Options

Long options carry a positive 𝝂, and short options carry a negative vega. When long on an option, the investor wants the premium to increase; when short on an option, the investor wants the premium to fall (decrease).

When implied volatility increases, there will be an increase in the option's premium; inversely, a decrease in implied volatility will decrease the option's premium, which is why 𝝂 is positive for long positions (purchased) and negative for short positions (sold).

Vega changes when there are more significant price swings (higher implied volatility), equating to higher uncertainty. Conversely, lower implied volatility can be equated to lower uncertainty and a lower likelihood of dramatic swings in the underlying security.

A long 𝝂 portfolio implies a positive exposure to increases in implied volatility, and a short 𝝂 portfolio indicates volatility vulnerability.

Remember, high volatility can result in drastic market swings. In addition, volatility typically negatively correlates to the market, i.e., spiked volatility can reflect a downward market velocity.

Managing a portfolio's 𝝂 exposure helps understand volatility risk and the trader's comfort level.

2. Measuring volatility

It can measure an option's portfolio or volatility exposure through multi-leg option strategies.

For example:

Long 1 ABC 70 call with 60 days to expiration at +.60 𝝂 (Long Volatility)

Short 1 ABC 70 call with 30 days to expiration at -.35 𝝂 (Short Volatility)

Net 𝝂: + .25 𝝂

This trade is long Vega and has positive volatility exposure.

Implied Volatility

Vega measures change the price of an option for each percentage point move in implied volatility. To understand what 𝝂 means, we must first understand implied volatility and how it is measured.

Implied volatility is calculated through an option pricing model that determines the current market prices, estimating an underlying asset's future volatility. Implied volatility may deviate from actual future volatility as it is a projection.

Implied volatility refers to the forecast of the expected volatility of the underlying asset. Implied volatility can be shortened to volatility or just IV.

A higher implied volatility means there is more uncertainty around the asset's price, and as IV increases, we can expect to see significant price swings.

Implied volatility is expressed as an annualized percentage change associated with one standard deviation.

It changes over time and is not always uniform. Therefore, the traders who use it monitor it regularly. As mentioned, options approaching expiration tend to have lower 𝝂 compared to similar options that are further away from expiration.

An IV of 20% would mean that the standard deviation over the next year would be a 20% change in price. Using the normal distribution, we find a 68.2% probability of a 20% change in price.

If the underlying asset's price is $10, then you would expect the stock to be between $8 and $12 in the next year.

How to Interpret?

This measures an option's price sensitivity to a 1% change in implied volatility. It is generally positive for both call options and put options that have time until the expiration date.

An option with a 𝝂 of 0.20 would mean that. for every 1% change in the implied volatility, the option price should change by $0.20.

Three main factors affect 𝝂:

- Implied volatility

- Strike price relative to the underlying asset’s spot price

- Time until expiration.

The longer there is until an option expires, the higher the extrinsic value of the premium. The extrinsic value is due to the ability to hold the option and the opportunity for the option to gain value as the underlying asset appreciates.

Higher volatility generally implies a higher extrinsic value is priced into an option's premium. This is because implied volatility heavily influences time value.

A higher implied volatility means a greater chance for the option to increase in value and the underlying asset to move in price before the expiry.

The option's strike price relative to the asset's spot price is also essential. This measure tends to be smaller if an option is very out-the-money.

This is because, even if volatility changes, there is still not a high probability that the option will end up in the money, meaning the price will not show a significant difference.

Let us solve a hypothetical example:

A call option with a premium of $7 and an underlying asset with a price of $150.

If the IV is 15% and the 𝝂 of the option is 0.15, what would happen to the option price if the implied volatility increased to 18%?

The 3% increase should mean that the price change would be an increase of 3 x $0.15 = $0.30.

We would expect the price to increase from $7.00 to $7.30.

However, if the IV fell by 3%, we would expect a decrease in the price by $0.30, resulting in a price of $6.70.

What is Vega-Neutral?

It is a strategy used for limiting risk in an options trade by hedging against the implied volatility in an underlying market.

This strategy will involve taking long and short positions on multiple options to create an options portfolio with an overall 𝝂 of zero – meaning that the portfolio's total value will not be affected by changes in implied volatility.

What is the use of this measure in options? Using this Greek can help determine the time value of an option.

The extrinsic value is essential in understanding an option's pricing. It can also assess an option's potential to increase value before the expiry.

Generally, this measurement will not be a static number as an option's implied volatility increases or decreases and moves closer to the expiration date; the 𝝂ega changes. Therefore, traders should closely monitor this to assess how an option's price might move.

Traders often refer to being long or short Vega. Being long 𝝂 means that traders hold a long position and will benefit from a rise in implied volatility, whereas being short 𝝂 means the trader will benefit if the implied volatility falls.

How is 𝝂 Calculated?

When the 𝝂 of an option is greater than the bid-ask spread, the option offers a competitive spread and vice-versa.

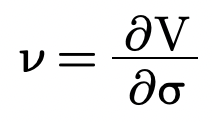

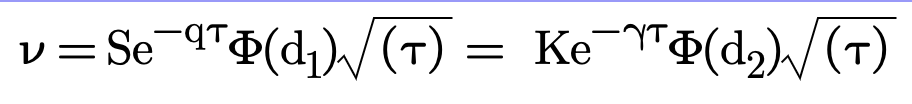

The general form of 𝝂 is represented by:

Where,

- 𝝂 – the option’s price

- ∂ – the first derivative

- σ – the volatility of the underlying asset

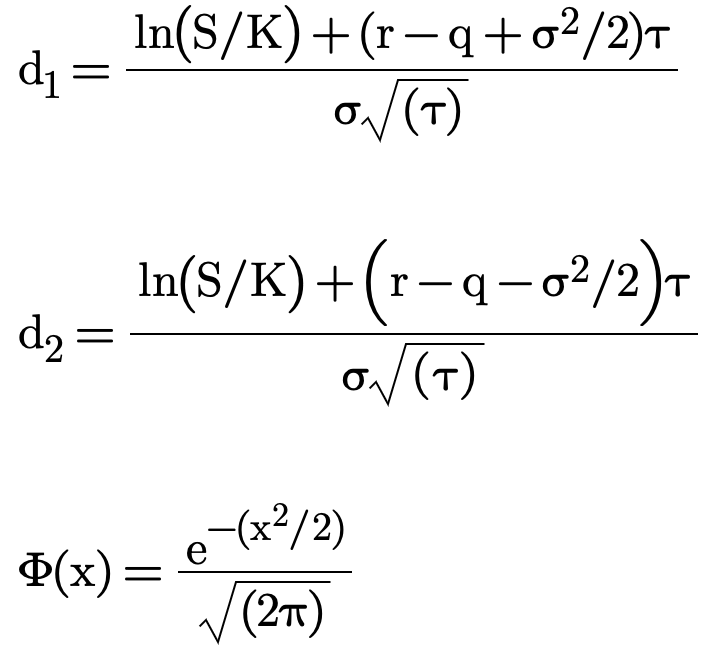

According to the Black-Scholes model, the calculation for 𝝂 is given by:

Where,

Where:

- S – the stock price

- K – the strike price

- q – the annual dividend yield

- r – the risk-free rate

- τ – time until expiration

- σ – the volatility

Example

For example, let us suppose that stock XYZ is trading at $40 per share in January and a February $42.50 call option has a bid price of $1.25 and an ask price of $1.30. Assume that the option's 𝝂 is 0.15 and the implied volatility is 10%.

The call options offer a competitive spread: the spread is smaller than the 𝝂. That does not mean the option is a good trade or that it will make the option buyer money. It is just one consideration, as too high of a spread could make getting into and out of trades more difficult or costly.

If the implied volatility increases to 11%, then the option's bid price and asks price should increase to $1.40 and $1.45, respectively (1 x $0.15 added to the bid-ask spread).

If the implied volatility decreased by 2%, then the bid price and ask price should drop to $0.95 by $1.00 (2 x $0.15 = $0.30, subtracted from $1.25 and $1.30).

Increased volatility makes option prices more expensive, while decreasing volatility makes options drop in price.

- Vega measures the rate of change of an option's premium with respect to a change in volatility.

- The closing prices of the stock calculate historical volatility.

- The implied volatility (IV) refers to the expected volatility of the underlying asset.

- Implied volatility represents the market's expectation of volatility.

- Higher volatility implies a higher extrinsic value priced into an option's premium.

- When volatility increases, all options increase in premium.

- When there are many days left until expiry, the effect of volatility is the highest.

- This can be used to assess the potential of an option to increase in value before the expiration date.

- Long options have positive 𝝂, while short options have negative 𝝂.

FAQs

The units of 𝝂 are $/ σ; however, like the other Greeks, the units are often left out.

Vega and implied volatility can change without any movement in the underlying. Therefore, it should not be confused with volatility. Volatility can be an implied or historical figure - 𝝂 measures an option position's sensitivity to implied volatility.

Changes in 𝝂 are based on the time to expiration. The further away the expiration date is, the higher 𝝂 will be. As there is more time before expiration, it implies a higher likelihood for a move to happen.

As volatility increases, traders will likely see more significant moves in the underlying. This will result in a higher payoff if the underlying price moves in the right direction away from the strike.

This is why this increases when volatility increases, and the value of an option, in turn, increases.

Researched and authored by Rohan Kumar Singh | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?