Diluted EPS Formula and Calculation

It is a company’s earnings per share calculated using fully diluted shares outstanding.

What is the Diluted EPS Formula?

Diluted Earnings Per Share is a company’s earnings per share calculated using fully diluted shares outstanding. The calculation considers all the stock options granted, convertible bonds, convertible preferred shares, and warrants.

The aim is to consider and assess the impact on the earnings per share (EPS) if all convertible securities were exercised.

Diluted EPS provides a comprehensive outlook on the company’s profitability, financial performance, and potential for future growth. In addition, this metric helps us understand the true extent of the earnings available to the shareholders in the worst-case scenario.

It is important to note that diluted EPS is a forward-looking metric based on assumptions about future events.

This means that the diluted EPS calculation can not determine for certain when these outstanding convertible securities, such as stock options, convertible preferred shares, convertible bonds, and warrants, will be converted, if at all.

As indicated by its name, Diluted earnings per share are always lower than basic earnings per share.

There are cases when the diluted EPS is higher than basic EPS due to anti-dilutive securities, meaning that these securities reduce them instead of increasing the number of outstanding shares.

If such securities are exercised, the value of the diluted EPS will be higher than the basic EPS.

Key Takeaways

- Earnings Per Share (EPS) is a metric that uses historical data.

- Diluted Earnings Per Share (EPS) is a forward-looking metric.

- They are famous metrics because they are easy to calculate.

- Diluted EPS, in most instances, is lower than basic EPS.

- Diluted EPS can be higher than EPS in cases of anti-dilutive securities.

- They can predict a company's future growth and compare competitors.

- A positive EPS and diluted EPS is a sign of good earnings and healthy management.

- A high diluted EPS indicates more returns for the common shareholder.

Why is diluted EPS important?

Most publicly traded companies issue convertible securities to large institutional investors and hedge funds. These securities, as mentioned before, are dilutive as they can potentially increase the total number of outstanding shares if exercised.

Common shares and corporate bonds may not appeal to certain investors looking to invest in companies and would like a better risk-to-return trade-off.

So, some investors, usually big players in the market, approach the companies they would like to invest in so that these companies can issue specific securities such as convertible preference shares and convertible bonds to them.

Stock options are another dilutive security issued to company employees as a form of compensation and bonus.

What makes their compensation is the fact that companies grant the option to the employees at a much lower strike price than the market. Most of these options are already in the money (ITM).

Retail and institutional investors looking to purchase company shares from the secondary market look to EPS and diluted EPS to effectively compare companies with their competitors to assess which company has the highest earnings per share.

Consistent high earnings per share indicate that a company is effectively growing and managing its daily operations.

EPS and diluted EPS are easy to understand and calculate, making them one of the most popular metrics looked at by retail investors. It can be estimated by anyone with the formula and gives excellent insight into the company.

However, at the institutional level, where the stakes are a lot higher due to the large amounts of money that need to be managed, EPS and diluted EPS aren’t paid close attention to. Instead, cash flow is of utmost importance at the highest asset and portfolio management level.

Formula and Calculation of Diluted EPS

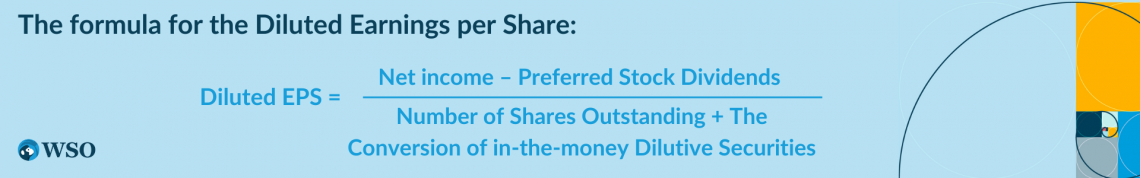

Since basic EPS and diluted EPS are metrics calculated to show the true extent of the earnings available to the common shareholder, preferred stock dividends are subtracted from net income. The numerator is the same for basic EPS and diluted EPS formulas.

Diluted EPS = (Net income – Preferred stock dividends) / (Weighted average number of shares outstanding + the conversion of any in-the-money options, warrants, and other dilutive securities)

To understand, we need to figure out all the in-the-money (ITM) dilutive securities that can be potentially exercised. Then, assume they would be exercised as if the worst-case scenario is taking place and add those securities to the current outstanding number of shares pool.

We calculate the weighted average number of outstanding shares because the conversion need not occur at the beginning of the financial year. We could have conversions take place at any time during the financial year.

So, we might have a different number of shares outstanding for the first half of the year and a different number for the second half. For this reason, we calculate a weighted average.

Suppose compensatory securities issued by a company are anti-dilutive, meaning that they increase basic EPS instead of reducing it. In that case, those figures are excluded from the diluted EPS calculation.

Diluted EPS Example Calculation

To calculate diluted eps, we’ll first have to calculate basic EPS. Let’s take a fictional company’s financials and move on to a real-world example.

For example, the following are the financials of company ABC ltd.

- Revenues – 20,000

- Cost of revenues (or goods sold) – 5,000

- Expenses – 3,000

- Preferred stock dividends – 2,000

- The weighted average of common shares outstanding – 10,000

- Convertible bonds – 1,000

- Convertible preference shares – 1,000

- In-the-money (ITM) employee stock options – 2,000

- Warrants - 700

We are now in a position to calculate net income. The formula to calculate net income is

Net income = Revenue – Cost of Revenue - Expenses

Net income = 20,000 – 5,000 – 3,000 = 12,000

Once we have our net income, we can calculate basic EPS. The formula for basic EPS is

Basic EPS = (Net income – Preferred stock dividends) / Weighted average of common shares outstanding

Basic EPS = (12,000 – 2,000) / 10,000 = $1.00

Moving on, for diluted EPS, we would need to add all the dilutive securities to the weighted average of common shares outstanding in the denominator while leaving the numerator unchanged.

Diluted EPS = (Net income – Preferred stock dividends) / (Weighted average number of shares outstanding + Convertible bonds + Convertible preference shares + ITM stock options and warrants)

Diluted EPS = (12,000 – 2,000) / (10,000 + 1,000 + 1,000 + 2,000 + 700) = (10,000) / (14,700) = $0.680

Note

If the company has not issued preference shares, it would not be paying any preferred stock dividends on it. So, we would subtract net income from 0.

Diluted EPS Real-world case study

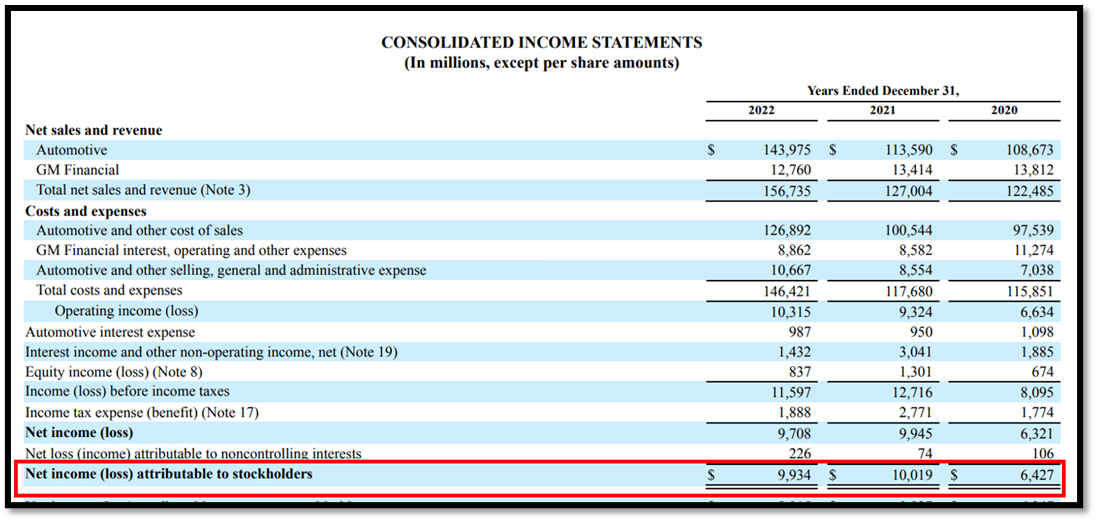

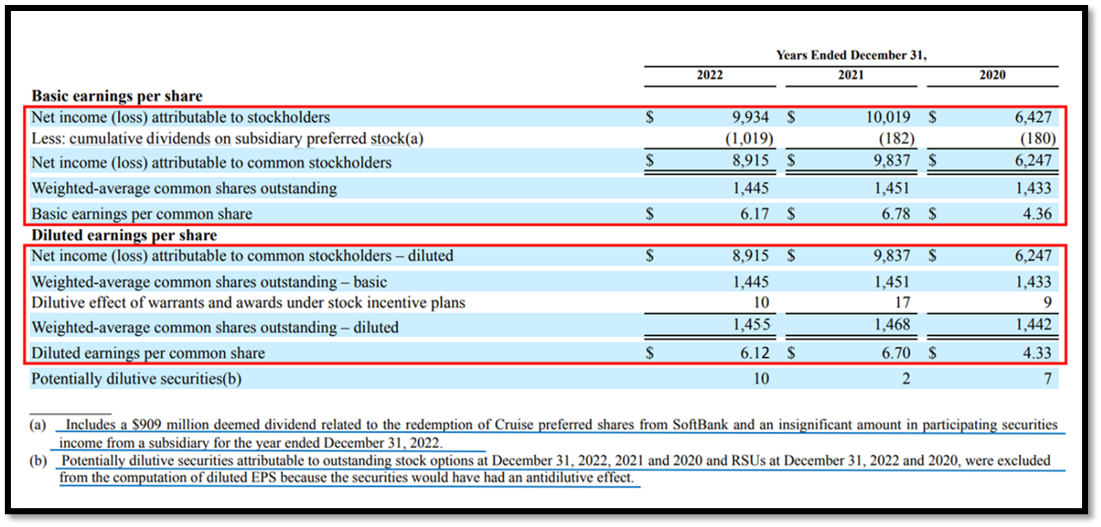

Moving on to the real-world case study, we’ll use General Motors as our example. We’ll be pulling out all the necessary figures from the annual report and the 10-k that all companies must release with the SEC after the end of each quarter.

You can check our article on the 10-k for more information.

The income statement shows that in the year ending December 31, 2022, the net income was $9,934 million or $9.934 billion.

We also find that the cumulative dividends on subsidiary preferred stock were $1,019 million or $1.019 billion. It is specified in the notes to the financial statements that $909 million was related to the redemption of preferred shares.

This is subtracted from net income to arrive at a diluted net income, which we use in our numerator.

Furthermore, our weighted average number of common shares outstanding increases from 1.445 to 1.454 billion shares by adding the dilutive effect of warrants and awards under stock incentive plans.

This new figure will be used as a denominator to calculate the diluted EPS, which would be the diluted net income divided by the new weighted average number of shares.

Diluted EPS = (9,934 – 1,019) / (1,445 + 10) = 8,915 / 1,455 = 6.12

General Motors specifies that certain outstanding stock options and RSUs (Restricted Stock Units) have been excluded from the diluted EPS calculation because they were anti-dilutive and increased the basic EPS.

In such a case, as discussed previously, we exclude them.

Note

It is a requirement by the SEC for companies to provide you with calculated basic EPS and diluted EPS.

Diluted EPS vs. EPS

The difference between EPS and diluted EPS is that it is a more conservative metric of profitability as it considers the potential dilution of earnings due to the issuance of convertible securities.

This means that the dilutive effect of potential new shares is considered when calculating diluted EPS, which is not done for basic EPS. The dilutive effect occurs when the number of outstanding shares increases.

The increase in outstanding shares can lead to a decrease in the stock price if the company's earnings do not increase respectively.

The formula for Earnings Per Share (EPS) and Diluted Earnings Per Share (EPS) is different.

For EPS, the numerator is net income minus preferred dividends divided by the end-of-period common shares outstanding.

For diluted EPS, the numerator remains the same, but in the denominator, instead of end-of-period common shares outstanding, we use the weighted average number of shares outstanding.

The calculation for diluted EPS is generally harder depending on the company’s capital structure. A complex capital structure can make the analysis difficult.

For example, many companies issue different types of shares and bonds. Even in the preferred share category, some may be able to convert while others don’t. The same is the case for bonds.

Earnings per share are less significant to investors than diluted earnings per share as it does not show the true profitability of the ordinary shareholder.

Another difference is that EPS considers historical data, while diluted EPS is a more forward-looking metric.

It is important to note that diluted EPS is usually lower than basic EPS. If the diluted EPS is higher than the basic EPS, it is ignored, and the company reports the essential EPS and diluted EPS the same.

Is high diluted EPS good?

Yes, high diluted earnings per share (EPS) is better than low diluted EPS because it indicates that the company can generate a significant profit.

This could be due to high revenue, low expenses, and decreased outstanding shares. On the other hand, a decrease in outstanding shares could be due to several reasons, including capital restructuring and share buybacks.

High diluted earnings per share indicate strong financials and long-term growth, which is better for the shareholders of common shares.

It makes it more attractive to investors who are always looking to purchase shares of companies with high earnings and future long-term growth prospects to get their desired returns.

A high diluted EPS can also increase competitiveness in the industry by attracting new customers and larger, more profitable projects because of their strong financials.

However, it is essential to note that EPS and diluted EPS entirely depend upon the company's financial reporting philosophy.

For example, the use of inventory valuation methods between First-In-First-Out (FIFO) and Last-In-First-Out (LIFO) can affect the net income depending upon several other factors. Therefore, net income is a crucial function of the primary and diluted EPS formula.

If the diluted EPS is significantly lower than the basic EPS, then that would indicate that the common shareholders don’t get much of the earnings coming their way, even if the basic EPS is high.

Negative basic EPS or diluted EPS is a sign that the company is spending more money than it’s making in revenues. This could be due to high research and development (R&D) costs, which are common for startups.

However, if a company is in its growth or mature stage of its lifecycle, negative basic or diluted EPS could indicate that the business is struggling, posing the risk of bankruptcy.

or Want to Sign up with your social account?