Inventory Valuation

An accounting practice carried out by firms

What Is Inventory Valuation?

Inventory Valuation is an accounting practice carried out by firms to determine the value at which inventory is carried in the financial statements until the related revenues are recognized. A good grasp of inventory valuation helps to maximize profits.

Inventory is an asset that includes raw materials, WIP, and goods held available for sale in the ordinary course of business.

For example, a stationery store would consider pens, pencils, notebooks, staplers, erasers, etc., as inventory available for sale in the ordinary course of business.

As an asset for a business, inventory needs to be recorded at a value on the balance sheet. Once the value of inventory is determined, the business's inventory turnover ratio can be calculated. This ratio can help strategize purchase budget plans.

Inventory management is critical in manufacturing industries, especially. A minor inconvenience or bad decision could halt unit production. Inventory cost is mainly influenced by carrying cost, lead or delivery time, and purchase cost.

Carrying costs generally make inventory costlier. Such storage and warehousing costs are usually feasible only for large businesses. Small businesses tend to operate smoothly and make more profits with less inventory on hand.

The amount of time between when the purchase order is placed and when it is delivered to the site is called lead time. Lead time plays a critical role in inventory management. There must be sufficient inventory on hand so that there is no shortage during lead time.

Inventory also faces the obstacles of depreciation, devaluation, depletion, and obsolescence. In dynamic business environments such as technology and electronics, inventory tends to become obsolete fast. Natural resources deplete, and other inventory items are subject to depreciation.

All of these factors help us understand how crucial it is to value inventory as accurately as possible and manage it as efficiently as possible to reduce costs and operate a business smoothly.

Key Takeaways

- Inventory valuation is the process of determining the value at which inventory is carried in a company's financial statements until related revenues are recognized. It's crucial for maximizing profits and managing inventory effectively.

- Inventory includes raw materials, work in progress (WIP), and goods held for sale in the ordinary course of business.

- Proper inventory management is essential, especially in manufacturing industries, to prevent production halts and minimize costs.

- Inventory costs are influenced by carrying costs, lead time, purchase cost, as well as factors like depreciation, devaluation, depletion, and obsolescence.

objectives of inventory valuation

Inventory valuation serves as a critical component in the financial management of businesses, serving two primary objectives. These are:

1. Calculating profit for a period

The gross profit of a firm is the excess of sales over the cost of goods sold (COGS). To determine COGS, inventory valuation is vital as COGS is ascertained by deducting closing inventory and adding opening inventory to purchases.

COGS = Purchase + Opening inventory - Closing inventory

Gross Profit = Sales - COGS

2. Determination of the financial position of firms

Closing stock or inventory is shown as a current asset on the balance sheet, which determines the overall financial position of the firm. Undervaluing or overvaluing the closing stock can change the actual value of the firm’s profit.

If the closing stock is understated, it indicates less inventory in hand than the actual stock. This will deflate the current year’s profit, inflate the profit of the next financial year, and understate the assets and equity.

Similarly, if the closing stock is overstated, it indicates there is more inventory in hand than the actual stock. It inflates the current year’s profit, deflates the profit of the next financial year, and overstates the assets and equity.

Under US GAAP, inventory is valued at cost or net asset value (NAV), whichever is lower, if the FIFO method is used.

Why is Inventory Valuation important?

Inventory valuation plays a pivotal role in the financial management of businesses, serving multiple critical purposes.

1. Statutory Compliance

Certain frameworks require companies to disclose the valuation of each class of their inventory. Hence, it is legal for companies to ascertain inventory value according to the guidelines.

2. Liquidity analysis

The speed at which businesses sell their inventory is a key measure of performance. Generally, inventory is not expected to be held for a long period of time.

Inventory turnover ratio = COGS or Sale / Average value of inventory

The inventory turnover ratio tells us the number of times inventory has been sold out in a certain time period. A high inventory turnover ratio indicates that the business has good liquidity.

Note

Exceptions: Some industries have a low inventory turnover ratio, but it is conventional as per their industry norms. Wineries, agricultural production crops, and petroleum refining are some examples.

3. Ascertaining the financial position

The framework within which a company values its inventory directly affects its profitability and its potential net worth. Hence, it becomes vital to value inventory in the best possible manner to arrive at the true financial position of the company.

methods of inventory valuation

Methods of Inventory Valuation are pivotal in accurately assessing the financial standing of a company and optimizing its operational efficiency. Here are some commonly utilized methods:

FIFO (First In, First Out)

Under FIFO, the inventory first purchased or requisitioned is used or sold first. Hence the inventory purchased first is recognized first. The total value of inventory decreases under this method as and when inventory is sold.

The advantages of FIFO are:

- The FIFO method helps to avoid obsolescence in a company as the oldest items are sold first, and maintain the newest items in chronological order.

- It is the most widely used method of valuing inventory and the most accurate method for positioning the expected cash flow with the actual cash flow of inventory.

- In situations of market inflation, the use of FIFO will result in the lowest estimate of the cost of goods sold and the highest profit.

Example of FIFO

Company ABC Ltd reported opening an inventory of 500 units for $10 each on January 1. It also made the following purchases in the same quarter:

| Date | No. of units | Cost per unit | Total cost |

|---|---|---|---|

| January 10 | 200 | 8 | $1,600 |

| February 15 | 200 | 5 | $1,000 |

| March 21 | 100 | 10 | $10,000 |

ABC Ltd sold 800 units on March 25. The expenses would be as follows:

| Date | No. of units | Cost per unit | Total cost |

|---|---|---|---|

| January 1 (Opening inventory) | 500 | $10 | $5,000 |

| February 15 | 200 | $5 | $1,000 |

| March 21 | 100 | $10 | $1,000 |

Hence COGS for the sale of 800 units would be $7,000, and the value of inventory would be $10,500 with an inventory level of 200 units.

LIFO (Last In, First Out)

Under LIFO, the latest inventory purchased or requisitioned is used or sold first. Under COGS, the cost of the most recent inventory is to be treated as an expense. This means that the value of inventory comprises the cost of older inventory.

LIFO is not preferred often because

- In situations of high inflationary markets, LIFO tends to report lower profits due to high COGS. Hence most companies do not prefer to use the LIFO method to value their inventory as it reduces the net income and earnings per share.

- In addition, LIFO is not permitted under IFRS; however, it is allowed under GAAP.

Using LIFO deflates the profits of a company, but it could be advantageous to file large taxes during inflation.

Example of LIFO

Company XYZ Ltd reported an opening inventory of 300 units for $10 on January 1. It made the following purchases in the same quarter:

| Date | No. of units | Cost per unit | Total cost |

|---|---|---|---|

| January 7 | 200 | $7 | $1,400 |

| February 15 | 150 | $10 | $1,500 |

| March 15 | 150 | $10 | $1,500 |

XYZ Ltd sold 600 units on March 20. The expenses would be as follows:

| Date | No. of units | Cost per unit | Total cost |

|---|---|---|---|

| March 15 | 150 | $10 | $1,500 |

| February 15 | 150 | $10 | $1,500 |

| January 7 | 200 | $7 | $1,400 |

| January 1 (Opening inventory) | 100 | $10 | $1,000 |

The COGS for 600 units sold would be $5,400, and the value of inventory would be $2,000 with an inventory level of 200 units.

WAC (Weighted Average Cost)

Under WAC, the weighted average cost is used to determine the value of inventory. This method is opted for by companies when the items of inventory are closely interlinked, and a specific cost can’t be allotted to the item.

To use this method, you must compute the weighted average cost. The weighted average cost is calculated by dividing the cost of goods sold by the number of units available for sale or further use.

Weighted Average Cost = COGS / Number of units available for sale

Periodic and perpetual inventory systems

Using the WAC method results in different outcomes under periodic and perpetual inventory systems.

-

Under a periodic system, the firm does an ending or an occasional inventory count to measure the level of inventory and assign inventory costs. This system is better suited to businesses with low sales volumes.

-

Car dealerships, art galleries, and start-ups are examples of firms that use a periodic system.

-

Under a perpetual system, the firm continuously tracks inventory levels and revises the cost of inventory. This method can be expensive, so it is better suited to businesses with high sales volumes.

-

Supermarkets, manufacturing companies, and pharmaceutical stores are examples of firms that use the perpetual system.

Example of WAC under perpetual and periodic inventory systems

At the beginning of its financial year, January 1, a company reported an opening inventory of 400 units for $100 per unit. Over the first quarter, the company made the following purchases:

| Date | No. of units | Cost per unit | Total cost |

|---|---|---|---|

| January 10 | 200 | 120 | $24,000 |

| February 18 | 150 | 135 | $20,250 |

| March 9 | 250 | 150 | $37,500 |

It also made the following sales in the same quarter:

| Date | No. of units |

|---|---|

| February 25 | 300 |

| March 16 | 250 |

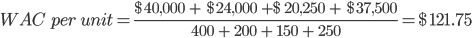

Under a periodic inventory system, the COGS for goods available for sale will be determined at the end of a specified period, in this case, the first quarter.

For the sale of 550 units in February and March, $121.75 will be assigned as the cost per unit. The remaining units will form part of the inventory's value.

Hence the value of COGS will be $121.75 x 550 units = $ 66,962.5, and the value of inventory at the end of the quarter will be $121.75 x 450 units = $ 54,787.5

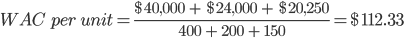

Under the perpetual inventory system, the COGS for goods available for sale is determined every time there is a sale. Before the sale of 300 units on February 25, the average would be:

Therefore, the COGS for 300 units sold on February 25 will be $112.33 x 300 units = $33,700, and the value of inventory will be $112.33 x 450 units = $ 50,550.

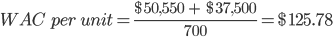

Before the sale of 250 units on March 16, the average would be:

Hence the COGS for 250 units sold on March 16 will be $125.78 x 250 units = $31,446, and the value of inventory will be $125.78 x 450 units = $ 56,600.

Note

Figures may vary due to differences in rounding off

SIM (Specific Identification Method)

The valuation method of SIM identifies, marks, and tracks every item of inventory separately from the time it enters the company until it is used or sold. This method is useful when all the items in inventory have different features and prices.

Each item is labeled with its purchase cost or any other additional costs incurred. Businesses that deal with high-value inventory, such as vehicles, jewelry, art galleries, or furniture, prefer to use SIM to value their inventory.

One drawback of SIM is that it requires the capability to easily identify all inventory items separately and track the costs incurred to produce them. This makes it an expensive and time-consuming method of valuation.

Example of SIM

Consider a jewelry retailer that focuses on handcrafted decorations. The store features two thousand pieces of jewelry in its collection, all of which are handmade using different materials, designs, and gemstones. Because each ornament is unique, the shop uses a Specific Identification Method (SIM) for inventory valuation.

With SIM, the store carefully records and uniquely recognizes every ornament, allocating distinct values according to their distinct qualities and composition. For example, a bracelet constructed of ordinary materials may not be worth as much as a necklace set with an uncommon gemstone.

By using SIM, the store owner may keep thorough records of the pricing and characteristics of each ornament, giving them a thorough understanding of the inventory's makeup and value.

In contrast to other techniques like FIFO, LIFO, or Weighted Average Cost (WAC), which offer generalized estimates, SIM offers unparalleled accuracy and granularity in inventory valuation.

Inventory Valuation: FIFO vs. LIFO

FIFO and LIFO are two of the most used methods of inventory valuation. FIFO is based on the assumption that the inventory items first purchased are sold off first, whereas LIFO works the other way around; the latest inventory items bought are sold first.

The method of valuation affects the profitability of the business directly. Hence, it is extremely important to choose the method that is most appropriate and fit for the business for longevity and to value inventory accurately.

| Aspect | FIFO | LIFO |

|---|---|---|

| Basis of valuation | Oldest inventory items sold first. | The newest inventory items sold first. |

| Impact on COGS | Typically results in lower COGS. | Typically results in higher COGS. |

| Impact on Profitability | Often leads to higher reported profits. | Often leads to lower reported profits. |

| Impact during inflationary periods | Generally favorable due to lower COGS. | Generally unfavorable due to higher COGS. |

| Accounting Complexity | Generally simpler as it follows a chronological order. | It may be more complex due to varying inventory costs. |

| Conformity with IFRS and GAAP | Widely accepted under both IFRS and GAAP. | Generally not allowed under IFRS but permitted under GAAP. |

Which method is better, FIFO or LIFO?

FIFO is the most common method and is considered the best way to value inventory. It allows less room for accounting errors and considers inventory first received as the COGS for goods used or sold.

On the other hand, LIFO considers the latest inventory received to calculate the value of inventory. The costs are usually higher than the costs to procure inventory previously. This increases the COGS and could result in cost more in situations of an inflationary market.

FIFO is more suitable than LIFO during periods of inflation, which is typically the case in almost every economy. Hence most companies prefer to follow FIFO.

Inventory Valuation: GAAP vs. IFRS

GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) are the prime accounting frameworks used widely in the financial world today.

The standards that govern financial reporting and accounting vary from nation to nation. Most companies in the US adopt GAAP, whereas most companies in other nations prefer to use IFRS.

| Aspect | GAAP | IFRS |

|---|---|---|

| Valuation Method | Allows LIFO method. | Prohibits the use of LIFO. |

| Fixed Asset Valuation | Historical cost basis; no revaluation allowed. | Revaluation of fixed assets permitted. |

| Treatment of Development Costs | Generally expensed as incurred. | Capitalized and amortized over time. |

| Write Down Reversals | Write-down reversals are not permitted. | Write-down reversals are permitted under certain conditions. |

How do GAAP and IFRS differ in inventory valuation?

There are many misunderstandings and differences of opinion during the application of GAAP and IFRS, especially with inventory valuation, even though the two frameworks have made endeavors to reduce the inconsistency.

While firms in most countries follow IFRS, the companies based in the US follow GAAP in their accounting practices. This creates room for confusion and disparities.

1. LIFO

One such dissimilarity is the method of valuation permitted to follow: LIFO. While GAAP permits companies to follow LIFO, the same is prohibited under IFRS.

LIFO tends to deflate the profits and most often does not reflect the actual inventory cost. Hence guidelines under IFRS result in more accurate book figures.

GAAP requires fixed assets to be valued at historical cost after deducting the accumulated depreciation, whereas under IFRS, fixed assets are allowed to be revalued.

Therefore, values under fixed assets may increase with time when IFRS is followed, but the same doesn’t happen with GAAP.

3. Development costs

Under GAAP, development costs are treated as an expense incurred. However, under IFRS, development costs are capitalized and then amortized over several financial years.

4. Write down reversals

Both frameworks, GAAP and IFRS, require the value of inventory or fixed assets to be written down to the market value when it decreases. However, if the value of inventory increases, the write-down can be reversed under IFRS but not under GAAP.

Inventory Valuation FAQs

Inventory is valued at cost and not the selling price. It must be valued at its procurement cost or realizable value, whichever is lower.

FIFO is widely considered the best method of inventory valuation. It takes into account the cost of inventory acquired first, which helps to reduce COGS and results in better profitability than LIFO.

Inventory is an asset that includes raw materials, WIP, and goods held available for sale in the ordinary course of business.

Inventory value is the total cost of the unsold inventory calculated at the end of each financial year. It can be calculated by multiplying the number of units left unsold by its cost.

Direct labor, direct materials, freight inwards, factory overheads, and import duties are some costs that can be added to inventory valuation.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?