Accrual

Generally, it refers to the summation of interests or different investments over time.

What Is An Accrual?

Generally, it refers to the summation of interests or different investments over time.

However, it is most prevalent in accounting and is used for the revenues earned or expenses incurred that affect a company's income statement, despite cash not being received or paid during the transaction.

They also serve as an abbreviated form of "accrued expenses"/"accrued revenues," They impact the company's net income on the income statement and the balance sheet.

Accrued expense refers to when a company makes purchases on credit, which means they receive a product/service without paying cash at the point of transaction.

In simpler terms, think of it as buying a book off Amazon with a credit card, and you only have to pay the cash from your bank account next month.

Accrued revenue is when a company receives income on credit, which means they sell a service/good without receiving cash at the point of transaction.

Consider it as Amazon recording down the book sold to you as revenue, despite your payment only going to them the next month.

Let's find out more about it in the sections below.

Key Takeaways

- Accruals form the basis of ABA, which is the only way of accounting under GAAP and is required by the SEC to be listed on the US exchanges.

-

They come in the form of accrued revenues/expenses, where they are recognized at the point of transaction without the receiving/payment of cash and cash equivalents.

-

ABA is preferred over cash accounting for it gives the company a more comprehensive picture of its financial health.

-

They are made through adjusting journal entries, which alter the cash transactions accordingly to the periods the transactions are completed.

-

It will be reflected on the income statement as regular revenue/expenses and are credited/debited respectively on the balance sheet.

-

Accrued revenues and expenses are similar to accounts receivable/payable and will take the form of the latter after invoicing/being invoiced, respectively.

Understanding Accruals

It is a key concept and forms the basis of Accrual Based Accounting (ABA), which refers to the recording of revenues that a company has earned but has yet to receive the cash for and expenses that have been incurred but that the company has yet to pay.

Now, that may seem boggling, for why would you record a transaction as revenue even though you have not received the money?

This is covered under the concept of Accounts Receivables (AR), where companies can record such “I owe you”s (IOUs)s as revenue due to the other party having a legal obligation to pay them. Cash is to be paid within a relatively short period, ranging from a few days to a year.

The opposite works the same way. Companies recognize expenses that have not been paid in cash yet because they have a legal obligation to pay them within a similar period. It falls under the concept of Accounts Payable (AP).

Why ABA?

This is because of the matching principle, which says that revenues and expenses should be recognized in the same period they were incurred.

This forms the basis of ABA, the preferred method under Generally Accepted Accounting Principles (GAAP) over Cash Accounting since the matching principle allows for a more accurate assessment of a company’s financial picture.

They allow businesses to have thorough records of sales and expenses, even if cash has not yet been paid or received for goods or services rendered.

This promptly reflects the revenue received when selling on credit, or projects that provide recurring revenue over a longer time, affecting a company's financial condition at the time of a transaction.

It also enables businesses to record assets that do not have a cash value, such as accounts receivable, accounts payable, employee salaries, etc.

Firms can also have a more comprehensive overview of cash flows, resulting in more effective management of their cash and other resources. It is also stipulated by the Securities and Equities Commission (SEC) as the only accounting method allowed for listed public companies.

Accruals Accounting Vs. Cash Accounting

Below is a more simplified and exaggerated example to give you a better idea:

A new start-up, “MonkeyTech,” has been in business for over two years, and they are a streaming company running on a subscription-based model.

-

Banana Plan “A” offers six months of streaming for $60.

-

Banana Plan “B” provides 12 months of streaming for $90 (25% discount).

-

MonkeyTech receives actual cash payments at the end of the plan.

-

Assume all consumer sign-ups and payments occur on the 1st day of each month.

-

Assume no prior profits to January 1st, 2021.

-

The Fiscal Year (FY) starts on October 1st and ends on September 30th next year.

-

Subscriptions in the below table are in thousands (‘000).

Under cash accounting

Total revenue for FY 2020/2021: $720,000

Despite transactions providing MonkeyTech with revenues spanning 6/12 months, under cash accounting, they will only be recorded as revenue when payment is made.

For Plan A subscriptions on 1st Apr 2021 and onwards, cash is only being paid on 1st Oct 2021 and onwards, resulting in them being counted under FY 2021/2022 and contributing to FY 2021/2022’s annual revenues instead.

Revenue from Plan B subscriptions spanning Jan to Sep 2021 is completely left out, for cash would only be received starting from Jan 2022.

While the above is a highly exaggerated example, it’s made better to understand the differences between the two.

In real life, most firms do the opposite of allowing such accrued revenues, known as deferred revenues. Real-life examples include Disney+ having a family plan where one pays a discounted cost of an annual subscription upfront before enjoying the service.

Under accruals accounting

Total revenue for FY 2020/21: $1,237,500

Compared to cash accounting, which reported $720,000 for FY 2020/2021 Annual Revenue, there is a relatively large discrepancy of ~40%.

Cash-based accounting results in more skewed values concerning time. Depending on the type of company, one period might be profitable, and the subsequent one isn’t—without any fundamental business changes—simply due to the timing of receipts and cash flow.

ABA records the revenue at the point and time of accounting and paints a much better picture of the overall performance for the FY.

From a corporate point of view, company stakeholders can have a better picture of its financial health. This enables company executives to manage their expectations and set realistic goals for their future development due to being more accurate and time-relevant.

How are Accruals made?

It is achieved through adjusting journal entries, which results in the cash transactions turning into accrual-based transactions in the financial statements at the end of a reportable quarter.

This achieves the revenue/expense recognition principle, which aims to recognize revenue/expense when it was earned/expensed rather than when cash is received/spent.

An adjusting journal entry occurs towards the end of an accounting period to better recognize potentially unrealized transactions, which may affect income/expenses.

How do Adjusting Journal Entries work?

Using the above example of “MonkeyTech” and its streaming plan A, when a consumer subscribes to it on 1st Jan, they can start using the service, but the company does not invoice the customer until the end of the plan, six months later.

Once it is invoiced and payment is collected on the 1st of July, MonkeyTech will need to do an adjusting journal entry at the end of each of the six months to recognize revenue for 1/6th of the total amount ($60) paid for the service.

At the end of each month, each Plan A subscription will bring about: $60/6 = $10 of revenue.

The same calculation applies for Plan B: $90/12 = $7.50.

Adjusting journal entries commonly involve items on the income statement or the balance sheet. Below are some examples of list items,

Income Statement:

-

Revenue

-

Insurance expense

Balance sheet:

-

Accumulated depreciation

-

Accrued expenses/income

-

Deferred revenue

How do Accruals affect a company?

To see the impact of accrued expenses/revenues on a company, we can see the impacts via the three fundamental financial statements:

Continuing with MonkeyTech as an example, it recorded down revenue as of 1st Jan.

At the end of 31st Jan, MonkeyTech receives their electricity bill for Jan, and their electricity costs for $1,000.

The company will need to pay their utility bills within 15 days (until 15th Feb), while they will only charge their customers six months later on 1st July.

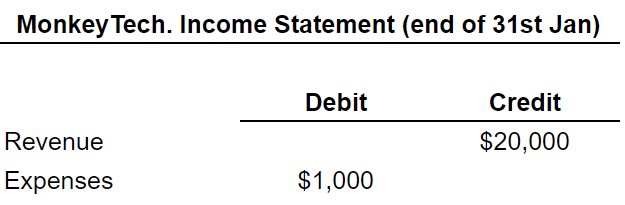

Effects on the income statement

Accrued revenue is recorded and reflected on the income statement as a credit to revenue, while accrued expenses will be reflected as a debit to expenses.

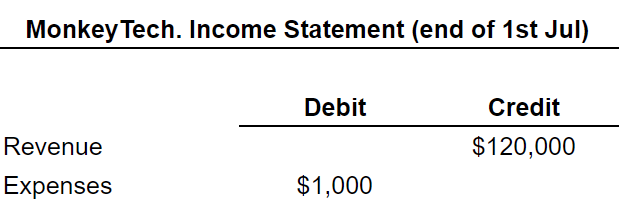

After payment is made for Streaming Plan A on 1st Jul:

There aren't many changes to the income statement, apart from recognizing the six months of revenue. However, most of the changes are reflected in the balance sheet, and let's take a look there.

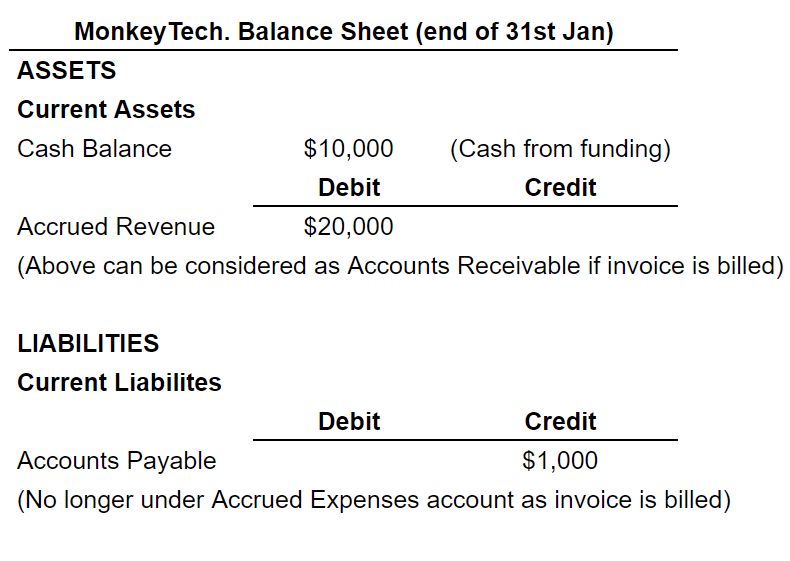

Effects on the balance sheet

Due to double-entry bookkeeping:

-

The accrued revenue account on the company's balance sheet will be debited by the same amount.

-

The accrued expense account will be credited with the same amount.

-

The accrued expenses will count under the accounts payable (AP) as MonkeyTech received the invoice.

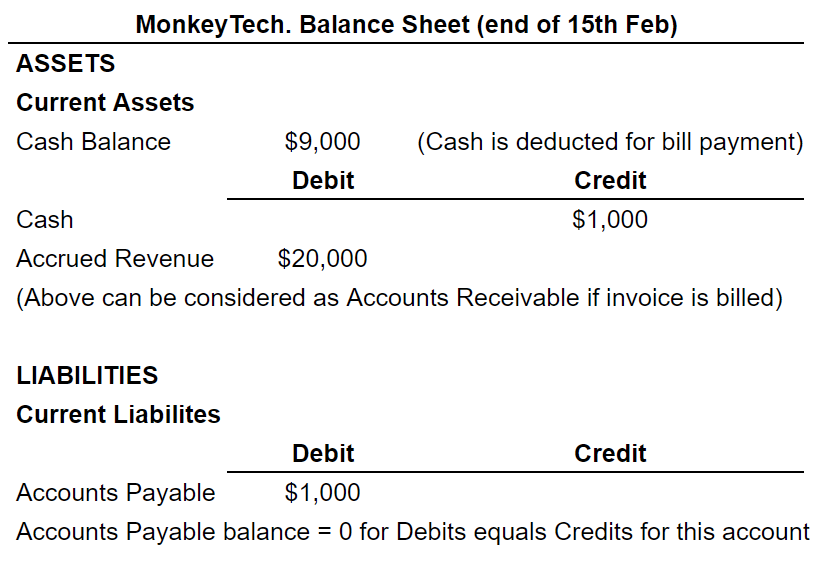

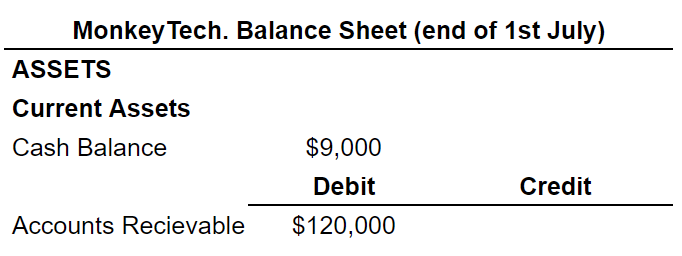

After MonkeyTech pays the utility bill on 15th Feb:

-

The payable account will be debited and be $0 (for debit=credits for the account).

-

The cash account will be credited $1,000, as it’s used for the bill.

-

The cash balance will decrease accordingly to $9,000 from $10,000.

-

No increase in accrued revenue, as it cannot be recognized for MonkeyTech did not provide the streaming service for the whole of February yet.

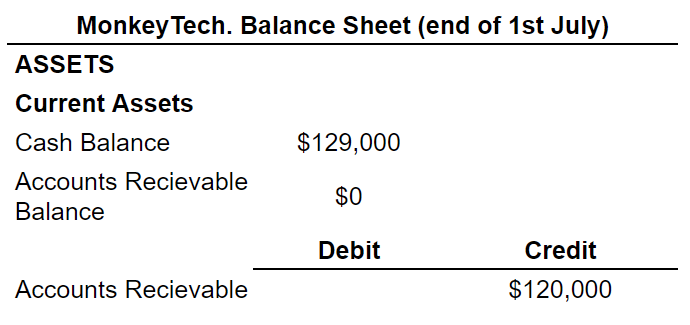

After MonkeyTech invoices its customers, it receives payment for Streaming Plan A on 1st Jul:

-

Salary credited to revenue in the income statement would be debited under accrued revenue in the balance sheet.

-

As MonkeyTech has sent out the invoice, accrued revenues would be under accounts receivable.

Assuming actual payment is made on the same day, the amount of cash received by the company would be debited to the cash account on the balance sheet, and the same amount would be credited to the accounts receivable account, thus closing it (debits=credits).

Now that we have seen how it flows through the balance sheet, let’s move on to the cash flow statement.

Accrued Revenues vs. Accounts Receivable

While both are similar and considered under the current liabilities section of Assets, accrued revenue is when the revenue has been recorded due to a recognized transaction. Still, the company has not invoiced it yet to the customer.

After doing so, it will be reflected in the accounts receivable instead, as seen in the examples above.

Accrued Expenses vs. Accounts Payable

Similar to accrued revenues and accounts receivable, the accrued expense is when the cost has been recorded due to a service/good provided as per the terms agreed upon, but the customer hasn’t received an invoice from the company yet.

After being invoiced, they will be reflected in the accounts payable section instead, as seen in the examples above.

Effects on the cash flow statement

Compared to the other two financial statements, there is not much impact on the cash flow statement.

As a cash flow statement lists the changes in the business's cash and cash equivalents, it will not record down or be affected by accruals for such accrued revenues/expenses that need the exchange of cash and cash equivalents to be recorded.

Researched and authored by George Lee | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?