EBITDA Multiple

A financial metric used to assess a company's value by comparing its enterprise value to its EBITDA earnings

What is the EBITDA Multiple?

The EBITDA multiple is a financial metric used to assess a company's value by comparing its enterprise value to its EBITDA earnings. It provides a measure of a company's value relative to its operational earnings.

The ratio commonly compares companies within the same or similar sectors. Investors and analysts can make more educated investment decisions by using a normalized ratio to detect which firms are undervalued or overvalued compared to their competitors.

This ratio is preferred over other return measures because it is normalized for company differences. The EV/EBITDA ratio compares a company's enterprise value to its EBITDA, providing insight into its operational performance relative to its overall value.

It's calculated by dividing the enterprise value (which includes market capitalization, preferred shares, minority interests, and debt minus cash) by EBITDA (earnings before interest, taxes, depreciation, and amortization).

Key Takeaways

EBITDA Multiple Ratio Uses

The stock market can be daunting, with limitless groups to choose from and some factors to remember. This is where the EBITDA Multiple ratio comes in. It's a monetary metric that helps buyers determine an enterprise's real worth and compare it to others in the same industry.

The ratio is valuable because it adjusts for differences in companies' capital structures, tax rates, and accounting methods, providing a more standardized performance measure.

Each organization has a unique capital structure, tax rates, and accounting methods that can impact its financial performance and value. Considering those variations, the EBITDA ratio offers a more correct and comparable degree of an organization's capability.

Note

Investors and analysts often use the EBITDA Multiple ratio to analyze and compare companies in the same sector. This helps them identify undervalued or overvalued organizations and make more informed investment decisions.

Compared to other measures of yield, such as the PE ratio, the EBITDA multiple is an extremely accurate and reliable tool for comparing a company's overall performance.

In today's rapidly evolving financial landscape, a solid understanding of financial metrics such as the EBITDA multiple can give investors a significant edge. With the proper expertise and gear, buyers can hopefully navigate the stock marketplace and make clever funding choices that may cause long-term monetary fulfillment.

What is the Formula for the EBITDA Multiple?

The formula itself is simple; just divide the enterprise value by EBITDA, and the resulting number will be the EBITDA multiple. A low multiple suggests that a company is cheap, while a high multiple indicates that a company is overvalued.

The formula used is;

EBITDA Multiple = Enterprise Value / EBITDA

Where,

Enterprise Value(EV) = Market Value of Common Shares + Market Value of Preferred Shares + Market Value of Debt (long and short-term) + Market Value of Minority Interest + Pension Liabilities Yet to be Funded Along With Other Debt-Deemed Provisions – Value of Associate Companies - Cash and Equivalents

EBITDA = Operating Income + Depreciation + Amortization

The ratio is a widely used financial metric that provides valuable insight into a company's value and investment potential.

Note

The ratio permits buyers to accurately compare organizations in the same industry by considering a business enterprise's capital structure, taxation, and fixed asset accounting.

A lower ratio suggests a cheaper business enterprise, which could present a great funding opportunity; at the same time, a higher multiple indicates a hyped-up employer that may be riskier to invest in.

Using the EBITDA multiple ratio formula, buyers can identify undervalued or overrated businesses and make more informed investment decisions.

Note

It is essential to note that the EBITDA multiple ratio is simply one tool among many. It ought to be used along with other metrics and qualitative evaluations when making funding choices.

EBITDA Multiple Example Calculation

Let's say a company has an EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of $10 million and is being valued using an EBITDA multiple of 8x.

Valuation = EBITDA x EBITDA Multiple

Valuation = $10 million x 8

Valuation = $80 million

So, based on this example, the company would be valued at $80 million using an EBITDA multiple of 8x. This multiple indicates that investors are willing to pay 8 times the company's EBITDA to acquire it.

Remember that this is a simplified example, and various factors, such as industry standards, growth prospects, and market conditions, could influence the EBITDA multiple used in practice.

Interpretation of EBITDA multiple

To understand the EBITDA multiple, it's essential first to know the factors that make up the ratio.

- Enterprise valuation: It is the market capitalization of a company plus the value of its debt, nonage interest, and preference shares minus the value of its cash and cash equivalents

- EBITDA: It stands for Earning Before Interest, Taxes, Depreciation, and Amortization. It measures a company's operating income, considering its depreciation and amortization disbursements

The interpretation of a company's EBITDA multiple ratio depends on whether it is higher or lower than the average multiple for its industry.

A lower multiple suggests that the company is undervalued and may represent a good investment opportunity. Investors might consider purchasing the company's stock, as the market may have overlooked its true value.

On the other hand, a higher ratio portrays that the company's valuation is magnified and may not represent a good investment opportunity. The market may have already priced in future growth expectations, making it unlikely that the company will perform better than expected.

However, investors should be cautious when interpreting a company's EBITDA multiple. For example, a low ratio may indicate that the company has significant debt or is experiencing financial difficulties, making it a riskier investment.

Conversely, an excessive EBITDA multiple can be justified if the organization is expected to experience significant future growth, making it a potentially profitable investment despite the high valuation.

Note

Investors shouldn't depend solely on the EBITDA multiple ratio when assessing a company's investment potential. They should consider other factors, such as the company's financial statements, industry trends, and competitive geography.

Furthermore, investors should be apprehensive that the EBITDA multiple ratios can vary significantly among companies within the same industry, so it should be used with other criteria for a more comprehensive evaluation.

Example Of EBITDA Multiple

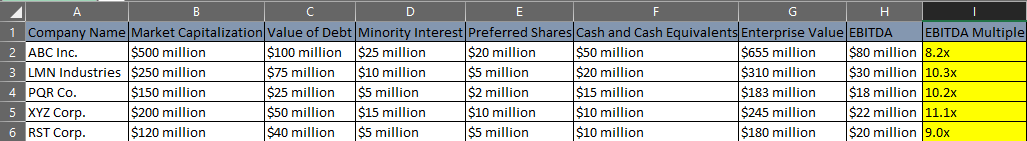

In this example, we have compiled data for five hypothetical companies across various industries and calculated their EBITDA multiple using an Excel sheet. This aims to provide a practical understanding of the multiple and its significance in evaluating a company's investment potential.

The table shows

ABC Inc.

ABC Inc. has the uppermost market capitalization and enterprise value, with an EBITDA of $80 million and an EBITDA multiple of 8.2x. This suggests that the market views ABC Inc. as a largely premium company with strong earnings potential.

RST Corp.

On the other hand, RST Corp. has the smallest market capitalization and enterprise value, with an EBITDA of $20 million and an EBITDA multiple of 9.0x.

This suggests that the market views RST Corp. as a company with reasonable earnings potential but not as high-end as ABC Inc. or LMN Industries.

LMN Industries

LMN Industries has a market capitalization of $250 million and an enterprise value of $310 million. Its EBITDA is $30 million, which results in an EBITDA multiple of 10.3x.

This suggests that LMN Industries is regarded as a valuable company with strong earnings potential, although not relatively as valuable as ABC Inc. LMN Industries has a slightly higher EBITDA multiple than PQR Co., indicating that the market views LMN Industries as a more appealing investment option.

PQR Co.

PQR Co. has a market capitalization of $150 million and an enterprise value of $183 million. Its EBITDA is $18 million, which results in an EBITDA multiple of 10.2x.

This suggests that PQR Co. is audited as a valuable company with solid earnings prospects, although not relatively as precious as ABC Inc. or LMN Industries.

XYZ Corp.

XYZ Corp. has a market capitalization of $200 million and an enterprise value of $245 million. Its EBITDA is $22 million, which results in an EV/EBITDA of 11.1x. This suggests that XYZ Corp. is considered a valuable company with strong earnings potential, although not relatively as valuable as ABC Inc.

The EV/EBITDA for XYZ Corp. is slightly higher than that of RST Corp., indicating that the market views XYZ Corp. as a more attractive investment option.

Interpretation

The table provides an overview of the financials of five academic companies, including their market capitalization, enterprise value, EBITDA, and EV/EBITDA.

The data suggest that ABC Inc. and LMN Industries are viewed as the most valuable companies with strong earnings potential, while RST Corp. is viewed as the least valuable company.

The companies' EV/EBITDA ratios range from 8.2x to 11.1x, indicating that the market views them as having attractive earnings potential.

Note

It's important to note that the EV/EBITDA should be considered in the context of the industry and comparable companies.

EBITDA Multiple Limitations

The EV/EBITDA ratio, widely used in finance, is not a standalone measure. Using the EBITDA multiple in conjunction with other metrics is beneficial for gaining a more comprehensive understanding of a company's performance.

Now, let's look at some of the limitations of the multiple below:

- Industry Specifics: Each industry has its own cost structures, growth potentials, and competitive landscapes, affecting EV/EBITDA ratios differently. For instance, service-based industries like consulting may show higher ratios due to lower capital requirements, while capital-intensive sectors like manufacturing may have lower ratios due to higher capital expenditures.

- Company Size: Smaller companies often face higher risk factors and may lack diverse revenue streams, leading to lower EV/EBITDA ratios than larger, more established ones. This is because smaller companies may struggle to attract investors and have limited scalability.

- Market Conditions: EV/EBITDA ratios are heavily influenced by market dynamics such as supply and demand, competition, and overall economic conditions. During periods of high demand or favorable economic conditions, companies may experience higher ratios, while adverse conditions can lead to lower ratios.

- Quality of Earnings: The sustainability and reliability of a company's earnings, known as the quality of earnings, play a significant role in determining EV/EBITDA ratios. Companies with consistent earnings and strong cash flows tend to have higher ratios, while those with volatile earnings or dependence on a few clients may have lower ratios due to perceived higher risk.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?