I taught the first session of my valuation class, that I previewed in my last post, today. As part of that class, I do what I call a “valuation of the week”, where I pick a company and value it and then post both my valuation (with the spreadsheet and the raw data that I used) and a shared Google spreadsheet for anyone who wants to take my valuation and make it their own (by changing the assumptions).

I do this for two reasons. First, I believe that you learn valuation by valuing real companies in real time, not by talking about valuation or reading about it. Second, from a purely selfish standpoint, I pick the companies that I find interesting as potential investments or as real world case studies for my valuations of the week. I find the “crowd valuation” that emerges from this process to be useful in reassessing my own valuations.

As my first valuation of the week, I picked Tesla, for three reasons. First, as a technology company in an otherwise capital-intensive, mature business (the automobile manufacturing business), it stands out. Second, the company has a charismatic

CEO, Elon Musk, an ambitious man (and I don’t mean that in a negative sense) with a great deal of imagination.

Third, the stock has taken off in the last year, up more than 500%, fueled by both positive news on the product front as well as on the financial front (increasing revenues, declining losses, paying down of debt).

At its current stock price of $168.76/share, the

market capitalization for the company is more than $20 billion. The question for investors, both in and out of the stock, is not whether the company was a good investment over the last year (of course, it was) but whether it is a good investment today. You can download the most recent

annual and

quarterly reports for the company.

Using the standard metrics, the company seems over valued. With revenues of $1.33 billion and an operating loss of -$217 million over the last twelve months, it seems absurd to attach a value of more than $20 billion to the company. At close to 15.4 times revenues, Tesla is being valued more like a young technology company than an automobile company. However, these standard metrics are also often misleading with young companies, since value should be driven not by revenues and earnings today but by expectations for these values in the future.

Expected Revenues

For Tesla to be able to deliver value as a company, it is clear that it has to scale up revenues. On the good news front, the company has had a good year, with the revenues in the first six months of 2013 of $956 million representing a surge from revenues of $41 million in the first six months of 2012. While growth will get more difficult as the company continues to become larger, the question of how difficult cannot be answered until we define the potential market for the company.

If we define it narrowly as electric/hybrid cars, the market is small (even though it is growing) and the potential revenues will have to reflect that. If we define it more broadly as the automobile market, the market is a huge one and Tesla’s potential revenue expands accordingly.

Since the line between electric, hybrid and conventional automobiles is a fuzzy one, which will get fuzzier over time, I will take the view (optimistic, perhaps) that Tesla is an automobile company that happens to specialize in electric cars and measure its potential revenues by looking at the biggest automobile companies today.

Based on revenues, the biggest companies are those that offer the full range (from luxury to mass market) of automobiles. It is true that BMW and Daimler make the top ten list, but they sell far more than just luxury cars. In valuing Tesla,

I am going to assume (and I am sure that some of you will disagree) that success will bring them revenues close to those delivered by a company like Audi ($64 billion).

While it is conceivable that Tesla’s revenues could approach those of the auto giants ($100 billion plus), I think the revenue growth required to get to those levels would be incompatible with the high operating margins that I will be assuming for Tesla. Assuming that Tesla stays making just electric cars, this forecast is an optimistic one, insofar as it assumes a rapid expansion in the electric car portion of the automobile market.

Profitability

The second piece of the puzzle in Tesla becoming a valuable company is that it has to become profitable. Based on the reported loss of $216.72 million over the last twelve months, the pre-tax

operating margin for the company is -16.31%. It is true that this paints too dire a picture of the company because the company did spend $306 million in R&D over the same twelve month period. Assuming a three-year lag, on average, between R&D expenditures and commercial payoff, and

capitalizing R&D does reduce the operating loss to about -$21.86 million (resulting in an after-

tax operating margin of -1.64%).

To get a sense of what the Tesla's operating margin will be, assuming it makes it as a successful company, I estimated the pre-tax operating margins of all publicly traded automobile companies globally,

dividing the operating income from the most recent 12 months by the revenues over that period for each company.

Since automobile companies have volatile earnings, I also computed a normalized pre-ta operating margin for each company by looking at the aggregate operating income over the last decade, as a percentage of aggregate revenues over that period. The distribution of the both measures of operating margin (the 2013 value and the average from 2003-2012) is shown below:

Note that the sector has low pre-tax operating margins, with the median value of less than 5%. Companies at the 75% percentile generate margins of between 7.5% and 8.5% and there are a few companies that generate double digit margins. One of the outliers is Porsche which reported a pre-tax operating margin of close to 16% in 2013, though its ten-year aggregate margin is closer to 10%. You can

download the dataset that includes the key numbers for all auto companies by clicking here.

For Tesla, we will assume that its focus will continue to be on high-end automobiles and that is margins will converge towards the higher end of the spectrum. In fact, I am assuming that the technological and innovative component that sets Tesla apart will allow it to deliver a pre-tax operating margin of 12.50% in steady state, putting it in the 95th percentile of auto companies (and closer to the margin for technology companies).

I will assume that the margin improvements occur over time, with the biggest improvements happening in the near years. The figure below captures the forecasted operating income and margin, by year, in my valuation of Tesla:

Based on my estimates, Tesla will generate more than $8 billion in operating income by year 10, making it more profitable than all but three other automobile companies today (Toyota, Volkswagen and BMW).

Investment Requirements

Growing revenues roughly sixty fold and improving operating margins to match the most profitable companies in the sector will require reinvestment. Some of it will take the form of additional R&D, as Tesla tries to keep its competitors at bay, and some of it will have to be in more conventional assembly lines and factories, as production gets ramped up. Over time, I believe that the latter component will come to dominate the former.

In my forecasts, I have assumed that Tesla will have to invest about a dollar in capital (in either R&D or plant/equipment) for every additional $1.41 in revenues. That matches the industry average of the sales to capital ratio of 1.41 for US companies. Since the sales to capital ratio for technology companies is higher (2.66), it is possible that I am over estimating Tesla's reinvestment in the early years.

However, the return on invested capital that I obtain for Tesla in steady state (in year 10), based on my estimates of operating income and invested capital, is 11.27%, putting it again at the top decile of automobile companies.

Risk

Tesla is undoubtedly a risky investment and there are three components of risk that I attempted to incorporate in the valuation:

a. Business/ Operating risk: Tesla is exposed to substantial business risk, some coming from macro economic sources (the strength of the

economy, inflation, interest rates), some resulting from technological shifts (the winning technology in the electric/hybrid auto business is still to be determined) and still more emanating from the sector (with every major automobile company staking out its claim on this segment of the business). To capture the risk,

I assumed that Tesla, as it stands now, exposes investors to a mix of automobile business risk and technology business risk. While I assumed a 60% auto/40% technology mix in arriving at a cost of capital of 10.03%, the value per share that I obtain is not very sensitive to this assumption:

Treating Tesla as a purely automobile company increases its value to about $74.73, whereas treating it as a technology company lowers the value per share to $60.84.

b. Geographic risk: While it is likely that as Tesla grows, it will have to look to emerging and more risky markets, I will assume that its risk exposure for the next decade will come primarily from mature markets, allowing me to use my current estimate of the equity risk premium for the US of 5.8% for the

cost of equity/capital computations.

c. Truncation risk: Tesla, in spite of its lofty market capitalization and recent successes, is still a young, money-losing company. A large shock to its business (from a legal setback, a

recession or a sector-wide slowdown) could put the company's survival at risk.

While that risk has declined substantially over the last two or three years, I think that it still exists and will attach a probability of 10% to its occurrence. If the company does fail, I will also assume that it will lose a significant portion of its value in a distress sale (receiving only 50% of estimated value).

Loose Ends

As with any young company, there are loose ends to tie up that affect value. In particular, I would point to the following:

a. Subsidized debt: Tesla was the beneficiary of subsidized loans from the DOE, amounting to roughly $465 million. While this loan loomed large two years ago, when Tesla was a smaller company with more default risk, it has faded in importance partly because of Tesla's success (and the resulting access to capital markets). Since Tesla has paid down the loan, it no longer has any effect on value.

b. Net Operating Loss carry forward: At the end of 2012, Tesla had a net operating loss of just over a billion that it is carrying forward. I

used the NOL to shelter income from taxes in the early forecast years, pushing up cash flows in those years. As a consequence, Tesla's income is sheltered from taxes for the first six years of forecasts.

c. Management/Employee Options: Of larger import are the management/employee options that Tesla has been generous in granting in the last few years. As of the

most recent 10K, the company had approximately 25 million options outstanding, with an

average strike price of $21.20 and 7 years left to expiration. Since there only 121.

45 million shares outstanding, the value of these deep in-the-money, long term options represents a significant drag on value.

The Bottom line

The ingredients that make a young, money-losing company into a valuable, mature company are no secret: small revenues have to become big revenues, operating losses have to turn to profits, there has to be enough reinvestment (but not too much) to make these changes and the risk has to subside. I am assuming all of these at Tesla but my estimated value per share of $67.12 is well

below the market price of $168.76. You can

download my valuation spreadsheet by clicking here.

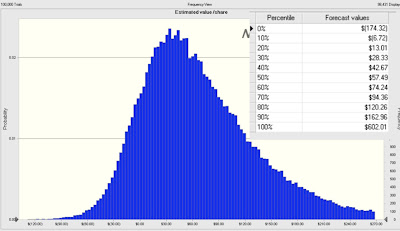

Is the value sensitive to my assumptions? Of course, and especially because Tesla is a young company in transition. In fact, replacing my point estimates for the input variables (revenue growth, target operating margin, sales/capital, cost of capital) with

distributions yields a distribution of value for Tesla that reflects my uncertainty about the future:

Note that there are scenarios where the value per share exceeds the current market price ($168.76), but I would add two cautionary notes. First, at least based on my estimates, the probability that the value exceeds the price is small (less than 10%) Second, the combination of outcomes (high revenue growth, high margins and low risk) that would yield these high values are difficult to pull off.

You can accuse me of being too pessimistic in my assumptions, but the narrative that underlies my valuation is an optimistic one. I am assuming that Tesla will grow to be as large as Audi, while delivering operating margins closer to Porsche's. Even with these assumptions, I cannot see a rationale for buying the company at today's market price but that is just my personal judgment. You are welcome to disagree. In fact, if you download my valuation and change the key assumptions, please take a minute to report your estimate of value per share in this

Google shared spreadsheet. Let's see how the crowd valuation plays out!

Impedit occaecati vitae enim voluptate consequatur. Veniam quia repudiandae non inventore corrupti eum.

Aut dolor aliquam minus sed. Necessitatibus ipsa beatae neque et debitis. At quia enim quia reiciendis et. In sunt eos voluptatum earum architecto sunt.

Aspernatur et mollitia necessitatibus voluptatem voluptatem nemo. Quas ipsum rem enim autem dolore et nesciunt perferendis. Debitis eos quaerat amet expedita. Nihil eum natus harum neque.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Quod nobis tempore saepe aut et ad. Non minima tempore temporibus ex atque. Qui officiis ut ipsum quo. Explicabo repellat quibusdam vel veniam.

Beatae non ullam rerum. Quasi est quod commodi unde.

Maxime iste id rerum. Accusantium quia alias quam mollitia. Voluptas ea ipsa autem eveniet pariatur laudantium. Vero distinctio reprehenderit quibusdam. Rerum minus occaecati molestias alias maiores quidem quia eius.

Libero qui et magni in est. Labore reiciendis voluptas enim rerum in ullam saepe. Dolore voluptate aliquam dolore placeat neque.

Exercitationem necessitatibus sunt unde quis facilis. Et distinctio et sed voluptatibus.

Eius voluptas in nisi quia dignissimos autem aut. Aut dolorem sunt possimus illum quis. Quia mollitia suscipit officia officia distinctio aperiam quae. Consequuntur dolorum nesciunt repellendus incidunt animi quibusdam dolorum et. Animi neque numquam est facilis optio ea saepe aut. Quia animi eligendi sapiente rem. Est corporis adipisci quae sit eligendi in.

Voluptatem iusto excepturi aspernatur accusamus exercitationem. Qui tempora itaque magni perspiciatis beatae et.

Atque laudantium quia et id dolor illum aliquam sunt. Est dolorem enim qui ut repellat harum ratione laborum. Ullam omnis velit animi.

Nemo hic natus qui eaque at. Omnis ut est porro eligendi vel minus animi dolor. Architecto fugit ipsum ad quae qui eveniet sint. Qui exercitationem et exercitationem eveniet eum.

Aut recusandae et velit ipsum amet. Est ipsam est quam dolorem. Quam id natus rerum maiores quos sint.

Optio ut velit aliquam quidem dolor. Reprehenderit assumenda dolorem ratione eveniet omnis est aut. Autem alias sit sed aliquam. Sunt molestiae quidem velit dolorem.

Laboriosam aut pariatur quia nulla id reprehenderit non. Sed quam fugit qui omnis corrupti. Sequi tenetur quidem culpa est rerum non reiciendis.

Cumque unde qui ut asperiores voluptas delectus magni et. Aut asperiores officiis totam tempora. Sed quo perspiciatis et nulla iste voluptas cupiditate. Sed distinctio nesciunt est voluptatem eos atque culpa sed.

Nulla eius ea praesentium quasi totam et est sequi. Qui commodi labore accusamus aut impedit vitae molestias. Sed corporis ab autem quo minus.

Est dicta numquam dolorum illo. Possimus commodi velit est numquam. Modi voluptatem accusantium quia harum aut consequatur. Sed quo quis sit qui. Eum dolor possimus doloremque doloremque eum nostrum nesciunt iusto. Est consequatur ratione id iste.

Mollitia fugit possimus sed aut. Architecto minima sequi dicta cum placeat quisquam nihil. Sunt sed facere omnis est asperiores porro.

Rem adipisci perferendis totam ut sed. Iusto tenetur sit possimus. Sunt saepe voluptas cum qui temporibus eaque et. Aliquid qui aut unde ad qui amet ut.

Quidem minus harum doloremque dolorum. Magni quisquam totam harum reprehenderit voluptas et autem. Vel culpa excepturi iure reiciendis temporibus. Quae veritatis aut veritatis inventore dolorem quos sint ut. Nobis ad praesentium quaerat dignissimos. Sit repudiandae id ullam alias modi rem.

Et quae commodi iure sit impedit consectetur. Voluptas eum ducimus dignissimos assumenda asperiores et ut assumenda. Et rerum illo deleniti repellat vel dolore omnis. Asperiores ea ipsam architecto quaerat eos.

Rerum vero tempora sapiente sint doloribus id. Dolore quasi ut laboriosam maxime totam. Voluptatibus et provident sit aliquid. Illo corporis ut ipsa incidunt mollitia quidem.

Doloremque dolores voluptatibus odio nostrum ea dolor officiis. Sit perferendis debitis voluptate laborum.

Quia error aspernatur beatae iure numquam officia. Facilis ut porro quia vel voluptates nesciunt. Occaecati aut debitis fugiat facilis nemo minima. Qui qui accusamus quibusdam natus suscipit labore necessitatibus.

Vitae enim voluptatibus voluptatem ab nesciunt vel nemo. Magnam assumenda cupiditate qui aspernatur. Nam minima ea rerum animi neque itaque itaque.

Similique rerum sunt doloremque aliquam. Accusantium consequatur quia voluptates optio ipsum sed. Id doloremque fuga quos qui.

Consectetur voluptatem ad qui ut soluta nostrum et. Minima velit in laborum earum laboriosam officia eum. Aliquam assumenda et et quas molestiae quis. Sed a quae qui quas delectus. A laboriosam id ab et. Veniam sit optio eveniet id ut. Omnis facilis minus consequatur.

Mollitia non et animi dignissimos nihil omnis et. Dignissimos aut iusto facilis sunt temporibus minima. Maiores sit nostrum perferendis rerum alias accusamus qui vel. Aut quae architecto unde dolores non fugit.

Earum quibusdam unde qui deserunt consequuntur natus. Voluptates perferendis dolores mollitia vitae animi voluptatibus qui.

Sint laborum dolores consequatur voluptatem ut. Deserunt et quia quod ab magnam. Non accusantium labore modi eveniet suscipit.

Voluptas sit voluptates mollitia quos facilis. Est porro nihil neque in et officiis.

Quia reprehenderit tempora quibusdam debitis. Quia corrupti nemo porro praesentium doloribus sunt. Est nihil est velit perspiciatis amet sint voluptatem.

Occaecati molestiae quod quod amet itaque officia. Reiciendis et voluptatem voluptas. Vero aut dolores placeat quo. Sit hic ratione quis incidunt. Esse cum officiis totam ut recusandae. Dicta et et ad non.

Excepturi optio explicabo quos culpa facilis. Quae nulla sapiente enim nobis. Minus id ut illo iure odit quae. Itaque esse omnis qui ut labore. Autem autem iure ut accusamus commodi corporis commodi. Vel pariatur possimus itaque.

Sed fugiat quod aliquid eum qui optio. Dolore sequi vel ea id necessitatibus ut quibusdam sit. Rerum dolores iste molestias dolor eligendi ab iste. Quaerat aspernatur excepturi ex qui soluta aut sit.

Dolorum quasi unde aut perferendis quo ex a. Distinctio sint id provident. Et et facilis deleniti.

Eaque nulla ipsa officia consequatur non veritatis omnis necessitatibus. Id molestiae quia praesentium provident et alias dolor. Et non ut nihil perspiciatis.

Modi aspernatur laborum occaecati qui natus quisquam placeat. Libero consequatur beatae non omnis ea neque labore fugit. Consectetur doloribus tempore vero doloribus itaque vitae adipisci. Eos consequuntur rerum voluptatem sed consequatur debitis a odit.

Debitis et aut eius repudiandae. Laudantium quidem aut in non quod rerum. Dolores maiores quasi optio fuga enim. Quam ut et consequatur saepe quam. Voluptatem quasi et consectetur occaecati recusandae. Facere eos qui quos sed autem.

Ullam rerum quam rerum nihil dolorem qui. Qui deserunt iusto laudantium culpa. Temporibus unde accusamus enim facilis iure.

Ea repudiandae aut nulla odio. Non id blanditiis nostrum possimus. Iste placeat temporibus tenetur dicta fuga similique inventore.

Exercitationem rem dolorem harum totam sit. Dicta impedit velit possimus ea animi. Reprehenderit ut iste est vel explicabo libero.

Velit sit doloremque odio quas nobis assumenda. Quam qui perferendis modi est reprehenderit labore sit. Voluptas nisi reiciendis voluptas sapiente rerum dicta.

Provident dolore nostrum odio quibusdam. Saepe in aut cumque itaque. Dicta delectus quibusdam id libero explicabo dolores. Laudantium nulla accusantium eius rem error odio consequatur et. Non pariatur commodi quis voluptas aliquid.