Top 10 Investment Banking Institutions in Europe (EMEA)

I've noticed there is a lot of content online ranking the top 10 most prestigious investment banks for M&A advisory from a US perspective. However, there are very few doing the same from an EMEA perspective, particularly from a London-office perspective. This results in some US-bias when making application decisions.

So, let's see if we can reach some consensus on a Top 10 Ranking for the EMEA region, based on a London-office perspective.

For simplicity, let's assume the average industry coverage team at each firm is representative of the entire franchise (i.e. let's make a team-agnostic ranking for M&A advisory in London).

Good luck everyone and stay civil! Rate the answer you agree with as "most helpful" or alternatively chime in with your own informed opinion.

I'll start with perhaps the least controversial:

1.) Goldman Sachs

2.) Morgan Stanley

3.) J.P. Morgan

4.) Rothschild & Co

5.) Lazard

6.) PJT Partners (overall rep)

7.) Bank of America

8.) Citi

9.) PWP

10.) Evercore

The Rest

Interesting to see that there is no Barclays here.

1) Goldman Sachs

2) Morgan Stanley

3) J.P. Morgan

4) Bank of America

5) Citi

6) Rothschild

7) Lazard

8) Barclays

9) Deutsche

10) BNP Paribas (mostly strong in Southern Europe)

I would add CS in the top 10, even after everything

-

Think most would take Roths over CS/Barc/UBS

This is purely from HH perspective for corporate PE exits. The full product offering seems to be preferred. For general career banking the list would be different with all the independents ranking much higher

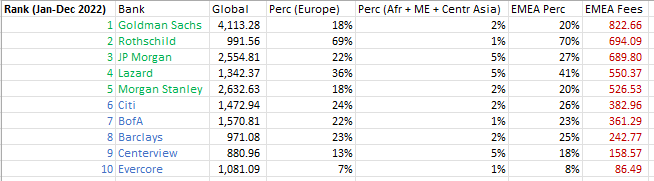

Using the Financial Times' data on EMEA M&A deal fees, I have produced a Top 10 M&A Investment Bank ranking for Jan-Dec 2022 and Jan-Dec 2021. I've attached these below.

My logic for using M&A deal fees to produce an investment bank ranking is that this measure takes into account M&A deal quantity (more deals = higher total fee intake), M&A deal size (higher value deals = larger deal fees), and whether a bank served as lead advisor in its M&A deals (lead advisor = larger fee).

If a bank is a lead advisor, the execution experience granted to members of the deal team will be richer so I viewed this as an important consideration alongside traditional factors of M&A deal volume and value.

Please find the rankings below (Units: $m):

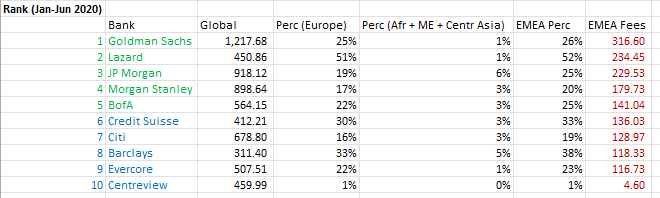

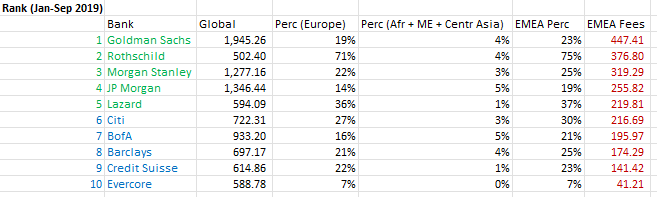

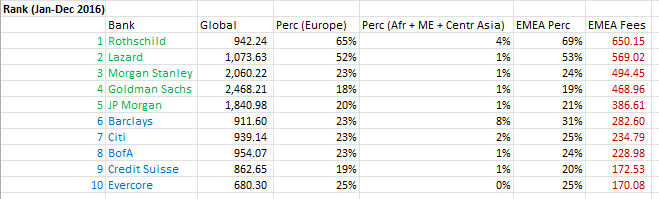

Using the WayBack Machine to access earlier versions of the FT's data, I managed to create similar league tables for Jan-Jun 2020, Jan-Sep 2019, and Jan-Dec 2016 (links to sources also available by DM). Please find these rankings below (Units: $m):

*H1 of 2020 may be an outlier due to the sudden impact of Covid-19.

My first-glance conclusion from all of this is that the Top 5 M&A Investment Banking Firms in the EMEA region are as follows:

1) Goldman Sachs

2) Morgan Stanley

3) J.P. Morgan

4) Rothschild & Co

5) Lazard

Interested to hear all of your thoughts on my reasoning, above yearly rankings, and overall conclusions!

P.S. WSO doesn't allow me to post all links here so feel free to DM me if you can't find any of my sources from this post or a quick Google search.

Numbers don’t lie

On the buyside, from my perspective for recruiting analysts:

1) Goldman Sachs

2) Morgan Stanley

3) JP Morgan

4) Rothschild

5) Lazard

6) BAML

7) Citi

8) Barclays

9) Evercore

10) Credit Suisse / UBS / DB and others

Does your exit opps ranking apply to PE as well, or just HF? Also, what is informing your ranking: backgrounds of friends, data...?

I would apply the same ranking if I was in PE.

But tbh it's just what I would write if I was forced to rank it like this. In real life, it basically makes no difference to me if someone is from GS, MS or Roths all considered top, would all matter on interview perf, case study or how I like the person.

.

Sed dolorem ducimus amet harum sit qui quo. Necessitatibus earum repellat exercitationem veritatis. Praesentium eius minima delectus soluta dignissimos assumenda excepturi eligendi. Maiores qui rerum non ut deleniti.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...