Top Banks in Austria

The banking sector in Austria plays a vital part in the country's frugality, serving as a crucial source of backing for individualities, businesses, and the government.

The banking sector in Austria plays a vital part in the country's frugality, serving as a crucial source of backing for individualities, businesses, and the government.

The sector is composed of several large banks, as well as lower indigenous and original banks that serve specific communities.

The largest bank in Austria is Erste Group Bank AG, headquartered in Vienna and operates throughout Central and Eastern Europe.

The financial institution presents various economic offerings: retail banking, industrial banking, investment banking, and asset operation.

Raiffeisen Bank International AG is another major bank in Austria, with a strong presence in Central and Eastern Europe.

The bank offers a comprehensive range of fiscal products and services, including commercial banking, retail banking, and asset operation.

Volksbank Wien AG, headquartered in Vienna, is a regional bank focusing on providing retail banking and corporate banking services to customers in Vienna and Lower Austria.

The financial institution has a history relationship back to 1905 and has become one of the leading banks in the region.

Volksbank Wien AG strongly emphasizes client pride and offers a wide variety of services and products, including financial savings debts, modern debts, loans, mortgages, investment products, and insurance.

The bank operates through a community of branches and online and cell channels, supplying clients with a handy get-right of entry to its offerings.

UniCredit financial institution AG is an associate of UniCredit institution, one of Europe's most important banking businesses.

The bank provides a comprehensive range of financial services to private individuals, businesses, and institutional guests.

Oberbank AG is an endemic fiscal institution with a strong presence in Austria, Germany, and the Czech Republic. The financial institution offers various economic services, such as retail banking, business banking, and personal banking.

In addition to these large banks, several lower indigenous and original banks operate in specific communities. These banks frequently focus on serving their original guests' requirements and furnishing acclimatized fiscal results.

The Austrian banking sector is largely regulated, with the Austrian Financial Market Authority( FMA) serving as the primary controller. The FMA is responsible for icing that banks operate safely and soundly and do not misbehave with all applicable laws and regulations.

Top Banks In Austria: Challenges And Innovations

One of the crucial challenges facing the Austrian banking sector is the low-interest rate terrain. This has pressured banks' profitability, as they're unfit to earn as much from their lending conditioning.

In response, numerous banks have been exploring new profit aqueducts, similar to offering figure-grounded services and expanding their asset operation businesses.

Another challenge the sector faces is the adding competition from fintech companies and other non-traditional fiscal services providers.

These companies are frequently suitable to offer innovative and more cost-effective fiscal results, which can put pressure on traditional banks to acclimatize and evolve.

Despite those challenges, the Austrian banking area remains a critical pillar of the country's frugality. The sector is well-subsidized and has a strong track record of riding profitable downturns.

With ongoing non-supervisory oversight and a commitment to invention and client service, the sector is well-placed to continue serving the requirements of Austrian consumers and businesses for times to come.

The Top Banks in Austria: Multidisciplinary Approach of the Austrian Banking Sector

The Austrian banking division is notable for its stalwart focus on sustainability and commercial dependability.

Numerous of the largest banks in the country have made commitments to environmental and social responsibility, with an enterprise similar to green backing and social impact investing. In addition, the sector has a strong tradition of furnishing fiscal education and promoting fiscal knowledge among consumers.

Banks in Austria offer a range of educational coffers and programs to help individuals make informed fiscal opinions and manage their finances effectively.

One of the unique features of the Austrian banking sector is the presence of "Sparkassen," which are savings banks that employ an original or indigenous position.

Sparkassen is possessed by original governments and operates as a non-profit association, focusing on serving their communities' requirements.

They frequently give introductory banking services to individuals and small businesses and may also offer fiscal education programs and other community-acquainted enterprises.

Note

The Austrian banking sector is characterized by a strong commitment to client service, invention, and commercial responsibility.

The sector is well-deposited to continue serving the requirements of Austrian consumers and businesses while conforming to ongoing fiscal geography changes.

With a focus on sustainability, fiscal knowledge, and community engagement, the sector is poised to play an important part in driving profitable growth and development in Austria in times to come.

More about the leading banks:

Erste Group Bank AG

Erste Group Bank AG is the largest banking group in Austria, serving more than 16 million guests in Central and Eastern Europe. It has headquarters in Vienna and has been operating for more than 200 years.

The Erste Group Bank AG provides various fiscal products and services, including retail banking, marketable banking, investment banking, and asset operation.

1. Retail Banking

It offers a comprehensive range of retail banking services, including current and savings accounts, mortgages, particular loans, and credit cards.

The bank's retail business is concentrated on furnishing innovative results that meet the evolving requirements of its guests. It has a strong online presence and mobile banking operation, making it easier for guests to pierce their accounts and manage their finances.

2. Commercial Banking

It is a leading provider of marketable banking services in Central and Eastern Europe.

The bank's marketable banking business is riveted on furnishing many products and services to small and medium-sized enterprises( SMEs) and commercial guests. It offers acclimatized results to help businesses grow, manage their finances, and alleviate threats.

3. Investment Banking

Erste Group Bank AG's investment banking division provides various services, including combinations and accessions, capital requests, and structured finance.

It is one of the largest asset directors in Central and Eastern Europe. The asset operation business offers a range of investment products and services, including collective finances, pension plans, and optional portfolio operation.

Erste Group Bank AG's Sustainability Erste Group Bank AG is committed to sustainability and commercial responsibility. It has set ambitious targets to reduce its environmental impact, promote diversity and addition, and support original communities.

Several external associations have also honored Erste Group Bank AG for its sustainability sweats. For example, in 2021, the Dow Jones Sustainability indicators ranked the bank as the most sustainable bank in Central and Eastern Europe.

Note

The Erste Group Bank AG has also been included in the FTSE4Good Index, which measures the performance of companies that meet encyclopedically honored ESG norms.

Financial Performance Of Erste Group Bank AG

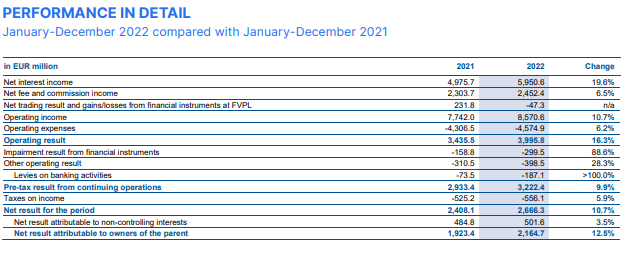

In the fiscal year 2022, Erste Group Bank AG reported strong financial results driven by a combination of rate hikes and strong loan growth. As a result, the net interest income increased by 19.6%, while the net figure and commission income rose by 6.5%.

The growth was seen across all seven core requests, with significant growth in payment services and asset operation.

The operating income increased by 10.7%, while the cost/income rate improved by 53.4%. The operating result also bettered significantly by 16.3%. Still, the net trading result declined to EUR 778.6 million due to valuation goods performing from movements in interest rates.

The impairment resulting from financial instruments amounted to EUR 299.5 million, or 15 base points of average gross guest loans.

Net allocations to credit loss allowances were posted in all core requests except Croatia, driven substantially by streamlined credit threat parameters grounded on the rearmost macro-scenarios and portfolio stage overlays for cyclical and energy-ferocious diligence.

The NPL rate grounded on gross client loans bettered to a major low of 2.0, while the NPL content rate( banning collateral) increased to 94.6%.

Note

Erste Group Bank AG reported other operating results of EUR398.5 million, driven by advanced banking impositions and increased periodic benefits to resolution finances.

Levies on income increased to EUR 556.1 million, while the non-controlling interests charge bettered to a record position of EUR 501.6 million. The net result attributable to possessors of the parent rose by 12.6% from the former time.

The total equity, not including AT1 instruments, rose to EUR 23.1 billion, while the common equity league one capital (CET1, final) rose to EUR 20.4 billion, over by 8.5% from the former time.

The total own finances (final) also increased to EUR 26.2 billion, over by 5.6%. Still, the total threat-weighted means increased to EUR 143.9 billion, over by 11%.

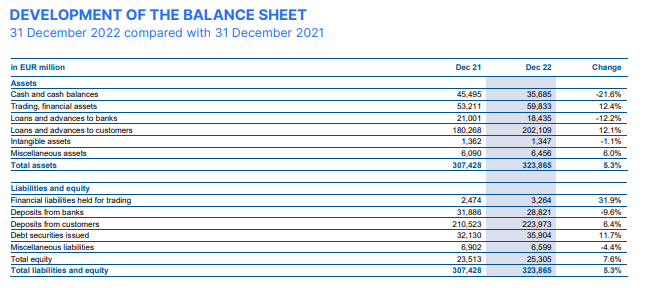

Erste Group Bank AG reported total funds of EUR 323.9 billion, over by 5.4%. On the asset side, cash and cash balances declined, primarily in Austria, to EUR35.7 billion due to the prepayment of TLTRO III finances.

Loans and advances to banks were lower at EUR 18.4 billion, while loans and advances to guests( net) rose to EUR 202.1 billion by 12.1%. On the liability side, deposits from banks declined to EUR 28.8 billion.

Erste Group Bank AG had a strong financial performance in 2022, driven by a combination of rate hikes and strong loan growth.

The bank's focus on retail banking, marketable banking, investment banking, asset operation, and insurance has helped it to maintain a strong presence in Central and Eastern Europe.

Still, the bank faces challenges similar to increased banking impositions and benefactions to resolve finances, which may impact its profitability in the future.

Raiffeisen Bank International

Raiffeisen Bank International AG (RBI) is a leading universal bank in Central and Eastern Europe, headquartered in Vienna, Austria.

The bank was established in 2010 when Raiffeisen International Bank- Holding AG was amalgamated with Raiffeisen Zentralbank Österreich AG.

The bank provides various financial services, including retail banking, commercial banking, leasing, and investment banking. RBI is an attachment of Raiffeisen Bank International AG, Austria's largest banking group. It operates in 14 countries in Central and Eastern Europe with a strong focus on the CEE region.

Raiffeisen Bank International AG has a rich history that dates back to the 19th century.

The bank's origins can be traced back to the founding of the first Raiffeisen credit cooperatives in Germany in 1864.

The conception of credit cooperatives was grounded on the idea of collective support and tone-help, where members pooled their coffers to give fiscal services to each other.

Note

The Raiffeisen cooperatives snappily spread across Europe, becoming an important source of backing for pastoral communities.

In the early 20th century, the Raiffeisen cooperatives in Austria and Germany began to combine to form larger indigenous banks.

These indigenous banks were suitable for giving their members a wider range of financial services, including savings accounts, loans, and insurance products.

Overview of Raiffeisen Bank International AG

In 1953, Raiffeisen Zentralbank Osterreich AG was established as the central bank for the Raiffeisen cooperatives in Austria. Raiffeisen International Bank-Holding AG was established in 1989 as the transnational arm of the Raiffeisen banking group.

In 2010, Raiffeisen International Bank-Holding AG intermingled with Raiffeisen Zentralbank Österreich AG to form Raiffeisen Bank International AG.

1. Products and Services

Raiffeisen Bank International AG provides various financial services, including retail banking, commercial banking, leasing, and investment banking.

2. Retail Banking

RBI offers a comprehensive range of retail banking products and services, including savings accounts, current accounts, disbenefit cards, credit cards, particular loans, and mortgages.

The bank also provides online and mobile banking services to its guests, allowing them to manage their accounts and make deals from anywhere, at any time.

3. Corporate Banking

RBI provides a full range of commercial banking services, including backing, cash operation, trade finance, and investment banking.

Note

The bank has a strong presence in the CEE region and is well-deposited to serve the requirements of original and transnational ports operating in the region.

4. Leasing

RBI offers leasing services for various means, including vehicles, ministry, and outfits. The bank's leasing products are designed to meet the requirements of both commercial and retail guests.

5. Investment Banking

RBI provides investment banking services, including commercial finance, combinations and accessions, and capital requests. The bank has a strong track record in advising on complex deals and deeply understands CEE requests.

6. Commercial Social Responsibility

Raiffeisen Bank International AG is committed to conducting its business responsibly and sustainably. The bank's commercial social responsibility (CSR) enterprise concentrates on three main areas: social responsibility, environmental responsibility, and responsible business practices.

7. Social Responsibility

RBI is committed to supporting social development enterprises in the communities where it operates. The bank has established the Raiffeisen Bank International Social Foundation, which supports systems in the areas of education, health, and social welfare.

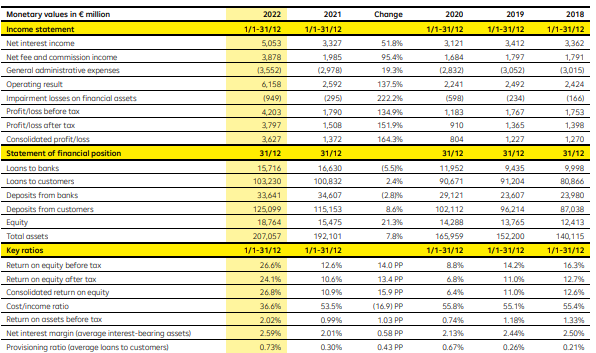

Macroeconomic Development & Financial Report Of of Raiffeisen Bank International

The time 2022 marked a significant geopolitical and macroeconomic turning point with the Ukraine war's launch on 24 February 2022. This had massive consequences for frugality as a whole and the people living in Europe.

The impact of the war wasn't only limited to the plutocrat and capital requests, but it also affected the movement of goods, marketable trade, and force chains, particularly energy inventories.

Likewise, the entire time was characterized by strong upward inflationary pressure, significant increases in crucial interest rates, and a generally unpredictable request terrain.

Note

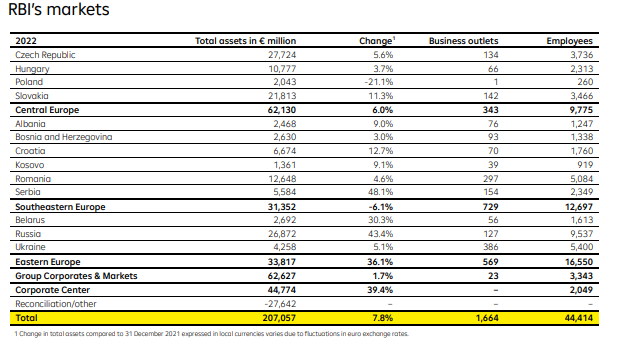

Despite the grueling conditions, Raiffeisen Bank International (RBI) managed to record a consolidated profit of €3.6 billion, with strong core earnings across the entire group. Still, RBI's presence in Ukraine, Russia, and Belarus made operating and managing pitfalls challenging during 2022.

The bank's flexible performance underscores its capability to navigate through turbulent times.

RBI's trade of Raiffeisenbank( Bulgaria), with effect as of 30 June 2022, helped to strengthen its capital base. As a result, Standard & Poor's and Moody's honored the bank's solid position and verified RBI's stability with an unchanged standing in 2022.

The standing agencies stressed the robust measures for mollifying threats, further emphasizing the bank's capability to manage pitfalls and its strong fiscal position.

Throughout that time, RBI remained focused on complying with EU and U.S. fiscal warrants regulations, which was particularly important given the bank's presence in Russia and Belarus.

In addition, the Supervisory Board reviewed the bank's strategic and geographic positioning, with a particular focus on core requests and strategic options concerning Raiffeisenbank Russia and Priorbank Belarus.

The integration of Crédit Agricole Srbija's announcement in Serbia and Equa bank in the Czech Republic progressed according to plan and has strengthened RBI's request position in its core requests.

The bank's digital metamorphosis, client-concentrated invention, and IT threat operation remained precedence, as did its strong positioning in sustainability(ESG).

The operation board regularly informed the Supervisory Board of developments concerning foreign-currency mortgage loans in Poland and the performing allocations to credit-linked vittles.

The Supervisory Board and its panels performed all their duties with great care and responsibility, holding 39 meetings plus 32 fresh movables. The board also bandied compliance matters at each meeting, focusing on the direct consequences of the warrants assessed against Russia and Belarus.

RBI's strong performance during the grueling 2022 fiscal time underscores its ability to navigate delicate request conditions. Despite the ongoing query, the bank remained focused on managing pitfalls, maintaining a strong capital base, and situating itself for long-term success.

Volksbank Wien AG

Volksbank Wien AG is a leading bank in Austria, headquartered in Vienna. It is a part of the Volksbanken Group, which has a history of more than 130 years in Austria.

The bank was installed in 1921, and considering then, it's been serving the needs of personal and corporate customers inside the location.

With a focus on personal service, innovation, and sustainability, Volksbank Wien AG has become a trusted financial institution in Austria.

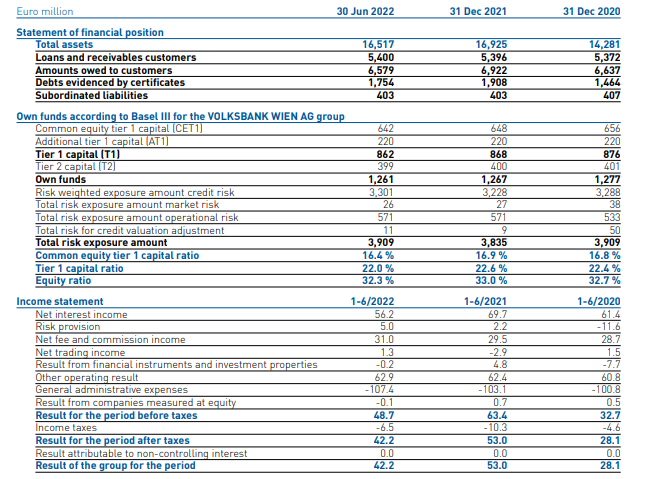

As of June 30, 2022, Volksbank Wien AG's total assets amounted to €16.5 billion, a slight decrease compared to the end of 2021, and a liquid budget of €5 billion.

Nine billion decreased via €0.8 billion compared to the previous year's quit because of a discount in deposits with the principal financial institution.

Loans and receivables to credit establishments elevated slightly to €2.4 billion, and loans and receivables to customers remained greater or less unchanged at €5.4 billion.

The increase in other assets from €0.1 billion to €0.3 billion essentially results from changes in the fair value of derivatives in the banking book. As a result, amounts owed to credit institutions have decreased slightly, and debts evidenced by certificates amount to €1.8 billion.

Equity, including the capital of non-controlling interests, increased by €31.3 million to €959.7 million.

The full comprehensive profits of the group within the first 1/2 of 2022 was €42.7 million, which includes the internet result for the first half of 2022 of €42.2 million and other complete earnings of €0.5 million.

Capital Adequacy and Performance Indicators Of Volksbank Wien AG

As of June 30, 2022, the regulatory own funds of the VBW group of credit institutions amounted to €1.3 billion, which remained the same as of December 31, 2021.

As of June 30, 2022, the total threat exposure quantity becomes €3.9 billion, a slight boom from the top of the preceding year (€3.Eight billion).

The CET 1 capital ratio to total risk amounted to 16.4%, slightly lower than the previous year (16.9%), while the fund's own ratio with total risk was 32.3% (31 December 2021: 33.1%).

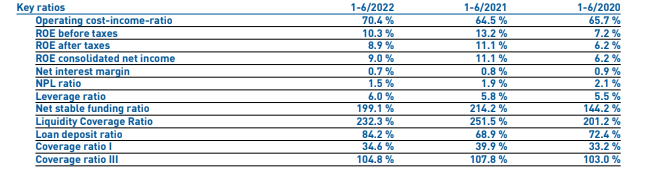

The bank's performance signs showed a go back on equity (ROE) earlier than taxes of 10.3% for the first half of 2022, which turned lower from the previous year's 13.2%.

In addition, the ROE after taxes decreased from 11.1% in 2021 to 8.9% in the first 1/2 of 2022. As a result, the Efficiency ratio, calculated from working profits in terms of operating fees, accelerated to 70.4%, compared to 64.5% within the preceding 12 months.

For the first half of 2022, Volksbank Wien AG reported a return on equity before taxes of 10.3%, a return on equity after taxes of 8.9%, and a cost-income ratio of 70.4%.

These performance indicators are considered customary within the industry and essential for banks' credit rating.

Additionally, within Volksbank Wien AG, the cost-income ratio was defined as an early warning indicator for the Bankensanierungs- und Abwicklungsgesetz (BaSAG, Act on the Recovery and Resolution of Banks).

Note

The Bankensanierungs- und Abwicklungsgesetz (BaSAG) is an Act on the Recovery and Resolution of Banks enacted in Austria in 2014. The BaSAG provides a legal framework for resolving failing banks in Austria and is designed to ensure that the resolution process is orderly, effective, and transparent.

Products and Services Offered by Volksbank Wien AG for Corporate

Volksbank Wien AG provides its customers with a comprehensive range of corporate and private banking services. The bank's corporate banking services include cash management, trade finance, and capital market products.

Its private banking services include investment advisory, asset management, and wealth planning. The financial institution's attention is on offering tailor-made answers to satisfy the precise wishes of its clients.

Volksbank Wien AG is committed to delivering innovative solutions to its customers through digital technology.

The financial institution's online and mobile banking systems enable customers to access their debts and conduct transactions 24/7. In addition, the bank has brought various modern products and services, such as contactless charge answers and biometric authentication.

Volksbank Wien AG offers its customers various financial services, including retail banking, corporate banking, and wealth management. Retail banking services encompass contemporary money owed, financial savings accounts, loans, mortgages, credit cards, and insurance.

Note

Corporate banking services offered by Volksbank Wien AG include financing, investment banking, cash management, and trade finance.

The financial institution has a dedicated crew of company banking specialists who work intently with customers to offer tailored economic solutions to their precise needs.

The bank also strongly focuses on sustainable finance and is committed to providing environmentally and socially responsible financial services to its corporate clients. Wealth management services offered by Volksbank Wien AG include portfolio management, investment advisory, and financial planning.

Future Outlook Of Volksbank Wien AG

VBW is dedicated to increasing its business and growing its market proportion in the coming years. The bank aims to continue its digital transformation and enhance its online banking services to offer its clients more convenience and accessibility.

VBW plans to invest in new technologies and innovative products to improve customer experience and increase efficiency. Moreover, the bank aims to toughen its danger management tactics to ensure the steadiness and balance of the organization.

VBW will focus on maintaining its high credit quality standards and adhering to regulatory requirements to manage risks effectively.

In addition, VBW has maintained its financial stability and profitability in the first half of 2022, despite the challenging economic environment caused by the COVID-19 pandemic.

The bank has continued to expand its business and enhance its digital capabilities while prioritizing risk management and social responsibility.

VBW's commitment to innovation, customer-centric approach, and sustainability goals puts the bank in a strong position to weather future challenges and achieve long-term growth.

UniCredit Bank

UniCredit Bank is a leading European marketable bank with a global presence, serving over 26 million guests in 14 countries.

Headquartered in Milan, Italy, the bank operates in Austria, Azerbaijan, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Germany, Hungary, Italy, Romania, Russia, Serbia, Slovakia, and Slovenia.

UniCredit Bank was formed in 1998 due to the junction between several Italian banking groups. Since then, it has expanded its operations through multitudinous accessions and combinations, becoming one of the largest banks in Europe.

Note

The bank is intimately traded on the Milan Stock Exchange and is a member of the FTSE MIB indicator.

The bank provides its services through a network of branches, online and mobile banking platforms, and ATMs. It also offers various credit and disbenefit cards, insurance products, and other fiscal services.

UniCredit Bank is a commercial and investment banking leader, furnishing a broad range of services to large and mid-sized pots, fiscal institutions, and public sector realities. It’s also one of the largest retail banks in Europe, serving millions of guests through its expansive network of branches and digital channels.

Note

UniCredit Bank is committed to sustainability and social responsibility, feeling that its business conditioning impacts the terrain and society.

The bank has set ambitious targets to reduce its carbon footmark, promote renewable energy, and support sustainable development. It's also laboriously involved in community development and philanthropy, supporting various social and artistic enterprises.

UniCredit Bank has a strong fiscal position, with total funds of €916.7 billion as of December 31, 2022. The bank's earnings in 2022 were €16.7 billion, while its net profit was €4.1 billion. In addition, UniCredit Bank is well-subsidized, with a CET1 rate of 14.7 as of December 31, 2022.

The bank's strong fiscal position, commitment to sustainability, and concentration on invention and digitalization make it well-placed to meet its guests' evolving requirements and continue to grow and succeed in the times to come.

OberBank AG

Oberbank AG is an indigenous bank in Austria that has been operating for over 150 years. The bank was innovated in 1869 and has since grown to become one of the most esteemed banks in the country, with a strong focus on client satisfaction.

Oberbank AG has established itself as a dependable mate for retail and commercial guests.

Oberbank AG's rich history dates back to 1869 when it was initiated as the ''Oberösterreichische Bank." The bank's early times were marked by rapid-fire expansion, and it snappily became one of the largest banks in Austria.

During World War I, the bank suffered significant losses, but it was suitable to recover and continue its expansion during the interwar.

In 1938, the bank was forced to combine with several other banks to form the "Donau Bank," but it was suitable to recapture its independence after the war.

Note

In post-war times, Oberbank AG concentrated on expanding its operations and establishing itself as a dependable mate for retail and commercial guests.

The bank's strategy proved successful and was suitable for maintaining its position as one of the largest banks in Austria. Oberbank AG has over 160 branches in Austria, Germany, and the Czech Republic and employs over 500 people.

For commercial guests, Oberbank AG offers a comprehensive range of services, including working capital finance, design finance, trade finance, and leasing. In addition, the bank also provides storeroom services, foreign exchange services, and interest rate operation results.

In addition to its traditional banking services, Oberbank AG offers online and mobile banking, allowing guests to manage their accounts and deals from anywhere, anytime.

The bank has developed a comprehensive sustainability strategy that includes measures to reduce its environmental impact, support social causes, and promote ethical business practices.

One of the bank's crucial enterprises is the "Oberbank Environment and Climate Fund," which supports systems promoting renewable energy, effectiveness, and sustainable transportation.

The bank has also enforced measures to reduce its environmental impact, including installing solar panels on its branches and using electric vehicles for its line.

Note

Oberbank AG is committed to supporting social causes and has established hookups with various non-profit associations.

Financial Performance of OberBank AG

Oberbank AG has a strong fiscal position and has consistently delivered solid results. In 2021, the bank reported total funds of €23.7 billion and a net profit of €216.5 million.

The bank's capital acceptability rate was 17.7%, well above the nonsupervisory conditions.

Despite the challenges posed by the COVID-19 epidemic, Oberbank AG was suitable for maintaining its profitability and liquidity.

The bank's operation has enforced various measures to alleviate the epidemic's impact, including loan prepayment detainments and fresh vittles for credit threats.

Oberbank AG is an estimable indigenous bank that has established itself as a dependable mate for retail and commercial guests. With a long history of success, the bank has demonstrated its capability to acclimate to changing request conditions and maintain profitability.

or Want to Sign up with your social account?