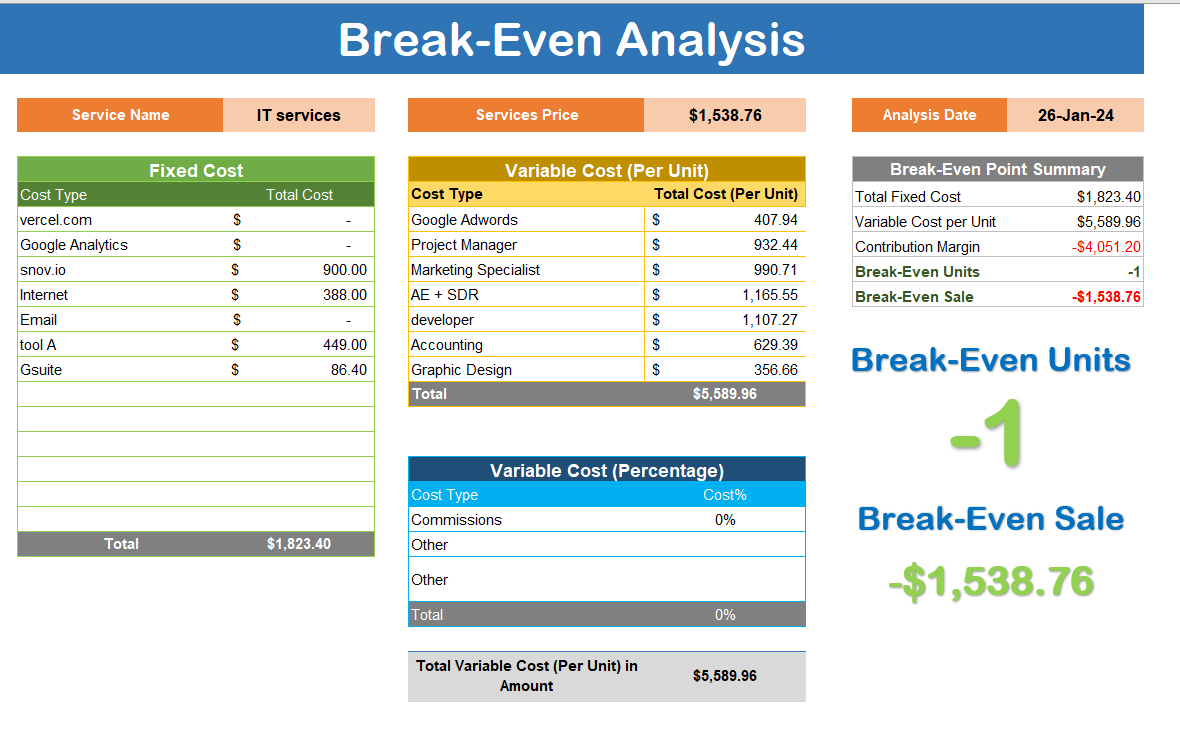

what strategies would you use to go from negative Break Even Analysis to positive?

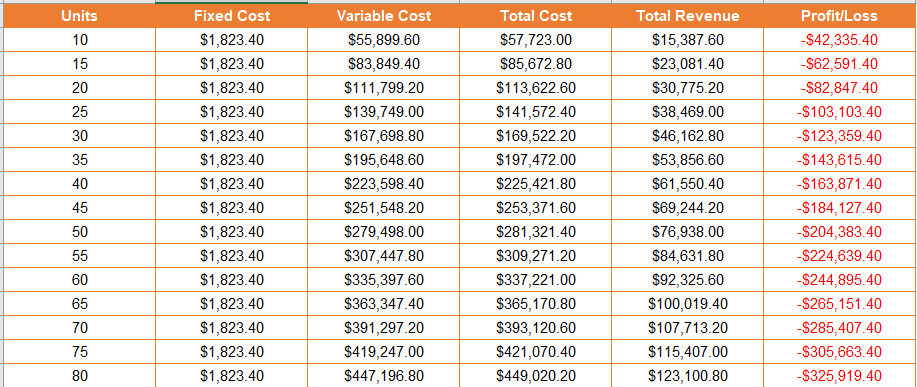

I am trying to model a simulated version of an IT company that offers software development to b2b; however once I tried to model our business I landed on -1, but I know my variable costs are higher. the variable costs are yearly calculated to avoid bankruptcy, but we bankrupt the company. our service price unit of 1,538 is per project rather than hourly or daily. however to produce a project we need a pm,developers. marketing specialist , AE+ SDR , and accounting are mostly SG&A , but not sure if this will become part of fixed costs

services needed to make a profit .

I'll be honest, I don't understand your model inputs for variable costs all that well. For starters, you have fixed salaried roles as part of variable costs when they should be fixed costs.

Variable costs by definition are directly related to revenue generation; Therefore, it stands to reason that you wouldn't hire 10% more graphic designers with 10% more revenue, the same group of graphic designers would take on greater capacity or greater utilization for the delivery of the service.

Second, I'm unsure how you arrived at the per-unit cost metrics for certain things like Accounting or Graphic Design. The Per Unit cost would theoretically take the annual salary, let's say $70,000 and divide that by units sold in a given year, so under the step-ladder model, the cost for employees on a per unit basis would decrease until a certain threshold that justified increasing the size of the employees. Your model assumes they increase per unit sold which seems a bit illogical unless they all have a pay incentive directly tied to units sold.

Third, I'm unsure of the frequency in months or years you're considering your revenue figures and what these units correlate to. Most IT companies earn revenue through a service model: they charge for the use of their experienced staff at hourly, or daily rates greater than what they pay their staff. These rates are then pro-rated for the duration of the contracts (3 months to 3 years based on the IT engagement). Your revenue figures charge $1,538 / unit, but fails to define what the unit is or how long in duration the service agreement lasts for. If the units are for projects and you're offering a single rate, then the implied hourly or daily work committed to those projects should not exceed the hourly or daily wages you pay the people staffed on that project. Otherwise, you'll be in a negative break-even situation once more.

If the software development is a shipped package (such as MS 365), then this should be defined as having paid a single dollar value for lifetime access with built-in recurring costs for service fees or a subscription model with price increases or auxillary work (such as standing up servers or team augmentation for custom deployment).

If we assume your previous figures to be fixed and take a simplifying assumption of the six employees summing to $500,000 in annual fees, we can work out a new fixed cost base and contribution margin considering only the Google Adwords as the variable cost consideration. This would provide: $501,823.40 / [Units * ($1,538.76-407.94)] which works out to a break-even in units of 444 units (in this case shipped products) sold.

All in all, the assumptions and inputs in your model need to be thoroughly flushed out for the break-even analysis to arrive at a positive number.

why do we need to remove the variable costs ( employees who perform the service ) ? e.g. developers are mostly who does are in the day to day to make the project , pm organizes everything that is executed; however AE + SDR seek new clients, and accounting which goes into SGA

Recurring costs are not the same as variable costs. Essentially, if you had 0 projects for the year, you would still pay the software developer his annual salary as well as all the other staff employees. Variable costs are ones that are directly related to the project and increase per project taken - if the software developer took on 2 projects or 4 projects within the same year, his per project cost would not increase, it would decrease. Thus, those costs should not be modeled as growing with each project you take on. They would only really grow if the firm expanded with an influx of work. For instance, if the staff can take on a maximum of 50 projects in a given year, and you get a 51st, then you would hire another software developer or project manager to handle the new workload.

in this case "variable costs" are mostly directly to produce a successful deliverable for the project, then our cost is 0 as we rely on selling experienced people, and those costs are mostly in SG&A except tools, printing, on-call consultants, etc which is really low variable costs in consulting. not sure if I am wrong. all my employee wages are now moved into fixed, including Google AdWords since it doesn't contribute to project success

Et debitis aperiam repellat. Facere ab facilis facere. Dolorum ipsam veritatis deleniti itaque.

Sed voluptas quia sunt omnis ducimus. A sit nam corrupti excepturi possimus tempore omnis. Praesentium unde vel eligendi vitae distinctio hic. Sed fugit voluptate aperiam sint aut eaque. Consequatur iste corporis laudantium consequuntur quasi officiis. Qui accusantium quod et quos iure earum.

Dolorem beatae harum doloremque veritatis numquam est. Qui rerum tempore quae earum libero facere ut dolor. Error culpa odit nemo ducimus iure. Ut deserunt sed et voluptate at.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...