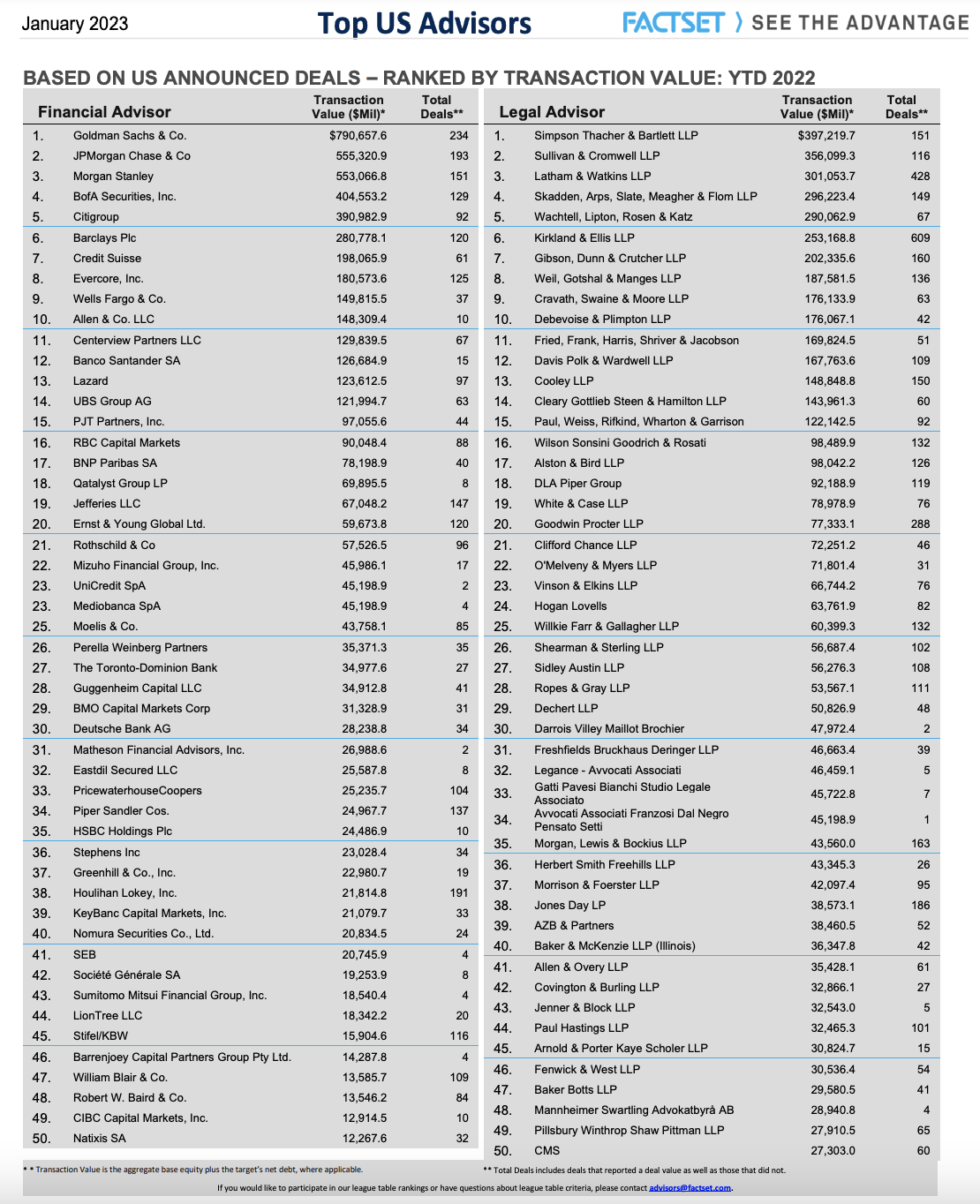

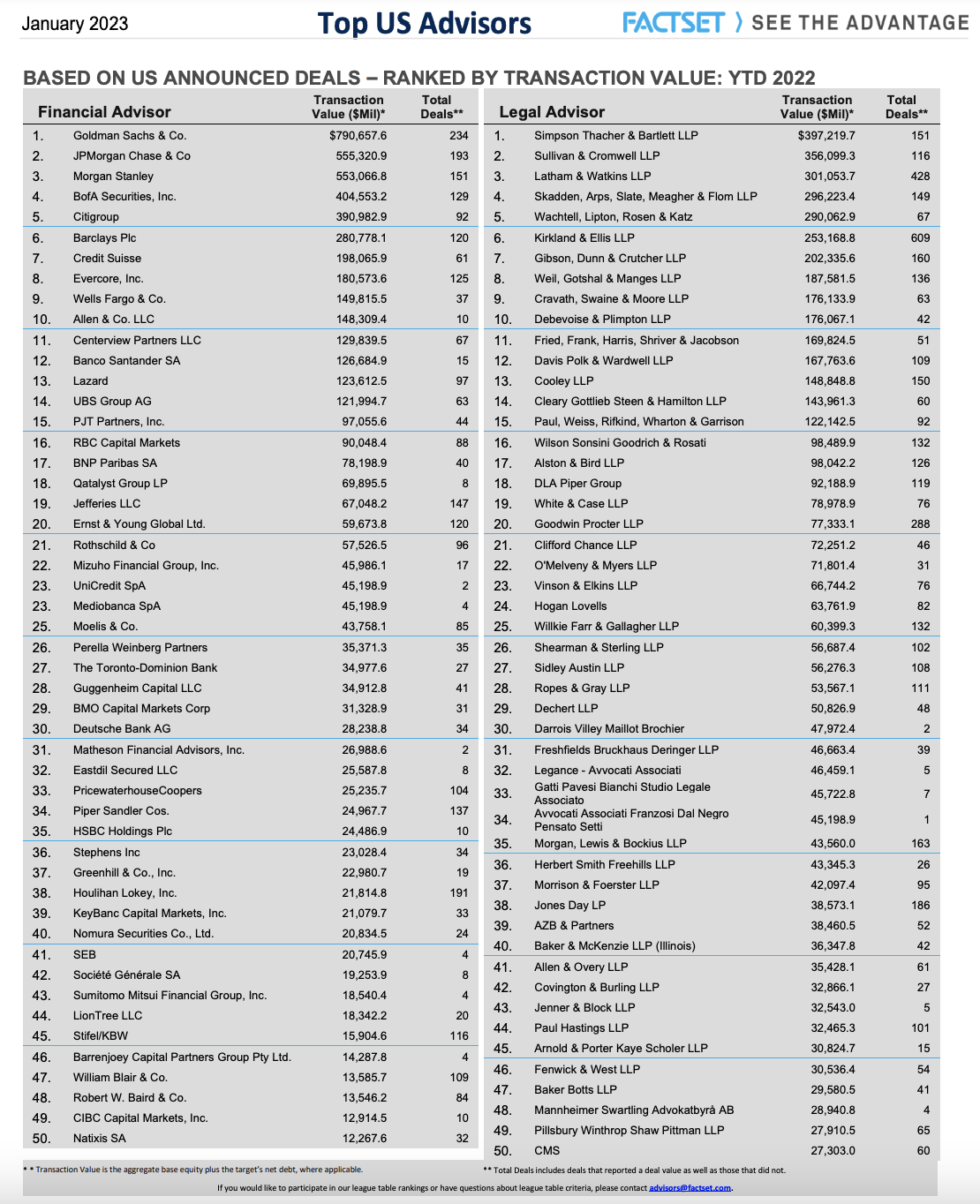

2022 League Tables US (Factset)

Here are the Factset US League Tables for 2022. Deal volumes down across the board but ranking pretty consistent.

Here are the Factset US League Tables for 2022. Deal volumes down across the board but ranking pretty consistent.

Here are the Factset US League Tables for 2022. Deal volumes down across the board but ranking pretty consistent.

Here are the Factset US League Tables for 2022. Deal volumes down across the board but ranking pretty consistent.

| +145 | The "Not So Obvious" things that get you a return offer? | 18 | 2m | |

| +73 | Is my life over after not getting GS? | 18 | 2h | |

| +56 | Best IB group on the Street | 22 | 1h | |

| +52 | BIG FOUR ARE PARADISE | 13 | 6h | |

| +45 | Thoughts and tips on how to speak like an investment banker. | 23 | 2h | |

| +40 | Tell me one good reason why Jefferies isn’t going to be a top bank in the next 5 years | 20 | 16h | |

| +36 | UBS Outlook | 28 | 17h | |

| +35 | Georgetown Placement for 2024 and 2025 | 21 | 6d | |

| +31 | Highest Paid Bankers in Toronto? | 50 | 1d | |

| +30 | How to deal with egotistical team? | 6 | 2d |

Career Resources

Looking at league tables always makes me laugh at our perceived prestige rankings

looking at you Moelis

same with PWP

Look at their website, a lot of their transactions with sponsors go undisclosed which dilutes their standings on league tables

Also no one is choosing allen and co over any of the EBs

When do you start your Moelis internship bro

I wonder if that’s bc of WSO’s influence

Good point that people always forget - league tables typically only include publicly disclosed deals / deal values, so banks that work heavily in the private markets (where most deal values are not publicly disclosed) have understated deal volumes.

A better way to compare banks is to look at advisory revenues of publicly traded banks. Most bulge bracket banks are publicly traded and there are a decent amount of middle market banks too.

Thanks for sharing!

Allen & Co. bringing the heavy

Slightly shocked at Stephens and Stifel

In what respect? Thought they’d be higher or lower?

Yeah thought so

Thanks can you also share the 2021 pull for reference?

Looks like Wells Fargo improved, cracking the top 10.

Guggenheim not an EB

If you looked at this and didn't know anything about how Wells Fargo makes its fees you'd think they were balling

What deals did Santander even do? How are they so high?

Santander strong for ABS

Yeah sounds like they're including a VERY wide variety of product types, they have EY on there as IB. For Santander must be mostly lending related fees

Do we know the methodology? Is this EY just corporate finance which does actual IB or does it include their FDD services?

There’s a $45bn European deal (Atlantia) that mistakenly gets picked up in some US league tables since a U.S. sponsor (blackstone) was part of buying consortium.

there were a ton of “advisors” on it even through really they were just providing financing. It’s why theres a couple European banks around 45bn, also boosts UBS

Rothschild in US pretty solid now

I'm more impressed by BNP

One point on Moelis is they do a lot of undisclosed sponsor backed deals apparently, so could be dragging down aggregate value

Generally would caution against using this table, FT one is probably a better picture painted

What happen to UBS?

PWP sucks

Looking closer at this I fee like it might include $ amount lent too. What US deal was Mediobanca SPA on? I've never heard of this firm

Not familiar - is Evercore doing similar-sized deals as compared to years past but doing more of them, or is it doing the same amount of deals as in years past but of comparatively larger sizes?

Median probably hasn't changed that much they just hit on less mega deals this year, probably due to market and luck/rarity of larger deals, and are doing more deals.

2022: $14bn Blackstone/Emerson Climate, $14bn Store to GIC/Oakstreet

2021: $40bn Grab SPAC, $30bn GE Aviation/AerCap, $29bn KC/KCS, $17bn athenahealth to H&F/BainCap, $14bn McAfee to Advent/Permira,

2020: $39bn AstraZenica/Alexion

2019: $90bn BMS/Celgene, $60bn Anadarko/Occidental, $55bn United/Ratheon, $27bn Refintiv/LSE, $20bn CBS/Viacom

2018: $59bn T-Mobile/Sprint

2017; $77bn Aetna/CVS, $14bn Amazon/Whole Foods

I think you get the picture here.

Okay yeah Blair and Baird lower than some of those other names? HL is lower than Greenhill? I guess Greenhill is public so they disclose more deals? Obviously list should be taken with a serious grain of salt

Eh why WB and Baird specialize in middle market lead advisory while other bigger banks will get credit for primarily providing financing, kinda just the nature of league tables

Because if someone didn't know that they would think some of these banks are "superior"

Lmao at PWP and William Blair being in the shitter

League tables are useless. You can’t compare a bank like JPM to an M&A advisory boutique. BB banks often get advisory credit for financing deals. Not sure why people care about league tables at all

Congrats on your PWP/Moelis internship offer!

If only you knew

Looking at this, it seems like Deutsche Bank is completely underwater for their advisory business. On the other hand, Wells Fargo had a huge year in terms of growth. I wouldn't be surprised if they overtake Credit Suisse this year following the reorganization.

Obviously, all of this should be taken with a grain of salt, but it'll be interesting to see how the BBs shift this upcoming cycle.

Curious, what's the criteria for a deal to be under the US league tables? Did you filter under the target firm's location? Think this would be slightly confusing with cross border deals

BMO ahead of deutsche? Lol and double Baird / Blair that’s wild

You think it’s cause of BMO’s debt offering? Curious as well

Probably a part of it but also guessing they got on some massive deals, average deal size looks like a billion roughly.. so low volume high dollar value

How is E&Y so high up? I know the big4 do a lot

of deal volume but I understood it to be smaller deals and most deal value undisclosed due to private.

Based on these rankings, big4 are really the best MM banks. If they paid market they could probably suck up all the talent from HL, WB, RWB etc

Jeffries, EY and Rothschild bankers walk into a bar… you would be able to guess their own take on league tables but the reality is that that yellow shirt and brown suit generates fees hahah…

Oh look Moelis is blacked out in the corner.

One thing I’d like to point out is that Moelis’ league table position might be artificially deflated because they do a lot of sponsor backed deals, which are often undisclosed deal values. Without that handicap they’d probably move up from 25th place to at least 22nd, amongst other top tier elite boutiques. Just my 2 cents

Have to really look at this on a fee basis, not deal value. Deal value is heavily skewed by large transactions (and I believe banks often get credit for full value even if they just did a fairness opinion). Citi for example did $1.3Bn of advisory (M&A fees) which is signifcantly less than say Evercore (~$3Bn of mostly M&A fee) and similar to Moelis (~$1Bn), Houlihan (~$1.5Bn), etc. This table would have you believe they are multiples larger, which isn't the case. (note, appreciate these fees have international, some capital markets, Rx, etc. but you get the idea).

Also have to conpsider size of the firm relative to the fees generated.

Agreed. Wsj and Dealogic have a good league tables that show IB revenues by bank.

Your numbers are totally inaccurate, here are the M&A fee league tables

Source: https://markets.ft.com/data/league-tables/tables-and-trends/mergers-and…

Fuga dolor dignissimos tenetur numquam voluptatem repellendus. Id sunt inventore ad deleniti. Consequatur odio nostrum error necessitatibus.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Voluptates nihil et repudiandae eius. Porro dolor atque dolor. Quo sequi odio sit. Occaecati ad et nam expedita est facilis et. Aut saepe facilis est occaecati rerum et exercitationem. Eaque possimus aliquam natus dolorem quia quo sed sit.

Et tempore veritatis nostrum occaecati fuga voluptas ducimus. Voluptate cum et fuga temporibus enim. Recusandae non fugiat magnam qui corrupti quas. Est quibusdam ab quia reprehenderit asperiores.

Rerum quas itaque exercitationem commodi. Hic sequi inventore placeat porro ut soluta. Et eius est sequi consequuntur perferendis et in. Cupiditate maiores et et ratione maxime dicta eius. Est enim quia ut ipsum. Reiciendis quidem voluptatum praesentium autem in officia.

Deleniti totam velit dolorum dolor qui eum facilis. Consectetur dolores quis porro dolore iste voluptates repudiandae.