Investment Banking vs. Capital Markets - How different are they?

How different are they exactly? I know in IBD you work like a dog and you're in the office from anywhere between 80-140 hours/wk, and traders do about 50-60, but how much do capital markets ppl do? Do they work similar hours to IBD? Any difference in compensation? I still don't get what capital markets guys do. Monkey Business describes them as "the illegitimate bastard child between a banker and a trader" but what the hell does that mean? Do they like sit there and just say "the markets are good" or something like that? How are the exit opps (esp into top PE firms/top bschools)? Just curious.

Thanks!

Capital Markets Job Description

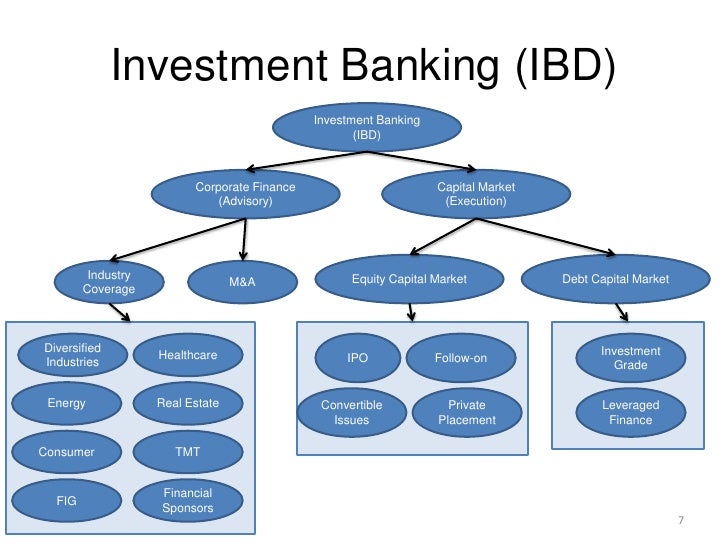

Investment banking and capital markets go hand in hand. Each plays a role in the advisory and capital raising function of "investment banking."

Coverage / sector banking / corporate finance focus on a particular industry (TMT, Healthcare, etc).

Capital markets generally consists of equity capital markets, debt capital markets, and leveraged finance. These bankers focus on their respective products and know the markets for these products inside and out.

Source: https://www.slideshare.net/Human_WSO/unofficial-g…

@ke18sb" says:

The investment banking division makes the product (the model) and the deck. Equity Capital Markets sells the product to investors (the syndicate).

@darthtony" explains that:

At Citigroup, Capital Markets Structuring & Originiation is one of the major groups within the Corporate and Investment Bank. It has two parts, Equity Capital Market (ECM) and Fixed Income Capital Markets (FICM). ECM bankers work very closely with IBD and play a major role in pricing the securities. FICM is consisted of many product groups such as Global Structured Credit Derivatives, Global Structured Credit Products (US CDOs), Domestic Liabilities Management, Financial Institutions, Asset-backed Finance Group, Global structured Solutions, Corporate Derivatives Solutions Group, and so forth.

@TireKicker" says:

ECM is the Chinese Wall (insofar as equity offerings are concerned--just to use that as an example). ECM is the liaison between the industry group (coverage group) and the sales and trading desk. When you are pitching equity to a client, ECM will often accompany the industry group bankers on the roadshow, and their role is to comment on the state of the markets, how receptive investors will be to the company's story, likely pricing (although 95% of the valuation is done by the industry group), etc.

It is "investment banking," but not in the sense that most people understand IB. ECM isn’t doing valuation work, models, huge pitch books, etc. They may contribute a few generic pages to a larger pitch done by somebody else.

What do people in capital markets do?

User "JustAnotherBanker" explains that:

"Desirable" work includes being constantly aware of the equity markets (if that's your thing), and there is limited pitch work."Undesirable" work includes being called upon frequently to create detailed trading-related reports for sector bankers (e.g. detailed ownership breakdowns and calculations of major shareholders' cost basis).

Capital Markets in the IPO Lifecycle

User "JustAnotherBanker" describes the stage division between the coverage team and the ECM team in an IPO process.

- Source the deal (coverage): Find client. Convince client that an IPO (by your bank) is a good idea. Involves pitchbooks, golf, and booze.

- Take the deal to committee (coverage): Make sure your bank is willing to take the risk (underwriting is risky).

- Negotiate fees (coverage): Set an underwriting/bookrunning fee (~7%). Set the "economics" (the fraction of fees paid to each bank on the deal), haggle over how expenses will be shared, and set provisions such as the Green Shoe (an over-allotment option that helps the underwriter to stabilize the stock price following the IPO).

- Set a target valuation and range (coverage): Come up with a valuation using dcf, benchmarking, and public peers. The client wants a high range, the bank wants a low range.

- Refine roadshow presentation (coverage and ECM): Help management put forth the best possible pitch to institutional investors. Involves re-tooling powerpoint presentations and coaching management.

- Create prospectus (coverage and lawyers): Write up a huge document about the business, its management, its market, the risks involved, and a million other things.

- Due diligence (coverage and lawyers): Make sure the company is legit. Make sure those "factories in Taiwan" actually exist.

- Create internal offering memoranda (coverage or ECM): Turn the information in the prospectus (if there's extra, don't let the SEC find out) into the banking equivalent of Cliff Notes for the sales/salestraders in S&T so that they can stabilize the offering when it finally hits the market (days/weeks later).

- Roadshow (coverage and ECM): Fly around for two weeks with the client, making the same presentation 3 times per day to various institutional investors. Sector bankers prep the client for tough questions and occasionally answer the really ridiculous ones. Sector bankers schmooze the investors and introduce the client. ECM (someone at the VP+ level) provides frequent market updates. ECM "builds the book" -- they take orders from the investors.

- Pricing (ECM): The team in syndicate (a cap markets function) arrives at a final price for the IPO shares based on the order book.

Capital Markets Worklife

@InvestorMA" says:

I know someone in ECM, and he works 6 days a week routinely, often till 12. A really busy week would be 80+ hours. He does no valuation work except in the macro view.

@MonkeyBusiness" explained that:

Supposedly you're supposed to be in by 7AM and accounted for no later than 7:30AM in capital markets so said all my interviewers. Than the higher the rank, the earlier you leave. Usually around 7-8PM on good days. Bad days you can be like the IBD bankers.

Similarly, user "JustAnotherBanker" cited:

Hours are typically shorter than in coverage groups but days usually begin earlier (~8am in ECM vs. ~9-9:30 in sector).

Capital Markets Exit Opporunties

When comparing Investment Banking and Capital Markets, the exit opportunities do not compare. Capital markets backgrounds are not as attractive to the traditional exit opp recruiters (PE, HF).

@rat4100" explains that:

Aside from leveraged finance, stay away from ECM/DCM for the purposes of exit opportunities.”

@1styearBanker" commented saying:

I work at a bulge bracket (BAML, UBS, CS) and I know quite a few capital markets people. In my view, capital markets has 0 exit ops.

Summary

In a detailed response @Monkey_Island" explains:

At its most basic level, the difference between capital markets and "investment banking (coverage)" is this:

- Capital markets is focused on PRODUCT knowledge.

- Investment banking is focused on INDUSTRY knowledge.

In general, it's pretty difficult for any banker to know everything about everything. To make things simpler and to really provide good insight regarding industries and products that most people won't have, investment banks utilize the services of different types of "experts." Some of these "experts" will focus on learning and covering the healthcare or software or whatever industry, while others will focus on learning and covering the convertibles market, the equities market, or the high yield bond market. Thus, just as you have "specialists" for different industries, you have "specialists" for different products.

How this all ties together is a function of individual banks. at some banks, product experts merely contribute pages regarding the market for the product, potential pricing for the product/product comps, and the capital raising process/procedure as it pertains to that product in order to assist the investment banker/relationship manager with execution.

At other banks, the relationship manager will simply hand off the execution process entirely to the DCM/ECM banker since that banker is the "expert" on the process and the product. At the end of the days, all of these people are doctors just as ALL ECM/DCM people are bankers.Any analyst who's ever been to a pitch where different products are being put on the table or where different capital raising ideas are being presented will realize that ECM/DCM is front-office advisory position. You may not being advising on pure M&A, but you are providing advice on financing alternatives since most acquisitions are not financed 100% with cash on hand.

Thus, in case of a product such as loans or bonds, industry guys would work with DCM to structure the appropriate loan/bond package, which would then be parceled off to the trading floor where institutional sales guys would find suitable investors. Traders would then come in to play by managing liquidity on the secondary market on behalf of clients who wanted to either a) get some of their purchased securities off their books or b) buy in or buy more.

Want to ace your investment banking or capital markets interview?

Check out WSO's investment banking interview course for access to 10+ hours of videos, 203+ technical questions and over 127 detailed behavioral questions and answers.

140 hours per week? I didn't know Auschwitz had an investment bank....over the line? Yes I'm sorry, had to throw it out there and yes I am Jewish.

Well obviously IBD analysts VERY RARELY work 140 hours...it's just an extremely high end of the range just like 80 is a low end of the range.

Auschwitz Securities LLC. LOL

80 is def not low end thats average, speaking from my experience as well as my friends

Fuck off Dan, everyone here knows that you're a college kid who's never even seen the inside of an investment bank.

is almost staggering.

at its most basic level, the difference between capital markets and "investment banking" is this:

capital markets is focused on PRODUCT knowledge

investment banking is focused on INDUSTRY knowledge

in general, it's pretty damn difficult for any banker to know everything about everything. thus, to make things simpler and to really provide good insight regarding industries and products that most people won't have, investment banks utilize the services of different types of "experts." some of these "experts" will focus on learning and covering the healthcare or software or whatever industry, while others will focus on learning and covering the convertibles market, the equities market, or the high yield bond market.

thus, just as you have "specialists" for different industries, you have "specialists" for different products.

how this all ties together is a function of individual banks. at some banks, product experts merely contribute pages regarding the market for the product, potential pricing for the product/product comps, and the capital raising process/procedure as pertains to that product in order to assist the invesment banker/relationship manager with execution. at other banks, the relationship manager will simply hand off the execution process entirely to the dcm/ecm guy since that guy is the "expert" on the process and the product.

at the end of the day, this is really no different from how things are set up at consulting firms, accounting firms, or even in medicine. you need people who can manage the relationship (what most industry bankers do) and you need people that know about particular products/services (i.e. what product bankers do).

take medicine for instance--you have a general practioner or family doctor that serves as your "relationship manager" w/ regard to medicine. however, does this family doctor know everything there is to know about medicine? no, he doesn't. thus, should more specialized needs evolve, your family doctor would pull in the approproate specialists--maybe a cardiologist to evaluate heart conditions, an oncologist to evalute/treat cancer, surgeons to perform more technical procedures, etc. however, at the end of the days, all of these people are doctors just as ALL ECM/DCM people are bankers.

the difference as i've mentioned earlier is industry focused banking as opposed to product focused banking.

and by the way, dan bush, you're dead wrong regarding your "jack you off middle office" comment, as you've either a) never been in banking, or b) are a such a low ranked analyst that no senior banker will give you any real responsibility.

any analyst who's ever been to a pitch where different products are being put on the table or where different capital raising ideas are being presented will realize that ecm/dcm is front-office advisory position. you may not being advising on pure m&a, but you are providing advice on financing alternatives.

and before you say something else that's dumb, there's no way you can challenge my credentials on this issue. i've not only been a bb industry analyst, but i've also been a corporate development guy at a top f50. when "industry bankers" come to make pitches regarding acquisitions, guess who come along?

that's right--the ecm/dcm guys. in the dream world of college ib-wannabes, m&a advisory is separate and off its own bubble. however, in the real world, most companies can't finance acquisitions with 100% cash on hand. thus, in order to do an acquisition, someone's got to finance it and with various ways of doing this (loans, bonds, converts, equity, etc.) you need people who know the individual products and product markets to give you the best advice on which product is best for your financing needs.

thus, in case of a product such as loans or bonds, industry guys would work with dcm to structure the appropriate loan/bond package, which would then be parceled off to the trading floor where institutional sales guys would find suitable investors. traders would then come in to play by managing liquidity on the secondary market on behalf of clients who wanted to either a) get some of their purchased securities off their books or b) buy in or buy more.

This is actually a question to which there is no 100% correct answer. Some banks categorize ECM/DCM under the Investment Banking Division, which usually also includes research. Some banks, although I think this is becoming more uncommon, categorize them under Sales and Trading. Some banks even categorize ECM under IBD and DCM under S&T (or FIC, or FICC, or whatever).

The difference really is that ECM and DCM are product groups that are close to the capital markets, and therefore it makes more business sense to put them closer to the S&T groups (physically and/or operationally). M&A is a product group, too, but the nature of their work makes it more logical to organize them closer to the industry coverage teams.

They're all "investment bankers" though, in the sense they are client-facing, do high-profile transactions, and make a lot of money.

ECM/DCM is less modelling intensive, more market-focused and a little "softer" in terms of the skill set. M&A is very modelling intensive and analytical, but a lot of guys in it only know how to model and can't see the forest from the trees. M&A tends to be more competitive to get into, but in reality the standards are not that much different.

As far as skillset required to get into M&A versus ECM/DCM: beyond taking an accounting or corporate finance course, it doesn't matter -- you have no skillset right now, nor does any other college sophomore/junior.