Jefferies Class Size

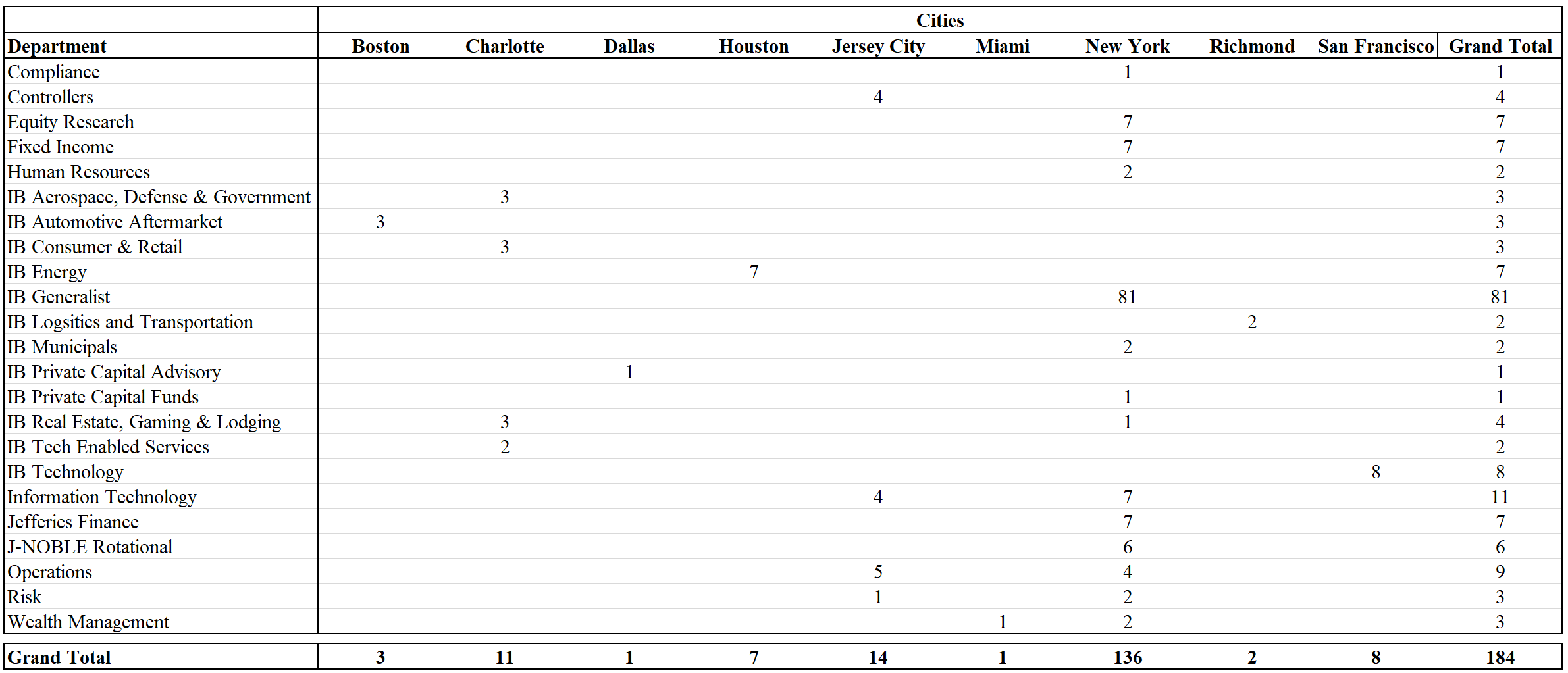

Incoming intern at Jefferies and wanted to just provide the class size, group, and locations as a data point for WSO. Reward with an SB if you enjoyed it. Looks like there is a total of about 117 IB summer analyst + summer associates. 85 of those are in NY (63 summer analysts, 22 summer associates) with SF and Houston taking a lion's share of the rest of them. Gotta admit didn't expect Jefferies to have such a big class size. Anecdotally have heard that SA 2022 is going to be even larger than this.

Looks like there is a total of about 117 IB summer analyst + summer associates. 85 of those are in NY (63 summer analysts, 22 summer associates) with SF and Houston taking a lion's share of the rest of them. Gotta admit didn't expect Jefferies to have such a big class size. Anecdotally have heard that SA 2022 is going to be even larger than this.

Interested in hearing your thoughts.

its the 8th largest bank in the world by revenue and people in this thread are surprised that there are huge analyst classes. go figure LOL

I think it is the 8th largest by revenue in IB but yeah I agree with you completely. I think people just don't realize how fast Jefferies has grown over the past 5 years (even 2 years). They have added a new group in IB (PCA), their usual groups have continued to do extremely well, ECM has boomed from the increase in SPACs and this is being reflected in the league tables, and lev fin is killing it too and they are also building out their RX rather quickly. It's almost like the bank is on steroids or something. I would wager that Jefferies has been the fastest growing bank over the past 5 years (both in terms of headcount as well as financial performance). There's no denying JEF's performance.

The problem is that the reputation takes time to catch up to the actual performance. People still think of Jefferies like what the bank was like in 2013. Give it time and I think Jefferies' reputation will catch on in the next couple of years.

Spot on post. Jefferies outperforms UBS and DB for the past two years, is growing way faster and has better momentum and yet ppl still talk like the latter aren’t even in the same category. JEF is knocking on the door of Barclays and CS too... I think 2021 league tables will surprise a lot of folks

Eh.. i work there. I mean the work/life balance is terrible, but still pretty cool to be working at JEF during this time. We've basically got experience with every single transaction out there (sell side, buy side, IPO, follow-up, debt, SPAC, etc.). Also, just won a sell-side bake-off where we beat out GS, Evercore, BaML, UBS, Guggenheim, and more.

Going to have to disagree with you on a few points.

1) "JFIN actively losing money on revolvers" is a misleading although somewhat true statement. JEF engages in very few investment grade issuances and the DCM team really only does IG bonds and revolvers at low dollar amounts, typically around $500m. JEF IG Finance isn't really a huge part of the business model like it is for debt powerhouse like JPM. The vast majority of what JFIN does is CLO management and buying/being the guarantor for LevFin's extremely leveraged underwritings. This is VERY different than what you described as losing money on revolvers as JFIN does very little of this (at the IG level) and is primarily investing in highly levered leveraged loans off the Mass Mutual balance sheet.

2) "Exact same type of deals at BofA or DB" is also a very inaccurate statement. On average, buy-side and sell-side M&A deals are going to be significantly smaller at Jefferies vs BofA, although this is group depending. ECM work at the two will be similar. Those on the coverage side at JEF will see very, very little work in IG debt vs BofA. On the M&A side you can expect BofA's deals to have more strategics vs JEF as well as larger deal sizes on average. LevFin is probably the closest when comparing the two as they are top competitors along with CS, however Jefferies is going to be doing far less HY-bonds than BofA and far more US sponsor backed leveraged loans at higher ratios. Additionally sponsor deals are going to make up a MUCH higher % of transactions across groups for Jefferies than typical BBs. The biggest point here is that the types of deals that Jefferies does can often be much more complicated or "hairy" compared to other banks as they tend to far supersede traditional leverage levels that most BBs are willing to go (typically >6.5x). This is what the JEF business model is all about and how they win deals from sponsors that say a more conservative levfin team like JPM wont be able to touch per their CC guidelines. Jefferies as a non-bank institution can easily surpass this and it's what has won them deals over the past few years. These levfin deals also create opportunities for the M&A team that can in turn sell the portfolio companies they just LBO'd 5-10 years ago. This is why Jefferies has seen explosive growth over the past few years as sponsors are now starting to exit their investments that were financed by Jefferies LevFin ~2013 when bank lending guidelines got more stringent and non-bank arrangers exploded onto the scene. Look into the 11.0x Revlon deal that was done last year. What other bank is going to do something like that?

3) In terms of the "chip on the shoulder" mentality, I'm not going to say that's entirely inaccurate. I think that attitude will change as Jefferies starts to get more recognition for its place in the industry. Jefferies looks very different today than it did 5-10 years ago and opinions/reputation tend to stick around a little longer than when results are recorded.