US & EMEA League Tables

What do you think about this year's league tables? Any key takeaway that you found during the year?

I was surprised that Citi had such a record year in ECM Globally but was not able to catch the first banks in M&A with those relationships

Also surprised that HSBC did that well in Europe, maybe their BS helped them to capture these deals?

Whats going on with Lazard? Weren't they top-notch in the past and used to be well ranked?

They are top-notch in the present too...rankings don't mean shit unless its by headcount.

Cool thread

Impressive number of deals for Roths as usual in EU

They're always #1 for deal flow, I think they're far too discredited on this site in terms of the learning opps that Analysts can get. Probably because of the US bias.

They also actually get on quite a few interesting but smaller deals like Ferrero buying Fox's Biscuits.

I totally agree with you, yeah

But still I find it quite impressive that they have been able to keep their numbers high even after covid

Does high # of deals mean better learning experience through reps even though most people seem to think of a lower # of deals but higher dollar value deals being more impressive particularly for exit ops? Also Roths has a fairly high deal count relative to its total deal volume in the US as well right?

Is Jefferies usually in the top 10 for M&A? I thought they were known more for their LevFin given their ability to work on deals that the bigger banks couldn’t work on.

You can also get m&a table credit for financing depending on relationship with sponsor

jefferies m&a has always been strong, but has particularly been reaping the benefits of all the sponsor financings levfin did really getting going around 2015. now those PE funds are looking to exit those investments, and the JEF m&a team will come back around 5-7 years later and sell them which is what we are seeing now.

Confused on how BofA beat out JPM. Thoughts on this?

They have been in most mega deals, that could be the reason but not sure

Looks like JPM underperformed this year, look at volume YoY is massively down. May definitely be a one off, but bare in mind that BofA is also or was also aggressively hiring in 2019.

And whats your opinion in Europe, it seems that that MS is catching JP lately (and even more if headcount adjusted) and that BofA is distancing even more from Citi / CS

Take a look at past and current league tables, MS > JPM in terms of M&A in both US and EMEA (exception for EMEA this year)

While certainly a bit of a surprise, not sure whether BofA being ahead of JPM is such an anomaly in the Americas. They definitely have the platform to catch up to the current top 3. In general, it seems obvious that they are distancing themselves from the other BBs and are likely to occasionally show up in the top 3 globally in the next couple of years. Something that is not fully clear to me yet, however, is in which sectors they really aim to claim leadership; it seems to be the case that they are pretty much #3-5 in every sector but not necessarily leading anywhere. The most momentum seems to be in Technology at the moment but it seems very unlikely for them to seriously outcompete GS/MS in this space.

Citi is clearly failing to fully sustain the initial growth they had in 17-19 and missed out on many, many megadeals in 2020. Something that shouldn't happen with this balance sheet but maybe Covid-19 proved particularly difficult for their platform. On the other hand, CS really stepped up and proved that their new leadership might be working.

Not sure what the search query was for those league tables, but here's what Factset shows when I search for mergers/acquisitions; announced in 2020 not including cancelled deals, rumors, or rumor cancelled; and target location in U.S.

Crazy how wide the gap is between the top 4 BBs and the rest.

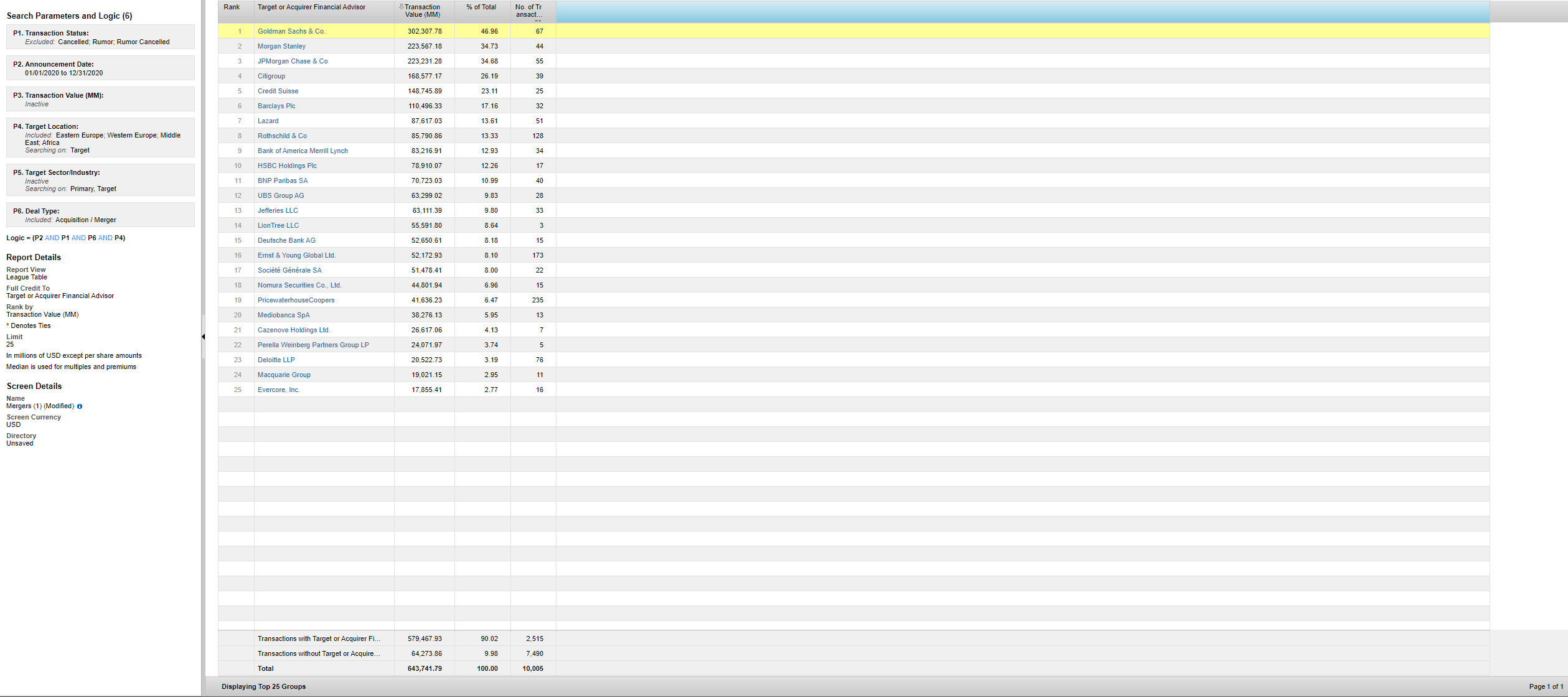

Here's what EMEA looks like

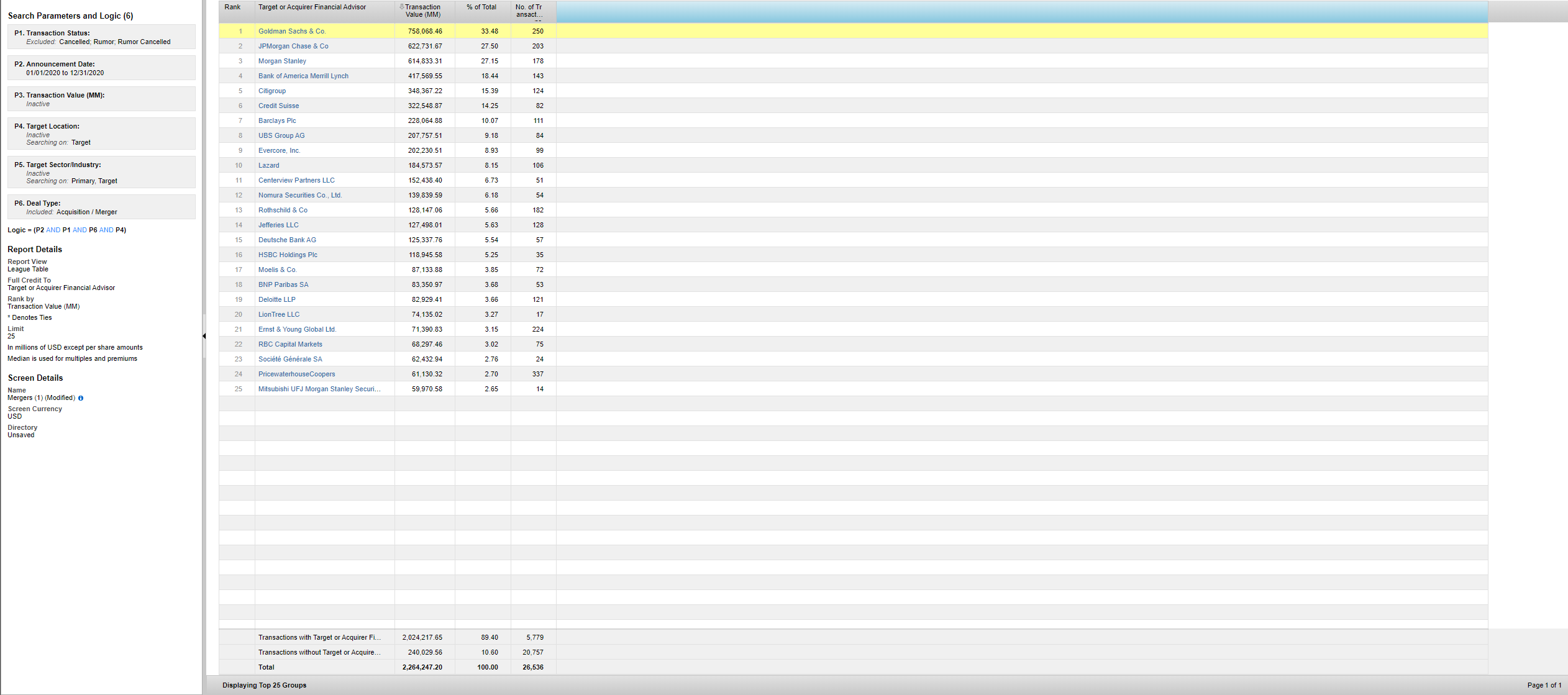

And here's what global looks like

LionTree true No.1 TMT shop

This is dealogic, same conditions as those stated by yourself

Just by watching Europe you can see that your league tables are pretty off, far off, so would assume the same applies to US & Global

dealogic messes around with the criteria too frequently and factset is off, too. Find below a more accurate table, from bloomberg. 1) GS, 2) MS, 3) JPM based on the deals I saw. BofA definitely isn't above JPM and JPM definitely isn't above GS and MS.

Dates : Custom(January 1 2020, December 31 2020) Apply to - announced date

Deal Status : Pending, Completed

Country : Include : United States, Apply to Target

Why are people giving him MS????

Dolorum magnam et similique ea molestiae corporis et. Eligendi rem nulla deserunt omnis aut voluptates. Libero qui amet quia facilis. Deserunt cupiditate eos cupiditate temporibus quia.

Harum delectus ex aliquam ab. Consequatur fugiat ea perferendis quo tempore iure quas quod.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Eaque dicta sit suscipit necessitatibus optio eligendi quidem suscipit. Et aut excepturi et id.

Animi minima earum eum libero veniam ipsam dicta. Autem aut at earum. Ea dicta quasi illum eligendi suscipit corporis.