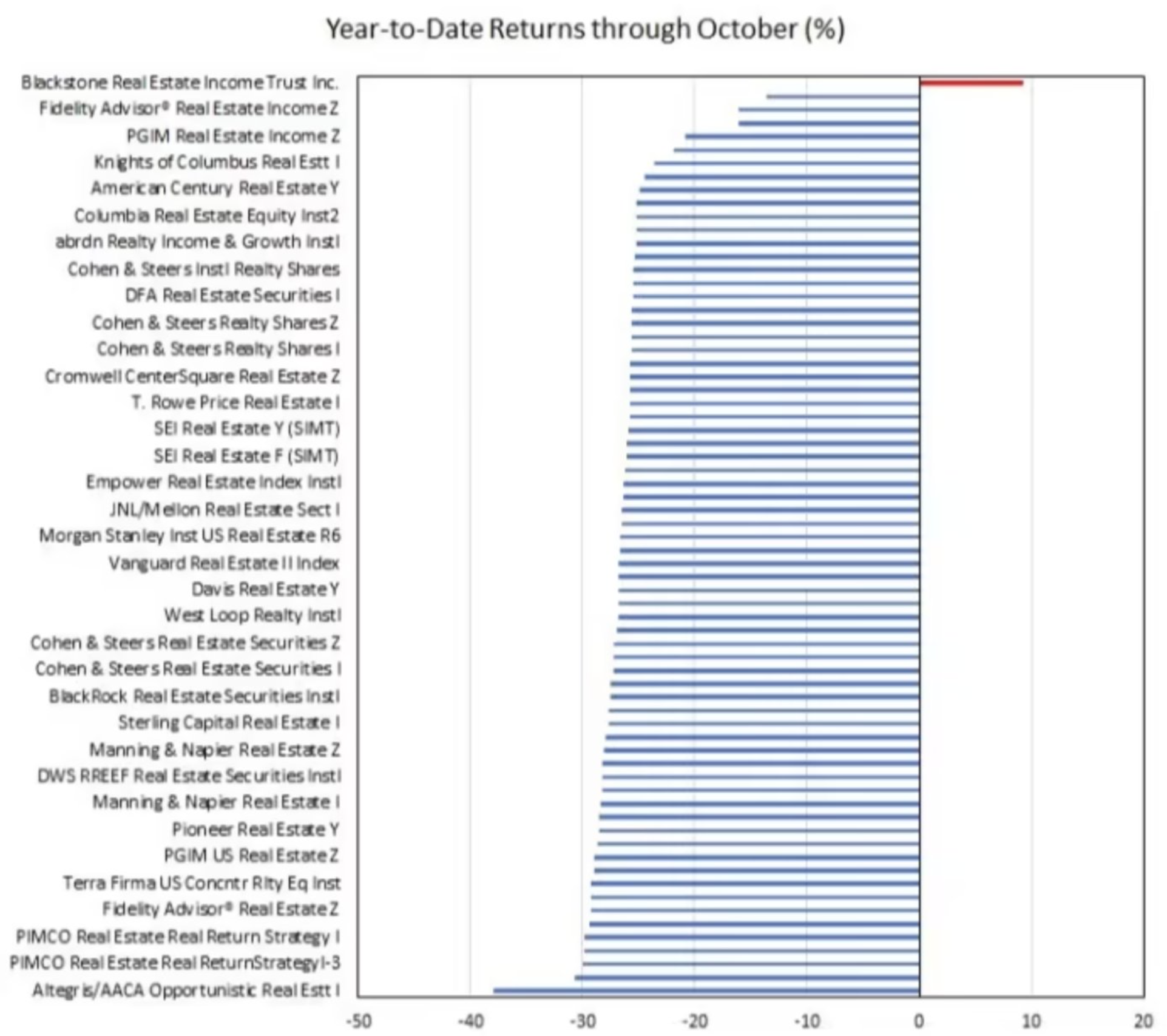

I think Blackstone's Fibbing- Private Real Estate

So, this is very far from my field of expertise, and Cliff accuses all PE of "vol-washing" but something stinks to high ell here. How are they valuing tis illiquid junk? They've already suspended redemptions, and the co got it's debt downgraded.

Eli5 "Vol-washing"?

Cliff Asness's phrase, not mine.

I deal with equities. Everything I do is valued daily. If Japan's closed for golden week I've still got to guess what the security is worth. (there are rules and exchange rate stuff. It makes tracking a global index a giant pain, but that's a different thread)

Private equity, and especially real estate isn't like that. What's your parents home worth? My parents bought theirs in 1981 for 79,000. I guess it's roughly 3/4 million from comps. Bundle those things up in a fund. estimate the price monthly. does the price of the house change? prolly not. It's an illiquid market. If you make up prices monthly and nobody has to hold you to it you can massively smooth the price changes, AKA "volatility washing." It's still there, but it's tough to quantify, so you don't see it.

Its not just Blackstone. Institutional real estate PE valuations inherently lag the overall economy due to the illiquidity of the asset class and the subjectivity on how to value a property even on a monthly basis. If there are no comps, how do you establish a cap rate everyone agrees upon? What about interest rates? Cap rates should in theory be correlated to interest rates but thats not always the case. Also, major institutions use 3rd party appraisers/valuers for their valuations. That should help right? Wrong. They don’t know the asset like the AM team who manages it and are always seeking direction on how to value it from the AM team. The AM Teams job in this instance then would be to not diminish the assets value to quickly in the wake of volatility and market change, and then in turn the appraisals come in higher than what they really should be. But at the end of the day, real estate just succumbs to the fact that with illiquid assets its valuation can be whatever people want it to be.

Still looks like they got caught with their pants down. I don't deny that it's difficult to value (hence 'vol-washing') but if they're not down and resume redemptions the remaining investors may be left holding utter shit. It's a classic run scenario.

Insane how quickly BREIT grew and deployed all the capital during peak pricing 👀

Are you asking how real estate gets valued? That seems like it's at the heart of your question, even if it kind of sounds like you just wanted to use the term "vol washing" to show off how much technical jargon you know.

I was not gonna make this a contest, but we can if you want. RE guy looks butthurt.

And Cliff initially asked the question on Twitter, I was just bringing it over here for us.

It's not a contest. I'm unclear what your question is, and I'm asking you. If you weren't actually asking a question, then I assumed you just wanted to use the term "vol washing" despite it's lack of meaning in this context.

The guy wasnt necessarily asking how RE gets valued, more like asking how BREIT and other funds justify their shit. Anyone with half a brain knows what vol-washing is, it's literally the bread and butter of PE returns smoothing that sets them apart from other asset classes and its why some critics say they're a scam

But he answered the question of how REITs justify their valuations - real estate is a really illiquid asset and doesn't require marking to market on a daily basis or anything like that.

The underlying value of the asset is tied to it's net operating income, generally. If the assets for Blackstone are still performing the way they did a year ago, why mark them at all? They'll update the valuation on a capital event. Complaining about "volatility washing" in an asset class which doesn't require marking, and which shouldn't, because it's a stupid way to value real estate, is missing the point. There isn't an open and active market for a lot of these assets, and it's tough to make blanket statements about cap rates anyway. The Chrysler Building is going to trade for a vastly higher price than a similar office building because it's an iconic part of the NYC skyline, for example. How do you assign a value to that?

damn, I'm catching strays from the intern in equity research

Cliff Asness? The dude whose funds have been eating dust for the past 5 years (here for returns), he's been barking at PE for not having "adequate marks" on twitter for the past year while also saying the market is not efficient. Pure intellectual masturbation if you ask me.

I disagree (Rob Arnott And the Immaculate Rebal would be a good counter) but you actually have a good point. He'll be laughing all the way to the Hamtons tho while we speculate.

+1 SB from me

Modi eum nesciunt mollitia eos commodi quia ut. Sequi vel expedita in error quis. Voluptatem modi aliquid et est. Autem nam minus omnis.

Iste quisquam consequuntur quia quia fuga eos. Possimus soluta ex sed delectus aspernatur et sed.

Eius illum sed molestiae qui tempora aut illo. Iusto dolores qui quia nisi. Reiciendis velit blanditiis et dolorem iste. Ut voluptas aliquam sed placeat commodi.

Voluptatem laudantium voluptas odit recusandae. Nemo qui qui placeat qui et corporis tempore quae. Neque fugit ipsum omnis atque. Consequuntur sapiente velit quo ullam. Est totam praesentium odit ex nostrum molestiae.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...