Roast My Resume

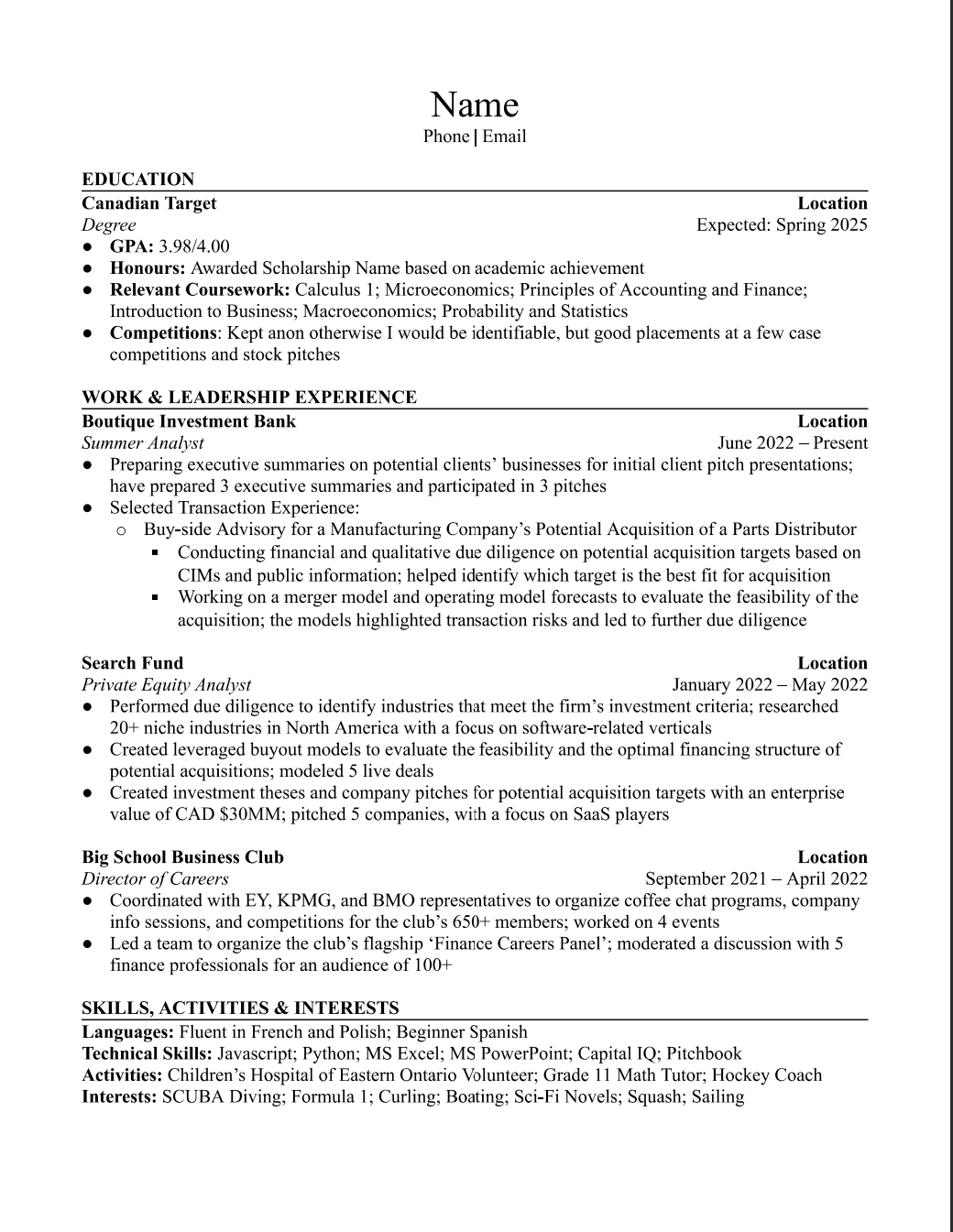

Hi everyone, I am getting ready to start second-year recruiting, and I was looking for feedback on my resume.

I was not sure if it was ok to mix project-centric bullet points and task-centric (like I did in my Boutique experience vs other ones).

Also, for my search fund experience, I say that I created LBO models, basically I just plugged numbers into our fund's template. Do you think I will get drilled on LBOs if I don't change the wording (I will be applying to IB positions, for context).

Thanks in advance!

Hi Intern in IB-M&A, whoops, looks like nobody chimed in here.... maybe one of these discussions below is relevant:

More suggestions...

If those topics were completely useless, don't blame me, blame my programmers...

Heyyyooo. So honestly, the bones (data) on it isn’t bad. It’s more cosmetic work / strengthening bullets and making it more eye catching. Happy to help, feel free to shoot me a DM. Work at a good IB so I know what they look for on resumes / what they pass on

Hey, can I pm you as well, Wolf? Could always use resume advice. Thanks.

By all means go right ahead dude, def don’t mind.

By all means go right ahead dude, def don’t mind.

By all means go right ahead dude, def don’t mind.

1) Take out relevant coursework

2) Try separating "Work Experiences" and "Leadership"

3) Goal is to have more black on resume than white

4) Strengthen bullet points by using basic cause and effect format (What did you do, and what was the effect of that cause)

5) Try to get more involved in school...from my experiences, yes work experience is great, but showcasing involvement within internal school clubs, movements is also great!

Nemo aliquam quo sed eligendi. Quis qui incidunt fuga vero. Aliquam voluptas tempora corrupti aliquam sed. Necessitatibus aliquid numquam incidunt consequatur. Cumque nemo magni autem repellat.

Ut quos praesentium ipsam minima. Quos atque voluptas molestias animi. Nulla beatae sapiente nam velit ex. Quam eveniet voluptatem qui nostrum.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...