Bonus Spending Szn

Sup

Now that the threads on bonuses have started and are being populated with 90% useless info and no numbers, thought I'd see what people are doing with theirs this year. Saving? Probably smart. That's the route I'm taking this year. Spending? Less smart but probably more fun. What are you buying? Maybe that new Rolex you've been eyeing, the new consoles, workout equipment, whatever. Would love to hear your bonus plans.

I'm boring and am knocking out student loans + a pelly given it's first year out of school.

Guy I work with who just got the VP-> director promote used his as a down payment on a house in Quogue - I thought that was dope. Seems like every director-promote buys the future country house and keeps the pied-a-terre as a matter of course.

Now that is fucking cool. That's what Saul Steinberg would do.

Quogue is cool and all but it really is like all old people and kids. Source: worked there for a summer. Saw the mannings at the quogue beach club which was kinda cool.

I’ve got about 17k left and am choosing to pay it down slowly - my personal hedge in case Biden decides to forgive loans. Preciate all y’all financing my degree.

I usually invest everything but 10k, which I spend on vacations and stuff. I'm not really worried about my job prospects going forward, and I will stay in banking for the long-tern, but I do think it's wise to put away most of your bonus for the sake of compounding returns.

Yeah this is perfect. 10K fund to fuck around and do whatever with gives you enough to satiate any needs while the rest grows

I got a bonus of 8% of my peasant salary. I'm saving it to start a business or lose it all on options trading.

What type of business do you want to start?

None. I chose to lose it all on options

PS5 + Rose Bowl tickets + new laptop + gifts for family and SO + some random clothes. The other 90% or so gets invested

This is the kind of bonus that I need.

Does this seem kind of low? Maybe I'm calculating this wrong, but isn't total cost around $500 (PS5) + $1000 (Rose Bowl Ticket x 2 + few hundred for lodging) + $2000 (new laptop) + ~$2000 for gifts and clothes = ~$5,500, making his total bonus only $55,000? That's low for a buyout fund bonus at the ASO2 level, right? I probably was very conservative with my pricing though.

Question for you guys spending your bonuses - did you already spend your entire base salary as well?

The way I think about it, I haven’t touched my bonus until I spend the entirety of my base salary. Given my low spending during Covid, I’ve probably got $10k of after-tax base salary savings to go.

So my answer is... yeah I’m gonna splurge on some new clothes but I won’t really be spending my bonus.

I spent a lot of it but saved a bit more than I thought I would due to COVID. Not a huge increase but nice nonetheless.

It’s really left pocket vs right pocket... sure, I save a portion of my base as well, so whether you want to view any expenditures as coming out of that pile or out of the new inflows is just your mindset. The money’s fungible so it doesn’t really make a difference

Fair enough. To me it’s interesting to see others spending habits. If someone spends their entire base (excluding 401k) and then drops $10k on a watch as a first year analyst - that’s very interesting to me.

Just seeing how comfortable others are spending on luxury goods. I know someone who spent his entire $175k base and a good chunk of his bonus as a single guy in his twenties. Know another guy who lives on 50k per year despite making close to $200k. I feel like many on WSO edge towards the first example rather than the second. Nothing wrong with either lifestyle

First stub (25k pre tax and probably 17.5 post). Spending 5-6k on a speedmaster rest is saved. I’ve honestly saved 90% of my post tax income so far ($30k) so not really worried about spending too much

Student loans and a Zenith El-Primero Heritage 146.

PATEK PHILIPPE

Grand Complications Split-Seconds Chronograph Perpetual Calendar

REF 5204/1R-001 | SKU#4080818

$229,950

Man that's harsh posting that on an analyst's question haha. But that's beautiful. Have actually become very very fond of the Nautilus recently as I used to hate the look

I like very much!

Apparently supporting the world’s most inefficient government. Fucking ~53% taxes fuck me man

Fuck

Damn bro, I'm in the mid 40's and I thought I had it bad... RIP

F

Welcome to Canada! 53% marginal rate starting at 200k

Sweden is even more fun - 55% marginal tax starting at $80k!

and 45% average tax rate

have you tried living in puerto rico

Tax will only get higher

Probably a new watch, gift for the parents, a trip and rest in investments.

I really want to retire by 40. This is not a sustainable lifestyle

Probably going to save for a down payment. Otherwise was thinking about a standing desk but FSA can cover that.

Bet it all that GME hits it out of the park. Been a big fan of Chewy for years and Ryan Cohen getting involved gives me confidence in the rest of the pivot thesis.

Where do you think it could go?

This video about sums up my feelings

Taking a quick LA trip to cop a few zips of gas, hopefully i don't get killed by a homeless guy. Wish me luck.

Best of luck mr. pageviews

Cartier watch for the wife’s 35th, saving the rest

New laptop/phone

Some gifts for loved ones

New dress shirts/dress shoes

Saving the rest

Lenovo X1 Carbon, Gen 8

$10K to savings, $15K to student loans, $7K to CC debt, $20K into investment account. Maybe $10K on Rolex...

Is your credit card debt fully paid off now?

Why did you have so much credit card debt

Don’t but a Rolex until you paid off all student debt.. that should be the #1 goal

Yeah this is an important question lo. Can't be living w that much CC debt (much less any amount of CC debt). Focus on better money management rather than waiting for the bonus to pay off your balance. Have a friend who did this habitually till he was a 3rd yr associate, though his balance was like 20K, and it fucked him for years. Terrible move

There is a very, very long line for just about any Rolex under $10k. Start getting on some waiting lists now.

I was just offered a black sub from my AD have 2 days to let him know but I don’t really want it and don’t want to sell it / ruin relationship. Things pop up

I buy from a dope up and coming artist and own a race horse. Hope the bonus is good because the horse is pretty slow

Paying off my mom's house

hell yea

Love it

My bank cancelled all analyst bonuses, so fuck me to tears

holy shit what bank

Toronto based bank, Scotia cut their first year analyst bonuses. The worst part is that my base is $40,000 CAD....

No way .. where?

55k after tax into student loan debt. Did it the morning it hit my account so it felt like I never got it lmao

200k on cryptos, 25k gold/ silver, 25k cash

Hedging against something? Or just a fan of crypto? Been skeptical of crypto for awhile, not as much now, but afraid buying in now would just be a FOMO move

Jeez. Thank goodness didn't get my bonus yet - would have been FCKD in the AyeAye !!

Would it be dumb to buy a used Ferrari or a Lamborghini? I probably won’t, but it is tempting...

More dumb more fun

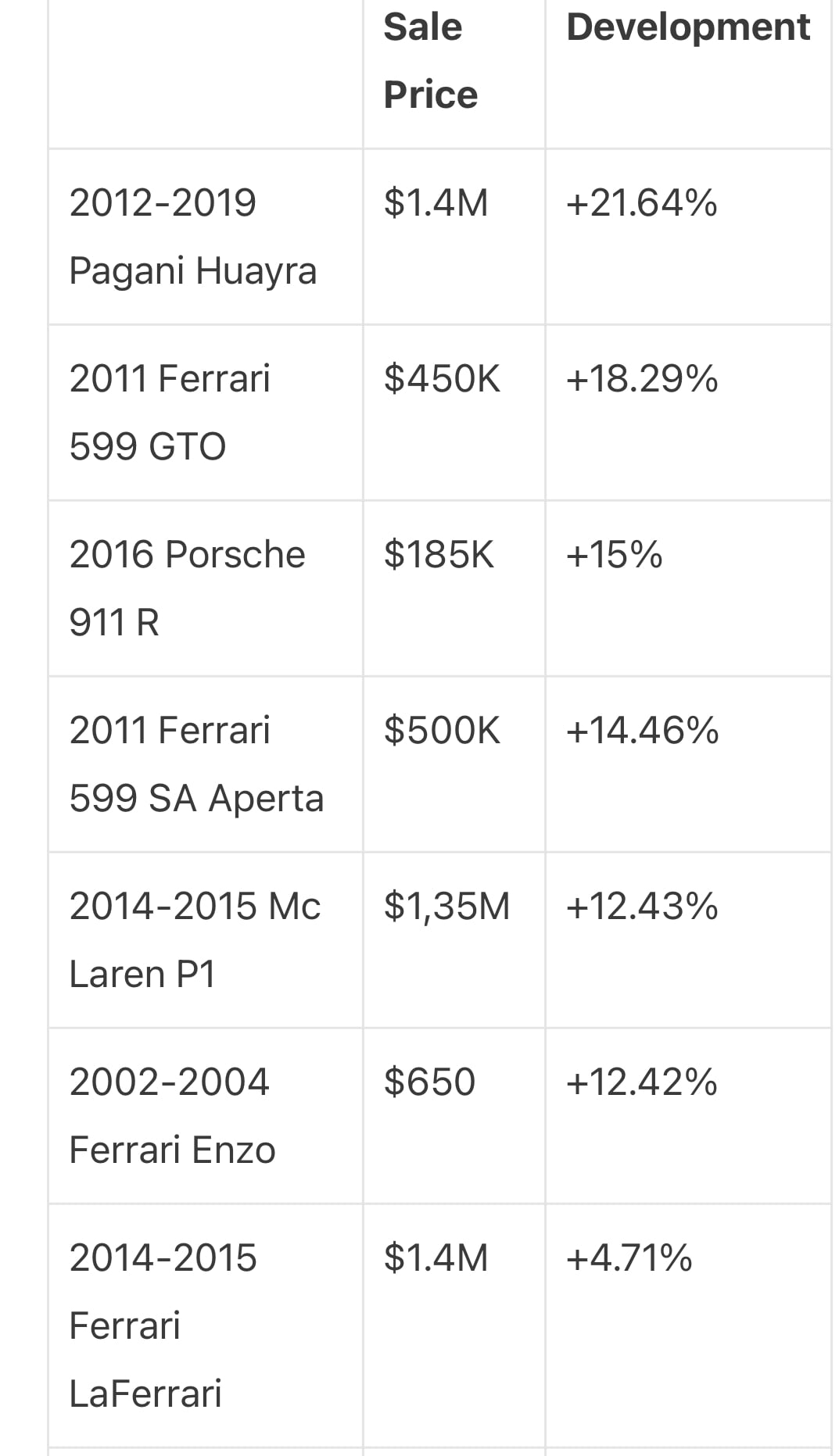

I don’t think it would be the worst thing in the world. There has been some price appreciation among some models as listed below. You’ll have to pay for maintenance and expensive oil changes, but you could probably sell it for near what you paid for it if you do it correctly.

those are a little above the price i'd be in for.

i'm looking for something in the 80-150k range.

something cool that won't depreciate much and serve as a 2nd or 3rd car.

I’m a big fan of the older Lamborghini Murcielago - this one looks sick

$150K, 72.7K mi

https://www.autotrader.com/cars-for-sale/vehicledetails.xhtml?listingId…

The old Murci is def one of the best. Wish they would bring it back.

I usually try to buy something nice for myself and the Mrs at bonus time - a few k each for something nice. The other few hundred k goes into the brokerage account, plus to pay for the 10-20k that my base salary would leave me short paying for nanny / mortgage / cars / vacations etc.

I spent my entire bonus on TSLA puts... calling a top is stupid, yes, but like fifty says: "get rich or die tryin"

Up +10% since this post, RIP

I sized my short materially yesterday (up to $75k exposure). Down 30% on initial amount since I've entered my position. Stay tuned.

20k to student loans, 6k to savings (I’m retarded for not having an emergency fund), rest going to ETFs and car loan

Seriously considering putting it all in cryptos.

$10k to the new country club in joining but that’s about it

I auto dump my bonus into my 401k and that has helped me max out contributions every year for a while now. I already save a good portion of my base into a brokerage account so whatever is left from my bonus I'll just keep as "slush funds" to cover anything else throughout the year. Already have a Rolex Daytona, already have 0 cc debt, never had student debt, so the bonus money is just a nice extra.

Lasik eye surgery.

Touring ski kit. Lines on lines on lines.

Which skis/bindings you going with?

where do you ski? east/west?

CC debt and vacations. Working on putting together a Park City trip as we speak.

May want to pick another spot. PC has been bone dry this season.

How are there multiple mentions of credit card debt? I thought people in finance were supposed to have money and understand basic personal finance principles

Curious too. Never had CC debt that couldn’t be paid off with the next pay stub. WTF are you guys buying?

Haha most people in finance are not well-versed in personal finance I've seen over the years

Not sure if this applies to any of the other posters but hope it does, but a few months ago I put some new furniture on a new card with a 12-month 0% interest period that I’m throwing some bonus at to pay down. Wouldn’t have done it if I couldn’t have paid it all off whenever I decided but didn’t mind floating it for a few months given no interest. Paying any CC interest seems nuts and I’d rather sell investments to pay it off than pay interest given the rates.

Getting a boob job and banking the rest.

what I'm planning to do with my SA earnings at the end of the summer. Good luck on the new titties!

You male or female?

Haha, female. TBD on what excuse I give my colleagues for being unavailable when it happens..

Do a leg job instead

Got 80% off trip to the Maldives. Taking the S/o for a week to roll around naked in the sand and drink for a week during A2A sabbatical

Do you like how they feel once you have em on? Theyre too light for me, which was a big turn off when I looked at these. I kinda wanna know I'm wearing a watch, you know?

Good point. I tried it on again yesterday and had a similar feeling. I tried the grey dial which is maybe why I didnt loveee it. The pink dial is just so freaking nice in person that I can look past the lightness. Plus I actually really like how the titanium is darker than steel.

60% towards house deposit, 20% personal spending, 10% topping up emergency fund, 10% investing (first year credit card debt and student loan free!)

Assistant to the vice president*

Perspiciatis dolores quidem itaque dolorem. Repudiandae suscipit omnis delectus sit dolorem. Perferendis ut rerum quis totam voluptates. Libero tempore rerum repellat quibusdam. Fugit libero deleniti non.

Earum eius impedit deserunt ex dolore dolores. Sequi non eius facilis omnis et perspiciatis ut. Molestias sed quisquam rem repudiandae aut natus ullam.

Magnam inventore unde explicabo deleniti quas. Consequatur quia non praesentium dolores non voluptatem et. Eveniet sed magnam asperiores quia et natus accusantium.

Minima qui numquam est ipsum fuga eos. Vitae ut iure voluptatem ea a corporis et et. Ipsum dolores nihil cumque consequatur doloribus at commodi. Quia alias qui qui blanditiis. Libero error animi voluptatum dolorem incidunt atque.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Ipsum cum et reiciendis ea veritatis quisquam quia aut. Sunt quia ut aut fuga. Accusamus possimus dolor ipsum iure.

Quis cumque aut cumque ea. Doloremque rem delectus voluptas corporis incidunt quo. Omnis incidunt nobis quisquam nostrum tempora sunt.

Similique quibusdam iure dicta nobis. Est voluptatem adipisci minima voluptate. Iusto minima tempore occaecati molestias. Ipsam quae autem cum exercitationem.

Explicabo ratione sint ducimus ea ducimus aliquam iusto. Repellat doloremque ut dolores nam est quia. Nesciunt est dicta quis sit quam. Ipsam tempore commodi eveniet sed occaecati.

Omnis libero est et exercitationem delectus. Voluptas omnis aspernatur maxime distinctio dignissimos. Reprehenderit quia neque et voluptatum corporis. Qui quia eum quaerat porro id debitis esse.

Qui aliquam veritatis quam ipsam deleniti laborum. Ipsa dicta similique sed velit veritatis dolorum. Non nostrum maxime qui. Et velit dolores placeat vero.

Aut eveniet sapiente eos quam quas consequatur consequuntur. Ea molestias aut aut non ex eos. In ea pariatur quia cum molestiae. Modi asperiores commodi autem exercitationem ut. Non enim officiis quia magnam cum. Vel ipsa autem totam molestiae voluptas animi eos.

Officiis eligendi placeat qui beatae inventore et quos. Voluptates illo fugiat eveniet sit distinctio incidunt. Velit pariatur neque voluptas nam. Tempora architecto voluptate non accusamus. Dolore delectus quis enim qui iusto unde est.