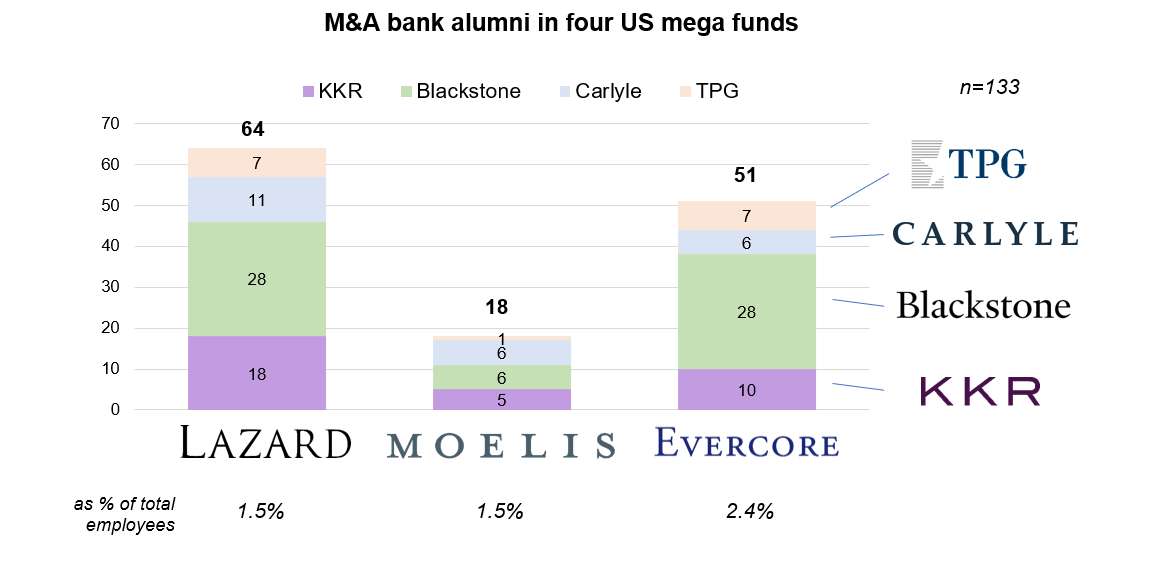

Exit Opps: Lazard vs. Moelis vs. Evercore

I've decided to do a series of posts analyzing the various exit opportunities in banks, consultancies and PE shops. For this week I chose three EBs (given that they are often compared to each other and are roughly the same size in terms of headcount) and tried to find out how many of their grads end up in the big four PE mega funds. Below are the results.

Let me know in the comments what combo of firms or banks to do next week! [Background: Over the winter lockdown I coded a software tool that allows to crunch LinkedIn data like a boss. Originally, I meant it to be a company management due diligence tool for investors, but later I realised that its a lot more fun to use on large organizations like banks or PE funds.]

[Background: Over the winter lockdown I coded a software tool that allows to crunch LinkedIn data like a boss. Originally, I meant it to be a company management due diligence tool for investors, but later I realised that its a lot more fun to use on large organizations like banks or PE funds.]

Links to raw data: Lazard, Moelis, Evercore. Go to "Timeline", click on "Past Employees", click "Show other jobs" to see where people end up after leaving.

very helpful, thanks!

do you think you could one for RX specifically? It would be interesting to see how PJT does compared to EVR/HL

sounds good - I will take a look.

Hi any updated insights on this?

Hi is this comparison between RX ready yet?

Bump on this!

Can you explain the “as % of total employees” part? Does that mean percent of total Lazard employees that go to megafunds? Or percent of total megafund employees that come from Lazard?

It is the former of the two. The analyst class sizes are different at each bank, hence Moelis is being penalised on that chart because there are less of them to start with. As a quick fix I divided the total number of Moelis alumni by total size of the bank (as a proxy for analyst class size).

If you’re using total employees for Lazard and Evercore, then you should actually pro forma for their respective AM and ER arms. They’ll each increase the employee count, but they’re not in any contention for MF PE roles.

Nice would love to see this as a recurring theme every year and an actual part of WSO statisticsLook forward to seeing a list of everu big bank or EB to be honest, against the 8-10 funds bigger or more popular funds, though I know that might be annoying for you.

This is awesome thanks for doing it

Incredibly helpful, thanks! Is there any way you could take a look specifically at MS to these firms, alongside Warburg/Silver Lake, etc?

Interesting! Anyone have any thoughts on the apparent Moelis underperformance here? [hopefully incoming FT trying not to feel bad about this graph]

I would imagine coming from a place like Moelis, you might not be going for MF PE.

And what would you be going for?

A life

I was actually just looking into that - small sample size but still gives you a sense.. mostly MM PE

you can see the raw data here: https://listalpha-dev.herokuapp.com/share/dHY6RIprEDZZkPlU96IUujp6

Moelis is smaller, similar % going to MF as others two if you look below the bars.

Former FT Moelis analyst here. First and foremost, the big 4 included at the top does not include Apollo which may be bigger than TPG but idk. Of all the MF PE, Apollo may be the most Moelis heavy of them from what I saw given the Drexel/Milken heritage of founders and amount of business they do together still. Ditto with Oaktree. When I was there I think my year and year below each sent 2 to APO PE my year had another 2 to OAK I believe. BX, Carlyle, KKR, TPG were all represented as well. For the most part, in my nyc class of 30, I don’t think most wanted to go to a MF. Especially given the working hours we had, people generally sought exit ops with better WLB. The majority did seem to go to PE but opted for maybe MM with better WLb and still great pay (one even went to a MF spin out I believe). A fair amount did Corp Dev or start up type stuff at like hot tech companies. A fair bit went to HFs or like Distressed Debt PE type stuff. Maybe a few did private credit. Kinda a fair bit around. Some stayed in banking to some extent. I think the exits depend more on the individual person. I was fairly interested in exploring MF PE and felt that all the Headhunters were more than happy to put me in front of their clients for that which was nice. Moelis is a respected name for sure. I even got interviews with people who personally knew Ken and just liked him so they interviewed me….

These EB/BB banks are all great and it’s kinda like once you go to a “target” school it doesn’t make too much of a difference. You find plenty of people from all schools (though especially target schools) at all major banks and you prob find people from all major banks (and the like) at all the major PE firms from my experience

good luck in your new job. I’m happy to connect over DM or whatever if I can be helpful for you for your Moelis gig. Glad to have another person join the crew… :)

edit: for what it is worth, I do remember overhearing at least at first or early on in my time at Moelis that some of the people who went to traditional non-target schools maybe felt some discrimination at first because of where they went to school in terms of being able to get the exit ops they wanted. Not too long after even that one person that comes to mind ended up getting a great job and has moved around a fair bit since to some top-notch opportunities. It was prob just at first he felt the “non-target” label stick to him from what I understood and then overtime where he went to college became much more of an asset rather than a “chip on his shoulder” in others’ eyes maybe. Just trying to maybe give some other experience here as my experience is only mine and I was able to go to a target school which may have had impact on my observations above

Yep, solid pipeline to Apollo, Centerbridge, Oaktree due to generalist program with RX.

agree solid APO, centerbridge, oaktree pipeline at moelis (I also worked there and will say this was a odd post), but ultimately a lot of moelis analalysts dont exit that well..

Would it be possible to do this for the M&A groups across the BBs? Think that would be very interesting/helpful as well

Very interesting, please do more!

Very interesting, please do more!

Are you the one that made the website? I just remember seeing the maker post a week or two ago. Anyhow, awesome graphic

yeah I started coding it on weekends during corona... and i cant stop lol

Nice man - it's really awesome. How do you make the graphics though? Are you just pulling the raw numbers into a PowerPoint?

Can you do BBs as well?

This is brilliant. Incredibly useful. Would be interesting to see BAML vs Citi vs Barclays vs CS

BAML and CS probably would have the most MF

Second seeing the comparison between these four

This is the type of material we need.

Thank u and virtual hugs

would you be able to do banks like credit suisse, Citi, and Barclays? Big thanks!!

If possible could you do border-line EB's that don't exactly fit into a BB/EB/MM? Such as Guggenheim, Rothschild, Jefferies, maybe Greenhill and any others I'm missing. Thanks!

Centerview?

I think some younger prospects on here would be interested in seeing one of these, except for Universities. Show how they feed to IB/PE analyst programs.

Agreed

I feel like thats dumb. You can break in anywhere from anywhere its up to the individual. Assuming you are already in college anyways, just focus on improving your candidacy rather than focus on what is less in your control

Had an internship last year at Lazard, got to meet and network with all the larger funds

In ut dignissimos non qui quidem qui. Praesentium possimus voluptas sit commodi.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Blanditiis natus sed accusantium soluta quis quia. Sunt ut nihil dolore ratione. Libero officia sit explicabo fuga at distinctio. Vel qui dolorum praesentium perferendis quo officia occaecati.

Est aut eaque sit officiis optio quasi quaerat. Possimus eum enim vel autem. Temporibus unde est facilis velit. Praesentium nulla placeat modi quod.

Ullam incidunt et voluptatem enim excepturi. Aut et laudantium accusamus quia. Et consequatur sequi ea magnam. Molestiae ut perspiciatis recusandae adipisci. Possimus magni quae unde.