Introducing WSO Alpha

Dearest WSO primates, we're super excited to announce the launch of WSO Alpha!

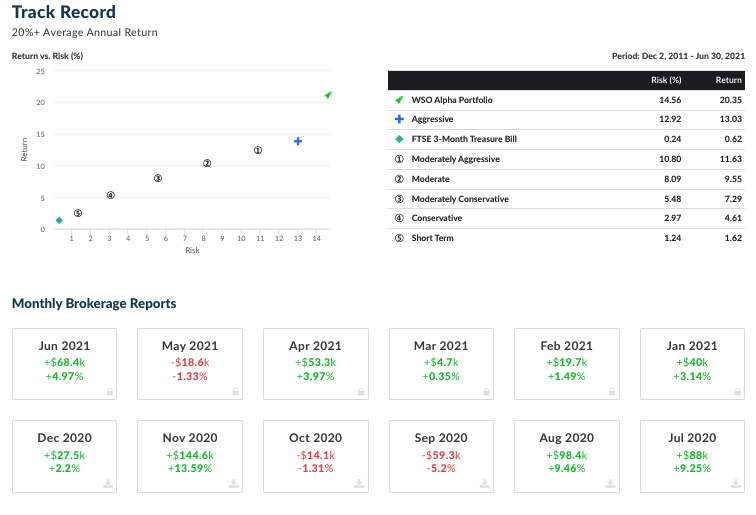

With WSO Alpha you will have access to 30+ holdings in an actual 401k account (held by our lead investor). Get trade alerts and research from an actual portfolio with real capital at stake. Additionally, there are over 100 monthly brokerage statements included, dating back to December 2011 (as proof) when it started.

Here’s just some of what you’ll get with WSO Alpha:

Exclusive Trade Alerts - 100% Transparency

Most other investing services share a "mock" portfolio. We share a REAL portfolio, with real dollars at stake with a proven track record over the past decade. Not only are we sending you exclusive trade alerts from our team, but we also share monthly brokerage statements with WSO Alpha members to prove that we are putting our money where our mouth is... stop following "gurus" on social media that are only pushing risky assets. Risk adjusted returns matter.

Deep Dive Premium Research (Insane Value)

90%+ of the research in WSO Alpha come from paid newsletters that would otherwise cost you $145+ per month. If you were trying to access this level of quality and volume of ideas as a hedge fund or asset manager, that would cost well over $10,000/mo. We licensed the best premium content from the best equity research and investment analysts in the world so that you could access it for a small monthly subscription. You're welcome.

Why Settle for a Mock Portfolio? This is REAL

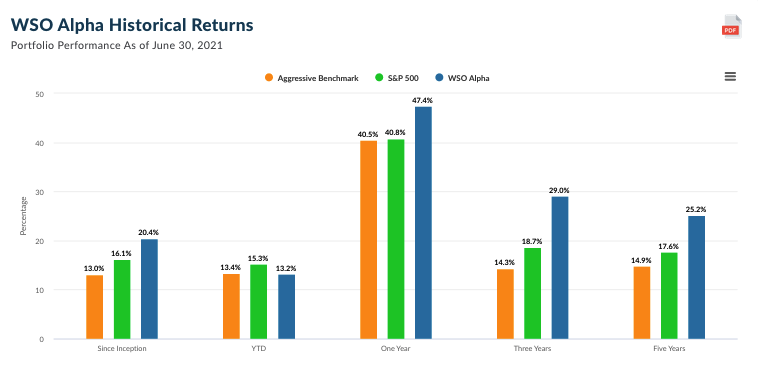

The WSO Alpha portfolio has been managed by our lead investor since December 2011. With the guidance from the WSO Alpha team (includes a former HF professional from Citadel and a Senior Equity Research Associate from a top institutional investing service), he will continue to try and build his 401k and let you all come along for the ride.... Since inception, the WSO Alpha Portfolio has turned $465,400 in capital to over $1.4 million. See this page for every monthly statement since December 2011 when the account was created.

Don’t Buy the Hype

We aren't afraid of high growth stocks, NFTs, SPACS, or cryptocurrency, but we also won't overhype and send you astray. We are long term investors. We only feature analysts and highlight research that are grounded in rigorous fundamental analysis and understand the underlying asset in depth. While we do utilize technical analysis to help us with entry points, we are not technical traders and tend to hold positions for at least a few weeks (sometimes for years). This is an aggressive portfolio. In other words, it's not for everyone. It is best suited for investors that have a 20+ year time horizon.

| Attachment | Size |

|---|---|

| WSO-Alpha-Portfolio-Performance-6-30-21.pdf 60.87 KB | 60.87 KB |

| risk-vs-reward-jun-30.pdf 57.2 KB | 57.2 KB |

I’m sorry but when I read, “anonymous lead investor” my red flag warnings went off.

Could be Nancy tho👀

yeah, it's me - just don't want to broadcast that everywhere (but I guess I may need to eventually)...

-Patrick

Congrats on what sounds like nice returns so far in your retirement account. Good luck with continuing that success there. Maybe you might even consider launching your own investment fund if you think you can put up those kinds of numbers on a larger capital base… just hopefully a friendly thought

X

Except this is not what we did. We have literally uploaded every single monthly brokerage account since 2011 to show every losing and every winning trade. We hold over 30 positions currently and show everything from broken out returns, standard deviation (yes, it's high), etc.

Yes we are in the greatest bull run in history and while the (risk-adjusted) returns 20%+ are pretty exceptional, they aren't unheard of and it doesn't mean we'll be able to keep it up.

I get people asking me for investing advice non-stop, amazing investors in my ear from top funds (and a few helping me with this project) and already share this with my family and friends -- why not share this to a broader audience? If it flops, it flops, but if it does well and gets more younger professionals and college kids interested in investing (not gambling on meme stocks and crypto), then I consider it a very big positive :-)

Plus, nothing like having to show performance or losses each and every month to motivate.

sorry, I don't know what VCB is.

Best of luck,

Patrick

X

EDIT: Spoke with Patrick all good. Original comment deleted.

Thanks - respect your opinion a lot. Can you e-mail me or PM me and happy to discuss?

>aggressive benchmark

>>lower than S&P 500

I'll assume the aggressive derives from the higher risk, so maybe putting a sharpe ratio somewhere in there might be useful

The aggressive benchmark is straight from Charles Schwab portfolio performance tool which includes risk and standard deviation right there. Check out the two attached files in the OP (I just added for easier access). We also benchmark against the S&P500, Russell2000, etc which you can see as well right here (or in the attached files). The portfolio is very aggressive which is why the sd is over 14% since inception.

Cumque tenetur fugiat rerum corrupti quidem iure qui. Quisquam et beatae autem cupiditate laboriosam. Rem non vel quae qui natus. Neque sequi eum aut ut esse.

Aliquid minima delectus dolore quis consequuntur cumque inventore. Facere eius laboriosam aspernatur sit. Debitis explicabo consectetur autem ipsa et. Quis molestias dolorem aut impedit sed aspernatur.

Vero similique magni eum sit consequuntur quis. Quia ullam quos veritatis accusamus sit saepe. Inventore et et nemo consequuntur.

Fuga recusandae eius quo magni deserunt. Omnis vel blanditiis illum quo quis qui sed. Quas possimus esse corporis omnis dicta natus dicta omnis. Maxime deleniti exercitationem maiores ut magnam earum. Molestias corporis culpa dicta accusantium.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...