POWERFUL TRADERS Greeting!

Hello everyone!

Just brief info, about us... So, we are the Team Traders with more than 20 years old of Practice & Experience in trading sphere...

Accurately suppose, that our abilities doesn't have some boundaries and limitations & knowledge skills more deeply than you able to expect...

We are glad to everyone! Novice & beginners, do not hesitate, you can ask us all about the Trading. Sure, we able to help.

Let's find theTrue of Trading together!

Kind regards, Team Traders "PowerfulTraders"

What's a stock?

Hello!

ES/NQ/YM/RTY/SPY/QQQ

Regards.

What’s a box spread?

Hello!

I do not think that it is difficult to understand what "box spread" is, and you will find an exhaustive answer to this question on the Internet in a complete and accessible form.

I am sure that it will be more interesting to find out where to more competently apply this strategy, under what price criteria of the option market and interest rates, the above will be more effective, how the price of the underlying asset will interact to the nearest strikes, what patterns or symbiosis of techniques can give more chances to execute this strategy.

In fact, there are several factors that can determine whether spreading the spread is a viable option for an investor. The state of arbitration plays a central role, as the balance of results is directly affected. The correct execution of puts and calls will also go a long way to the success of the strategy.

For example, choosing a short, wrong call will cause the whole equation to go out of scope and not balance the net premium and the present value that we expected.

Therefore, everything is not easy.

In any case, we are grateful to you for such an interesting question!

Respectfully, Team Traders "PowerfulTraders"

Damn Deutsche's Equities arm really fell off...

What makes you so Powerful?

Hello!

Of course, Trading made us strong!

Frankly, we love Trading with all our hearts ...)

We are woven from the same market failures, millions of attempts, endless punishments from the market, years of market research, improving our techniques and analyzes, constantly correcting mistakes and improving in all aspects of trading, until we come to stability and prosperity.

We can say with great confidence that Trading is one of the most difficult professions that we have ever met.

Too many variables, too much attention, everything is definitely not easy!

But in any case, we are glad that the Market and Trading is our Mother and Father!

Best regards, Team Traders "PowerfulTraders"

What is this trading this post speaks of?

Hello!

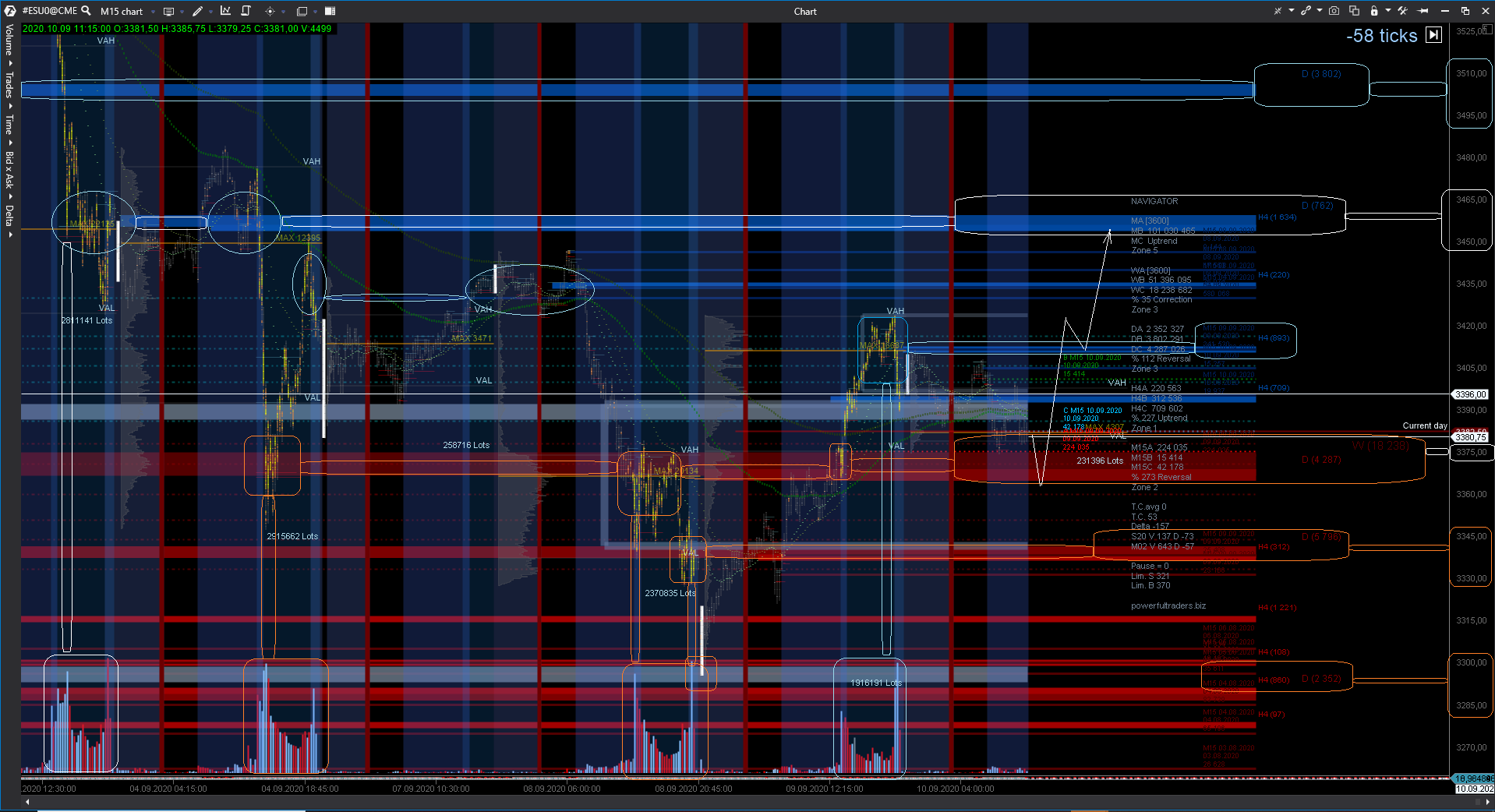

This is just a picture showing the daily work of one Tengri Trader from the "PowerfulTraders" team.

We use different methods of analysis starting from technical analysis, we consider wave analysis, harmonic trading, varieties of fibonacci techniques, market profile, volume-cluster analysis, dynamic volume analysis, intermarket liquidity correlation according to Murphy, interaction of all financial institutions and their impact on markets in the framework of a general whole, footprint, Depth of Market, Spread & Smart tapes, algorithms as assistants to traders, etc.

Today we will launch another post in which we will show our technique ... We have a lot of charts, interesting thoughts and pictures, the only thing we don’t know is whether it is possible to show a video using a link from YouTube ... We do not want to get banned.

Regards, Team Traders "PowerfulTraders"

Please support us and we will show you a lot!

You have 20 years of trading, combined? So is that like 40 people with 1/2 a year of experience? 1 person with 20, 3 people with ~7?

what constitutes “experience”?

Hello!

There are no more than 21 people in our team.

On average, each trader has different experience and varies from 12 years to 25 years of experience.

Each Tengri trader is versatile and versatile in one way or another of analysis and understanding of the markets.

Experience is an empirical concept, as we came to trading almost from that time and the countdown of education and experience began.

For us, gaining experience was given with a lot of blood and wasted time, at first everything was extremely difficult and incomprehensible, but over time and only over time, a complete understanding of the psychology and work of markets came.

Please support us and we will tell you more!

Regards, Team Traders "PowerfulTraders"

If you make so much why would you need me to support you?

And... what... exactly do I get for supporting you?

Sounds like a lose/win situation and I’m not polishing any new trophies.

Do you have experience in IB S&T? Prop Trading? HF?

Hello!

Of course, we have knowledge about the properties and mechanisms of work in Sales & Trading , Investment Banking and any of Prop.

But the main question is why do we need this?

We are self-sufficient, we trade with our modest resources, we multiply our budget as needed, and for this reason we do not need to entrust any bank trader to manage our capital.

In the case of HFT, let's say ...

There are many varieties of them, built by quanta using primitive technologies inherited from old traders, there are those that use more complex techniques of replay logic, in addition to hyperjumping over the heads of other orders ... We are not even afraid of Ultra HFT, as long as we cope with any method and can replay any complex algorithm, but we are worried about neuro technologies capable of studying known trading methods, working on their mistakes, creating new strategies and replaying all the others ... If there are more of the latter, in a hundred years, then the markets will change greatly.

But it's too early to talk about it ...)))

Regards, Team Traders "PowerfulTraders"

Lmao, I love how "insider trading" is one of their tags.

Rerum tempore necessitatibus voluptatem praesentium. Tempore vel sed maiores libero quae enim consequatur. Aut eos omnis minus non corrupti. Vel sapiente voluptas sed aut amet corrupti suscipit distinctio. Perferendis praesentium doloremque consequatur officia numquam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...