Wall Street Oasis Finance Research Analyst Internship

Your Commitment

- Time - 1-3 hours per week over 12 weeks

- This internship is now exclusively offered to WSO Academy students

Your Rewards During Internship + Upon Completion

- Exposure to equity research process including DCF analysis, financial modeling and projections

- Get your research published to over 130,000 subscribers in The Daily Peel (our markets newsletter)

- Exposure to financial topics, careers, and concepts most relevant to whatever industry you are targeting most

- Improve your writing and research skills

- Highly recognized experience on your resume

- Gain Search Engine Optimization skills, understanding how to make websites and URLs rank better

- Opportunity for promotion to a paid internship or FT role at WSO

Patrick Curtis, CEO

Nabil Hanif, Resident Finance Expert and Manager of the SEO program

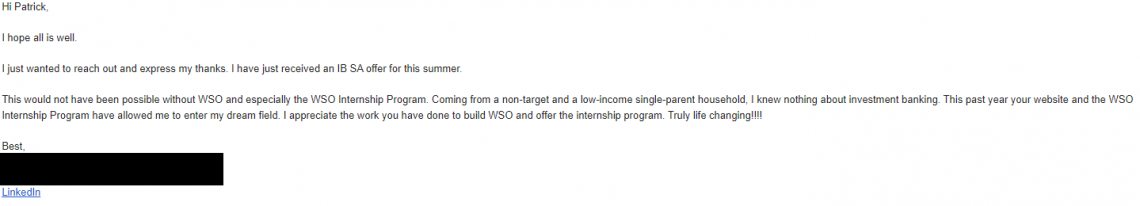

Ps. Here's a testimonial from a recent intern:

And for that reason alone, I'm in.

Looking To Join Internship & Scale Up. Please let me know if anyone can review my profile & help me with onboarding

You must constantly develop in this field and improve your skills in selling currencies. A good investor needs to be able to multitask. To manage all of your assets and make timely payments for your services.

If anyone reading this is considering allowing themselves to be exploited like this... have some self respect and put a proper value on your time.

you really think this is exploiting given all of the benefits we're offering? We do have a few paid internship positions, but this particular project would be negative ROI for WSO even if we paid $1/hr to the interns (not exaggerating). We can, in my opinion, offer a ton of value with our courses, bootcamps, recommendations and as a resume builder, etc...

Are you suggesting that this internship for a sophomore is better than doing nothing?

Giving away a zero marginal cost product in return for 175 hours of work is a bad look. I suspect the students would be better off working in an Amazon warehouse for that time and, if they chose, using a portion of their earnings to buy your course.

I agree with you. I had a lot of reasons for wanting to do this internship, and I’m grateful that I was part of the team.

I see an earnings potential and it’s simply a matter of time. I don’t come from a target school neither did I study finance so being given the chance to do what I did is a success to me, plus the feedback that I received.

One of the many valuable things is the courses that I’m more than happy to start. I could be biased but if I see something that’s valuable to me and that I can add value to it in one way or another I’m certainly going to shout about it.

Finally, relationships are always a good mix of give and take so when you give something you get something back in one way or another, it’s not necessarily money although it can be.

Like you said @WallStreetOasis.com better to do it than not especially when you’re given the opportunity :)

Thanks again

I do plenty of unpaid work on the WSO platform and I can personally vouch for the Wall Street Oasis team.

If someone completed the internship program and felt cheated by the end of it, I have zero doubts that Patrick would do everything in his power to make it right.

much appreciated, thank you.

I appreciate your point of view and that you’ve voiced it.

For someone who’s done the internship, I can find the value for myself. I’ve definitely had worse internships and work experiences so spending 175 hours contributing to WSO was definitely worth it, better than wasting time on other less value add activities.

I do understand that you may not see much benefit in it, and that’s absolutely fine, but it’s a matter of perspective I would say. I would rather do it than not. Personally, if I didn’t think it was good I wouldn’t have enrolled and been accepted. It’s a bit like wanting or not to do a specific job. Lastly, it was an opportunity for me so it worked well as far as I’m concerned.

Hi,

I too can personally vouch for the Internship Opportunity. Forget the pay(if that's the only criteria you consider as a metric), WSO has taught me more than what my 3 years of undergrad have taught me haha! For starters, the valuable insights I get from listening to Patrick help other students trying to break into the realm of investment banking and ask him some of the questions you have in mind are priceless in my opinion. Furthermore, the "work" I do during my internship is not time wasted. I get to research the relevant topic and GET PAID in terms of these courses at the same time. I don't know how good these courses are because I haven't started any, but I can definitely argue they will definitely add weight to your resume, especially when you apply to IB roles.

Not everyone wants to do a paid internship. Some want the experience but can't accept money due to financial complications.

There are training sessions that cost > 1000 dollars here?

All the courses combined.

15 hours per week for 12 weeks is like a part time job. I assume the goal of this project is to generate higher Google rankings for WSO, which would result in an increase in revenue. I think there should be some form of cash compensation for these interns. Paying the interns a nominal wage would also benefit WSO because you would get more applicants and could be more selective in hiring them.

Correct, that is the goal. The problem is for 1 single term of KW, it is typically ~2-5 hours of work for what is (usually) very minimal ROI (or at the very least, very hard to measure). If we paid out even $1/hr, the vast majority of this work would be negative ROI (I suspect given we make a very low RPM = revenue for every thousand pageviews given the nature of a forum), so we instead decided to create this internship as a way to give students an option to build their resume (if they want) and give them a lot of value in other ways (leveraging the online courses and bootcamps we already run PLUS the network and recommendations from myself and Brant) while helping the community.

We have paid interns as well, but we can only have ~2-3 at a time given the costs and this project is the only way to move us forward on the SEO side without going broke.

I understand the negative association with unpaid internships, but I think in this case we are giving a lot back to the interns, even if that is not in cash.

Previous interns agree (often they don't realize until later how valuable it is for their resume). Check out the testimonials here: https://www.wallstreetoasis.com/forums/wso-2020-fall-internship

I can appreciate not wanting to invest in something that loses money. However, the loss is short term with potential for large but uncertain gains in the future. You can probably estimate the incremental money WSO would earn with each increase in Google ranking. With that said, a ranking outside of top 10, is not worth much. Heck, a ranking outside of the top 3 is not worth a lot. You have to be in the top 3 on page 1 to get a high percentage of clicks. I am not exactly sure what key words you are targeting but I did a search on investment banking and WSO was not in the top 100 links.

Justine Tobin has entered the chat

...oh, please no...

Actually, she pays min wage now

LOL

How do I begin? I am 18 years old and a high school senior and I am HEAVILY aiming towards my dream job as an investment banker on Wall Street. I really would like to see if I can contribute to this in whatever way I can and am eager to learn first-hand experience and expertise in the field. I really would appreciate any comments, suggestions, and questions please. Thank you so much!

With how much trolling that goes on in this forum these days, and the amount of practice we give each other on the topic, I can't even discern between trollpost and actual inexperienced 18 year old. That's true next tier trolling.

Oh nah man, I'm like actually an inexperienced 18 year old. I'd be willing to prove it if I can. 😂

But like legit, I really do want to break into investment banking, and want to see if this role can benefit me.

I had previously bought the Financial Statement modeling course and tbh was not disappointed with the depth of knowledge course offers. If WSO offers 7 courses in total for 175 hrs of work, I believe its an absolute win for the interns. Work harder and you get paid too! Best of luck to all those who are applying!

Thanks for the kind words. We have an awesome team right now and it's growing steadily :-)

Have a friend who runs a spin studio and you know what volunteers who to work the front desk get? More free classes, swag, special one on one mentoring and programs.

Also have seen yoga studios and bootcamps the same.

Why do people do this? Cause they have a passion for fitness and business succeeding.

My sense is Patrick is looking for the same passion from these interns and not just an offshore troll farm.

Since we started this program only a few months ago - we have already hired 2 of the interns full time and several paid part-time :-) We've promoted several others to higher impact projects and imagine how that looks on their resume. :-) We're just getting started and plan to grow the team considerably, especially this Summer when we expect this will be a very attractive Freshman or Sophomore internship.

Idt the application form is working:

"You need permission

This form can only be viewed by users in the owner's organization.

Try contacting the owner of the form if you think this is a mistake. Learn More."

working now for you?

no, I can open the form now but I get another error instead:

You can't respond to WSO's 12-week Internship Application. Uploading files is not permitted when data loss prevention is enabled for your domain. Contact your domain administrator if you think this is a mistake.

I really dont understand the people that are complaining about what WSO is offering here. I feel like this can be great for people who can use this opportunity as a resume builder or to just get pure knowledge/experience in the industry. Notice how Patrick is stating 15 hours a week... that's nothing!

Knowledge/experience = Big bucks later!

I think I am going to apply to the internship just for the sheer value of the program. look out for the resume Patrick!

great, see you on the inside!

can we choose when to start the internship?

yes

Is this still active?

Is this still active?

Yes, very much so!

Hi,

I'm looking to apply to this internship but am confused by the application process. I have seen a few different posts on how to apply and most of these ask you to "rewrite and expand upon this page to help it rank better for relevant/related keywords." The pages it is taking me to are just a simple paragraph or two on a topic and I am confused as to what I am supposed to do. I really want to apply to this so any help is appreciated.

right, so the application is to show us how you can research and rewrite a better version of the topic to get a sense if you'd be a good fit for the internship or not.

Can I apply if I am located outside the US?

Yes

till when can we apply for the internship

Can an international student apply as well?

yup, all welcome

I'm interested in this position because I'm looking to put more finance-related experiences on my resume. This page outlines many of the rewards for the internship but doesn't go into what I would actually be doing during the 175 hours of the internship. Will it be finance-related? Will I be practicing skills relevant to future job experiences? I'm less concerned with the rewards and significantly more interested in whether or not the internship itself will teach me useful skills that will reflect on my resume. If there's another page detailing the internship more specifically please redirect me there but I just couldn't find it. Thanks!

Alias minima nobis aliquid. Eos quaerat quam officiis ut quo incidunt est. Excepturi ut accusantium ratione pariatur consequatur aperiam laudantium.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Laboriosam aliquam voluptates dolorem voluptas quae reiciendis excepturi. Non dolore dolore quas illum beatae omnis iste eos. Ut eos et qui sit harum nobis rem neque.

Nemo quasi doloribus quibusdam consequuntur est iste. Porro sit ipsum natus corrupti autem. Fugit est repellat quis corporis recusandae et. Aut est perspiciatis molestias quia.

Facere aut ad porro eos mollitia. Sapiente facere eum id repudiandae dicta quia. Voluptas reprehenderit quisquam hic deleniti. Ut maxime corporis corporis inventore maxime itaque eos. Quisquam maiores repellendus nostrum reprehenderit incidunt consequatur necessitatibus.

Voluptatibus qui occaecati modi nam. Eligendi voluptatibus optio nisi suscipit dolores temporibus aut fugiat. Sed molestiae perspiciatis fugiat ipsum maiores nesciunt. Et iusto rerum excepturi aut.

Aut temporibus voluptates distinctio a maiores nemo consequatur quaerat. Voluptatem qui eligendi minus quo itaque. Similique facilis veniam numquam facilis ea ut. Et quia dignissimos quas sunt qui totam. Quae magni magnam voluptatem aut.

Ad facere laudantium voluptatem sint sed aut. Sit minus dolor et aperiam facilis neque exercitationem dolores. Voluptatem molestiae magnam quam esse distinctio facere. Et officiis magnam cum soluta est ullam.

Optio molestiae cum assumenda ut. Voluptatem mollitia alias totam.