Bank Teller Job Description

An entry-level position that involves dealing heavily with customers and assisting them in various transactions

What is a bank teller?

A bank teller is an entry-level position that involves dealing heavily with customers and assisting them in various transactions. This job requires mathematical skills, customer service skills, basic computer skills, and strong attention to detail.

Bank tellers have several responsibilities, the first and foremost being assisting customers. However, it may not always mean helping them directly.

They often help customers make various simple transactions and can help them with other situations, usually by giving them information and telling them what they will need before referring them to another more qualified person who can handle their needs.

Some of their responsibilities include helping customers:

- Cash checks

- Cancel checks

- Send wire transfers

- Make loan payments

- Request loans

They also record these transactions and keep track of the bank's money while following specific bank procedures for the organization and security. As a teller is an entry-level position, it does not require much experience or qualifications.

The only thing a teller needs to have is a high school diploma and usually some experience, specifically in jobs handling cash. However, experience in Customer service is valuable for candidates applying for this position.

This position also gives way to many opportunities for promotion. More senior roles are available to tellers, given they can show diligence and competence, including:

- Head teller

- Personal banker

- Loan officer

- Sometimes bank manager

Despite these opportunities, being promoted to these positions requires greater qualifications, such as a bachelor's degree in finance, business, or related fields. Bank tellers typically work around 40 hours per week; the median a teller makes is under $16 per hour.

However, pay is set to increase in many large banks in the coming years. While this rising pay is promising, it seems to coincide with a decline in the number of bank teller jobs available amidst the automation of teller roles at most banks.

Key Takeaways

- Bank tellers are entry-level positions that involve assisting customers with various transactions and providing customer service.

- Bank tellers responsibilities include cashing checks, canceling checks, processing wire transfers, handling loan payments, and assisting with loan applications.

- Bank tellers must have basic mathematical skills, customer service skills, basic computer skills, and strong attention to detail.

- Advancement opportunities for tellers include positions such as head teller, personal banker, loan officer, and bank manager, which may require further qualifications.

- The job of a bank teller typically requires a high school diploma, some experience in handling cash, and prior customer service experience. Additional certifications or degrees may be beneficial but are not always required.

Understanding The Bank Teller Job

This is an entry-level position offered at banks. They are the face of the bank and are often the first person a customer sees when they walk into the branch. In any bank, a teller is a person responsible for managing customer relations and assisting customers with their banking experience.

Bank tellers deal with many customers throughout the day. As a result, their job contains many different responsibilities, most of which are related to fulfilling customer needs.

They greet customers as they come to the bank and assist them with any questions or processes they may need to go through.

They may assist customers with savings account transactions, wire transfers, managing bonds, processing loan payments and applications, and many other duties.

Often a teller is there to understand what services customers require and help process simple transactions. However, they may refer customers to other bank employees for more complicated situations.

Note

Bank tellers are also expected to advertise the bank's various products and services. In this sense, they are responsible for being like a salesperson and should be knowledgeable about the different offerings of the bank they work at.

A large part of the job is understanding what customers need, recommending various products or services offered by the bank, and describing the details and benefits of these products and services.

These professionals have fairly normal working hours, averaging around 40 hours per week, but the workload may also be more depending on the position.

The tellers make decent money, with the median pay in 2020 being just under $16 per hour. Bank of America has raised its minimum wage to $20 per hour and plans to bring that to $25 per hour by 2025. Some other larger bank chains are following suit.

Note

While greater pay may be forecasted for tellers, this may result in fewer available jobs. The Bureau of Labor Statistics (BLS) estimates that the number of tellers in the country will fall by 17% in the next decade.

How to Become a Bank Teller?

There are very few requirements for becoming a teller. Candidates must have completed a high school education and earned their diploma. Very few teller positions require the applicant to have a bachelor's degree.

Suppose the candidates have a bachelor's degree, especially in accounting, finance, or a related field. In that case, they will likely climb the bank ranks very quickly and will not stay tellers for long.

Many employers expect to see some experience in positions with similar duties. For example, many teller positions require some experience in handling cash.

In addition, employers may look for prior customer service experience and sales jobs as the position involves much customer service work.

Note

While there aren't any certification requirements for this position, the American Bankers Association offers an ABA Bank Teller certification that consists of 35 courses and takes about 13 hours to complete. ABA also offers several other banking-related certifications and training courses.

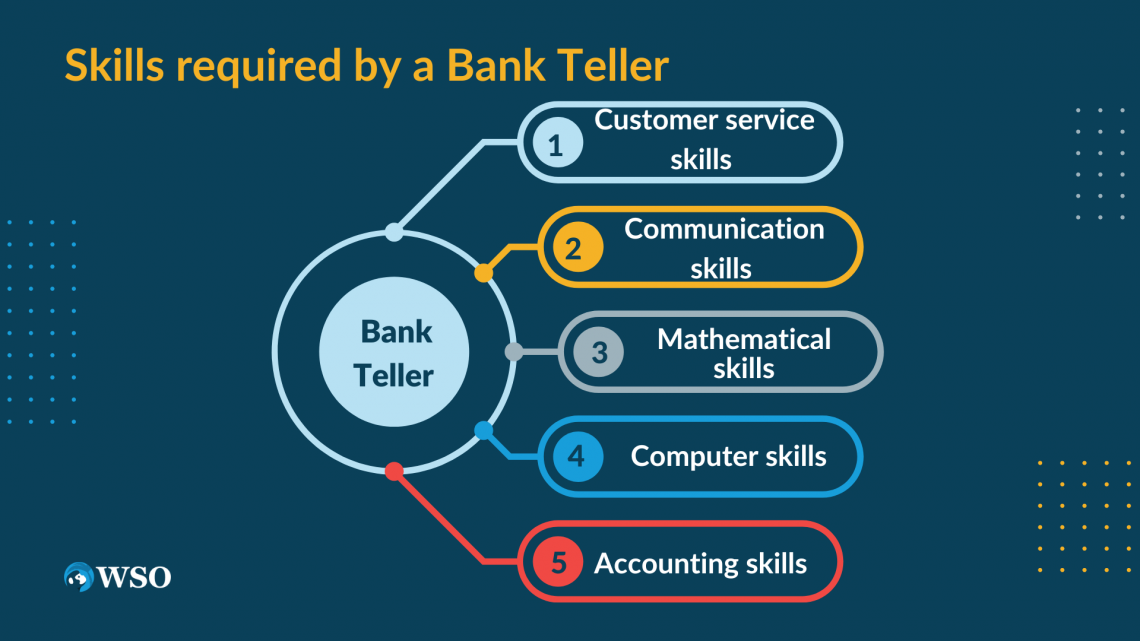

Beyond education requirements and job experience, there are several skills that employers prefer in a candidate for this role.

This includes customer service skills, including being friendly, eager to assist customers, and having good communication skills. Hence, they can calmly and clearly explain customers' options and what the bank can do.

In addition, mathematical skills are helpful in this position because they must be able to record transactions and do some accounting work for the bank.

They should also have some basic computer skills. In addition, they should pay attention to detail to carefully make and record transactions without mistakes, fill out other paperwork and consider security concerns.

Note

While some experience is preferred, most of the knowledge used in the job is learned through on-the-job training.

For about a month, the bank trains tellers and teaches them how to perform certain tasks, bank-specific procedures, and details on various bank products and services they should be familiar with.

Job Responsibilities Of A Bank Teller

These tellers have different responsibilities, including dealing with customers, maintaining security for the bank, and keeping track of banking transactions. These responsibilities require attention to detail, some mathematical skills, basic computer skills, and friendly customer skills.

In many cases, tellers act as greeters and may receive help from many other more qualified positions within the bank that deal more directly with assisting customers with more of the bank's services.

Tellers usually assist customers in navigating many of these issues and can deliver some help and will help direct them to other employees that can deliver further expertise.

They assist customers with various transactions or other problems, such as exchanging dollars for foreign currencies or vice versa.

They also help customers manage their bank loans, helping them receive loans and make loan payments. However, more experienced bank employees do the actual issuance of loans.

Note

Bank tellers help customers open and close bank accounts, sign up for debit and credit cards, and can assist customers with their safe deposit box.

They also help cash traveler's checks, redeem bonds, wire transfers, and other simple transactions. However, tellers may also need to be wary of counterfeit currency and fraud.

Beyond customer service, tellers are expected to help record transactions and follow many banking procedures and regulations for security measures. This includes creating reports, keeping track of banking transactions, counting money in the ATM and the bank, and handling discrepancies.

Day in the life of a teller

The day of a teller is not particularly exciting, but they are the face of the bank as they deal with most customers and assist them in many different transactions throughout the day.

Below is a description of what one of those days may look like.

7:30 AM - Arrive at the bank. At this time, a bank teller should count the money in the drawer and ensure the transactions are organized and there are no discrepancies.

In addition, they ensure that all securities and bank procedures are in place and do any accounting before preparing for customers to begin coming.

8:00 AM - The bank opens. A father and son come to open an account. The teller gives the father and son information about the different types of accounts offered at the bank and directs them to an account clerk that can help them fill out the correct information and officially open an account.

8:30 AM - The second customer comes to make a large wire transfer. The teller helps them make this transaction. Customers come in one after the other, all requesting various services.

9:00 AM - A customer wants to take a loan. A teller should help give the customer information about standard interest rates and loan terms, advising that it depends on credit and some factors.

The teller directs the customer to a loan officer that can help them fill out an application that will be reviewed further before issuing a loan.

10:00 AM - Another customer would like to cash a check. The teller helps them cash the check and shows them how they can now do this through the bank's mobile app and do not need to come to the bank.

11:00 AM - A customer comes in and wants to withdraw more money than they can withdraw from the atm. The teller helps them withdraw the money and asks them if they'd like any specific denomination of bills.

12:00 PM - Takes a lunch break and rests their bones.

12:30 PM - A customer comes wishing to deposit some money. The teller directs them to the ATM and offers help if they need it.

1:30 PM - A customer comes in hoping to re-amortize their loan. The teller tells them that they must make a minimum payment to deduct this from their principal and direct them to a loan officer to assist them.

3:00 PM - Customers may still be coming in; however, the teller tries to count the drawer and make necessary reports.

3:30 PM - The 8-hour day comes to an end. Turn over the station to the next teller and clock out to leave.

or Want to Sign up with your social account?