Projecting Income Statement Line Items

The estimation of future business performance by analyzing existing financial information

Projecting Income Statement Line Items

An income statement, also known as a profit and loss statement, is one of the main financial statements that the company prepares. The income statement summarizes a company's performance for a specified period.

The statement includes information on the company’s revenues and expenses. Depending on the accounting standards used by the company, the statement of profit and loss can include different lines.

Generally, a profit and loss statement consists of a mixture of the following lines:

- Revenue

- Cost of goods sold (COGS)

- Distribution/selling costs

- General and administrative expenses

- Other operating income/expenses

- Finance income/costs

- Share of results of associates and joint ventures

- Income tax benefit/expense

Projecting the income statement is critical when building a three-statement model. The reason is that income statement figures drive projections of some of the balance sheet and cash flow statement lines.

At the same time, you may also encounter the need to project some of the elements of the income statement when working in financial reporting or financial planning and analysis functions.

In this case, information (predominantly EBITDA forecast) is usually prepared upon the request of top management.

Each specific line item will have its drivers of the values. Thus, projecting is usually performed on a line-by-line basis. The analysts start with revenue and work their way down the remaining lines.

Some expenses that need to be projected for modeling purposes are hidden within a broader financial line.

For example, interest expenses/income are usually included in finance costs/income, while depreciation and amortization expenses are spread out throughout multiple lines.

When building a model, the following steps will help to make the process more structured:

- Start with publicly available historical data

- Use historical data to construct ratios

- Use information from the above steps to make projection assumptions

- Project the income statement line items using the assumptions

Key Takeaways

- An income statement is one of the main financial statements that the company prepares; the statement summarizes a company's performance for a specified period.

- Projecting the income statement is critical when building a three-statement model.

- Another important measure of the company’s performance, EBITDA, is derived from the profit and loss statement.

- The collection of historical data is the starting point for projecting the income statement lines.

- For the projection to be meaningful, however, one needs to have a deep knowledge of the company and the industry the company operates in.

- There are usually multiple ways to project one or the other financial statement line.

- When projecting the profit and loss statement, one can utilize general and more comprehensive approaches, depending on the purposes of the projection.

The use of historical data

Before you can proceed with projecting the profit and loss lines, you need to analyze the historical data carefully. The collection of historical data can be done in two ways:

1. Manually collect data from the financial statements

Manual collection of data implies a collection of data from publicly available resources and manually inputting it into an Excel worksheet. Relevant data can be found in the company's 10K forms, press releases, or other publicly available resources.

2. Collect the data through available Excel plugins

Alternatively, you can collect data through the available Excel plugins. Factset or CapitalIQ are some of the providers of financial data that allow data extraction directly into the Excel workbook.

When working with historical data, you may encounter a series of issues. Some of the generally encountered issues when inputting historical income statement data include:

- The level of breakdown

- Line item classification

- Data adjustments

- Aggregating the data

The level of breakdown

It is common for companies to report total amounts in the income statement and provide more detailed information in notes to the financial statements. The level of breakdown may vary by company.

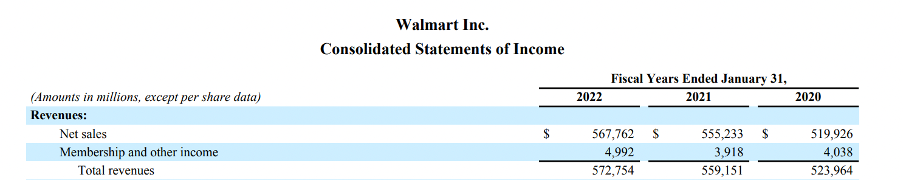

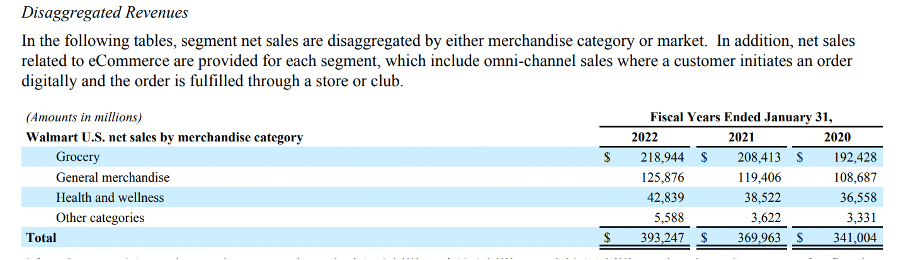

For example, Walmart Inc reports two revenue lines on the face of the profit and loss statement – 1. net sales and 2. membership and other income. A further breakdown of the net sales amount is available for review in note 13 of the financial statements.

Understanding the breakdown level you need to meet the projection purposes is important.

If your model requires a detailed breakdown (revenue by product, etc.), you will need to utilize the data from the profit and loss statement and notes. Otherwise, the total amount should be sufficient.

Line item classification

Companies can classify their operating expenses in various ways. Some companies aggregate certain expenses into one line in a profit and loss statement, while others use a few separate lines in a profit and loss statement.

The line item classification step is especially important if you subsequently use the data for comparison purposes (compare data of one company to another).

If this is the case, you need to ensure that each financial statement line includes income/expenses for all companies in question.

Continuing with Walmart Inc, Walmart Inc reports interest expenses/income on the face of the income statement.

At the same time, other companies might report these expenses/income in finance expenses/income lines. Therefore, you will have to look for this information in the notes to the financial statements.

Data adjustments

Companies may prepare financial statements following different accounting standards. Common accounting standards include Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Preparing financial statements per GAAP or IFRS means that the income statement is prepared in a specific format, which usually excludes certain information used in the models (EBITDA, etc.).

As a result, you must analyze notes to the financial statements to find information needed to present income statement data in a way that is beneficial for analysis.

The level of analysis will depend on the company. Some companies disclose the underlying EBITDA in their financial results (Rio Tinto, BHP, among others), but others do not.

When companies disclose the underlying EBITDA in their financial results, pay attention to what is being disclosed, as often, the measure is adjusted to incorporate the management's view.

Aggregating the data

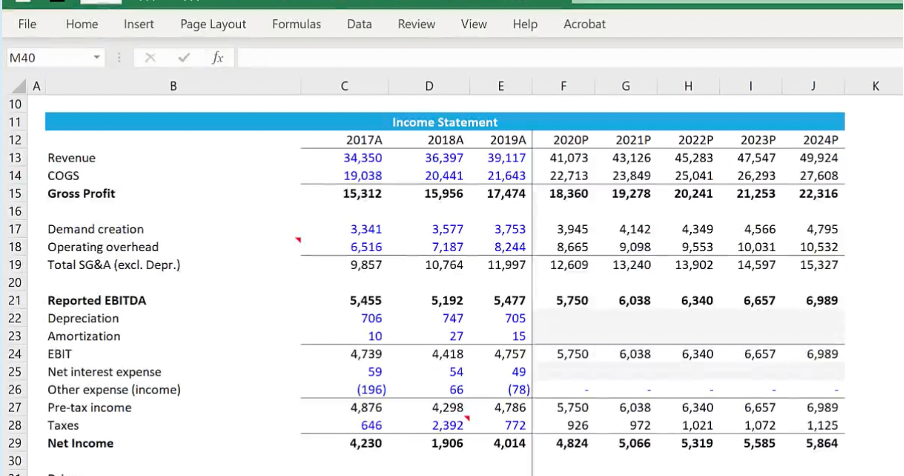

An example of aggregated historical data that is further used for projection purposes is provided below (2017A, 2018A, and 2019A):

Information from the income statement and from the notes to financial statements was collected and aggregated into a user-friendly format.

As you may notice:

- Numbers derived using formulas are colored black, and pasted values are blue.

- The use/absence of decimal points is consistent throughout the sheet.

- Data is structured from left to right (unlike data in financial statements, where the reporting period comes first).

These are some of the best practices when it comes to financial modeling. At this point, you should be able to proceed to identify trends and use these trends in line-by-line projecting.

Income statement projections

Collecting historical data is an essential first step in projecting as it shows historical trends. But one needs to remember that it is just the first step.

For a projection to be meaningful, you need to have a deep understanding of the business and the industry the business operates in.

When projecting income statement lines, you need to understand the company’s business model, key customers and sales strategy, how well the company is positioned compared to its peers, and the cost structure.

One of the important things to watch when using historical data in projecting is one-off items. These one-time items can distort your projections if not given proper consideration.

Revenue

Revenue comprises the fair value of the consideration received or receivable for the sale of goods and services in the ordinary course of the company’s activities.

There are several different ways to project sales revenue:

1. As a growth rate from the previous year

Each subsequent annual revenue is derived by multiplying the past year’s revenue by 1 + the predetermined growth rate.

2. As price time quantity

Each subsequent annual revenue is derived by determining the expected quantity and the expected price in that period. This approach requires a more comprehensive projecting approach.

3. As a factor of some macroeconomic metrics

Each subsequent annual revenue is derived based on the historical revenue and that year’s macroeconomic metric.

Revenue is one of the essential projection numbers for a three-statement model. Once you have the revenue projection ready, you can proceed with the cost of goods sold figures projection.

Cost of goods sold (COGS)

Cost of goods sold, also known as cost of sales, are costs that the company incurs in the production of goods it sells or in the provision of service revenue it generates.

Like with revenue, there are different ways to project the cost of goods sold:

1. The difference between gross profit and revenue

Each subsequent annual cost of goods sold is derived by subtracting projected revenue from the projected gross profit.

2. As a percentage of revenue

Each subsequent annual cost of goods sold is derived by applying the historical COGS margin (calculated as COGS/revenue) to projected revenue.

Alternatively, a more comprehensive approach may be applied. When using this approach, the cost of goods sold is broken down into raw materials costs, labor costs, electricity costs, etc. An individual cost driver is then applied to project each category.

Operating expenses

When projecting operating expenses, including selling expenses and general and administrative expenses, two approaches may be used – a simple approach and a more comprehensive approach.

A simple approach entails projecting expenses using the margin approach, meaning that subsequent annual expenses are derived by applying the historical margin (calculated as operating expenses/revenue) to projected revenue.

A more comprehensive approach entails breaking down operating expenses into individual components (labor costs, rent expenses, advertising expenses, etc.) and applying varying drivers to each component.

Due to the nature of operating expenses, a more comprehensive projection approach is desirable as it provides more precise projections.

Depreciation and amortization

Depreciation and amortization expenses are a systematic allocation of the depreciable amount of an asset over its useful life.

These expenses are rarely found on the face of the income statement. Instead, they are spread across COGS, distribution/selling expenses, general and administrative expenses, and other operating expenses lines.

Depreciation and amortization expenses are accrued to match the economic benefits from using property, plant, equipment, and intangible assets for more than one period.

NOTE

Projecting depreciation and amortization expenses play an important role in the EBITDA projection. This measure is used as a performance indicator by top management of many companies as well as in modeling.

One can project depreciation and amortization expenses as a percentage of capital expenditures, the net book value, or revenue based on historical trends identified.

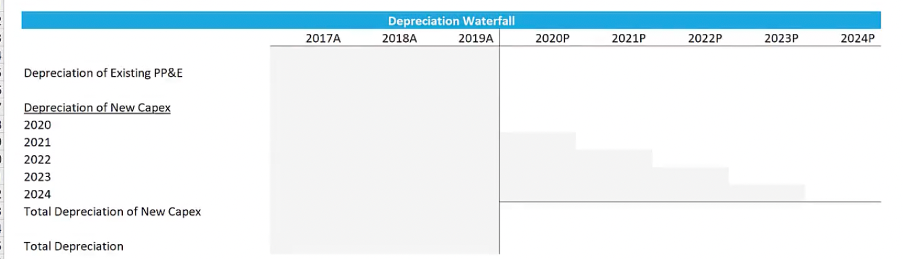

In addition, the expenses can be projected through depreciation and amortization waterfall, a more precise calculation.

When using the waterfall method, one projects depreciation and amortization expenses of the existing property, plant, equipment, and intangible assets and the depreciation and amortization expenses of new capital expenditures using the expected average useful life.

Interest expense

Interest expense is the cost the company incurs for borrowed funds. Borrowed funds can come in the form of bank loans, issued bonds, trade financing, non-bank borrowings, and such.

Interest expense is commonly projected through the use of the debt schedule. The debt schedule outlines schedules of the individual financial debt instruments that the company has.

Schedules include information on the opening balance, interest movements, principal movements, and closing balance.

One commonly used method to arrive at the amount of the projected interest expenses involves multiplying the opening balance of each instrument in each period by the interest rate.

Alternatively, to account for the fluctuations in the balances of borrowed funds during the period, an average balance of each instrument in each period can be used in the projection.

Taxes

Tax expense is the amount the company owes to the tax authorities. Tax expense is projected by applying the historical effective tax rate to projected earnings before tax.

The companies usually disclose their effective tax rates in their financial statements. They also explain changes in rates during the reporting periods. Information comes in handy when projecting tax expenses.

One thing to remember is that, in some cases, the historical effective tax rate will not indicate the future.

This could be the case when new tax laws come into effect after the historical period. Such information is usually disclosed in the financial statements if known during preparation.

After projecting revenues and expenses covered in this section, you can build an income statement that can be used to extract information requested by the top management and used as a base in a three-statement model.

or Want to Sign up with your social account?