2/10 Net 30

2/10 net 30 is an agreement that if the buyer pays within ten days, they will receive a 2% discount on the net invoice amount. If not, you must pay the entire invoice amount within 30 days.

What is 2/10 Net 30?

It is a trade credit arrangement offered by suppliers to buyers. Providing a 2% discount on the net amount when an invoice is paid in the initial ten days will provide an incentive for clients to pay their invoices before they are due.

The full invoice amount must be paid within 30 working days if the purchaser does not benefit from an early payment discount.

This credit term is specified in the purchase order and invoice, outlining the agreement between the buyer and seller.

The typical net 30 credit term means the balance is due within 30 days of the invoice date. In the case of 2/10 Net 30, the "2" represents the discount amount (2%), and the "10" represents the due date (10 days after the invoice date).

Buyers can create confidence in their suppliers through early payment or on-time delivery of invoices, thus building up a longer-term relationship with them. It also provides leverage for negotiating future contracts.

Suppliers also benefit from early payments since they receive a quicker injection of working capital, which they can utilize immediately.

This credit term is commonly used in industries where working capital requirements are high, and funds are needed to manage day-to-day operations efficiently. These discounts are commonly used in supply chain relations and provide advantages for both buyers and suppliers.

The concept of this payment term allows suppliers to offer credit periods to buyers while incentivizing early payments through discounts. This arrangement benefits buyers by providing a risk-free return on investment and a quicker recovery of trade payables for suppliers.

While suppliers may initially be hesitant to extend longer credit terms to new buyers, consistently demonstrating the ability to make timely payments can lead to negotiations for more favorable terms, including access to short-term discounts and cost savings.

To maintain a stable supply of goods and services, support their client base and be able to exploit growth opportunities, small businesses must establish and nurture good relations with suppliers.

Building strong relationships with vendors and consistently paying invoices on time can help businesses maintain a steady cash flow and access the benefits of short-term discounts and overall savings.

Understanding credit terms and their impact on both the buyer's and supplier's businesses provides a competitive advantage during contract negotiations and strengthens the overall financial position of the buyer.

Key Takeaways

- "2/10 net 30" is a commonly used payment term in business transactions. The "2/10" part of the term indicates that a 2% discount is available if the buyer pays the invoice within 10 days of the invoice date. This discount serves as an incentive for prompt payment.

- The "net 30" part of the term means that the buyer is expected to pay the full invoice amount within 30 days. This is the standard credit period given to the buyer.

- Establishing clear payment terms like "2/10 net 30" fosters transparency and trust between the buyer and seller. It sets expectations and avoids confusion regarding payment timelines and potential discounts.

Net Method Vs. Gross Method

The net method and gross method are two approaches for accounting for invoices with the option of taking 2\10 Net 30 payment discounts. These methods differ in how they record the discount on the invoice.

Net Method

The net method records the invoice at the discounted amount. For example, if an invoice totals $500 with a 2% discount for early payment, the net method records it at $490.

Under the net method, the company credits the accounts payable account for $490 and debits the purchases or inventory account for $490 when recording the invoice.

No additional adjustments are required if the payment is made within the discount period. The accounts payable team would credit cash for $490 and debit accounts payable for $490 when paying the invoice.

Note

The net method is commonly used by companies that consistently take early payment discounts as part of their accounting policy.

Gross Method

The gross method records the invoice at the full invoice amount without subtracting the discount. Using the previous example, the gross method would record the invoice at $500.

If the company decides to take the early payment discount, an adjusting purchase discount journal entry is made.

For instance, if the payment is made within the discount period, the company would credit cash for $490, debit accounts payable for $500, and credit $10 to purchase discounts taken, which offsets the total purchases or inventory account.

Note

The gross method is often chosen by companies that do not consistently take early payment discounts or want a simpler initial recording method.

Both methods require adjustments if the discount is not taken after the initial recording. For example, if the payment is made after the discount period, an adjusting entry is made to account for the purchase discount lost.

It's important to consider the company's specific accounting policies and practices when determining the most appropriate method for recording early payment discounts.

Note

Remember to consult with an accounting professional for specific advice and guidance based on your company's circumstances and accounting requirements.

Use of 2/10 Net 30 in different Industries

The 2/10 Net 30 payment term is commonly used in various industries where business-to-business transactions are prevalent. Here are a few examples of how this payment term is commonly applied in specific industries:

1. Manufacturing Industry

In the manufacturing sector, suppliers of raw materials or components often offer the 2\10 Net 30 payment term to their buyers.

This allows manufacturers to secure necessary supplies while offering an incentive for prompt payment, thereby helping them manage their cash flow and inventory more efficiently.

2. Retail Industry

Retailers frequently negotiate the 2\10 Net 30 payment term with their suppliers. This enables them to receive goods or merchandise for their stores promptly and incentivizes them to pay early, ensuring that suppliers receive payment within a reasonable timeframe.

Note

This arrangement helps retailers maintain inventory levels and meet customer demand.

3. Construction Industry

The 2\10 Net 30 payment term is also utilized in the construction industry. Contractors and subcontractors often agree to these terms with their suppliers of construction materials, equipment, or services.

Note

The discount encourages timely payment, facilitating cash flow for suppliers and ensuring the availability of resources for ongoing construction projects.

4. Technology Industry

In the technology sector, where companies frequently rely on the procurement of hardware, software, or IT services, the \10 Net 30 payment term is common.

This allows technology companies to acquire necessary equipment or software licenses while offering an incentive for early payment, benefiting both the buyer and the supplier.

5. Wholesale and Distribution Industry

Wholesale distributors often employ the 2\10 Net 30 payment term in their relationships with retailers or other businesses.

By providing an early payment discount, wholesalers encourage buyers to settle invoices promptly, helping to maintain a healthy cash flow and streamline their operations.

Note

It is important to note that the applicability of the 2\10 Net 30 payment term may vary within industries, and different variations of this payment term may be used to suit specific business needs.

The key objective is to strike a balance between incentivizing prompt payment and maintaining positive supplier-buyer relationships across various industries.

Impact of 2/10 Net 30 on 3 Financial Statements

This payment term impacts the three main financial statements – the income statement, balance sheet, and cash flow statement – in the following ways:

Let us see how it impacts the Sales Revenue in the income statement.

The total amount of sales made during the period is reported as sales revenue. However, if a discount is given due to "2\10 net 30" and the buyer takes the discount, the discount amount is recorded as a deduction from sales revenue. This reflects the reduced revenue earned by the seller.

- Accounts Receivable: The outstanding amount owed by customers who have not yet paid is recorded as accounts receivable. The accounts receivable balance includes invoices issued with "2\10 net 30" terms, which decreases as customers receive payments.

- Accounts Payable: The amount owed to suppliers or vendors for purchases made on credit is recorded as accounts payable.

Note

In the case of "2/10 net 30," the accounts payable balance includes invoices received with these terms, and it decreases as payments are made to suppliers.

3. Cash Flow Statement

- Operating Activities: The cash flow statement records cash inflows and outflows from operating activities. The cash received from customers for invoices issued with "2 10 net 30" terms is recorded as an inflow under operating activities.

- Investing and Financing Activities: The cash flow statement may not directly reflect the specific terms of "2\10 net 30." However, if the buyer takes advantage of the discount, the cash paid would be recorded as a financing activity outflow.

Note

The above explanations provide a general framework for understanding how this trade credit agreement can affect the financial statements. Understanding that the impact on financial statements can vary according to specific transactions and accounting practices of a company is important.

Case Study—2/10 Net 30

In addition to understanding the concept of "2/10 net 30" payment terms, exploring case studies or success stories can provide practical insights and inspiration for readers. Let's look at an example: XYZ Electronics.

XYZ Electronics, a supplier of electronic components, implemented the "2\10 net 30" payment terms to incentivize early payments from their customers.

Under this policy, customers were offered a 2% discount if they paid their invoices within 10 days. Otherwise, the full payment was expected within 30 days.

The introduction of "2\10 net 30" had several positive effects for XYZ Electronics. Firstly, it improved cash flow by encouraging customers to make early payments.

The 2% discount served as an attractive incentive, motivating customers to settle their invoices promptly and reducing the average collection period for receivables.

Additionally, the policy strengthened relationships with customers. By offering a discount, XYZ Electronics demonstrated a commitment to customer satisfaction and provided an opportunity for cost savings.

This approach fostered goodwill and encouraged repeat business from satisfied customers.

Moreover, XYZ Electronics gained a competitive advantage in the market. The ability to offer flexible payment terms, combined with the reputation for timely deliveries and quality products, positioned XYZ Electronics as a preferred supplier within the industry.

By implementing "2\10 net 30," XYZ Electronics not only improved its cash flow but also enhanced customer relationships and gained a competitive edge.

This case study showcases the practical benefits of using such payment terms and highlights the potential positive impact on both financial performance and customer satisfaction.

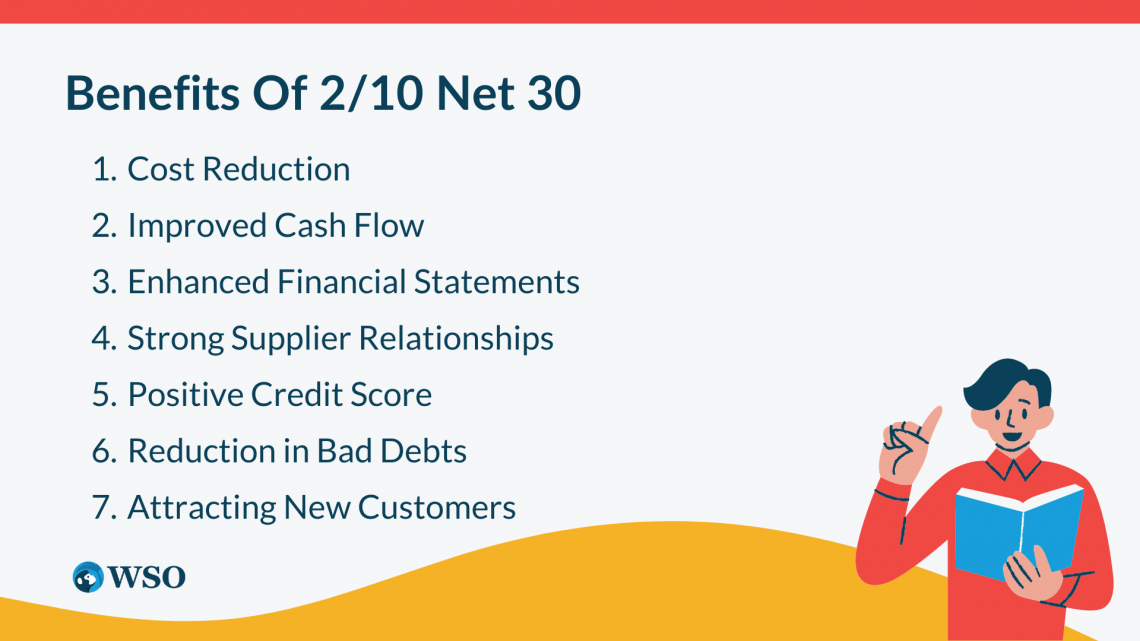

Benefits of 2/10 Net 30

This trade credit arrangement is commonly used in business transactions. It offers a discount incentive to buyers who pay their invoices early, allowing sellers to improve their cash flow.

In this section, we will explore the benefits of 2\10 Net 30. Understanding these factors can assist businesses in determining the suitability of this trade credit agreement and its impact on their financial operations.

1. Cost Reduction

When buyers take advantage of the early payment discount, they can reduce the cost of goods sold and other expenses by paying 2% less for their purchases of goods and services. This contributes to overall cost savings for the buyer's business.

2. Improved Cash Flow

Sellers benefit from this trade credit agreement as it speeds up accounts receivable collections of credit sales.

Note

By encouraging early payment, sellers can improve their cash flow, ensuring they have readily available funds for their business operations and financial obligations.

3. Enhanced Financial Statements

Taking early payment discounts positively impacts a company's financial statements, including the balance sheet, income statement, and statement of cash flows. It demonstrates efficient working capital management and highlights healthy cash flow generation.

4. Strong Supplier Relationships

Paying bills early or on time through early payment discounts helps build trust and solidify supplier relationships. This fosters continued shipments of products and can lead to favorable treatment and support from suppliers in the future.

5. Positive Credit Score

Consistently paying invoices early or on time contributes to a healthy credit score for the buyer's business. This can enhance the buyer's reputation and creditworthiness, opening doors for future financial opportunities and favorable terms.

Creditworthiness and credit history play a crucial role in the implementation of the 2/10 Net 30 payment term.

Note

Suppliers may assess the creditworthiness of buyers by reviewing their financial statements, credit reports, payment history, and references.

Buyers can establish a positive credit reputation by maintaining a strong credit history, paying bills on time, managing debt responsibly, and providing financial references to demonstrate their reliability.

6. Reduction in Bad Debts

By incentivizing early collections, sellers offering these discount terms can potentially reduce bad debts. The prospect of receiving a discount encourages timely payments, minimizing the risk of non-payment or delinquency.

7. Attracting New Customers

The availability of early payment discount terms, such as 2\10 Net 30, can attract new customers who view the discount as an opportunity to reduce the overall price of products or services. This can help expand the customer base and drive sales growth.

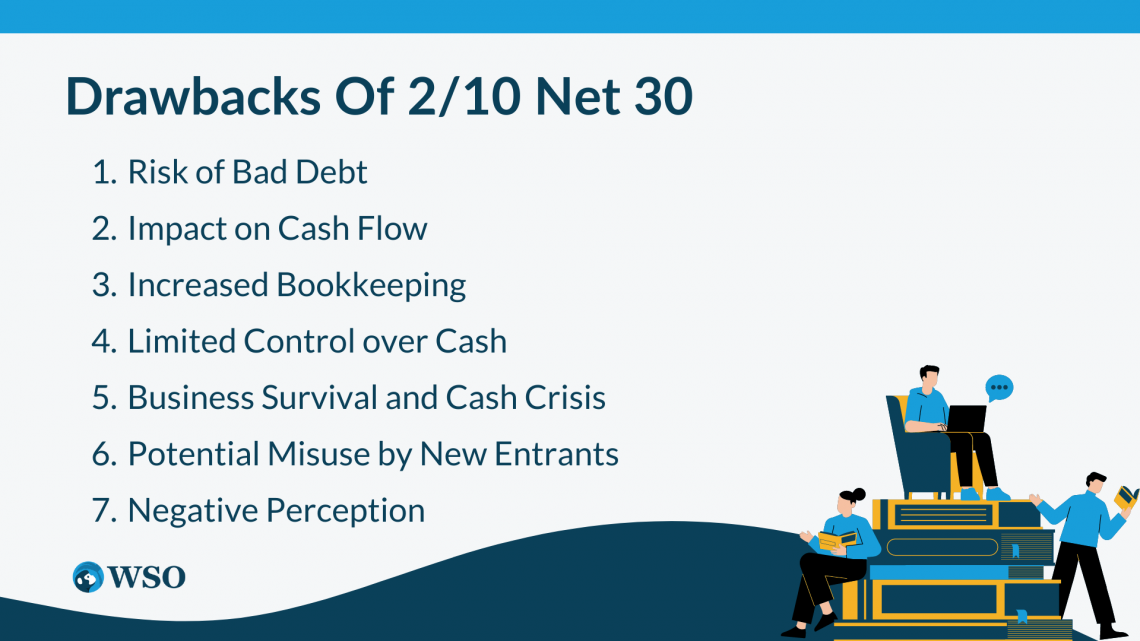

Drawbacks Of 2/10 Net 30

This arrangement presents certain drawbacks for buyers and sellers. By examining these factors, businesses can make informed decisions regarding the suitability of 2/10 Net 30 and its potential impact on their financial operations.

1. Risk of Bad Debt

Offering trade credit increases the risk of bad debt, as delayed cash transactions give buyers more time to default on their payment obligations. This can result in unpaid invoices and financial losses for the seller.

2. Impact on Cash Flow

Suppliers offering early payment discounts under the 2\10 Net 30 terms receive 2% less cash from credit sales. This reduction in immediate cash inflow can strain their liquidity and hinder their ability to meet financial obligations, potentially leading to cash flow challenges.

3. Increased Bookkeeping

Implementing 2-10 Net 30 or similar credit terms may require additional seller bookkeeping efforts. They need to accurately track and record customer discounts when the early payment discount is taken, adding complexity to their accounting processes.

4. Limited Control over Cash

Sellers granting longer credit periods with early payment discounts relinquish some control over their cash flow.

Note

Sellers rely on customers' willingness to pay in advance, thereby benefiting from discounts that may not always be able to meet a seller's financial needs and timing.

5. Business Survival and Cash Crisis

This credit arrangement can pose challenges for businesses during economic downturns or cash crises. The need to collect cash quickly through early payment discounts may strain the company's ability to manage its operations effectively.

6. Potential Misuse by New Entrants

New entrants in the market may use higher early payment discounts as a strategy to attract customers without fully considering the long-term impact. It may initially attract customers, but it is not sustainable or financially viable for a company in the long run.

7. Negative Perception

Offering 2-10 Net 30 or similar credit terms can create the impression that the business is facing liquidity issues or is eager to recover outstanding payments quickly.

This impression could harm the company's image and its relations with consumers, leading to a loss of confidence or future business opportunities.

By carefully assessing these disadvantages, businesses can make informed decisions about implementing credit terms like 2-10 Net 30 by carefully assessing these disadvantages.

Note

Businesses must ensure that offering or accepting the 2\10 Net 30 payment term complies with relevant legal requirements. This includes adhering to consumer protection laws, contract laws, and any applicable industry-specific regulations.

They must consider potential cash flow risks, resource constraints, and the impact on customer relationships. Balancing these considerations with the benefits of trade credit is crucial for maintaining financial stability and healthy customer partnerships.

Alternatives To 2/10 Net 30

In addition to the 2/10 Net 30 payment term, there are several other alternative payment terms and variations commonly used in the trade credit landscape. Here are a few examples:

A) 1/10 Net 30

This payment term offers a 1% discount if the invoice is paid within 10 days, with the full amount due within 30 days. It is similar to the 2-10 Net 30 term but provides a smaller early payment discount.

The advantage of this term is that it still incentivizes prompt payment, albeit with a lower discount. However, the disadvantage is that the discount may be less attractive to buyers compared to the 2% discount offered under the 2-10 Net 30 term.

B) 2/15 Net 40

This variation extends the payment period to 40 days instead of 30, but offers a slightly longer time window for taking advantage of the early payment discount. Buyers can receive a 2% discount if they pay within 15 days instead of the usual 10 days.

Note

This term allows buyers more time to settle the invoice while still offering an attractive discount. However, it may put additional strain on sellers' cash flow due to the extended payment period.

C) Net 60 or Net 90

These terms extend the payment period significantly, providing buyers with 60 or 90 days to pay the invoice in full without any early payment discount.

These longer payment terms can be beneficial for buyers who require more time to generate revenue or manage their cash flow. However, sellers may experience increased financial risk and potential cash flow constraints due to the longer waiting period for payment.

D) Progress Payments

Instead of a single payment upon completion or delivery, progress payments divide the total amount due into multiple installments based on project milestones or specific dates. This payment structure is commonly used in construction projects or long-term contracts.

It allows buyers to manage their cash flow by making payments over time, while sellers receive regular cash inflows throughout the project duration.

Note

Progress payments can be more administratively complex to track and manage.

When comparing these alternative payment terms, the advantages and disadvantages will vary depending on the specific needs and circumstances of the buyer and seller. Factors such as

- Cash flow requirements

- Financial stability

- Business relationships

These factors can influence the choice of payment terms.

Sellers need to carefully evaluate the impact on their cash flow, profitability, and risk exposure, while buyers should assess the available discounts, their ability to meet payment deadlines, and their cash flow constraints.

2/10 Net 30 FAQs

This payment method is primarily useful to businesses or individuals who have a high level of liquidity, i.e., more cash, so that they can make those credit payments early and get a discount.

The 2/10 Net 30 is a cash discount provided to the buyer by the seller.

The purpose is to incentivize early payment and provide a financial benefit to the buyer. It encourages prompt payment and helps the seller improve cash flow.

To calculate "2/10 net 30," follow these steps:

A. Identify the terms

The terms "2/10 net 30" mean that a 2% discount is offered if payment is made within 10 days, and the full amount is due within 30 days.

B. Determine the net amount

Start with the total invoice amount. Let's say the invoice's $1,000, for instance.

C. Calculate the discount

Apply the discount percentage to the net amount. The discount shall be 2 % of the amount of $1,000, which is $20 per invoice.

D. Determine the discounted amount

Subtract the discount from the net amount. In our example, the discounted amount would be $1,000 - $20 = $980.

E. Determine the due date

The full payment is due within 30 days of the invoice date.

In short, in case payment is made within 10 days of purchase, the customer can receive a 20 percent discount with this repayment period on an invoice amount of $1,000. Otherwise, within 30 days, the full amount of $1,000 will have to be paid.

or Want to Sign up with your social account?