Breakeven Number of Units

The point at which a company expects neither a profit nor a loss on the total number of products or services sold

What Is The Breakeven Number Of Units?

The break-even number of units is the point at which a company expects neither a profit nor a loss on the total number of products or services sold. The break-even number of teams allows a business to understand whether its effects will start to bring profit to the company.

The break-even number of units can be understood by determining the break-even point.

The break-even point (BEP) calculation and analysis determine the number of units of products or services a company needs to sell to break even its profit and loss.

The break-even point (BEP) can be represented by the number of units (quantity) a company has to sell or the dollar amount of sales (revenue) it has to generate to cover its total costs, which consist of both the company's fixed and variable costs.

Total profit and total loss at the break-even point are equal. As soon as the company exceeds the break-even point, the company can begin to generate a profit. However, if the company falls below the break-even point, it incurs losses.

The primary purpose of break-even analysis is to determine the minimum output that must be exceeded for a business to be profitable. The break-even analysis is an internal management cost accounting tool that provides a dynamic view of the relationships between cost, volume, and profit (CVP).

Calculating the break-even number of units can be valuable for all business areas because it allows a company to determine the units it needs to sell to make a profit.

The break-even point in economics, business, cost accounting, and financial planning is one of the simplest and most commonly used analytical tools.

The break-even point is not a general value and will vary from business to business. Some companies may have a higher BEP, and some may have a lower BEP. For instance, a company that sells televisions must sell 400 TVs annually to break even.

A company is selling below the break-even number of units and is therefore operating at a loss. To earn a profit and cover its fixed and variable costs, a company must consider increasing the number of TVs it sells yearly.

However, suppose the company believes it will not be able to sell the required number of units within a year. In that case, it may consider the following options:

1. Reducing fixed costs: This can be achieved through reduced labor costs, lower rents, or better account management

2. Reducing variable costs: This can be done by finding a new supplier that sells the TVs for a lower price.

Both options could lower the break-even point, so a company can sell fewer TVs than it used to and still pay its costs.

Key Takeaways

- Breakeven units define the point of no profit or loss, critical for business viability.

- Breakeven analysis, through BEP, helps determine sales quantity or revenue needed for profitability.

- Strategies like cost reduction or negotiation can keep a company above the breakeven point.

- BEP in sales dollars, an alternative calculation, offers a different financial insight.

Calculating the Break-even point (BEP) with the formula

Using the BEP formula, two popular methods are often used to calculate the break-even point. However, both ways require businesses to know their fixed, variable, and selling costs.

- The selling price is how much a company will charge consumers for a unit of product.

- Fixed costs are the same regardless of the number of units sold.

- Variable costs depend on the speed of production.

For example, rent of production space, insurance, and loan payments are fixed costs. It must be paid whether the company does not produce a single product or produces a million products in it.

However, the variable cost of product components is directly proportional to the number of units produced. This means that in each period before the company starts to generate a profit, it must cover all of its fixed costs.

The break-even point occurs when all fixed costs have been paid on the sale of the last unit. After that, the difference between the variable costs and the selling price is profit.

Calculating the Break-Even Point in Units

The formula for the break-even number of units is easy to calculate:

The break-even formula gives a company the number of units of products and services it must sell to generate enough revenue to cover its fixed costs.

To calculate this, a company first needs to find the contribution margin per unit, which is the selling price of products per unit minus the variable cost per unit.

Break-Even Point in Units Examples

Suppose a company wants to know the break-even point for its products.

The information needed to calculate a company's BEP in units can be found in its financial statements as follows:

- Selling price per unit

- Variable cost per unit

- Fixed and administration costs

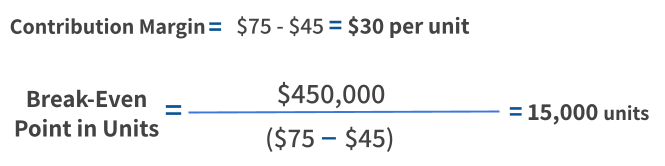

Assume that a company has $450,000 in fixed and administration costs. For 100,000 units of product produced, the selling price per unit is $75, and the variable manufacturing cost per unit is $45. A company's break-even point in quantity would be as follows:

This BEP calculation demonstrates that a company needs to sell exactly 15,000 units of a product to generate sufficient revenue to cover its fixed costs and all other costs associated with producing and marketing products.

Any sales over 15,000 units will begin to generate a profit for the company. Otherwise, sales below 15,000 units will start to cause losses.

Calculating the Break-Even Point in Sales Dollars

Another popular method often used to calculate BEP is the break-even calculation using the sales dollar (revenue) formula. For example, the procedure for break-even revenue is as follows:

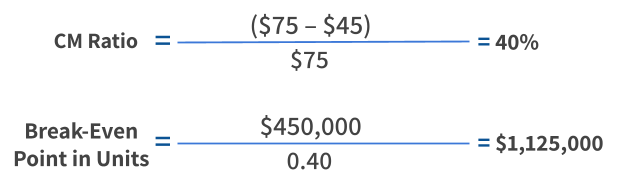

Calculating the break-even point in sales dollars involves dividing the fixed costs by the contribution margin ratio.

The contribution margin ratio (CM ratio), also known as the profit-to-volume ratio, is an expression of the contribution as a percentage of sales. To get this ratio, a company divides its contribution margin by its sales

Break-Even Point in Sales Dollars Examples

Assume a company wants to know the break-even point for its products. For example, a company has $450,000 in fixed and administration costs.

For 100,000 units of product produced, the selling price per unit is $75, and the variable manufacturing cost per unit is $45. Therefore, a company's break-even point in sales dollars would be as follows:

The company needs to make $1,125,000 of total product sales to cover its fixed costs and all other costs associated with producing and selling products.

Any revenue beyond the sales of $1,125,000 will begin to generate profit for the company. Otherwise, it will start to cause losses.

Researched and authored by Mumina Abdurakhmonova | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?