Goodwill Impairment Accounting

Refers to a charge when the carrying value of goodwill on financial statements surpasses its fair value

What Is Goodwill Impairment Accounting?

When the carrying value of goodwill on financial statements surpasses its fair value, corporations declare a goodwill impairment charge. Goodwill is documented in accounting once a corporation purchases assets and liabilities for a price more than their identified net value.

This occurs when the ability of purchased assets to produce cash flows deteriorates and the fair value of the goodwill falls below its book value.

The most well-known charge has been the $54.2 billion announced for the AOL Time Warner, Inc. acquisition in 2002. This was the greatest goodwill impairment loss ever disclosed by a firm at the time.

Goodwill is an intangible asset that compensates for the excess acquisition price of another firm based on proprietary or intellectual property, brand awareness, patents, and other intangible assets that are difficult to quantify.

Private corporations in the United States may choose to expense a portion of their goodwill on a straight-line approach over ten years or shorter, lowering the asset's recorded value. This is known as an amortization expenditure.

Businesses should consider whether an impairment adjustment to goodwill is required each fiscal year. This impairment assessment may have a major financial impact on the financial income statements since it will be recorded immediately as an expenditure.

Goodwill may be written off and erased from the balance sheet in specific instances.

Goodwill is not amortized under GAAP in the United States or IFRS in the European Union and abroad. Companies undertake an impairment test to reflect their worth from year to year appropriately. Impairment losses are functionally equivalent to amortization.

Key Takeaways

- Goodwill impairment accounting occurs when the carrying value of goodwill on financial statements exceeds its fair value, leading to the declaration of a goodwill impairment charge.

- Impairment tests for goodwill must be conducted annually or triggered by major incidents such as changes in the economy, competitive environment, legal issues, key personnel changes, diminishing cash flows, or declining market values of assets.

- Two widely employed methods for impairment testing are the income strategy (reducing future cash flows to present value) and the market strategy (assessing assets and debts of similar organizations).

How does Goodwill Impairment Accounting work?

Corporations report an earnings charge on their income statements when they uncover direct proof that the asset linked with the goodwill can no longer produce the expected financial outcomes at the time of acquisition.

Goodwill is an intangible asset that is frequently connected with the acquisition of one firm by another. Goodwill is recognized when the purchase price exceeds the net fair value of all identified intangible and tangible liabilities and assets taken during an acquisition.

Some examples of goodwill include the value of a company's brand name, a strong client base, good customer relations, good staff interactions, and trademarks or proprietary technologies.

Because many businesses buy other businesses and pay a price that exceeds the fair value of the acquired firm's identified assets and liabilities, the disparity between the purchase cost and the fair market value of capital assets is recorded as goodwill.

However, suppose unanticipated circumstances occur that reduce projected cash flows from purchased assets. In that case, the recorded goodwill may have a present fair market value less than what was initially booked, and the corporation must report impairment of goodwill.

A drop in the predicted cash flows connected with the purchased firm diminishes its fair value, resulting in impairment of goodwill. Once this impairment is reported, a loss is recognized in the current cycle.

It may be more problematic during recessions when cash flows from activities are more likely to fall. As a result, during recessions, goodwill charge-offs are exceptionally substantial.

Is goodwill impairment necessary?

Impairment tests must be performed annually or even when a major incident causes the fair market price of a goodwill asset to fall underneath the carrying value.

Some triggering factors that may lead to impairment include adverse changes in the overall state of the economy, a more competitive environment, legal ramifications, changes in key individuals, diminishing cash flows, and a situation in which present assets demonstrate a trend of declining market value.

There are two widely employed methods to test:

- First, the income strategy involves reducing expected future cash flows to their current value.

- The market strategy entails investigating and assessing the assets and debts of organizations in the same sector.

The amount that should be recorded as an impairment loss

Before testing for impairment, business assets should be carefully evaluated at their fair market price. If goodwill has been appraised and determined to be impaired, the whole impairment value must be written down as a loss immediately.

An impairment is shown on the income statement as a loss and a decline in the goodwill account.

The difference between the asset's present fair market price and its bearing value or amount (i.e., the amount equivalent to the asset's recorded cost) should be reported as a loss.

The highest impairment loss cannot surpass the carrying amount, meaning the asset's value cannot be decreased to zero or reported as a negative figure.

How to calculate Goodwill Impairment

The conventional computation of goodwill on the acquisition of a subsidiary is the excess of the fair value of the consideration provided by the parent over the parent's portion of the fair value of the net assets bought.

This strategy is known as the "proportional method." It solely considers goodwill related to the parent firm.

Another way of calculating goodwill on the acquisition of a subsidiary is to contrast the fair market value of the entire subsidiary (represented by the fair value of the parent's consideration and the fair value of the non-controlling interest).

It is calculated with the total fair value of the subsidiary's net assets. This strategy is known as the "gross or whole goodwill method."

It calculates the goodwill that applies to the whole subsidiary, i.e., the goodwill attributable to both the parents and the non-controlling interest (NCI).

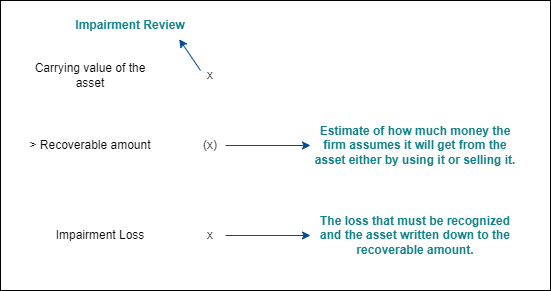

Basic Principles of Impairment

When the carrying amount of an asset exceeds the recoverable value, it is considered impaired. In turn, the recoverable amount is defined as the greater of the fair value minus the cost to sell and the value in use, where the value in use is the present value of future cash flows.

This is an example of an impairment review calculation.

The carrying amount is the amount at which the asset is presently reported in the financial accounts.

Examples of Goodwill Impairment

A corporation owns an asset with a carrying value of $800. There has been no revaluation of the asset. The asset is being evaluated for impairment. If the item were to be sold, it would fetch $610 plus $10 in selling charges. (The asset's fair value less selling expenses is thus $600.)

The present value of the future cash flows generated by the asset if it is retained is estimated to be $750. (This is the asset's value in usage.

Solution:

When the carrying amount of an asset exceeds the recoverable amount, the asset is considered impaired. The recoverable amount is the greater of the fair value minus expenses to sell and the value in use.

In this scenario, with a fair value minus cost to sell of only $600 and a value in use of $750, it meets the regulations and makes good sense to recover the greater of the two, i.e., $750.

| Categories | Amount |

|---|---|

| Asset Information (A) | $800 |

| Recoverable Amount (R) | $750 |

| Impairment Calculation (I) = (A - R) | $50 |

The impairment loss must be reported in order for the asset to be written down. There is no accounting policy or option in this regard.

If the recoverable amount exceeded the carrying amount, there would be no impairment loss to recognize, and there would be no accounting entry since there is no such thing as an impairment gain.

Example Of Goodwill Impairment In Accounting

Example 1

Here's a depiction of goodwill impairment and how it affects the balance sheet, income statement, and cash flow statement.

Firm AA pays $15 million for the assets of company DD, valuing its assets at $10 million and recording goodwill of $5 million on its balance sheet. After a year, firm AA evaluates its assets for impairment and discovers that company DD's revenue has been steadily falling.

As a result, the current value of firm DDs assets has decreased from $10 million to $7 million, representing a $3 million impairment to the assets. In addition, this reduces the value of the goodwill asset from $5 million to $2 million.

Impact on Balance Sheet

The first impact on the balance sheet is a reduction in goodwill from $5 million to $2 million.

Impact on Income Statement

A $3 million impairment charge is recorded, lowering net profits by $3 million.

The impairment charge is a non-cash item reclassified as cash from operations. The only change in cash flow would be if there was a tax effect, which is normally not the case because impairments are not tax-deductible.

Example 2

Borough pays $500 to purchase an 80 percent stake in High's equity shares. At that time, the fair value of High's net assets was $400. The NCI's fair value at that time (i.e., the fair value of High's shares not bought by Borough) was $100.

The proportional goodwill arising is computed by matching the consideration supplied by the parent with the stake acquired by the parent in the subsidiary's net assets, yielding the goodwill attributable to the parent.

| Category | Amount |

|---|---|

| Parent's cost of investment at the fair value of the consideration given | $500 |

| Less Parent's Share of Fair Value of Net Assets (80% x $400) | $320 |

| Goodwill Attributable to the Parent ($500-$320) | $180 |

considerations of Goodwill Impairment Accounting

A few changes were made to the process of Accounting over the years.

1. Accounting Standards for Goodwill Changes

During the accounting fraud of 2000–2001, goodwill impairment became a concern. As a result, many companies fraudulently inflated their balance sheets by declaring exorbitant valuations of goodwill, which were permitted to depreciate throughout their anticipated useful life.

Amortizing an intangible asset throughout its useful life reduces the amount of expenditure reported in any one year.

Previously, bull markets disregarded goodwill and similar manipulations, but accounting scandals and regulation changes required corporations to disclose goodwill at actual amounts.

Current accounting requirements need yearly assessments for impairment of goodwill, and goodwill is no longer amortized.

2. Amortization of Goodwill

For private enterprises, the work necessary to manage the goodwill asset is deemed high, and the utility of goodwill knowledge is likewise considered restricted. As a result, a private corporation can amortize goodwill in a straight-line fashion over a ten-year lifespan.

If the entity can establish that a shorter useful life is more suitable, this could amortize goodwill over a shorter term.

Goodwill amortization ultimately reduces the carrying value of an organization's goodwill asset to the point where goodwill impairment is highly improbable, eliminating the need to spend time on such assessments.

3. Annual Goodwill Impairment Test

Companies must examine their goodwill for impairments at least yearly at the reporting unit level, according to the US generally accepted accounting standards (GAAP).

Economic circumstances degradation, increasing competition, key employee loss, and regulatory action are all examples of events that may result in goodwill impairment.

During the exam, the definition of a reporting unit is critical; it is described as the business unit that a company's management monitors and assesses as a separate segment. Typically, reporting units reflect various business lines, geographic areas, or subsidiaries.

Goodwill Impairment Accounting FAQs

When the firm discovers that there is an impairment of goodwill as a consequence of periodic review, it can issue the record by debiting the goodwill impairment account and crediting the goodwill account.

If goodwill has deteriorated in accordance with the most recent goodwill impairment accounting, the amount of decline must be recorded on the balance sheet.

If the drop is severe, the corporation will record an impairment charge. This cost affects net income by the same amount for the year.

If the value of goodwill remains constant or rises, the amount entered remains constant. However, if goodwill falls, the amount may alter. If this is the case, the firm suffers from impairment of goodwill.

If goodwill has been appraised and determined to be impaired, the whole impairment amount must be written down as a loss immediately. An impairment is shown on the income statement as a loss and as a reduction in the goodwill account.

Impairment is a non-cash cost that is disclosed in the income statement's operational expenditures section.

On a company's balance sheet, goodwill is normally recorded as a capitalized unidentified intangible asset resulting from the acquisition of another company's net identifiable assets.

On the acquiring company's balance sheet, goodwill is represented as an intangible asset in the long-term assets section.

Goodwill depreciation cannot be claimed beginning in the fiscal year 2020-21, even if acquired. For computing capital gain, the purchase price should now just be the cost of the acquisition of goodwill.

or Want to Sign up with your social account?