Lower of Cost or Market (LCM)

An approach specifying when evaluating a company's inventory, inventory should be reflected on the balance sheet either at its historical cost or the market value.

What Is the Lower of Cost or Market (LCM) Method?

The lower of cost or market (LCM) approach specifies that when evaluating a company’s inventory, it should be reflected on the balance sheet either at its historical cost or the market value.

The historical cost is the price at which the company's inventory was acquired. According to the LCM rule, a business shall record the cost of inventory at whichever cost is less: the initial cost or its market price.

The idea of the lower cost or market was initially included in typical accounting methods in England throughout the nineteenth century.

The lower of cost or market was regarded as fair since assets were valued on a going-concern basis rather than the cost at which they were acquired.

The academic accountants struggled to accept the idea since it lacked clarity. However, despite the criticism, the lowest cost or market swiftly gained traction in practice and, by the early 20th century, was acknowledged as the most generally utilized approach for inventory valuation, according to the special committee report on cooperation with stock exchanges.

LCM survived despite lacking accounting logic because of its conservative approach to valuation and because it addressed the opposing principles of cost value.

Due to its conservative nature, users may value the inventory at the price when it is conservative, and users may value the inventory at the price it might be sold.

Key Takeaways

- The Lower of Cost or Market (LCM) method is an inventory valuation approach that determines the value of inventory on a company's balance sheet by considering the lower of its historical cost or its current market value.

- Companies following the U.S. Generally Accepted Accounting Principles (GAAP) are obligated to use the LCM approach to value their inventory.

- The LCM approach is a fundamental concept within GAAP, emphasizing the importance of considering both historical cost and market value when valuing inventory.

- The concept overlooks time, making profit appear overstated or understated.

- The concept follows periodicity and conservative accounting concepts, absorbs more expensive products, helps avoid additional taxes, and may serve as security for short-term loans.

Understanding Inventory

Both the raw materials required to make products and the products on hand for purchase are included in the inventory. On a company's balance sheet, it is categorized as a current asset.

The three types of inventory include

- Raw materials

- Work-in-progress (WIP), and

- Finished goods

Inventory Turnover is one of the essential assets a business can have because it is one of the significant ways to generate money and profits for the company stockholders.

Inventory is a necessary valuable asset for every firm. It is the collection of finished or raw materials that a business maintains on board for everyday business activities.

The inventory is categorized into :

- Raw materials (any materials needed to produce finished goods)

- Work-in-progress (WIP)

- Lastly, finished goods

Inventory is listed as a current asset in a company’s financial statement (balance sheet) and acts as a link between product delivery and manufacturing, as we discussed earlier.

The carrying cost of material in inventory is transferred to the Cost of Goods Sold (COGS) segment of the profit and loss statement or Income statement.

Why Is the Lower Cost or Market Method Used?

Companies can declare losses using this technique by depreciating the value of the impacted inventory items.

Most of the time, when a business retains the stock for a longer period, the LCM rule applies. However, remember that the above circumstances typically develop over time.

When applying LCM, there is a clear criterion that you must observe. There is neither a gain nor a loss recorded when the cost and the market value are identical.

This value could be adjusted to the market value, calculated by weighing the cost of replacing the inventory, the difference between the item's net realizable value and its normal profit, and the item's net realizable value.

On the balance sheet, the amount by which the inventory item was written down is recorded under the cost of goods sold.

The GAAP regulations utilized in domestic and international trade include the LCM approach. As a result, almost all assets are valued at their purchase cost when they first enter the accounting system.

Following reporting periods, GAAP specifies numerous possible techniques for adjusting asset values.

What Do Generally Accepted Accounting Principles (GAAP) Mean?

A unified set of accounting guidelines, methods, and standards known as generally accepted accounting principles (GAAP) were released by the Financial Accounting Standards Board (FASB).

10 GAAP Principles:

- Principle of Regularity: GAAP-compliant accountants carefully follow the rules and regulations that have been set forth.

- Principle of Consistency: Throughout the financial reporting process, consistent standards are being used.

- Principle of Sincerity: Accuracy and objectivity are values that GAAP-compliant accountants maintain.

- Principle of Permanence of Methods: All financial reports are prepared using standardized procedures.

- Principle of Non-Compensation: Positive or unfavorable parts of an organization's performance are completely disclosed with no hope of debt forgiveness.

- Principle of Prudence: Speculation does not impact how financial data is reported.

- Principle of Continuity: Asset values entail the assumption that business as usual will continue.

- Principle of Periodicity: Revenue reporting is broken down into conventional accounting units, such as fiscal quarters or fiscal years.

- Principle of Materiality: The organization's financial position is thoroughly disclosed in financial reports.

- Principle of the Best Faith Possible: It is considered that everyone involved is being sincere.

When their accountants put together a public company's financial statements, they must adhere to GAAP in the United States.

Points to be noted:

- The FASB's accounting regulations, known as GAAP, are what U.S. businesses must adhere to when creating their financial statements.

- The goal of GAAP is to make financial information more understandable, consistent, and comparable to other financial information.

- The non-GAAP financial reporting technique, pro forma accounting, can be compared with GAAP.

- The main objective of GAAP is to guarantee the accuracy, consistency, and comparability of financial accounts for businesses.

- Most other jurisdictions utilize IFRS standards, while GAAP is mostly used in the United States.

Utilizing the Rule of Lower of Cost or Market

The rule often applies to firms whose products commenced to date.

The rule is also applicable to products that lose value as an outcome of a declining market price, which is defined as the existing cost of replacing outdated stock if the market price is equal to or less than the net realizable value, which is essentially the expected selling price minus removal costs.

Other Aspects in Applying the Rule of the Lower of Cost or Market

- Category analysis: The lower cost or market rule normally relates to a single product, but it can also do so for a wide range of similar products.

- Hedges: When a fair value hedge secures inventory, the impacts of the hedge should be applied to the cost of the inventory, potentially eliminating the need for LCM adjustments.

- Recovery from the last-in, first-out (LIFO) layer: During interim periods, one may avoid writing down the LCM if there is reason to believe that the inventory will be replenished by the end of the year.

- Raw materials: If the final products are expected to sell at or above their costs, one shouldn't write down the costs of the raw materials.

- Recovery: A write-down to the LCM may be avoided if strong evidence is that market prices will rise before inventory is sold.

- Sales incentives: If future-expiring sales incentives are still in effect for certain products, there may be potential LCM issues.

Inventory Valuation at the Lower of Cost or Market (LCM)

The inventory that the company purchased at cost is contrasted with that inventory's market value in the lower cost or market inventory valuation approach.

The market value of inventory is its replacement cost or how much it would cost to buy a similar amount of inventory on the open market. To comprehend replacement value, there are a few restrictions to keep in mind:

- The replacement cost cannot exceed the net realizable value (NRV)

- A normal profit margin subtracted from the net realizable value ensures that the replacement cost cannot be lower.

Net Realizable Value (NRV)

The sale price of the inventory, less any expenses required to get it ready for sale, is the inventory's net realizable value.

The average difference between the cost and sale price of the inventory represents a typical profit margin. Such replacement cost limitations set a replacement cost floor and cap.

Under GAAP and International Financing Reporting Standards (IFRS), the net realizable value is a crucial metric in inventory accounting. Because it prevents the overvaluation of assets, NRV computation is crucial.

The steps of valuing inventory at a lower cost or market are as follows:

- Find out the inventory's previous purchase cost first.

- Next, figure out the inventory replacement cost. The market value of inventories is the same.

- Compared to net realizable value and net realizable value less a typical profit margin, replacement cost:

- We will utilize the net realizable value as the replacement cost if it is higher than the replacement cost.

- Similarly, if the replacement cost is less than the net realizable value less a normal profit margin, then the net realizable value less a profit margin will be used as the replacement cost.

- Additionally, we can utilize the same replacement cost if it falls between NRV and NRV less than the normal profit margin.

- Replacement costs need to be matched with inventory costs. Also, a write-down is not necessary if the historical cost of the inventory is less than the replacement cost.

- If the cost of inventory is greater than the replacement cost, writing down inventory to replacement cost is necessary.

Examples Of Lower Of Cost Or Market (LCM)

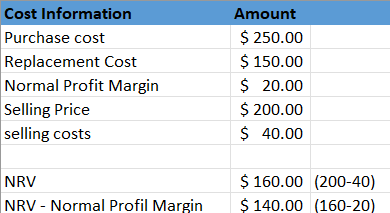

XYZ company sells wallets. Cost information regarding the inventory of XYZ company is presented below:

Replacement cost, in this instance, is situated between net realizable value and net realizable value less a typical profit margin. Therefore, $150 is taken as the replacement cost. Therefore, compared to the $250 purchase price, a $100 write-down is required.

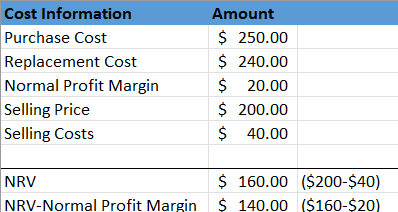

XYZ company sells wallets. Cost information regarding the inventory of XYZ company is presented below:

The replacement cost, in this instance, is more than the net realizable value. Therefore, $160 was used as the replacement cost. Therefore, compared to the $250 purchase price, a $90 write-down is required.

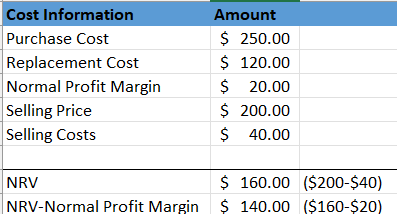

XYZ company sells wallets. Cost information regarding the inventory of XYZ company is presented below:

Replacement cost, in this instance, is less than net realizable value, less a normal profit margin. Therefore, $140 was used as the replacement cost. Compared to the $250 purchase price, a $110 write-down is required.

Accounting for the Lower Cost or Margin (LCM)

Companies that follow U.S. GAAP must value their inventory using the lower-of-cost or market (LCM) technique. Market value is the cost to replace inventory, whereas cost is the price paid for it at the time of purchase.

If the size of a write-down brought on by the lower of cost or market analysis is irrelevant, charge the expense to the cost of products sold; this is typically the case.

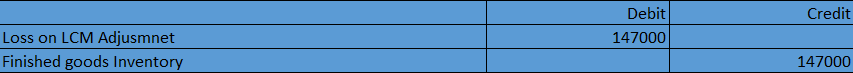

If the loss is significant, you may want to keep track of it in another account, such as "Loss on LCM adjustment," to report on this information separately (especially if such losses occur frequently).

The journal entry would be as follows if the data from the prescriptive were used:

LCM: Advantages, Limitations, and a few noteworthy points

The main concern with the lower of cost or market rule is that it is inconsistent in that losses from retaining inventory are recorded while gains are not. As a result, it generally understates assets, and if the estimated reductions do not occur, it might boost future income.

Additionally, calculating market value—even lower—does not reveal how much cash is locked up in inventory. Therefore, you cannot determine how much your goods could sell in the present market by using cash value because it is lower.

Advantages

The following are a few benefits of lower of costs or market:

- First, the periodicity and conservative accounting concepts are followed by lower costs.

- It makes it possible to absorb more expensive products.

- An organization might avoid paying additional taxes by cutting costs.

- The value of an inventory item may serve as security for short-term loans.

- Inventory valuation might also be helpful when a business is being sold off.

Limitations

Some of the limitations of LCM are as follows:

- Lower of cost or market overlooks the time, which results in overstated or understated profit.

- Selecting the appropriate valuation method is a difficult procedure, no matter what.

- The auditors and regulatory bodies must be notified of any changes to the valuation methodology.

- The operations of stock counting and physical stock verification take a lot of time.

Noteworthy Points

- You must determine whether a change is short or long-term.

- Inventory value changes due to the valuation method should be consistent with previous years.

- Any value loss must be immediately justified.

- Any gain should not be recorded unless achieved or is certain to be realized.

Conclusion

According to the lower-of-cost-or-market (LCM) approach of inventory costing, inventory is valued at the lesser of its original cost and its current market (replacement) cost.

The term "cost" refers to the historical cost of inventory as calculated using the weighted-average inventory technique, particular identification, FIFO, or LIFO.

The market typically refers to the replacement cost of a product in the typical purchasing amount. The fundamental premise of the LCM approach is that if an item's purchase price drops, so will its selling price. Accounting has traditionally embraced the LCM approach.

Inventory valuation is done using the lower-of-cost or market (LCM) technique. It aids in conveying an accurate and fair perspective of an organization's financial accounts to all stakeholders.

This accounting standard policy should be strictly followed to prevent any inconsistency in the financial statement audit process and reporting.

Researched & authored by Jeason Jose | Linkedin

Reviewed & Edited by Raghav Dharmarajan

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?