Pension Accounting

Yearly pension expenditure computation and financial statement disclosure of a pension plan's assets and liabilities.

What Is Pension Accounting?

Yearly pension expenditure computation and financial statement disclosure of a pension plan's assets and liabilities.

In the United States, the Financial Accounting Standards Board (FASB) oversees the application of generally accepted accounting principles (GAAP) to pension accounting.

The pensions promised to employees subject a company that sponsors a defined benefit pension plan to the related investment risk. If the plan is in deficit, it might substantially impact its worth.

The numbers that may influence a value are the subject of this essay.

Although a thorough understanding of pension accounting is optional for a valuation professional, it is critical to understand the "what and where" of the primary pension figures in a set of financials.

The cost of a pension plan is sometimes referred to as both the cash contribution and the pension expenditure calculations - one as a cash outlay and the other as a decrease (or increase) in corporate earnings.

Both are calculated using similar ideas, but the computation procedures are vastly different. Pension plan formulae link members' retirement benefits to their income and/or service with the company.

Based on their specific company demands and the needs of their workers, each employer chooses how to reflect remuneration and service.

Deferred compensation, such as pensions, is a type of deferred compensation. Participants exchange today's salary for future pensions.

The cost of the deferred pay must be recognized when it is earned, according to both the pension funding rules and the pension accounting rules.

An actuary uses the pension formula to determine how to represent the plan's cost throughout each participant's working life. Three main principles are employed:

- Every year, active participants receive new rewards. This is referred to as the typical cost by actuaries. The plan's cash and accounting costs are always included in the typical cost.

- Actuaries must consider the difference between the actuarial liabilities and the assets, which is the worth of benefits previously received. When the actuarial liabilities exceed the assets, it is referred to as an unfunded liability.

- When the actuarial liabilities are smaller than the assets, there is an asset surplus, which lowers costs. Actuaries use assumptions to calculate normal costs and actuarial liabilities.

Because we have markets to assess the equities and bond investments held in the pension trust, measuring assets is quite simple. However, there is no freely traded market for pension obligations.

The IRS and the FASB provide highly explicit and often contradictory guidelines to actuaries and plan sponsors on how assumptions are chosen, who picks them, and what conditions they must represent.

Key Takeaways

- The FASB oversees GAAP application to pension accounting in the US, with a focus on understanding key pension figures in financials.

- Defined benefit pension plans expose companies to investment risk, potentially impacting their value if deficits arise.

- Pension costs include service cost, interest cost, actual return on plan assets, amortization of prior service costs, and gains/losses, contributing to the net periodic pension cost.

- Actuaries assess actuarial liabilities against plan assets, leading to unfunded liabilities or asset surplus based on the comparison.

- Pension plans include defined contribution plans with investment risk for employees and defined benefit plans determined by the employer, which offer lifetime income based on factors like service and compensation.

The Types of Pension Costs

Several charges connected with defined benefit plans may look enigmatic at first.

The following table is a list of the costs that add up to the net periodic pension cost recognized in each accounting period:

| Cost | Explanation |

|---|---|

| + Service cost | The actuarial present value of benefits for services provided during the current reporting period. The cost includes a projection of future employee salary levels, which will be used to calculate benefit payments. |

| + Interest cost | The interest on the estimated benefit obligation is calculated in this way. It is a monetary item, not a cost associated with employee remuneration. |

| + Actual return on plan assets | Adjusted for contributions and benefit payments, this is the difference between the fair values of beginning and ending plan assets. It is a monetary item, not a cost associated with employee remuneration. |

| + Amortization of prior service costs | When an employer amends a plan, it may include benefit increases based on services provided by workers in previous periods. If this is the case, the cost of the increased benefits is amortized over the periods in which those workers who were active on the amendment date are projected to receive benefits. |

| + Gain or loss | This is the profit or loss arising from a change in the value of a projected benefit obligation due to changes in assumptions or plan assets. |

| = Net periodic pension cost |

Accounting for Each Type of Pension Cost

The applicable defined benefit plan costs are accounted for in the table of net periodic pension costs recognized in each accounting period (see table above).

1. Service Cost

The incremental change in the actuarial present value of benefits connected to services performed during the current accounting period is the amount of service cost recognized in profits in each quarter.

2. Interest Cost

The interest expense for the expected benefit obligation is recorded when incurred.

3. Amortization of Prior Service Costs

-

On the modification date, these expenditures are charged to other comprehensive income and subsequently amortized to earnings over time.

-

The amount to be amortized is calculated by allocating an equal amount of expenditure to each future term of service for each employee eligible for benefits.

-

If most employees are idle, the amortization period is the employees' remaining life expectancy.

4. Prior Service Credits

-

If a plan modification affects plan benefits, report the reduction in other comprehensive income on the amendment date.

-

This amount is then subtracted from any residual prior service costs in cumulative other comprehensive income.

-

Any remaining credit is then amortized using the same technique as previously mentioned for earlier service expenses.

5. Gains and Losses

-

If the strategy is regularly used, gains and losses can be seen immediately.

-

If someone doesn't want to account for them right away, it could account for them as changes in other comprehensive income as they happen.

6. Recognize the difference in other comprehensive income in the period in which it occurs, and amortize it to profits using the following calculation:

-

Include the gain or loss in net pension cost for any year in which the gain or loss is higher than 10% of the larger the projected benefit obligation or the market-related value of plan assets as of the beginning of that year.

-

If the test is positive, divide the excess by the average remaining service time of those active employees eligible for benefits.

-

If most plan members are inactive, amortize the surplus over their remaining lives.

Pension accounting examples

There are several examples below if anyone wants to learn more about how pension accounting works.

A) Example 1

-

In March 2019, the province urged every employer to create a pension investment plan for its employees due to a new rule in the country about pension accounting.

-

In April of this year, Devin Company launched a pension investing plan.

-

The entire value of the plan's assets and liabilities was $16 million at the end of the year's income statement in 2019.

-

The pension expenditures increased to $19 million in May 2020, requiring the company to contribute $4 million to the investment plan.

-

By the end of 2020, the overall assets and pension obligations had grown to $19 million.

-

A credit to the account, denoted as CR, is a rise in liabilities or shareholders' equity. A debit is a decrease in liabilities, denoted by the letter DR.

-

This is how anyone computes pension accounting to keep track of how much their company contributed to their pension:

| Dr | Cr | |

|---|---|---|

| Defined Benefit Pension Liability | 16,000,000 | |

| Cash | 16,000,000 |

To register a pension expenditure, follow these steps:

| Dr | Cr | |

|---|---|---|

| Pension expense | 19,000,000 | |

| Defined Benefit Pension Liability | 19,000,000 |

To put a reasonable value on pension liabilities, do the following:

| Dr | Cr | |

|---|---|---|

| Other comprehensive income (OCI) | 1,000,000 | |

| Net defined benefit liabilities | 1,000,000 |

B) Example 2

-

Georgetown and Sons Ltd. has a defined benefit pension plan with $5.6 million in total assets and liabilities as of December 2018.

-

In 2019, the firm contributed $2 million to the pension plan, bringing the total pension expenditure to $7 million.

-

At the end of 2019, the fair value of the pension assets and liabilities was $7 million.

To record the company's pension contribution:

| Dr | Cr | |

|---|---|---|

| Defined Benefit Pension Liability | 2,000,000 | |

| Cash | 2,000,000 |

To record pension expenditure, use the following code:

| Dr | Cr | |

|---|---|---|

| Pension expense | 7,000,000 | |

| Defined Benefit Pension Liability | 7,000,000 |

To put a reasonable value on pension liabilities, do the following:

| Dr | Cr | |

|---|---|---|

| Other comprehensive income (OCI) | 600,000 | |

| Net defined benefit liabilities | 600,000 |

Types of pensions

Employees can choose from the following types of pension plans:

A) Plan with a predetermined contribution amount

-

Someone knows how much he pays into this plan, but he can't predict how much money he will have once he retires.

-

For example, suppose someone's monthly pension is $15, and he contributed $5,675 into his pension fund throughout his career.

-

Because of investments, the amount someone gets may be less or more than the entire amount.

-

Anyone's employer usually contributes a certain amount to their pension plan each year. The pension firm then invests its defined contribution money in one or more financial products on its behalf.

-

Someone might be able to influence their investing decisions. The performance of his investment determines the amount that he receives when he retires.

-

The defined contribution plan is less popular than the defined benefit plan since it exposes employees to investment risk.

B) Plan with Defined Benefits

-

Unlike a defined contribution plan, this pension plan is determined by the amount provided by the employer.

-

This pension plan provides several benefits to employees. A defined benefit plan can provide anyone with income for the rest of their life.

-

Someone's compensation, years of service, and even their age are all factors in determining their defined benefit pension plan.

C) Someone's pension formula may change somewhat; however, it may look something like this:

-

2% x Average Annual Pensionable Earnings Over the Previous 5 Years x Years Pensionable Service

-

Example: 2% of $200,000 multiplied by 25 years equals $100,000.

On the other hand, a defined benefit retirement plan involves the employer taking investment risk and ensuring that the investments have enough money to sustain the pension distributions.

Complex actuarial projections and insurance for assurances are usually required in these projects, resulting in higher administrative expenses.

IFRS vs. GAAP

Changes in equity can be made directly in the statement of comprehensive income or indirectly through the income statement/profit and loss account.

Only the items in the income statement/profit and loss account influence reported earnings; hence this difference is critical.

The income statement is influenced in the following way.

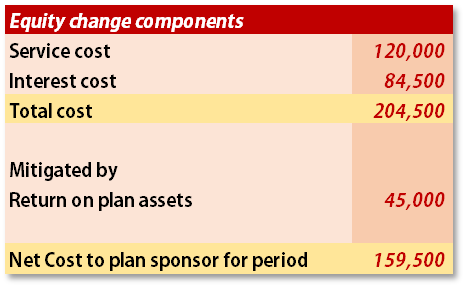

A) Example 1

In actuality, plan assets are impacted when the actual return differs from the predicted; this is known as an experience gain or loss, and changes to the actuary's assumptions influence plan obligations; this is known as actuarial gains and losses.

When it comes to the handling of experience and actuarial gains and losses, there are three options.

While US GAAP allows for two different approaches, IFRS only allows for one.

Comparing the reported earnings of three organizations (as in comparables valuation) using each approach indicates that the earnings are not comparable without "cleaning up" the pension expense statistics.

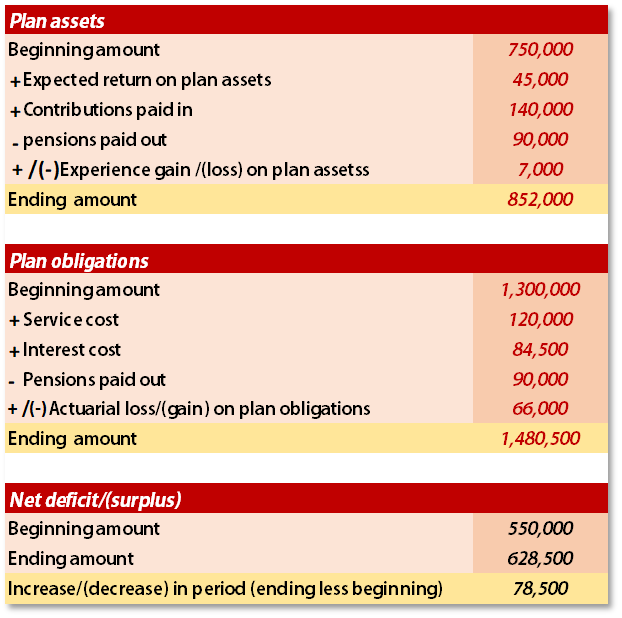

B) Example 2

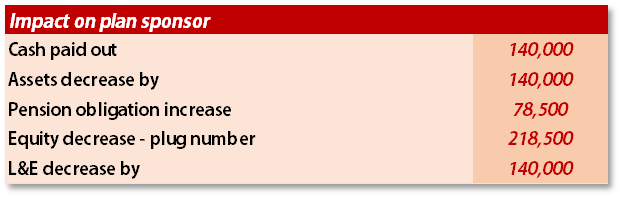

This example incorporates these concerns and yields the following outcome:

On the balance sheet, the engineering is the same as in Example 1:

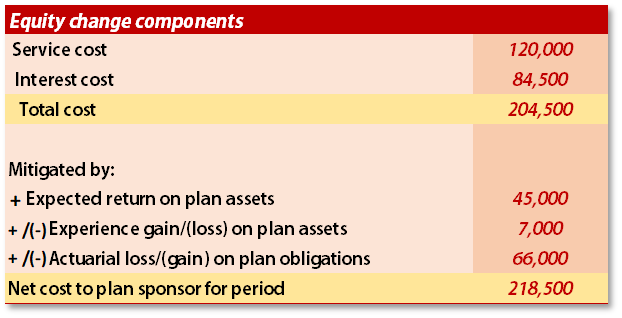

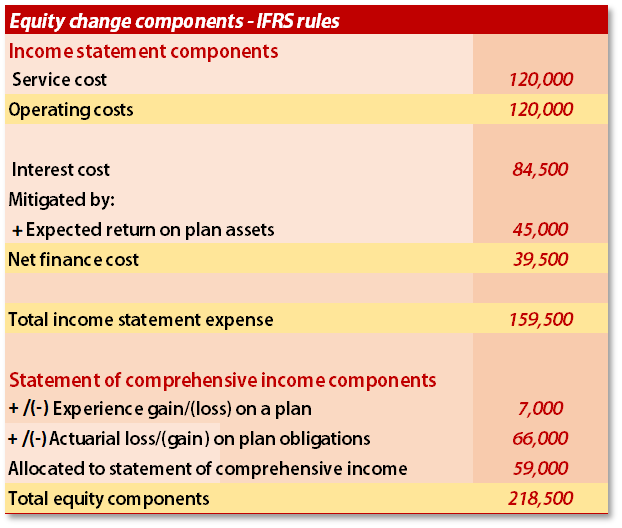

The equity change components have become more sophisticated, incorporating both an experience gain on plan assets and an actuarial loss on plan liabilities. The following is a summary of the equity changes:

The question is whether these line items should be entered into equity through the income statement/profit and loss account or the statement of comprehensive income.

The income statement/profit and loss account, as well as the statement of comprehensive income, are affected by IFRS in the following ways:

Because the International Financial Reporting Standards (IFRS) do not indicate which line items in the income statement/profit and loss account are impacted, care should be taken when "cleaning up" for pensions when calculating EBIT or EBITDA.

The 120,000 service cost is recorded as an operational item, while the remaining things are included as a net interest expense of 39,500 (84,500 – 45,000).

Many businesses report this way, while others assign whole income statement expenses to operate line items.

The actuarial loss on the liabilities and the experience gained on plan assets influence the statement of comprehensive income. However, under IFRS, these items do not influence the income statement or profit and loss account.

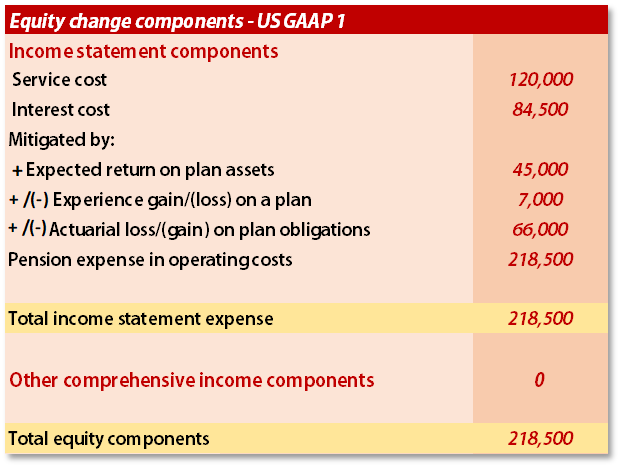

The income statement/profit and loss account, as well as OCI, are affected by US GAAP – FULL METHOD as follows:

The operational expenses in this example incorporate all period changes. The actuarial losses / (gains) and experience gains / (losses) are likely to be erratic from period to period, distorting results and necessitating "clean up" for any value estimate.

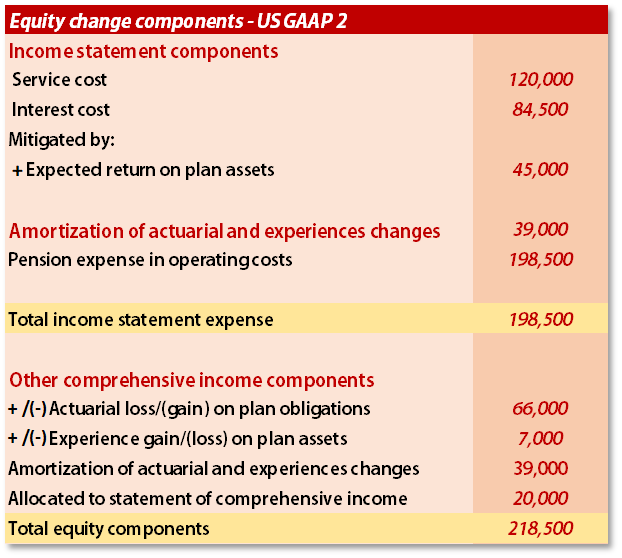

The actuarial gains/losses, net of any experience adjustments to plan assets, are allocated immediately into other comprehensive income and subsequently amortized into the income statement/profit and loss account over time in the US.

GAAP - AMORTIZATION METHOD. Assume that 39,000 has been amortized in the current period. The income statement/profit and loss account, as well as the statement of comprehensive income, are influenced in the following ways:

Summary

Pension obligations can significantly affect a company's worth, and understanding the intricacies of pension figures in financial statements is crucial for valuation professionals.

Pension plans often tie retirement benefits to an employee's salary and tenure with the company. Deferred pensions are deferred compensation, meaning participants forego their current salary for future pension benefits.

Actuaries play a vital role in pension accounting, determining costs based on three primary principles: yearly rewards for active participants, the difference between actuarial liabilities and assets, and the assumptions made for normal costs and liabilities.

The discrepancies between the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP) in the US underscore the importance of understanding pension accounting nuances when comparing businesses' financials across different reporting systems.

The following is the structure of the income statement/profit and loss account:

| Service cost / new pensions accrued | Will always be included in operating costs |

|---|---|

| + Interest cost | According to US GAAP, operating costs are always included, but under IFRS, financial costs are also included |

| – Expected return on assets | Operating costs are always reported under US GAAP, but financial costs can be reported under IFRS |

| + Actuarial loss net of experience gain on plan assets | Not expensed under IFRS. Deductible or amortized under US GAAP. |

| Net pension expense |

The following factor impacts comprehensive income:

| + Actuarial loss net of experience gain on plan assets | That is recorded in full under IFRS. Excluded from OCI in full or included and amortized over time under US GAAP |

| Comprehensive income impact |

or Want to Sign up with your social account?