Types of Liabilities

Based on their maturity, liabilities can be classified as either short-term or long-term

What Are The Types of Liabilities?

Liabilities are the company's obligations, and the company is supposed to pay back all of its liabilities/obligations. Based on their maturity, liabilities can be classified as either short-term or long-term.

Short-term liabilities, also known as current liabilities, are obligations due for payment within the company's short run (usually one year), while long-term liabilities, also known as noncurrent liabilities, are obligations payable for the long run (after one year).

The nature or duration of liabilities affects the company's liquidity as short-term liabilities are to be paid sooner.

Maintaining high liquidity is crucial for covering short-term liabilities, ensuring that a company has sufficient cash and assets that can be readily converted into cash. In contrast, long-term liabilities could be paid after one year and require low liquidity.

If the company pays off its liabilities on time without any delay, then such a company would be considered safe and less risky by creditors/lenders. Liabilities appear on the balance sheet, and current and noncurrent liabilities are categorized.

Key Takeaways

- Liabilities are categorized based on their maturity into short-term (current) and long-term (non-current) liabilities.

- Current liabilities, due within one year, require companies to maintain liquidity for timely payment. Examples include accounts payable, short-term notes payable, and income tax payable.

- These obligations extend beyond one year, with higher liquidity less of a concern. Examples include long-term debt, deferred tax liabilities, and pension benefit obligations.

- Various formulas help calculate different liabilities, such as accounts payable, short-term notes payable, interest payable, and accrued expenses, aiding in financial analysis.

- Liabilities influence financial metrics like working capital, debt ratios, interest payments, and profitability, highlighting their significance in financial management and decision-making.

Current Liabilities

Current liabilities are obligations due for payment within one year from the balance sheet date, requiring the company to maintain sufficient liquidity to cover these obligations.

Therefore, the company should invest in liquid assets such as money market instruments, marketable securities, and other current assets to pay these obligations. Some of the current liabilities that can be found in the balance sheet of most of the companies are:

- Accounts payable: When the company buys goods or services on credit and needs to pay its vendors/suppliers for their credit purchases in a short period, this is called accounts payable

- Short-term notes payable: Liability or obligation of the company to pay principal and interest on borrowed sum within a year is referred to as short-term notes payable

- Interest payable: The amount of interest expense accrued to a date that has not been paid is called interest payable

- Income tax payable: The income tax payable is the tax amount the company is expected to pay in a year

- Accrued expenses: Accrued expenses are recorded but not yet paid and, therefore, represent a liability for the company

- Short-term debt: Short-term debt is a portion of a loan to be paid within a year. Therefore, it is the loan or debt paid during or within one year

- Other current liabilities: Other current liabilities include all other current liabilities except those listed above. Other current liabilities are also to be repaid within a year

Non-Current Liabilities

Non-current liabilities are of longer duration, and liquidity is not a concern for the company. However, the amount of long-term liabilities that a company has to pay is generally higher than the payments on short-term liabilities.

Some of the non-current liabilities found in most companies' balance sheets are:

- Long-term debt: Long-term debt is the amount of money the company borrowed (Debt/Loan) and should repay that sum and interest to the lender. Long-term debt can be paid after a year and has a long duration, for example, between 3 - 30 years

- Deferred tax liabilities: Deferred tax liabilities arise when taxes are deferred due to temporary differences between accounting and tax rules, leading to recognition of taxes in future periods

- Long-term lease obligations: Long-term lease obligations are liabilities related to paying rent for renting office spaces or any other asset/assets.

- Pension benefit obligation: A pension benefit obligation is a long-term liability created for the employer and is based on the present value of benefits promised to employees in the future. For example, the employer reports this liability if a pension plan is underfunded

- Bonds payable: Bonds payable represent the money the company owes to bondholders after issuing bonds. Bonds can be issued at par, premium, or a discount to their face value

Note

The bond issuer (company) must pay a coupon (interest) based on coupon rate and face value. At maturity, the issuer must pay the final coupon plus the principal.

- Debentures: Debentures are long-term debts not secured by any collateral. Debentures are viewed as riskier by lenders as it is an uncollateralized loan. If a loan has collateral and the borrower defaults, the lender can claim collateral security/asset and safeguard themselves from risks and losses

- Other non-current liabilities: Other non-current liabilities are long-term obligations other than those listed above

Calculating Current and Non-current Liabilities

Here are some examples to help you calculate current and non-current liabilities.

Example 1

To calculate accounts payable, first, calculate days payable outstanding (DPO) and cost of goods sold

DPO = Accounts Payable/ Cost of goods sold * 365 days

Accounts payable = (DPO/365 days) * Cost of goods sold

| Days payable outstanding (DPO) | 85 days |

| Cost of goods sold | $175,000 |

Accounts payable = (85/365) * 175,000 = $40,753

Example 2

The formula for calculating short-term notes payables is:

Short-term notes payables = Interest amount + Principal

Short-term notes payable interest amount = Interest rate * Principal

Here, the Principal is the sum borrowed or the amount of money borrowed.

If the rate of interest is 10% and the Principal is equal to $100000, then the interest amount of short-term notes payable will be:

= Interest rate * Principal

= 0.1 * $100,000 = $10,000

And, therefore,

Short-term notes payable = $10,000 + $100,000 = $110,000

Example 3

The formula for calculating Interest Payable is:

Interest Payable = Interest rate * Principal

Where Principal = Sum borrowed or loan amount

If the Interest rate is 7.5% and the Principal is $56900, then

Interest Payable = 0.075 * $56,900 = $4268

Example 4

The formula for calculating Income tax payable is:

Income tax payable = Taxable income * Tax rate

If the company has a taxable income of $5432790 and the tax rate is equal to 35%, then

Income tax payable = $5,432,790 * 0.35 = $1,901,477

Example 5

The formula for calculating Accrued Expenses is as follows:

Accrued Expenses = Payroll + Utility bills + Rent + Accrued interest + Tax

| Payroll | $90,000 |

| Utility bills | $85,000 |

| Rent | $457,000 |

| Accrued interest | $50,000 |

| Tax | $7,500 |

Accrued Expenses = Payroll + Utility bills + Rent + Accrued interest + Tax

= $90,000 + $85,000 + $457,000 + $50,000 + $7,500 = $689,500

Example 6

The formula for calculating Short term debt is as follows:

Short-term debt = Short-term bank loans + Lease + Wages + Accounts Payable + Income tax payable

Short-term debt = Total debt - Long-term debt

| Short-term bank loans | $100,000 |

| Lease | $127,000 |

| Wages | $12,000 |

| Accounts payable | $9,500 |

| Income tax payable | $5,700 |

| Total debt | $205,000 |

| Long term debt | $103,000 |

Short-term debt (as per the first formula) = Short-term bank loans + Lease + Wages + Accounts payable + Income tax payable

= $100,000 + $127,000 + $12,000 + $9,500 + $5,700 = $254,200

Short-term debt (as per the second formula, based on total debt and long-term debt)

= Total debt - Long-term debt

= $205,000 - $103,000 = $102,000

Example 7

The formula for calculating Accrued interest is as follows:

Accrued Interest = Loan amount * (Annual interest/ 365) * Period for which interest is accrued

If, Loan amount = $450000, Annual interest = 10%, and Accrual period for interest = 180 days

Accrued interest = $450,000 * (0.1/365) * 180 = $22,192

Example 8

The formula for calculating Long-term debt is as follows:

Long-term debt = Long-term debt ratio * Total assets

Long-term debt = Total debt - Short-term debt

| Long-term debt ratio | 0.25 |

| Total assets | $423,500 |

| Total debt | $90,000 |

| Short term debt | $25,000 |

Long-term debt, referring to the long-term debt ratio and total assets, is:

= Long-term debt ratio * Total assets

= 0.25 * $423,500 = $105,875

Long-term debt is based on total debt, and short-term debt is:

= Total debt - Short-term debt

= $90,000 - $25,000 = $65,000

Example 9

The formula for calculating Deferred tax liability is as follows:

Deferred tax liability = Expected tax rate * (Taxable income - Earnings before tax)

If Expected tax rate = 34%, Taxable income = $67000, and Earnings before tax = $47500 then

Deferred tax liability = 0.34 * ($67,000 - $47,500) = $6,630

Example 10

The formula for calculating Long-term lease obligations is as follows:

Long-term lease obligations = Depreciation fee + Finance fee + Sales tax

| Depreciation fee | $8000 |

| Finance fee | $45000 |

| Sales tax | $3470 |

Long-term lease obligations = $8,000 + $45,000 + $3,470 = $56,470

Example 11

Pension benefit obligation is the present value of future benefits promised to employees. Present value is calculated using a discount rate to discount future benefits and expressed as

Pension benefit obligation = Present value (Benefits)

Benefits = Final Salary * Benefit% * Number of service years

Present value = Benefits/ (1+ Discount rate)N

N = Number of service years

Rica worked for ABC for 20 years. Her final salary was $50000, and her Pension benefits were promised at 2%. The employer used a 10% discount rate to discount these benefits.

Benefits = $50,000 * 0.02 * 20 = $20,000

Present value of benefits = $20,000/(1.10)20 = $7432

Pension benefit obligation = Present value (Benefits) = $7432

Example 12

If the bond is issued at a premium, then bonds payable:

Bonds payable = Face value + Unamortized premium

If a bond is issued at a discount, then bonds payable:

Bonds payable = Face value - Unamortized discount

Bonds with a face value of $100000 are issued at a premium with an unamortized premium of $6500.

Bonds payable = Face value + Unamortized premium

= $100,000 + $6,500 = $106,500

Bond with a face value of $100000 issued at a discount with an unamortized discount of $8,000.

Bonds payable = Face value - Unamortized discount

= $100,000 - $8,000 = $92,000

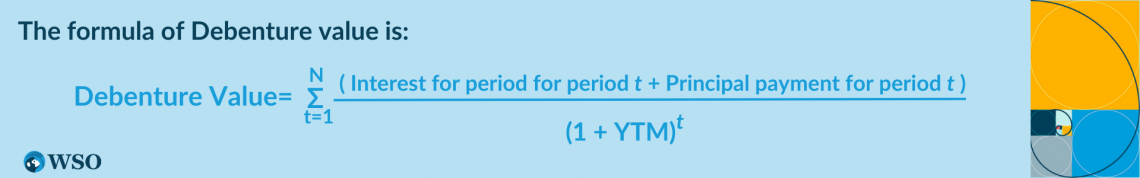

Example 13

The formula for calculating the Debenture value is

YTM = Yield to maturity = Discount rate

Debenture value = Sum of Present value (Interest for period t + Principal for period t)

Debenture with maturity = 3 years is issued, $600 = Principal to be remitted in equal installments, Rate of interest = 5%, and Discount rate = YTM = 10%

| Year | Outstanding Principal | Principal | Interest @ 5% | Total Cash Flow = Principal+Interest | Discount @ 10% | Present value of Cash Flow |

|---|---|---|---|---|---|---|

| 1 | $600 | $200 | $30 | $230 | 0.91 | $209.3 |

| 2 | $400 | $200 | $20 | $220 | 0.83 | $182.6 |

| 3 | $200 | $200 | $10 | $210 | 0.75 | $157.5 |

Debenture value = Sum of the present value of Cash flow

= $209.3 + $182.6 + $157.5 = $549.40 = $550

Impact of Liabilities on Financial Variables

To understand, we'll take a look at different liabilities and their impact.

| Liabilities | Effects |

|---|---|

| Accounts Payable | Increase in accounts payable reduces working capital, decreases current ratio, increases days payable, and shortens the cash conversion cycle. |

| Decrease in accounts payable increases working capital decreases days payable, and lengthens the cash conversion cycle. | |

| Short-Term Notes Payable | Increase leads to higher interest and cost of debt capital. |

| Shift to more equity decreases interest payments, increases working capital, and decreases current ratio. | |

| Decrease results in lower interest payments and cost of borrowing, boosting working capital, and current ratio. | |

| Interest Payable | Higher interest payable decreases earnings before tax, profit margins, and interest coverage ratio. |

| Lower interest payable increases earnings before tax and profit margins. | |

| Tax Payable | Higher tax payable decreases net profit and net profit margin. |

| Lower tax payable increases net profit and net profit margin. | |

| Accrued Expenses | Accrued expenses represent a liability. |

| Accruing more expenses increases liabilities, decreases expenses, and increases revenue. | |

| Paying accrued expenses reduces liability but decreases revenue. | |

| Short-Term Debt | Increase raises debt-to-asset ratio, and interest payments, and enhances tax deductions. |

| Decrease decreases debt-to-asset ratio, and interest payments. | |

| Long-Term Debt | Increase raises total debt and riskiness. |

| Decrease lowers total debt and riskiness. | |

| Deferred Taxes | Increase increases liability and current-year profits. |

| Deferring only a few taxes indicates sufficient cash/reserves. | |

| Long-Term Lease Obligations | Increase escalates cash outflows, and rent expenses. |

| Decrease alleviates lease liability and rent expenses. | |

| Pension Obligation | Increased obligations demand higher liquidity. |

| Various factors affect pension obligations. | |

| Bonds Payable | Increase increases liability and coupon payments. |

| Coupon payments depend on face value and coupon rate. | |

| Debentures | Increase indicates higher risk, and may require a higher discount rate. |

| Decrease indicates reduced risk, and may increase company value. |

Types Of Liabilities FAQs

Yes, liabilities can be negative and represent a credit balance when the company pays more than liability.

Yes, but it depends on the accounting standards followed by the company. Few standards allow for this type of reporting/representation.

As long as assets increase with liabilities and match each other, liabilities will be good. Burdensome liabilities the company finds not easily payable would be considered unavoidable and bad.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?