Collusion

An anti-competitive business practice where parties cooperate to maximize their profits and gain an unfair advantage over the market prices

What is Collusion?

Collusion is an anticompetitive business practice where two or more parties cooperate to maximize their profits and gain an unfair advantage over the market prices and hence, market equilibrium.

Often, it is a contract between companies or individuals to split a market, set pricing, control production, or restrict opportunities. In addition, it usually entails a deal between two or more vendors to take measures to reduce market competition.

These agreements raise the price that consumers pay for goods instead of competition among suppliers that can supply the same goods at low costs.

Price fixing by agreement amongst manufacturers is illegal under antitrust regulations. However, it can lead to legal actions being taken often, which is why participants must keep such agreements a secret.

It is most common in an oligopoly market structure, where a few enterprises have a considerable market or industry-wide effect.

Now that we know the topic let us look at some factors and causes that affect its presence.

Key Takeaways

- It is a contract between two or more parties to maximize their profits at the customers' expense. This contract is of two types, 1) Explicit, i.e., Written, and 2) Tacit, i.e., Unwritten or Unofficial.

- Product Homogeneity, Symmetry, Barriers to entry, etc., make it easier for firms to collude due to obstruction of competition.

- Government regulations, buyer power, etc., discourage collusion by either prosecuting the firms and imposing fines on them or in the form of a lost customer base.

- Game theory suggests that even if the most profitable position for any firm would be to collude, there is always a self-serving vendetta and an incentive to cheat and gain a more significant market share.

Main Causes of Collusion

The main causes are:

Because of first-mover advantage, trade barriers, availability of economies of scale to larger firms, high switching costs, massive research and development costs, etc., new firms are deterred from entering markets and competing with the major players.

Due to this, consumers are left with little to no alternatives to choose from, making it reasonably easy for dominant firms to collude with one another and gain benefits at the expense of the consumers.

2. Symmetry

Firms in a similar position concerning dimensions such as costs, market shares, technological advances, etc., are more likely to arrive at a win-win agreement that suits them all.

Symmetry makes it easier for firms to collude since price setting and cost calculations become pretty simple.

3. Inelastic demand for goods

Markets with inelastic demands for goods often make collusion easier for the few major players that dominate markets. This is because consumers tend not to change their spending habits even with price changes.

This is because such goods are often necessary for the consumers' survival—Eg., prescription drugs, utilities, etc.

4. Limited Government Regulations

Markets that do not have government regulations in place and demand poor execution of the said regulations often have high collusion since firms do not have governments watching their every move like "watchdogs."

This means that the firms in such markets do not have to worry about legal actions or penalties before engaging in collusive behavior and are therefore not deterred from doing so.

Types of Collusion

Now that we have established some of the main reasons why it may arise, we can dive in to understand its types: Implicit/Tacit and Explicit.

Explicit

Parties agree to maximize joint profits, usually by officially working together. Often existing between oligopolists, this type of collusion is "legal"; hence, written agreements and terms of contracts exist.

Under an explicit scenario, oligopolists' aim as a group is to behave the way a monopolist would and maximize joint profits by limiting production and subsequently increasing prices.

Explicit often also leads to cartels, a group of firms colluding to regulate market production and prices to obstruct competition.

A perfect example of a powerful and influential cartel would be the Organisation of Petroleum Exporting Countries (OPEC), which exhibits influence over the oil market, accounting for about 40% of global oil production.

These member countries also hold regular meetings to discuss ways to keep global oil prices and production steady.

Cartels are generally illegal in most countries, considering how they lead to deviations from socially optimum production points in any market. But, the reason why OPEC has been so successful for all these years since its formation is that:

- Foreign governments form that the US has no authority over, which is why no Antitrust laws can be applied.

- The authentication of OPEC's mission by the United Nations has played a significant part in increasing the difficulty of imposing fines on it.

- OPEC's member countries imposed an embargo on the United States in 1973 due to their involvement in the Yom Kippur War, causing oil shortages. Therefore, countries hesitate to charge OPEC for fear of retaliation formally.

Tacit/ Implicit

Unlike explicit, tacit (or implicit) tends to be more unofficial. For example, it is an unwritten or unspoken understanding between two or more firms to limit competitive activity via options such as price leadership.

Price leadership, as the name suggests, is the idea of a dominant firm determining the prices of the products they sell, forcing other firms to follow suit and match their pricing scheme if they want to secure their market share.

Price leadership is an effective tool to secure market share, but there are instances where price leadership drives consumers away. Therefore, the pros and cons of such a strategy should be appropriately studied.

Advantages of Price Leadership

- Secures a higher profit margin for the price leader: Since price increases are quickly followed suit, consumers would be forced to pay the higher prices agreed upon.

- Increases barriers to entry: If the prices are set at a high extreme, it would be difficult for new firms to enter the industry and act as disruptors.

Disadvantages of Price Leadership

- Full Cooperation from all firms: Even one disagreement upon the discussed price can cause disruptions in the market, and the integrity of the "price leader" can be affected.

- Over-Reliance on Price Leaders: Small firms rely on the leaders to make decisions regarding quantity, prices, etc., because it helps them save costs on their research. If the findings of the price leader are wrong, entire industries can go under.

- Ineffectiveness and Complacency: Under price leadership, sometimes, prices are high enough that even the most minor influential firms earn returns over and above the competitive level.

- The only firms that gain the most using the price leadership strategy are the first movers, i.e., the ones that are proactive about shifting their pricing mechanisms rather than reactive.

Collusion Real World Example

Some of the examples are:

Sainsbury's and Asda (2007)

After low prices on products such as milk, Sainsbury's and Asda colluded with dairy suppliers like Dairy Crest and Wiseman Dairies to increase the prices. Consumers were being charged three extra pence for a pint of milk, fifteen extra pence for a quarter pound of butter, etc.

The brands had agreed in 2007 that they were a part of a dairy price-fixing group and earned about $270 million extra from shoppers. They also claimed that these price fixes were solely to increase the incomes received by dairy farmers.

The Office for Fair Trading (OFT) found that the incomes received by the farmers remained unchanged. As a result, Sainsbury's and Asda eventually agreed to pay £116M as compensation but decided to keep their statements regarding the accusations the same.

Sainsbury's said that its price-increasing initiatives were designed to help dairy farmers have a sustainable income stream during times of a financial crunch and while it "regrets" the aftermath of its decision, the sole aim of it was not to generate higher profits.

Royal Bank of Scotland and Barclays (2008)

Between October 2007 and March 2008, some Royal Bank of Scotland staff members were accused of disclosing details of the bank's facilities–both generic and specific–to their counterparts at Barclays.

The OFT accused Barclays of using this information for its loans. This means that some of its customers could have been charged way more than they otherwise would have been.

This offense occurred during an economic crunch, so the banks might have found it more difficult and expensive to borrow from each other in wholesale markets.

Barclays, having stated that the staff members were approached in ways that the bank deemed "inappropriate," cooperated fully with the investigation conducted by the OFT and avoided paying any legal fee whatsoever.

RBS was charged an initial fee of £33.6 million, but the OFT cut this fine after the nationalized bank admitted the offenses it was charged with and cooperated.

British Airways and Virgin Atlantic (2006)

British Airways, having made a £611M profit in 2006, set aside a total of £350M to cover fines and any other costs of legal action. The OFT revealed that British Airways and Virgin had colluded over six times, during which consumer charges rose from £5 to £60 per ticket.

British airways' chief executive denied accusations of collusion and claimed that the price surcharges were a "legitimate way of recovering costs." However, he did agree that the conduct of some of the employees was inexcusable.

He said he was happy with the company's long-standing compliance policies against limiting competition. Still, he regretted that some individuals had failed to accept the same.

British Airways was charged with a fine of £121.5M by the OFT because American businesses and consumers ended up being the most hurt by the crimes, seeing as to how American companies rely on competitive shipping rates for exports and consumers rely on imports for goods.

Collusion and Game Theory

Game theory studies mathematical models in which rational players have strategic interactions.

Prisoners' dilemma is one of the most common examples of game theory, and we shall apply it in our study of collusion to see how exactly it works.

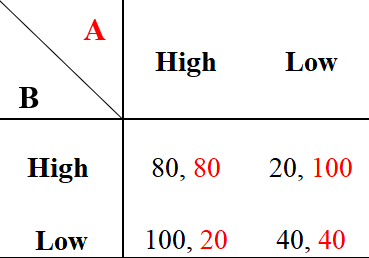

For simplicity purposes, let us assume:

- The only two firms operating in the market are Firm A and Firm B.

- The products produced by these two firms are not highly differentiated. However, the firms have enough market power to influence prices.

- The main motive of both firms is profit maximization.

Consider the following scenario. If the two firms decide to compete, they will have to set low prices because the demand for goods increases as prices fall.

By completing and setting low prices (P1), the firms would share customers equally and earn $40M each in revenue. However, if they decide to collude and set high prices (P2), both firms would make $80M in revenue. The profits of both the firms would be higher, too.

Since we have already assumed that each firm's motive is profit maximization, both the firms would also have an incentive to cheat.

For example, even after the agreement collusion, Firm A can undervalue its products and sell them at low prices (P1) to gain a larger market share. As a result, firm A would now earn $100M while Firm B's revenue would fall to $20M.

Firm B would lower its prices to P1 too, and the market would return to the original position, with both firms making $40M.

Ideally, the most profitable position for both firms would be to charge high prices and collude, but it depends on the incentives to keep colluding and how long these incentives can be reaped.

Laws against it are specifically designed to incentivize firms to report instances of collusion first and avoid getting prosecuted.

Therefore, for any firm, it is in their best interest to report the collusion first and become immune from being fined, rather than strongly hoping that the competitor would not run to the regulator.

Researched and authored by Sara Malwiya | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?