Price Leader

A scenario in which the dominant corporation in an industry determines the market price for products or services

What is a Price Leader?

Having as many advantages as possible when attempting to expand your organization is beneficial. As a result, astute business leaders are always searching for market dynamics they can exploit as development levers.

Leading the prices is one such market factor. What does this phrase imply, and can it be used as a growth strategy? In this piece, we'll talk about just that.

It is a scenario in which the dominant corporation in an industry determines the market price for products or services. It often occurs when the products are homogenous, meaning that there are no differences between the items or services offered by various businesses.

As a result, buyers pick the item at the lowest price without considering it.

This phenomenon is frequent in markets with an oligopoly, such as the airline sector. With this power, its competitors are frequently forced to follow its lead and lower their prices to maintain their market share.

When pricing in the airline sector, a dominant corporation often decides what is reasonable, forcing the other airlines to follow suit.

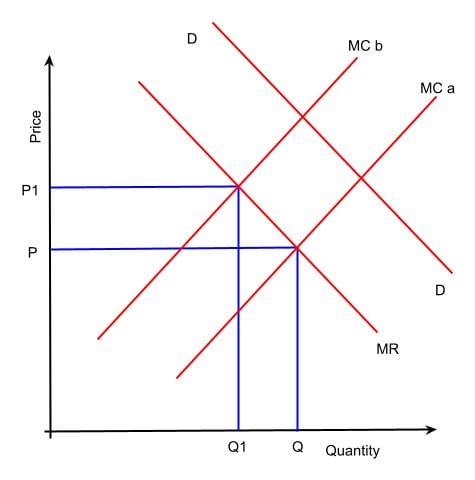

The intersection of the marginal cost (MC) curve with the marginal revenue (MR) curve represents the ideal level of output and pricing.

In the diagram above, Company A is the market leader, and Company B is a tiny business operating in the same sector. Because Company A is the market leader and has economies of scale, you can see that A's marginal cost line is lower than B's.

Without any product distinction, the demand for both businesses is the same throughout the economy. Marginal revenue is, therefore, unchanged.

Business A's marginal revenue currently meets the marginal cost at a considerably lower point. The ideal pricing for company A is "P," while the perfect production is "Q." Although, Firm B should follow price P rather than price P1, as price P is less expensive. Firm A is demonstrating pricing leadership.

How Price Leadership Works

This is more likely to emerge under specific economic circumstances in an industry when fewer businesses are participating, entrance is restricted, the market is homogenous, demand is inelastic or less elastic, and organizations have similar long-run average total costs (LRATC).

LRATC is an economics statistic used to calculate the lowest average total cost a company may sustainably incur while producing a certain level of output (when all inputs are variable).

Price leadership is more prevalent in industries that generate goods and services with little to no product differentiation. When there is a significant amount of consumer demand for a particular product, price leadership also frequently appears, drawing customers away from any rival goods.

As a result, the price of the specific interest in great demand among consumers overtakes all others. Moreover, these are often big businesses in an industry with the lowest manufacturing costs and can, thus, undercut the prices of their rivals.

Competitors who disagree with the dominant company's pricing may set higher prices. However, doing so may decrease the market share for their products or services. Each company may set prices somewhat independently of one another when there is a lot of competition with products of various quality and value propositions.

A dominating business in the market can utilize its position to effectively determine the pricing of products and services for the whole market when there is little to no competition.

Conditions under which price leadership occurs

For a pricing leadership model, numerous requirements must be untaken. These elements or possibilities are:

1. Majority of the market

The pricing leader is often the most prominent firm in the sector or the one with the capacity to serve clients across borders. Alternatively, we may state that one business in the industry ought to be larger than the rest.

Size is often volume, capacity, earnings, revenue, finances, and other factors.

2. Trend Information

Some businesses are more adept at foreseeing consumer desires or emerging trends. In other words, these businesses are more responsive to changes in demand or are more equipped to meet such changes.

They could be tiny businesses, but if they have this capability, they might overtake their competitors in terms of pricing. In a short time, other companies, including larger ones, will adopt the prices set by this tiny business.

3. Technology

A company's proprietary technology may enable it to overtake its competitors in terms of pricing. As a result of having access to such cutting-edge technology, a business like this may demand a high price from its clients.

The profit needed to level up other firms would have to adapt to the prices set by this company.

4. Oligopoly

A market with an oligopoly is favorable to this approach. It implies that there shouldn't be any businesses in that sector.

5. Integrated Products

The existence of homogenous goods is a crucial need for this strategy. It implies that all businesses in that sector must provide comparable goods and services.

6. Superior performance

A business may be well known for using execution techniques superior to its rivals, giving it the chance to charge a more significant price per unit.

The method is frequently relevant to sectors that bill hourly or by individual contracts.

Even at a higher cost, clients prefer dealing with productive organizations that produce high-quality results on the projects they are hired to do.

Types of price leadership

Pricing leadership comes in three different guises. You'll see that dominance still matters in each of them, but it's critical to comprehend how dominance may be achieved.

1. Barometric

In such leadership, a company that is better equipped to spot market trends is typically present. As a result, this business can adapt to changing circumstances and establishes pricing that others must match.

Any company, regardless of size, maybe even a smaller firm, becomes a pricing leader in such a circumstance.

Other businesses typically follow the pricing leader in the sector because they believe it is aware of the information they are not.

If a tiny business is the pricing leader, it's conceivable that it does not hold that position won't long.

Competitors will follow a company's lead if the company's the first to identify market developments rather than waiting for them to come to light independently.

2. Collusive

Collusive pricing is a form of price leadership in oligopolistic industries with a high barrier. Here, the leading businesses in the sector come to an explicit or implicit price agreement.

Furthermore, the lesser firms in that industry are forced to follow the dominant company's pricing strategy.

Price adjustment does not correspond to a change in operating expenses. Therefore, this kind of approach may be against the law.

It is also illegal in cases when the goal of the price control or setting is to deceive clients. It is challenging, however, to demonstrate that price-setting conduct is unlawful.

Smaller companies are compelled to adopt the price modification introduced by big companies. Consequently, this strategy is most prevalent in industries with the highest entry barriers and known production costs.

These agreements between businesses, whether explicit or implicit, may be considered unlawful if they aim to deceive the public. There exists a thin line between price leadership and illegal collaboration.

If price adjustments for an item are unrelated to changes in the company's operations company's leadership is more likely to be viewed as deceitful and perhaps unlawful.

3. Dominant

As is evident, such leadership entails a dominant corporation establishing the price. Typically, the company with the largest market share is the dominant one.

It might also be referred to as a partial monopoly. Under such a scenario, the chief business uses predatory pricing to push out lesser competitors from the market.

In the majority of nations, this kind of leadership is forbidden. When one company dominates the market share in its sector, the dominating pricing leadership model is present.

Other smaller businesses in the industry offer the same goods or services as the market leader. These smaller businesses, however, have little control over prices under this paradigm.

Predatory pricing, which refers to decreasing prices to levels that make it hard for smaller, rival enterprises to stay in operation, may be used by the price leader in this model.

Business strategies that use predatory pricing and harm smaller businesses are typically prohibited in most nations.

Price Leader Examples

Let's look at an illustration to demonstrate how pricing leadership functions.

Tablecloths are produced by Company A, and four to five more businesses operate in the same sector. The largest producer and retailer of tablecloths in the nation is Company A.

Company A only charges $7 for the item since it is the market leader. The prices set by competing businesses in the same industry category for comparable goods range from $9 to $11.

As a result, Company A sets the rates in this situation, and other businesses must follow suit. Of course, if other companies want, they can set their prices at $7 to track it. In some cases, however, following the dominant company isn't an option, as it doesn't entail operating at a loss indefinitely.

Let's try to talk about a practical instance of pricing leadership.

Jio, the newest telecom provider in India, quickly overtook its competitors in terms of pricing. For a few months following its debut, the business offered all of its client's free phone services and internet.

Customers were only allowed to utilize 2GB of internet each month. Daily unlimited data became commonplace after JIO's introduction. A revolution occurred.

Jio completely transformed the sector. As a result, many industry participants sought mergers or left the market. This ultimately caused a significant shift in India's telecom sector. As a means of surviving the market, some small suppliers began merging.

As soon as JIO began offering low monthly prices to clients, other service providers were forced to adopt equal pricing to remain in business.

The other established and veteran businesses in the market are left with little choice but to follow suit and create similar strategies. Yet, they can see client emigration, mergers, and amalgamations to stay in the game.

This is a perfect demonstration of price leadership.

Becoming a Price Leader with Price Intelligently

We've seen how this may spur development, but unless you're lucky enough to command the lion's share of the market in your sector, you'll need to rely more on alternative strategies.

A program like price Intelligently can be useful in this situation. Price Intelligently gives you a detailed study of your sector and the lowest costs your specific product may be sold for.

1. Utilize data to make your pricing environment clear

It is rather simple to determine how much you can reduce the plus component of the equation and still earn a profit for businesses that use cost-plus pricing. The pricing structures of SaaS enterprises are more intricate.

You may get a detailed understanding of your market, its price, and your specific pricing strategy using the data that price Intelligently provides. Prices can be decreased to a level that is still lucrative using the information provided.

2. Localize prices to increase sales

Businesses frequently neglect to localize their pricing, resulting in significant money being lost.

Localizing pricing is the most excellent strategy to benefit from different markets' varying wills to pay for a product. In addition, localizing prices will give your company a strong growth lever and may make you the market leader in pricing.

3. Keep an eye on your competitors and adjust pricing to meet demand.

Understanding the market more thoroughly than your rivals is one method to establish yourself as a pricing leader. Price Intelligently enables you to obtain a close-up and analytical look at how your competitors are doing and why pricing in your sector works or doesn't.

These precise insights will enable you doesn't on top of trends and establish yourself as a pricing leader.

Advantages of price leadership

It enjoys the following benefits:

1. Profitability

The corporation and the other participants will benefit from more enormous profits when they set high product prices and competitors match the price adjustments, provided customer demand doesn't alter.

Additionally, it assures that the dominant company doesn't lose the sizeable market share it now enjoys to the competitors when they copy the behavior.

2. Eliminates price wars

Price wars are likely leaders when there are similar-sized enterprises in the market as each rival looks to gain market share.

However, since the smaller rivals fight to maintain their market position, there are likely to be fewer price wars when one business becomes the market leader. Instead, they will change the cost of their goods and services to match the price leader's price range.

3. Higher quality goods and services

An annual company sales rise when it becomes a pricing leader, the company's these funds are then utilized to supply new features and enhance offering quality. Customers are willing to pay a premium for a premium product, but a business can only provide it if its operations are successful.

The firm may reinvest the profits from its present goods in research and development to develop fresh concepts that will help it provide value to its consumers.

Disadvantages of price leadership

A dominant company must deal with the following adverse effects:

1. Unjustified competition

A dominant company can use operating synergies to lower their prices to amounts out of reach for minor competitors. The smaller rivals will try to cut their costs to keep their market share because they do not benefit from the same operating synergies as the price leaders.

However, if small businesses are continuously forced to provide low pricing, they will lose money and leave the market.

2. High cost of goods or services

When a company with the lowest pricing raises the cost of its goods or services, its rivals will inevitably follow suit or work together to do the same. As a result, consumers will be forced to pay more for goods and services considered earlier more affordable.

Cost Leadership Vs. Price Leadership

Many people misunderstand these two ideas and think they both refer to the same thing. However, even though the two ideas may sound similar, they are entirely distinct.

Cost leadership, as the name suggests, has to do with how much it costs to produce a good or service. For example, a firm with the lowest manufacturing costs is considered a cost leader.

This business can afford to lower the price of its offerings to establish itself as a dominant company because of its cheap cost of manufacturing, production, labor, etc.

They can cut competition and gain an additional market share if other businesses do not do the same. However, by reducing prices, their profit margins decrease, and they could also incur losses.

It may or may not be sufficient for a corporation to initiate a pricing war if it is a cost leader. In a price war, the cost leader is provided with some benefits.

To summarize, cost leadership strategies emphasize having the lowest operational expenses, whereas the strategies prioritize having the lowest prices in the market.

Some cost leaders may outperform the competition by offering the lowest pricing and operational costs, making them both the price and cost leaders in their respective industries.

Research & Authored by Ankit Sinha | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?