Current Account

A component of the balance of payments that gauges the inflow and outflow of goods, services, investment incomes, and transfer payments between different countries.

What Is the Current Account?

In macroeconomics, a current account represents a component of the balance of payments that gauges the inflow and outflow of goods, services, investment incomes, and transfer payments between different countries.

The current account is an indispensable constituent of a nation's equilibrium of payments structure, chronicling its international transactions in commodities, amenities, and earnings over a given duration.

In simpler terms, it evaluates a nation's fiscal and monetary streams with the remaining part of the world. The current account reflects a nation's budgetary robustness and ties with the international community.

The main elements of the current account are:

- Trade-in-Goods: Trade and commerce in commodities allude to the import and export of palpable articles, such as motor vehicles, apparel, and electronic devices. This constituent is frequently used to indicate a nation's competitiveness in trade and commerce.

- Trade-in-Services: Trade and commerce in amenities alludes to the import and export of intangible commodities, such as consultation, finance, and tourism. This constituent is crucial for nations that depend on service sectors for their fiscal expansion.

- Investment incomes: Includes dividends, interests, migrant remittances from abroad, and net transfers. Investment incomes allude to the money garnered by a nation's inhabitants from investments and labor overseas and the funds earned by foreigners from assets and work within the country.

- Net Transfers: Net transfers are in the form of international aid. Such transfers are also in the form of donations, aid, or official assistance.

A current account balance can be both positive (surplus) and negative (deficit), given the circumstances. A deficit or negative balance indicates that the economy's imports exceed its exports. A surplus indicates that a nation's exports exceed its imports.

If a nation has a current account deficit, it needs a surplus in the financial account to maintain the balance.

Key Takeaways

- In macroeconomics, the current account is a crucial component of the balance of payments, tracking the inflow and outflow of goods, services, investment incomes, and transfer payments between nations.

- It serves as a record of a country's international transactions over a specific period, reflecting its economic interactions with the rest of the world.

- A positive trade balance suggests competitiveness and increased foreign currency earnings, while a negative balance indicates the need for enhanced competitiveness.

- The current account deficit indicates greater demand for imports, potentially leading to currency depreciation and competitiveness challenges in local industries.

Understanding the Current Account

A current account can have different impacts on the nation's economy. A current account deficit may cause the economy to depreciate due to greater demand for imports and foreign currency.

A current account deficit may indicate that the nation is uncompetitive in providing goods and services and that local consumers are shifting from indigenous products to imported products.

The trade equilibrium in products and services is assessed by deducting the value of imports from the value of exports. If a nation exports more than it imports, it has a positive trade balance; if it imports more, it has a negative balance.

A positive trade balance indicates that a nation is competitive in worldwide commerce and is receiving more foreign currency than it is disbursing. Conversely, a negative trade balance suggests that a country needs to be more competitive and spend more foreign money than it receives.

The earnings constituent is calculated by aggregating earnings received from overseas and earnings disbursed to foreigners. If a nation garners more profits from overseas than it pays to foreigners, it has a positive earnings balance.

It has a negative earnings balance if it disburses more earnings to foreigners than it garners from overseas.

Subcomponent of Current Account #1: Trade in Goods

A trade deficit is not always sinister. However, it could imply that a country is importing items it cannot produce locally or investing in its economic system by importing items for production and export.

Trade in goods is a fundamental constituent of a country's current account. It encompasses the international transaction of concrete commodities, such as imports and exports of goods.

To comprehend the intricacies of trade-in goods, here are some vital points:

- Calculation: The trade-in goods component of the current account can be determined by subtracting the import value from the export value.

- A positive trade balance implies that a country is competent in international trade, earning more foreign currency than the expenses incurred. On the other hand, a negative trade balance indicates the opposite.

- Factors Affecting Trade in Goods: Multiple factors, such as government policies and laws, technological incapabilities, and natural resources, affect a country's trade efficiency in goods.

- Countries with skilled labor and advanced technology produce goods efficiently, hence cutting down the cost of production.

- Government Policies and Regulations: Governments can use tariffs and trade barriers on imported goods to shield domestic industries and promote exports. Similarly, the state can provide subsidies to domestic producers to increase competitiveness in the international market.

- Environmental Impact: Goods' production and transportation can have severe environmental consequences like greenhouse gas emissions, leading to climate change. Countries can alleviate these consequences by formulating policies that advocate for sustainable production and transportation methods.

- Positive and Negative Impacts: A positive trade balance is beneficial since it can lead to economic growth and increased employment opportunities. In contrast, a negative trade balance can result in debt accumulation and inflation.

- As a result, policymakers have to promote a positive trade balance that could affect a country's economy.

Note

A country with a trade surplus has an aggressive benefit in producing and exporting items, while a country with a change deficit depends more on imported goods.

Advantages And Disadvantages Of Trade In Goods

As we have gone through the vital points of trade in goods, we must deeply comprehend its advantages and disadvantages.

Following are the advantages and disadvantages of trade in goods which you can refer to understand how it affects our economy.

Advantages of Trade in Goods:

- Access To Different Goods: Access to goods that are unavailable or more expensive domestically improves the standard of living for individuals and businesses.

- Promotes Economic Growth: Promoting investment and entrepreneurship stimulates economic growth and creates new employment opportunities. It helps countries diversify their economies by leveraging their strengths in specific industries, generating revenue, and promoting economic development.

Disadvantages of Trade in Goods:

- Dependency: Dependence on foreign goods makes a country vulnerable to supply chain disruptions and fluctuations in global market prices.

- Environmental Considerations: Environmental degradation can occur when goods production and manufacturing emissions affect the surrounding environment, which may result in greenhouse gas emissions and other types of pollutants.

- Job Displacements: Job displacement in specific industries due to competition from lower-cost imports leads to economic hardships for workers and communities.

Factors Influencing Trade in Goods

The goods trade is a complicated subject with many variables to consider.

- Natural Resources: Natural resources are one of the primary factors influencing trade in goods. This comparative advantage often results in a positive trade balance for the country.

- Technological Capabilities: Another essential factor affecting trade in goods is technological capabilities. Countries with advanced technology and skilled labor can produce goods more efficiently, lowering production costs and higher profits.

- In contrast, countries with obsolete technology or unskilled labor may need help to produce competitive goods in international markets.

- Governmental Policies & Regulations: Government policies and regulations also play a crucial role in goods trade. For example, governments can impose tariffs and trade barriers on imported goods to protect domestic industries and promote exports.

- Government Subsidies: Similarly, the state can provide subsidies to domestic producers to increase competitiveness in international markets. Therefore, governments and businesses should prioritize sustainable production and transportation methods that mitigate these impacts.

- Environmental Factors: Trade in goods can also have significant environmental impacts. For example, producing and transporting goods can lead to climate change, air and water pollution, and deforestation.

In the end, economists and policymakers must recognize the beneficial and harmful effects of goods trade on a country's economy. For example, a vital trade balance increases job opportunities, while a negative trade balance results in inflation and debt buildup.

Therefore, policymakers must promote balanced and sustainable trade in goods that benefit all stakeholders.

subcomponent of Current Account #2: Trade-in Services

In the modern globalized economy, trade in services has become an essential feature of a nation's current account. It pertains to exchanging intangible commodities across borders, such as professional services, tourism, and transportation.

A country with a negative service balance may need to invest in its service sector to become more competitive and increase its service exports.

Factors Affecting Trade-in-Services:

- Technological Advancements: Technological advancements have made it more convenient for companies to offer services across borders. In addition, the proliferation of the digital economy and communication technologies have enabled remote service provision, minimizing production costs and enhancing efficiency.

- Government Policies and Regulations: Government policies and regulations play a fundamental role in trading services. Policies that foster open trade and foreign investment can boost the growth of the services sector. Conversely, restrictive policies can limit the sector's growth.

- Education and Training: Education and training are crucial in expanding the services sector. When a country invests in education and training, nations can deliver high-quality services, draw in foreign capital, and increase its viability internationally.

- Environmental Impact: Trading services have a lower environmental impact than trading goods since they involve exchanging intangible products. However, the transportation of people and goods associated with the services sector can still have environmental consequences.

- Governments and companies should prioritize sustainable transportation methods and reduce the carbon footprint of the services sector.

Advantages And Disadvantages Of Trade In Services

Here are some advantages and disadvantages of trade-in services. They can help us understand how trade in services affects our country and its policies.

Advantages of Trade in Services:

- Elevated Economic Expansion: Service trade fosters economic growth by enabling international investments and entrepreneurship. As a result, it generates fresh job opportunities, betters the standard of living, and amplifies a country's GDP.

- Innovation and Knowledge Transfer: Trading services cultivate innovation and knowledge transfer between nations. Companies can gain more access to technology and expert services that might be unavailable within their country's boundaries by outsourcing services such as research and development to other countries.

- It improves the quality of products and services of the country, making them more competitive in the global market.

- Diversification of Economies: Trading services authorize countries to diversify economies and capitalize on their strengths in particular industries. By focusing on services, nations can decrease dependence on a single industry and create revenue from various sources.

Note

The tourism industry significantly contributes to the service balance, with countries like France and Spain having a positive service balance due to their large tourism industries.

Disadvantages of Trade in Services:

- Job Displacement: Transferring services to countries with lower labor costs may lead to job displacement in specific industries, resulting in economic difficulties for workers and communities.

- It might generate social and political tensions, exerting pressure on governments to implement policies that shield domestic industries and workers.

- Dependency on Foreign Expertise: Reliance on foreign expertise might result in losing control over vital aspects of a nation's infrastructure and services. It can diminish sovereignty and pose a threat to national security.

- Quality Control: Services' quality might be difficult to control in a foreign country, leading to inadequate or substandard services. This can have detrimental consequences for consumers and harm a company or government's reputation.

In summary, trading services are a crucial element of a nation's current account, with advantages and disadvantages. It can foster economic growth, stimulate innovation and knowledge transfer, and diversify economies.

However, it can also result in job displacement, dependence on foreign expertise, and quality control issues. Therefore, policymakers should aim to balance promoting trade in services and safeguarding domestic industries and workers.

Additionally, they should prioritize sustainable production and transportation methods to decrease the services sector's environmental impact.

subcomponent of Current Account #3: Income (earnings)

The income balance is sometimes called the net investment or factor income balance.

Income from service exports is a crucial component of a country's current account, and various factors influence it. Therefore, policymakers and businesses must develop effective strategies to increase service exports and earn more income.

We will closely examine each of these factors.

- Labor market conditions: The demand for services in the international market is a primary factor influencing the income earned from service exports. The availability of skilled workers is crucial in determining the competitiveness of services offered.

- Investing in education and training programs is crucial because it helps develop a skilled workforce.

- Exchange rates: Exchange rates between countries significantly impact income earned from exports. An advantageous exchange rate can make a country's services more affordable and increase demand, leading to higher pay.

- Conversely, an unfavorable exchange rate can decrease demand and lower income. Hence, policymakers must monitor and maintain stable exchange rates.

- Political and economic stability: A stable political and economic environment can attract foreign investors, increasing service exports and earning income. In contrast, political and economic instability can discourage foreign investors and decrease export income.

- Policymakers must promote political and economic stability to attract foreign investment and increase income.

- Technological advancement: Technological advancements improve the quality and efficiency of services, leading to higher income. Countries that invest in research and development and adopt new technologies can offer more competitive services and earn more income.

- Therefore, policymakers and businesses must invest in technological advancements to improve the quality and efficiency of services and increase income.

- Education and training: Education and training are crucial in developing a skilled workforce offering valuable services and earning more income. Investing in education and training programs is essential in improving the quality of services and increasing income earned from service exports.

- Regulations and Policies: Regulations and policies that govern service exports can impact income earned. For example, restrictions on foreign ownership or licensing requirements can limit service providers' ability to enter the international market and net income.

- Policymakers must review and revise regulations and policies to facilitate service exports and increase income.

Note

Profits from overseas investments can encompass interest payments on loans, income from overseas subsidiaries, and dividends from shares owned by foreign investors.

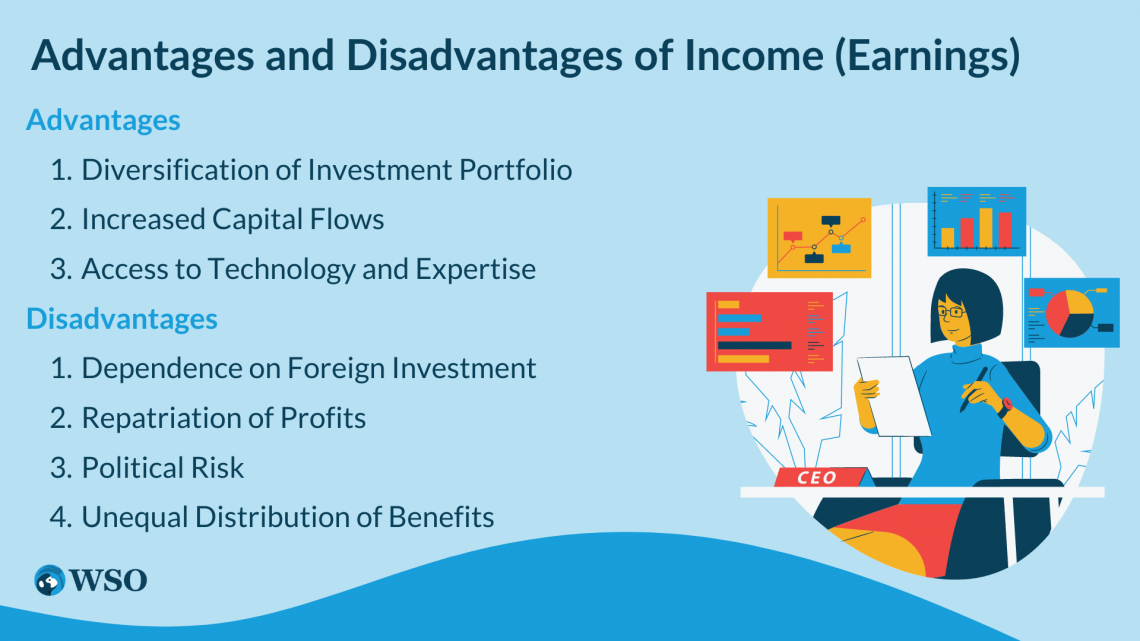

Advantages And Disadvantages Of Income (Earnings)

Many factors affect a country's current account balance. Moreover, those factors include two variables that we must understand: the advantages and disadvantages of income.

Here are some advantages and disadvantages that you can refer to understand how a country's current account balance gets affected by income.

Advantages of Income:

- Diversification of Investment Portfolio: Income from foreign investments diversifies a country's investment portfolio, reducing the risk of economic shocks and instability.

- Increased Capital Flows: Income from foreign investments can attract more capital flows, leading to increased investment and economic growth.

- Access to Technology and Expertise: Foreign investments can bring new technologies, managerial expertise, and business practices to a country, boosting productivity and efficiency.

Disadvantages of Income:

- Dependence on Foreign Investment: A country's reliance on foreign investment can create economic vulnerability, exposing it to fluctuations in global markets.

- Repatriation of Profits: Foreign investments may have advantages for the local economy, but they may be limited if foreign investors choose to repatriate their earnings.

- Political Risk: Political instability and government policies can discourage foreign investors, reducing the inflow of foreign investment and the associated benefits.

- Unequal Distribution of Benefits: Income from foreign investments may benefit only a tiny population segment, leading to social and economic inequality. Therefore, policymakers and businesses must consider various factors that impact income earned from service exports.

For example, increasing income requires investing in education and training, adopting new technologies, promoting political and economic stability, and reviewing regulations and policies.

By developing effective strategies that focus on these factors, countries can develop a skilled workforce, offer competitive services, and increase income from service exports.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?