Dove (Economic Policy)

An advisor who seeks the support of monetary policies for the growth and development of a nation.

What is Dove (Economic Policy)?

A Dove in economics is a policy advisor who seeks the support of monetary policies for the growth and development of a nation. Statements that suggest inflation to have a minimal impact are considered 'Dovish.'

These monetary policies involve the maintenance of a low-interest rate with the belief that the resulting inflation due to a low-interest rate will have a minimal impact on the economy.

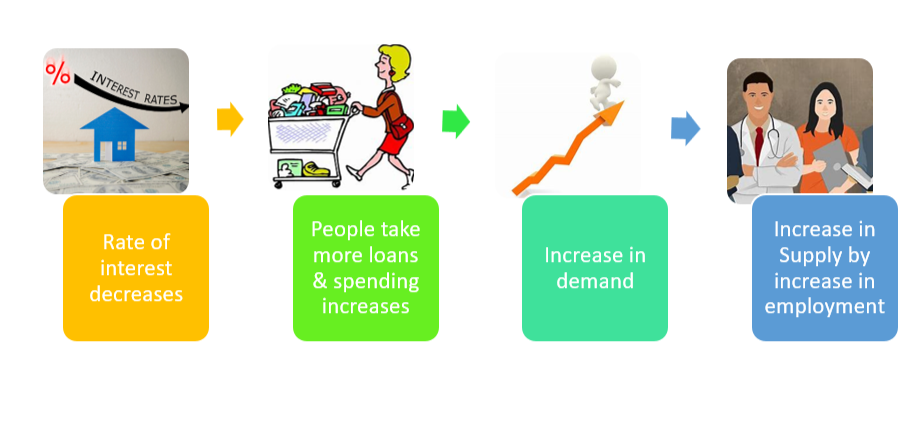

A Dovish policy advisor would focus on the reduction of interest rates, which would, in return, encourage people to take loans and spend more, increasing demand and supply and lowering unemployment.

When an expansionary monetary policy is introduced, and the interest rate decreases, domestic goods become cheaper to finance. Further, there is an outflow of goods through trade as the currency value depreciates since domestic goods are now more affordable. (Mundell Fleming Model)

This term is more common in the United States, where it is used for the Federal Reserve board members. They greatly influence the country's monetary policy since they are responsible for setting the interest rates.

If a nation's central bank is dovish, it is expected to keep its monetary policy loose. In contrast, if it's Hawkish, which is the exact opposite of dovish, it will have a tight hold on its monetary policy.

When a central bank describes inflation in a good light stating its negative impact being negligible, such language is considered Dovish. In contrast, if inflation is described in a negative view, saying its large effect on the economy, such a language is considered Hawkish.

Example

Policy advisors like Ben Bernanke (the 14th chair of the Federal Reserve) and Janet Yellen (state secretary of the treasury and the 15th chair of the Federal Reserve) are both dovish advisors. Throughout their tenure, they supported low-interest rates.

Alan Greenspan (former chairman of the Federal Reserve) was a hawkish and dovish advisor during his tenure at the Federal Reserve. He supported hawkish tendencies of high-interest rate policies in 1987. But that stance changed, and he started to favor low-interest rates in the 1990s.

Key Takeaways

- Dove is an economist who encourages low-interest rates for growth through monetary expansion. The opposite of this economic policy is a hawk who believes in a high-interest rate.

- The object is to stimulate the economy by focusing on lowering unemployment and increasing demand for goods & services by encouraging consumers to take loans and get access to money to spend.

- It is the opposite of a hawk, where monetary policies are maintained closely to control inflation. They focus on keeping inflation low for the smooth operation of the economy.

- The value of currency depreciates in terms of foreign currency since now the rate of interest is low in the domestic country, making its goods cheaper than other trading countries.

- Economists argue that this economic policy can lead to inflation in an economy if not supervised rightly or continued for a long period.

- The best policy of an economy is a fusion between Hawk and Dove economic policy, which can lean to one side or the other according to the prevailing conditions in an economy.

History Of Dove (Economic Policy)

The term was first used in May 1966 during the Vietnam War. Two groups were formed that believed in different schools of thought to find the solution to the war.

The Doves were the people looking for a more negotiatory solution in the war. On the other hand, the hawks were labeled as the people looking for a militant solution by increasing the number of soldiers and weapons.

They wanted to leave Vietnam peacefully and were against the war. So they formed protests and campouts to get their point across to the then-president, Richard Nixon. But, on the other hand, the Hawks were US citizens who wanted to win the war.

The term is derived from the docile and peaceful nature of the bird, the dove,' and its opposite is a 'Hawk.' Therefore, they are seen as a symbol of peace, whereas Hawks are predatory birds known for attacking their victims out of the blue.

The de-escalation of the war in 1968 was a part of an economic decision since it was clear by then that not only was the fight difficult to win but was also too expensive in the long run, which set the entry of these terms into economics.

Despite being a familiar term in economics today, many economists don't prefer using these terms to describe their planning or ideas. For example, a central bank is chosen to be neither always a dove nor a Hawk but change its policy as per the economic situation.

Impact of high-interest rate

A high-interest rate means an increased cost of borrowing which discourages spending more, cost of financing is higher, which lessens disposable income.

Disposable income is the amount of income left after deducting taxes and security charges available to spend or save in any way the individual prefers.

Due to the higher interest payment cost, personal income is impacted heavily. Thereby affecting consumer spending. Higher interest rate incentives to spend less and save more. They are moving the level of investment and consumer spending negatively.

Such a scenario incentives the economy to save more due to greater returns because of high-interest rates and increased investment levels. Banks also tend to give more loans since the risk of lending decreases freely.

Further, when a country increases its rate of interest, and its trading partners don't do the same, there will be a fall in the value of the price of imported goods since the domestic goods are now expensive in comparison.

But on the other hand, it also discourages people from taking loans because of soaring interest payments. So now, access to money is low, decreasing the consumer's spending power.

Government debt expenditure also increases due to the higher cost of interest payments. This puts pressure to raise taxes to finance the interest payments, reducing disposable income and decreasing consumer spending.

A dove insists on a low-interest rate as it helps consumers seek loans due to low-interest payments and take up car loans, mortgages, and credit cards. So, naturally, this increases spending, increasing the demand.

This increase in demand is fulfilled by increasing the number of workers employed and a higher wage, reducing unemployment. Hence this process has a positive impact on the economy.

Dove's Impact on Aggregate Demand

A decrease in aggregate demand can lower economic growth, identified by a reduction in production, GDP, and employment. Such a situation can lead to a recession.

A recession is a temporary period when the production level of a nation subsides by a fall in the level of GDP consecutively. During such a time, trade and activities are reduced, which results in firms letting go of their workers. Thus increasing unemployment.

However, on the other hand, a growth in employment level increases the wages and salaries offered by the firms. Due to this increase, the buying capacity of the consumers increases since the workers helping produce the goods are the consumers of that good as well.

The rise in disposable income helps the public afford slightly higher consumer goods unavailable due to budget constraints. Now consumers can shop more, build houses, and manufacture products. This, therefore, changes their consumption pattern as well.

However, it would be concerning if inflation rises uncontrollably and continuously for a long period, because of which the prices of the commodities will increase too. This causes the price level of goods to rise.

Since there is also a high rate of employment which means people can afford these commodities & services despite their high prices, This leads to a cycle of increases in wages and prices, leading to inflation.

This will lead to an overall increase in the price level, and a wage increase then tends to become cyclical in such a situation, and the benefits of a low-interest rate are not seen as expected by the doves.

What is Dove's stance on inflation and its risks?

There are two dual mandates: Full employment and Stable price level, which create tension. However, this also creates a balancing act since one-sided actions can make the other side worse off. Thus they believe that the negative effect of a low-interest rate is negligible.

However, inflation will rise inconsiderably if the interest rate is low for a long period. A temporary deviation in inflation above 2% is a reasonable price for more jobs and thus more employment.

Freely cooperative systems are considered highly unstable since there is a risk that someone would be incentivized to play the Hawk to gain more profits, according to the Game Theory. Such a situation can disrupt the balance, making such a system unstable.

Furthermore, they believe in low-interest rates to increase the aggregate demand of the consumers. But an increase in aggregate demand can raise inflation and the price level when there is a sudden increase in commodity demand.

So we come to the question of whether an economic policy of this type is even worth it or not.

There are dilemmas faced every day, and most have a choice between altruistic & cooperative behavior, which is dovish or selfish, and aggressive, which is hawkish. While the Dovish stance will be considered ration, Hawkish is the most stable.

Stability is needed when predatory/ selfish and cooperative/ altruistic forces constantly balance each other. It's like elements of fun in a job that is difficult to be done. But a situation like this strikes a balance.

Dove Vs. Hawk

We can see the main difference between the two policy perspectives as follows:

- Doves are seen as tender and delicate birds. They are considered the epitome of peace and tranquility. On the other hand, hawks are deemed full of aggression and violence.

- Doves are interested in low-interest rates and favor expansionary monetary policies, whereas Hawks are primarily interested in high-interest rates.

- Doves are concerned with economic growth, but Hawks support the operation of an economy at a level below its full-employment equilibrium.

- Hawks view inflation as a priority and believe a high-interest rate reduces an economy's inflation. They always project an increase in inflation in the future and always see the possibility of low-interest rates increasing risks in the economy due to inflation.

- A hawk believes that if inflation pressure goes up and is left unchecked, it increases the price level making everyone worse off.

- This even lowers the standard of living.

- Eventually, such a case can be noted in the case of hyperinflation in Venezuela, where the crisis has been ongoing since 2016, with inflation of 686.4%.

- On the other hand, Doves are the advisors or policymakers who believe that low-interest rates result in employment growth and value low unemployment as a concern over low inflation.

- When an economy slows down, businesses start closing, and unemployment prevails. So they focus on cutting the interest rate so that it is cheaper to borrow capital, help companies run their operations, and increase employment.

- Investors, citizens, etc., prefer a chairperson capable of maintaining both stances and switching between the two as the situation demands according to the economic conditions.

or Want to Sign up with your social account?