Fed Beige Book

The Summary of Commentary on Current Economic Conditions.

What is the Fed Beige Book?

The Federal Reserve (Fed) Beige Book is officially known as The Summary of Commentary on Current Economic Conditions; the name Beige Book was coined because the front cover is beige.

First introduced in 1970 as the Redbook, then evolving into the Beige Book, it now contains a qualitative economic summary of the 12 Federal Reserve Districts in the U.S.

Published eight times a year by the Federal Reserve, it helps inform sections of the Fed in creating appropriate monetary policy.

The Federal Reserve can create a monetary policy to affect several economic factors. Monetary policy is mainly conducted by altering the following elements:

- Reserve requirements

- Federal funds rate

- Open market operations

The reserve requirement is the percentage of deposits banks legally must have at the end of every day.

The prime rate is the interest rate that Reserve banks will use when giving other banks short-term loans. While both of these are important, the Beige Book does not directly impact either of these.

Open market operations are performed by the Federal Open Market Committee (FOMC), which meets eight times a year to discuss the U.S.’ economic health and how to keep the economy stable. This article will focus on the monetary policy created during FOMC meetings.

The Federal Open Market Committee uses the information in the Beige Book to determine if the U.S. should buy or sell its government securities to change the federal funds rate as needed.

By selling government securities, the government reduces the money supply, thus increasing interest rates. Higher interest rates mean it is more expensive to take out loans, discouraging businesses and households from doing so. The opposite can be done by buying government securities.

Key Takeaways

- The Beige Book summarizes the economy as seen by survey respondents, interviewees, and economists.

- It helps members of the Federal Open Market Committee (FOMC) create monetary policy.

- It is published eight times a year, two weeks before each Federal Open Market Committee meeting.

- The information gathered is qualitative data about current situations, while the private Teal Book has both qualitative and quantitative data.

- The Teal Book is composed of what used to be the Green Book and Blue Book, which predate the creation of the Beige Book. Teal Book editions are available to the public after five years.

- One of the more standard monetary policy actions the FOMC takes is changing the federal funds rate to either promote or discourage businesses and households from spending. They do this by choosing to buy or sell U.S. government securities to expand or contract the money supply.

- The federal funds rate at the time of writing is 2.25%-2.5% due to the .75% increase in July 2022. This change was created to manage inflation and its side effects.

The Federal Reserve

The Federal Reserve is the U.S. central banking system. Its duties include:

- Creating monetary policy

- Overseeing financial institutions

- Stabilizing the financial system

- Ensuring the financial system is safe and efficient for all

- Protecting the customer and helping in community development

The three main entities of the Federal Reserve System that promote these goals are:

- The Board of Governors

- Federal Reserve Banks

- The Federal Open Market Committee (FOMC)

The Board of Governors, which oversees the Fed, consists of seven members appointed by the U.S. president and confirmed by the Senate. Governors serve a 14-year term, with a new member elected every two years to prevent the president from using the governors to their advantage.

Within the Board of Governors is a Chair, currently Jerome Powell, and a Vice-Chair, currently Lael Brainard. Both the Chair and Vice-Chair serve 4-year terms.

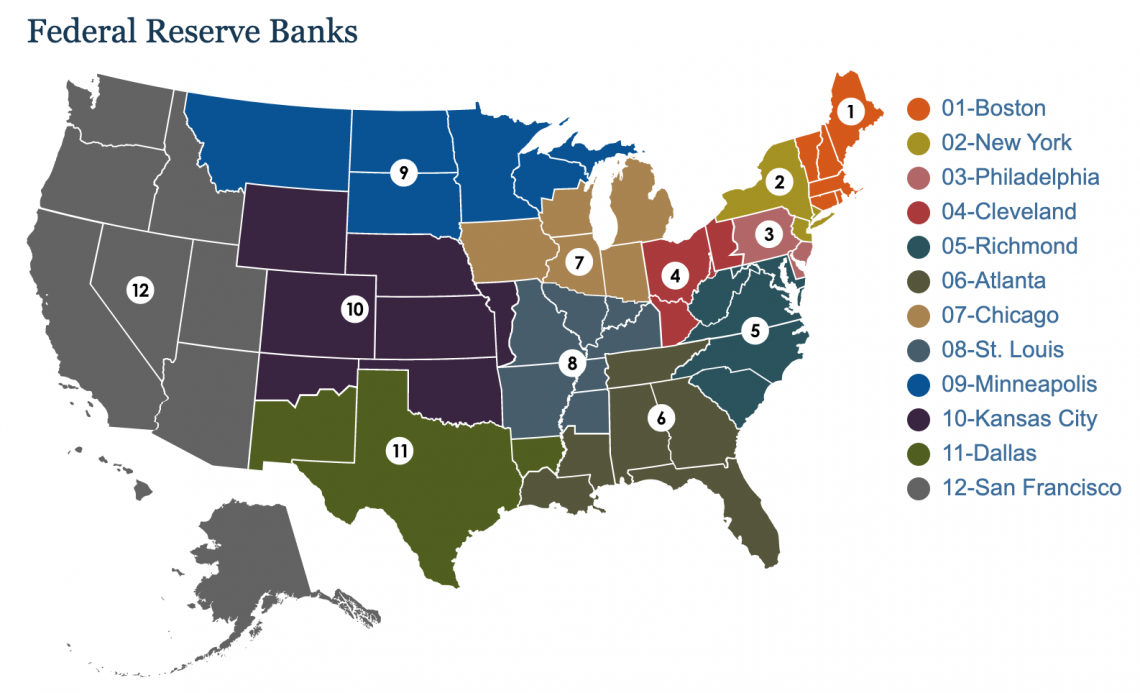

The U.S. is split into 12 geographical areas based on trade lines from the 1910s. A president oversees each district and reports to the Federal Open Market Committee. Also, each section has its own Fed bank, which operates out of the city the community is named after.

The Federal Open Market Committee consists of twelve members; the Board of Governors, the Federal Reserve Bank of New York President, and four presidents of other Federal Reserve Districts rotate yearly.

The President of the Federal Reserve Bank of New York is always on the FOMC for several reasons:

- The New York bank is the only Fed part of the Bank for International Settlements, which provides central banks with various resources.

- The New York district has some of the largest commercial banks in the U.S.

- The New York Fed is heavily involved in the foreign exchange and bond markets.

Thus, the New York district of the Fed is considered the most important, necessitating its president to be present for Federal Open Market Committee meetings.

Importance Of The Fed Beige Book

It contains three sections:

- A national overview containing overall economic activity, labor markets, and prices

- Highlights for each Federal Reserve District

- A detailed summary per district, including:

- Labor markets

- Prices

- Manufacturing

- Consumer spending

- Real estate and construction

- Financial services

- Other areas of analysis are specific to each section.

Because the Fed Districts are created based on geographic region, districts may have different, more niche areas mentioned in the detailed summary. Cleveland, for example, has a section on freight because it is an integral part of the district’s economy. In contrast, none of the other communities have an entire team dedicated to this.

Another example is Richmond, the only district with a section for Ports and Transportation. While the type of information is similar to that in Cleveland’s area on freight, they are separate because of the differences in geographical features.

Compiling similar information from each district is helpful to the Federal Open Market Committee when creating monetary policy.

The Fed has a dual mandate; its primary goals are maximum sustainable employment and stable prices. The committee can understand the economic status of all 12 districts by reading the book.

From this, the committee can determine what needs to be changed and how much to promote economic growth throughout the country's sectors.

The Beige Book and the Federal Open Market Committee (FOMC)

The Beige Book is published eight times a year, two weeks before the eight Federal Open Market Committee meetings. This allows members of the committee time to read the report and prepare ideas to discuss at the meeting.

One example is the Beige Book edition, published on March 4, 2020. It is important to note that this was during the international COVID-19 Recession.

In the book, there was much about dropping tourism and travel, insufficient employees in many district sectors, and increasing goods prices.

Following this report, in the Federal Open Market Committee meeting on March 15, 2020, committee members agreed to lower the target federal funds rate to 0%-.25%. This was a drop from the target rate of 1%-1.25% decided just two weeks prior on March 3, 2020.

By dropping the federal funds rate, the committee aimed to promote investments and spending by businesses and households by making it less expensive to take out loans. Unfortunately, while this drop was helpful during economically harsh times, Americans still feel the aftermath several years later.

In the July 13, 2022, edition of the Beige Book, districts reported increased inflation, especially in food and energy prices.

So, to help target inflation, the FOMC decided to increase the target federal funds rate to 2.25%-2.5%. They passed a vote increasing the current federal funds rate by 75 basis points, .75%.

When the federal funds rate increases, it becomes more expensive to borrow money, which can deter people and businesses from taking out loans. This decreases the amount of money in circulation, thus reducing inflation.

This inflation can be partially attributed to COVID-19-related issues. These issues initially pushed the Federal Open Market Committee to keep the federal funds rate low. However, if interest rates were raised sooner, Americans may not be struggling with inflation now.

Limitations Of The Beige Book

Although the Beige Book does not have much statistical data, it is still valid. The qualitative information in this book comes from surveys, interviews, economists, and market experts, all of whom can compare previous data to current data to fill the book with analysis.

This also means there is a chance for bias in the surveys and interviews. Because there is no quantitative data, people can be skewed and report sentiment that is not entirely accurate to themselves.

In the past, it was concluded that the news skewed respondents’ answers. Respondents had watched the news and had both overstated and understated their actual view of the state of the economy to align more with the pictures they saw in the media.

The effort to be “correct” is unhelpful, as this information is collected to understand the feelings of the average American, and skewing the answers impairs that. However, because plenty of people and businesses are interviewed for the book, the chance of bias affecting the consensus is low.

Before the creation of the Beige Book, other books were used to inform Federal Open Market Committee members on monetary policy. These books, the Green and Blue Books, were helpful as they included both qualitative and quantitative data.

What Is The Teal Book?

The Teal Book, known as the "Report to the FOMC on Economic Conditions and Monetary Policy,” is another tool that members of the Federal Open Market Committee used to determine what actions they would like to take.

Created in 2010, the Teal Book is the merger between the Green Book, known as the "Current Economic and Financial Conditions," and the Blue Book, known as the "Monetary Policy Alternatives.”

Interestingly enough, the Green and Blue Books were named as such because of the colors of their front covers, and the Teal Book was named for the color merge between green and blue.

These books used to be separate, as the Blue Book had a more restricted audience than the Green Book, with these books only becoming available to the public after five years. Teal Books are also only available to the public five years after publication.

The Teal Book comprises two parts:

- Part A is the “Economic and Financial Conditions: Current Situation and Outlook,” with information on forecasts for both the U.S. and international economies.

- Part B is the “Monetary Policy: Strategies and Alternatives,” with classified information on potential future monetary policies that the FOMC may choose to use.

The in-depth analysis from the Teal Book can help guide Federal Open Market Committee members with what monetary policy to create, as the information in this book is from economists, surveyors, and statisticians. On the other hand, the Beige Book is more geared toward understanding the public’s perspective so the committee can create policies that help Americans.

Researched and authored by Divya Ananth | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?