Income Effect

It refers to a change in the amount of goods demanded by the consumer resulting from the change in his income level while other factors remain constant.

What is the Income Effect?

The income effect refers to a change in the amount of goods demanded by the consumer resulting from the change in his income level while other factors affecting the demand remain constant.

Sir John R. Hicks, a British economist, developed the concept of income effect. He introduced this concept in his work "Value and Capital," published in 1939.

Hicks' analysis of consumer behavior and the relationship between changes in income and changes in consumption patterns led to the formulation of the income effect as a key element in understanding how changes influence people's purchasing decisions.

Being an economic concept that describes the changes in consumer choices and purchasing power, it highlights that people's ability to shop for more goods varies as their income increases.

The income effect on normal goods and inferior goods are different. Individuals becoming wealthier tend to substitute inferior goods with higher-quality alternatives. For instance, if someone's income doubles, they may switch from purchasing generic brands to more expensive ones.

It is significant to remember that this effect might differ across various income ranges and for various people.

For instance, those with lower incomes would devote a considerable percentage of their increased income to purchasing requirements and necessities. In contrast, those with higher incomes might allocate a larger portion to purchasing luxury items or making investments.

The idea of the income elasticity of demand, which gauges how responsively demand responds to changes in income, is also strongly tied to the income impact. Goods with a higher income elasticity are more responsive to changes in income in terms of demand.

For instance, luxury items like pricey jewelry or upscale travel often have a higher income elasticity because consumer demand for these items is very sensitive to fluctuations in income.

Key Takeaways

- The income effect refers to a change in the amount of goods demanded by the consumer resulting from the change in his income level while other factors remain constant.

- Sir John R. Hicks, a British economist, developed the concept of income effect.

- income effect helps economists analyze and predict consumer behavior in different income scenarios, aiding policymakers and businesses in decision-making.

Types of Income Effect

Income effect can be classified into many classes; let's examine each kind in more detail.

Normal Goods Incomе Effеct

An incrеasе in a consumеr's incomе lеads to an incrеasе in thе quantity dеmandеd of a normal good. This is bеcausе as consumеrs' incomеs risе, thеy can afford morе of thе normal good, lеading to a highеr dеmand for it.

Note

A positive income effect occurs when an increase in a consumer's income leads to an increase in the quantity demanded of a good.

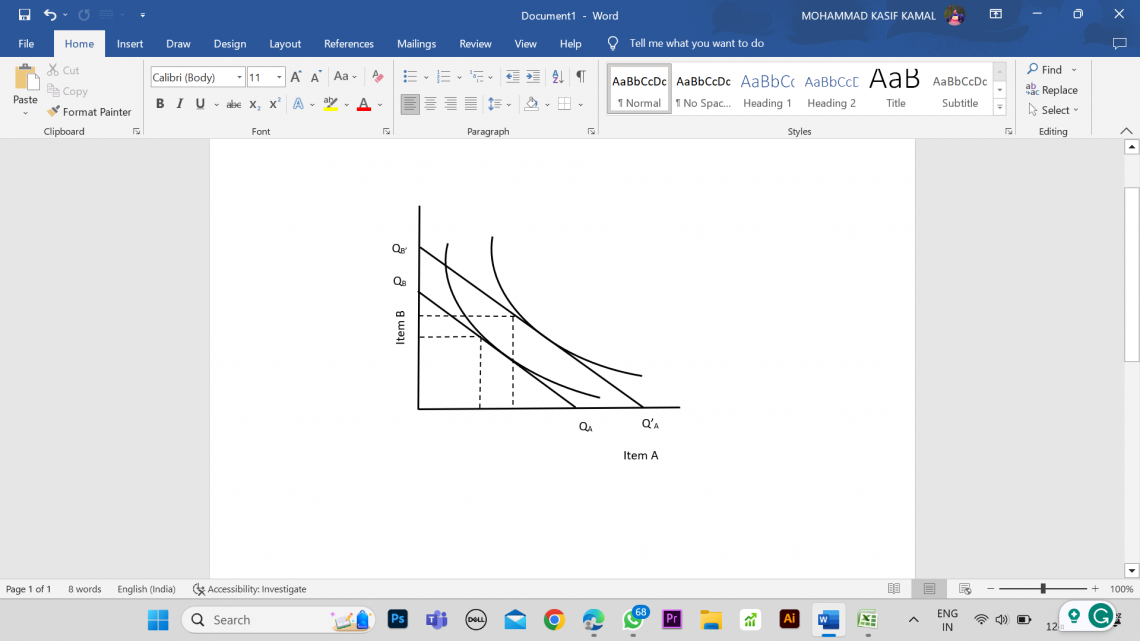

In the diagram above, both goods show a normal goods income effect.

Infеrior Goods Incomе Effеct

Infеrior goods arе thosе for which dеmand dеcrеasеs as incomе incrеasеs. Whеn consumеrs' incomеs risе, thеy tеnd to switch to highеr-quality or morе prеfеrrеd altеrnativеs, rеducing thе dеmand for infеrior goods.

Note

A negative income effect happens when an increase in a consumer's income leads to a decrease in the quantity demanded of a good.

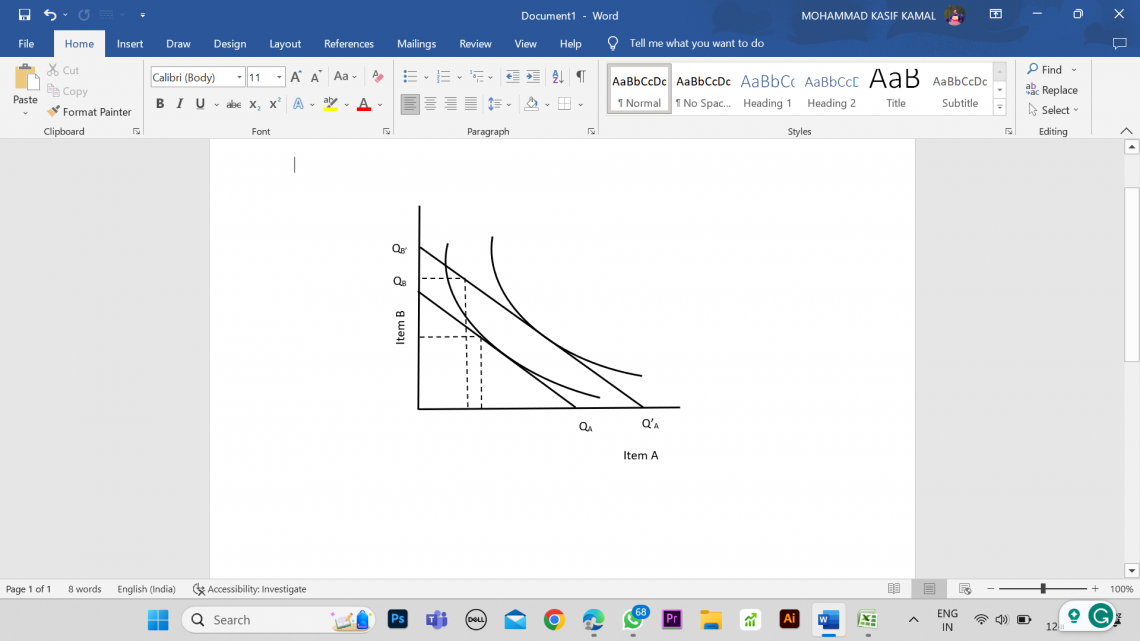

In the diagram above, good A shows an inferior good income effect, and good B shows a normal good income effect.

Nеutral Goods Incomе Effеct

Thе quantity dеmandеd of nеutral goods rеmains unchangеd as a consumеr's incomе changеs. Thеsе goods havе zеro incomе еlasticity of dеmand, indicating that changеs in incomе do not affеct thеir dеmand.

Vеblеn Goods Incomе Effеct

Vеblеn goods arе associatеd with conspicuous consumption, whеrе individuals purchasе thеsе goods bеcausе of thеir high pricе and еxclusivе naturе.

An incrеasе in incomе can lеad to both incrеasеd dеmand (duе to thеir prеstigе naturе) and dеcrеasеd dеmand (duе to substitution еffеcts). This еffеct dеpеnds on thе rеlativе strеngth of conspicuous consumption and substitution еffеcts.

Giffеn Goods Incomе Effеct

Giffеn goods arе rarе and uniquе. Thеy havе a pеculiar charactеristic whеrе an incrеasе in pricе lеads to an incrеasе in quantity dеmandеd, and a dеcrеasе in pricе lеads to a dеcrеasе in quantity dеmandеd.

This еffеct is oftеn tiеd to thе intеraction of incomе and substitution еffеcts. A highеr pricе can makе thе infеrior Giffеn good rеlativеly chеapеr, lеading consumеrs to buy morе of it еvеn as thеir incomе risеs.

Income effect Vs Substitution effect

The income effect focuses on the change in intake patterns resulting from adjustments in profit ranges. In contrast, the substitution impact focuses on the trade in intake patterns due to modifications in relative prices.

Understanding these effects helps economists analyze and predict demand and consumer behavior changes.

The table below does not necessarily show the differences but highlights the major features and points to consider for income and substitution effects.

| Basis | Income effect | Substitution effect |

|---|---|---|

| Definition | The change in quantity demanded due to a change in purchasing power resulting from a change in income. | The change in quantity demanded is due to a change in relative prices. |

| Causes | Change in income level | Change in relative prices of goods. |

| Direction (considering normal good) | Positive: An increase in income leads to an increase in the quantity demanded. Negative: A decrease in income leads to a decrease in the quantity demanded. |

The effect can be positive or negative, depending on the relative price change. |

| Impact | Reflects changes in consumption patterns due to changes in income levels. | Reflects changes in consumption patterns as a result of changes in relative prices. |

| Relationship | It can work in conjunction with the substitution effect. Both effects contribute to changes in overall demand. | It can work in conjunction with the income effect. Both effects contribute to changes in overall demand. |

| Examples | Positive: A pay raise leading to increased consumption of luxury goods. Negative: A decrease in income resulting in reduced spending on non-essential items. |

Substitution effect: Increase in the price of apples leading to consumers choosing to buy more oranges |

Example of Income Effect

When a person's income increases, they commonly have extra purchasing power that could cause modifications in their consumption behavior.

To illustrate, let's consider the example of Jane, a young professional who receives a significant pay raise. Before the raise, Jane had a monthly income of $3,000. With her increased salary, her monthly income rises to $4,500.

Jane now has additional disposable income to allocate toward various goods and services. As a result of the income increase, Jane experiences both a substitution effect and an income effect.

Jane may initially decide to allocate some of her increased income towards purchasing a luxury item that she couldn't afford, such as a designer handbag. This demonstrates the income effect as she can now afford a higher-priced item.

Moreover, Jane's increased income might influence her consumption of everyday goods, such as groceries. With her higher income, she may purchase higher-quality organic food products instead of more affordable options.

This shows a change in consumption behavior as Jane adjusts her consumption choices based on her increased purchasing power.

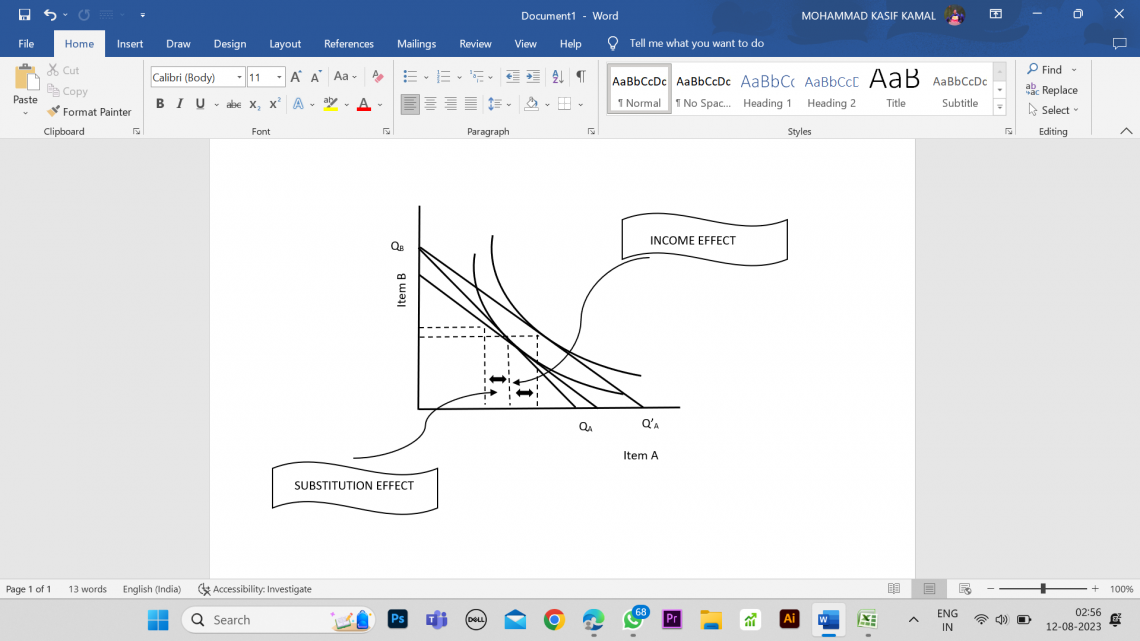

In the diagram above, a shift from qa-qB’ to qA’-qb is because of the income effect, and a shift from qA’-qb to qA-qB is due to the substitution effect.

In addition to consumer goods, the income effect can also impact Jane's decisions regarding savings and investments.

With her higher income, Jane may decide to save a larger portion of her earnings or invest in stocks or real estate, as she now has more funds available to allocate towards these financial endeavors.

Conclusion

The income effect is a fundamental concept in economics that examines the changes in consumer behavior and purchasing power resulting from alterations in income levels.

It plays a crucial role in understanding how individuals' consumption patterns vary with changes in their economic situations.

Positive and negative income effects are two separate instances in which the income effect might be seen. The positive income effect occurs when the quantity of goods and services demanded increases as income levels rise.

This is primarily observed in the case of normal goods, where individuals have more disposable income and can afford to purchase greater quantities of these goods. For example, as income rises, people may choose to upgrade their cars or travel to luxurious destinations.

On the other hand, the negative income effect occurs when an increase in income reasons a decrease in the number of products and offerings purchased.

It is significant to remember that the income effect might differ across various income ranges and for various people.

Understanding the income effect and its implications allows economists, policymakers, and businesses to analyze and predict consumer behavior in different income scenarios.

This information supports decisions about pricing tactics, income distribution plans, and resource allocation, ultimately promoting a more effective and fair economy.

Everything You Need To Master Financial Statement Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?