The Economic Crash of 2020

It was a global phenomenon resulting from a convergence of elements, including the COVID-19 pandemic and disrupted supply chains.

What Is The Economic Crash Of 2020?

The economic crash of 2020 was a global phenomenon resulting from a convergence of elements, including the COVID-19 pandemic, financial imbalances, and disrupted supply chains.

The year 2020 will forever be remembered as a time of extraordinary upheaval and hesitancy. The world was caught off guard by a relentless force that brought economies to their knees and left lasting scars on societies.

The economic crash of 2020, fueled by the global COVID-19 pandemic, brought about a paradigm shift that reshaped industries, shattered livelihoods, and tested the resilience of nations.

Before 2020, the global economy was relatively stable. Countries were interconnected through intricate webs of trade, finance, and collaboration, fostering a sense of interdependence that propelled economic progress.

However, beneath this apparent equilibrium, a storm was brewing, a viral storm that would expose the fragility of our global systems.

As news of a novel Coronavirus emerged from Wuhan, China, in late 2019, few anticipated the magnitude of its impact. The virus, officially named COVID-19, swiftly spread across borders, morphing into a full-blown pandemic by early 2020.

Governments worldwide grappled with the decision to implement lockdown measures to curb the virus’s spread.

As the initial shocks of the economic crash subsided, economies slowly began to recover. Governments and businesses adapted, pivoting toward remote work, embracing digital transformation, and reevaluating global supply chains.

That's why we will delve into the causes and immediate impacts of the economic crash of 2020, examining the responses from governments and central banks.

We will study the long-term effects and structural changes of this unique crisis and the social and human consequences. To conclude, we will concentrate on the post-pandemic world and the good effects of this crisis.

Key Takeaways

-

The economic crash of 2020 was a global phenomenon resulting from a convergence of elements, including the COVID-19 pandemic, financial imbalances, and disrupted supply chains.

-

The crash had immediate impacts, including job losses, financial hardship, and disruptions to various sectors of the economy.

-

Governments and central banks responded with unprecedented stimulus measures and monetary interventions to stabilize the economy and support businesses and individuals.

-

The social repercussions of the economic crash were profound, with increased unemployment, income inequality, mental health challenges, and disrupted education and healthcare systems.

-

The recovery and rebuilding phase involved efforts to stimulate economic growth, support small businesses, invest in sustainable infrastructure, and prioritize reskilling/upskilling of the workforce.

-

The long-term results of this crash led to structural changes such as accelerated digital transformation, shifts in consumer behavior, a focus on resilience and risk management, and a reevaluation of globalization and trade dynamics.

Background of the Global Economy in 2020

In 2020, the global economy was marked by a delicate balance between progress and vulnerability. Before the unforeseen events unfolded, there were signs of stability and growth in many regions, although some underlying challenges persisted.

Globalization has promoted interconnectedness among countries, enabling the exchange of goods, services, and investments. Supply chains have become increasingly complex, facilitating efficient production and distribution across borders.

This interdependence fueled economic growth as businesses tapped into larger markets and benefited from specialized expertise worldwide. Technological advancements have shaped the global economy.

The digital revolution gained momentum, transforming industries, business models, and consumer behavior. E-commerce has significantly increased, enabling businesses to reach customers globally and challenging traditional retail.

Tech companies, both established giants and agile startups, were at the forefront of innovation, driving economic expansion and shaping various sectors. However, the global economy in 2020 was not without its challenges.

Trade tensions escalated between major economies, leading to the imposition of tariffs and strains in trade relationships. Geopolitical uncertainties, including Brexit, added further complexity to the economic landscape.

These factors introduced a sense of caution and uncertainty among businesses and investors.

Note

The start of the year was marked by vigilant optimism about further economic growth.

Governments and central banks implemented measures to stimulate their respective economies, resulting in improved employment rates and increased consumer spending.

However, the world was about to face an unforeseen disruption of unprecedented proportions. The emergence of the COVID-19 pandemic changed the course of the global economy and reshaped the trajectory of nations.

Causes of the Economic Crash Of 2020

The economic crash of 2020 was the result of various factors that converged to create an unprecedented global downturn. The primary catalyst for this crisis was the outbreak and rapid spread of the COVID-19 pandemic.

However, several underlying causes compounded its impact, leading to widespread economic disruption and a severe recession.

1. COVID-19 Pandemic

The COVID-19 virus spread rapidly across the globe, prompting governments to implement strict measures to contain its transmission.

Lockdowns, travel restrictions, and social distance guidelines were necessary to protect public health but had severe economic consequences.

Businesses, especially those in the travel, hospitality, or retail sectors, were forced to close or operate at a limited capacity. This caused a sharp decline in economic activity.

Note

For accurate pandemic statistics, click here: Pandemic statistics.

2. Disruptions in Global Supply Chains

The pandemic's impact on global supply chains was a significant driver of the economic crash. Factory closures, transportation disruptions, and the unavailability of raw materials and components disrupted manufacturing processes.

This disruption had a cascading effect on industries reliant on timely and efficient supply chains, such as automotive, electronics, and retail.

3. Plummeting Consumer Spending and Confidence

Fear and uncertainty caused by the pandemic led to a significant decline in consumer spending. With job losses, income reductions, and heightened economic anxiety, individuals cut back on non-essential purchases.

Note

The decline in consumer demand profoundly impacted businesses, particularly those in the retail and service sectors, leading to revenue losses, layoffs, and closures.

4. Government-Imposed Lockdowns and Restrictions

Governments implemented widespread lockdowns and restrictions on economic activity to contain the spread of the virus. While necessary from a public health standpoint, these measures had immediate and severe economic consequences.

Many non-essential businesses were forced to close, resulting in significant revenue losses, bankruptcies, and job losses.

5. Financial Market Instability

The economic crash was accompanied by extreme volatility in financial markets. Investor panic and uncertainty about the pandemic's impact on the global economy led to massive stock market declines, increased market volatility, and liquidity concerns.

Note

The financial market turmoil further exacerbated the economic downturn, affecting businesses, investor confidence, and access to capital.

6. Dependence on Specific Industries

The economic crash exposed the vulnerability of economies heavily reliant on specific industries that were severely impacted by the pandemic.

Sectors such as travel, tourism, hospitality, and entertainment were hit hardest, experiencing sharp revenue declines and widespread job losses. Economies heavily dependent on these sectors faced significant challenges in diversifying and mitigating the economic impact.

These causes, combined with other contributing factors such as trade disruptions, geopolitical tensions, and fiscal challenges, created a perfect storm that resulted in the economic crash of 2020.

Immediate Impacts Of The Economic Crash Of 2020

The economic crash of 2020 profoundly and immediately impacted individuals, businesses, and governments worldwide.

The convergence of various factors, primarily driven by the COVID-19 pandemic, led to a rapid and severe downturn in global economic activity.

1. Skyrocketing Unemployment

Businesses across industries were forced to lay off employees or shut down entirely due to the economic decline.

Sectors heavily affected by the pandemic, such as travel, hospitality, and retail, experienced significant job losses. This resulted in millions of individuals suddenly facing unemployment and financial hardship.

2. Business Closures and Bankruptcies

The economic downturn led to a wave of business closures and bankruptcies. Numerous small and medium-sized businesses, lacking the financial resources to endure extended durations of economic inaction, were especially susceptible.

Note

Business closures had a cascading effect, affecting supply chains, reducing consumer choice, and causing further job losses.

3. Decline in Consumer Spending

Consumer spending witnessed a sharp decline with rising unemployment, reduced income, and economic uncertainty.

Individuals and households focused on essential purchases, cutting back on discretionary spending. This significantly influenced industries such as retail, travel, and entertainment.

4. Stock Market Volatility

Financial markets experienced extreme volatility during the economic crash. Stock markets globally witnessed rapid declines and increased volatility as investor confidence plummeted.

The unprecedented uncertainty surrounding the pandemic's impact on the global economy led to panic selling and wild market swings.

Note

Investors faced significant losses, and market indices recorded some of the most significant declines in history.

5. Government Fiscal Strain

The economic crash put governments under immense fiscal strain as they grappled with increased healthcare, social support, and economic stimulus spending.

The sudden loss of tax revenue due to business closures and reduced economic activity further compounded fiscal challenges.

Note

Governments had to navigate the delicate balance between supporting citizens and businesses while managing public finances for long-term sustainability.

6. Disruption of Global Trade

The economic crash disrupted global trade flows as countries implemented protectionist measures and travel restrictions.

Supply chains faced significant disruptions, with delays in the transportation of goods, shortages of critical supplies, and reduced international trade volumes.

This disruption affected businesses reliant on international markets and further strained the global economy.

Note

The immediate impacts of the economic crash of 2020 were far-reaching and disruptive. The sudden rise in unemployment, business closures, consumer spending decline, stock market volatility, and fiscal strain on governments highlighted the severity of the crisis.

Governments and central banks took swift action to mitigate the impact, but the road to recovery would prove to be a complex and challenging journey.

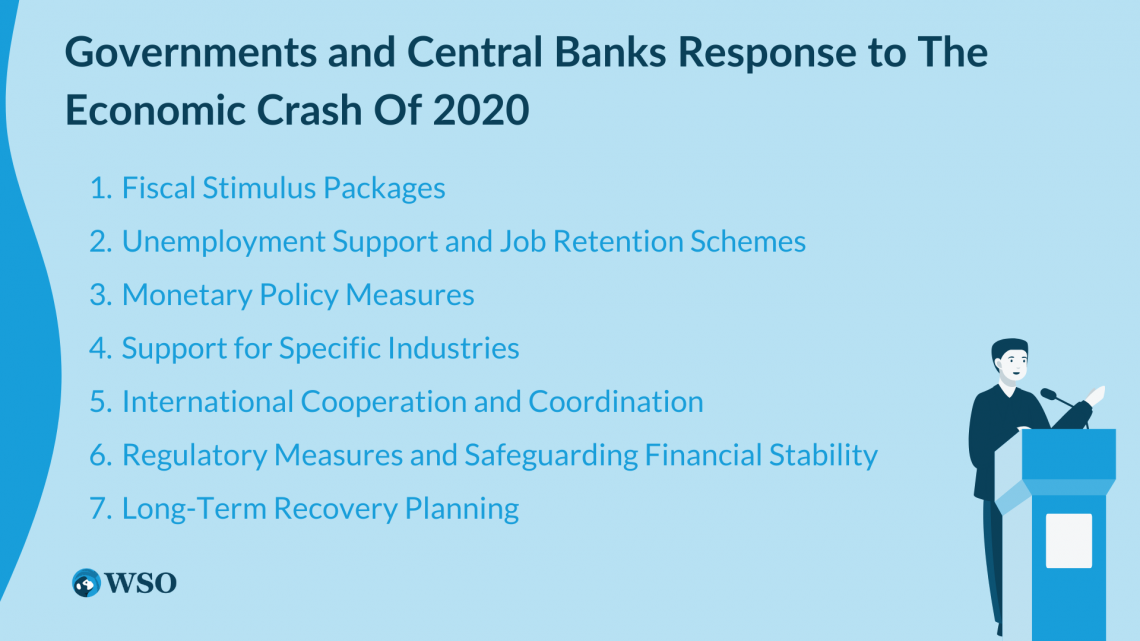

Governments and Central Banks' Response to The Economic Crash Of 2020

The economic crash of 2020 prompted governments and central banks worldwide to implement unprecedented measures in an attempt to stabilize economies, support businesses, and protect livelihoods.

The severity and scope of the crisis required swift and coordinated action.

1. Fiscal Stimulus Packages

Governments worldwide have rolled out massive fiscal stimulus packages to inject liquidity into their economies and support businesses and individuals.

These packages included measures such as direct cash transfers, grants, loans, and tax relief for affected businesses. The aim was to stimulate consumer spending, prevent widespread bankruptcies, and safeguard jobs.

2. Unemployment Support and Job Retention Schemes

To address the surge in unemployment, governments introduced support mechanisms and job retention schemes. These initiatives aimed to provide financial assistance to individuals who lost their jobs and help businesses retain their workforce during the economic downturn.

Note

Unemployment benefits, wage subsidies, and furlough programs were implemented to relieve affected workers and businesses temporarily.

3. Monetary Policy Measures

Central banks played a decisive role in securing financial markets and supporting the economy. They implemented various monetary policy measures, such as lowering interest rates, providing liquidity support to banks, and implementing asset purchase programs.

These measures aimed to lower borrowing costs, maintain liquidity in the financial system, and support lending to businesses and households.

4. Support for Specific Industries

Governments and central banks targeted support toward sectors heavily impacted by the pandemic.

For example, governments provided financial assistance in the travel and tourism industry, implemented marketing campaigns to encourage domestic tourism, and offered incentives to stimulate demand.

Note

Measures such as rent relief and support for affected businesses were introduced in the hospitality sector.

5. International Cooperation and Coordination

Recognizing the global nature of the crisis, governments and central banks engaged in international cooperation and coordination.

They exchanged information, shared best practices, and coordinated policy responses to mitigate the impact of the economic crash.

Note

Multilateral institutions, such as the IMF and World Bank, provided financial assistance and policy guidance to affected countries.

6. Regulatory Measures and Safeguarding Financial Stability

Governments and regulators have implemented measures to safeguard financial stability and protect the financial system's integrity.

They introduced regulatory relief measures, relaxed bank capital requirements, and implemented measures to prevent excessive market volatility and maintain market functioning.

7. Long-Term Recovery Planning

Alongside immediate measures, governments and central banks have initiated long-term recovery planning. They recognized the need to rebuild economies in a sustainable and resilient manner.

Note

Efforts focused on investing in infrastructure, promoting innovation and technology adoption, and strengthening healthcare systems. Governments also prioritized addressing structural vulnerabilities and ensuring greater preparedness for future crises.

The response from governments and central banks during the economic crash of 2020 demonstrated the scale of the challenge and the determination to mitigate the impact on economies and societies.

Comprehensive fiscal stimulus packages, monetary policy measures, industry-specific support, international cooperation, and long-term recovery planning aimed to lay the foundation for a sustainable and inclusive recovery.

Social and Human Consequences of The Economic Crash Of 2020

The economic failure of 2020 had far-reaching social and human consequences, impacting individuals, families, and communities worldwide.

The unprecedented nature of the crisis, coupled with its rapid onset, posed significant challenges and brought about profound changes to various aspects of society. In this section, we will explore the social and human consequences resulting from the economic crash.

1. Increased Unemployment and Financial Hardship

The economic crash led to a surge in unemployment rates, leaving millions of individuals without jobs and facing financial hardship. Loss of income and livelihoods put immense strain on households, impacting their ability to meet basic needs, such as housing, food, and healthcare. Increased financial stress and uncertainty affected overall well-being and strained social support systems.

2. Rise in Income Inequality

The economic downturn disproportionately affected vulnerable populations, exacerbating income inequality. Low-wage workers, gig economy workers, and those in precarious employment were particularly impacted.

Note

The crash widened the wealth gap, as the wealthy were often better positioned to weather the crisis, while those with limited resources faced greater challenges accessing support and opportunities for recovery.

3. Mental Health and Well-being

The economic crash had significant implications for mental health and well-being. The loss of jobs, financial strain, and social isolation caused by lockdowns and social distancing measures took a toll on individuals' mental health.

Increased stress, anxiety, and depression were observed, necessitating additional support and mental health resources to address the growing need.

4. Disruption in Education

The economic failure disrupted education systems worldwide. School closures and the shift to remote learning posed challenges for students, parents, and educators.

Access to technology and reliable internet became critical for remote learning, creating disparities in educational opportunities.

Note

The disruption in education may have long-term consequences, including learning gaps and diminished social development for affected students.

5. Impact on Healthcare Systems

The economic crash placed immense strain on healthcare systems already grappling with the health impacts of the pandemic. Resource constraints, funding challenges, and increased demand for healthcare services added pressure to an already burdened system.

Note

Access to healthcare, particularly for vulnerable populations, became more challenging, exacerbating existing health disparities.

6. Social Cohesion and Inequality

The economic crash highlighted and magnified social divisions and inequalities. It exposed systemic vulnerabilities and societal disparities, including access to healthcare, housing, education, and social services.

The resulting social tensions and inequalities underscore the need for greater social cohesion, inclusivity, and policies that address structural inequalities.

Recovery And Rebuilding After The Economic Crash Of 2020

The economic crash of 2020 necessitated a concerted effort to initiate a recovery and rebuilding process.

As societies and economies progressively emerged from the depths of the crisis, governments, businesses, and communities rallied to lay the foundation for a sustainable and inclusive future.

1. Economic Stimulus and Infrastructure Investment

Governments have implemented robust economic stimulus measures to reignite economic activity. These actions included infrastructure investment, such as the development of transportation networks, renewable energy projects, and digital infrastructure.

2. Assist Small and Medium-sized Enterprises

SMEs, often the backbone of economies, faced significant challenges during the economic crash.

Governments introduced targeted support programs to help SMEs recover and rebuild. These initiatives included financial assistance, access to credit, business advisory services, and technological support to enhance their competitiveness.

3. Reskilling and Upskilling

The economic crash underscored the importance of reskilling and upskilling the workforce to adapt to evolving job markets.

Note

Administrations, educational institutions, and companies collaborated to provide training programs and initiatives to equip individuals with the skills needed for future jobs. This focus on lifelong learning aimed to enhance employability and bridge skill gaps.

4. Sustainable and Green Initiatives

The recovery period presents an opportunity to prioritize sustainability and address climate change concerns.

Authorities and businesses have embraced sustainable practices and investments in renewable energy, energy efficiency, and environmentally friendly technologies.

5. Social Safety Nets and Welfare Reforms

The economic crash highlighted the need to strengthen social safety nets and ensure a resilient welfare system.

Note

Governments have implemented reforms to enhance social protection programs, expand access to healthcare, improve income support mechanisms, and address inequality. These measures aim to provide a safety net for individuals and families during times of economic uncertainty.

6. Digital Transformation and Innovation

The economic crash accelerated the digital transformation of various sectors. Governments and businesses have embraced digital technologies, e-commerce, and remote work arrangements.

Note

Investments in digital infrastructure, internet connectivity, and cybersecurity have become crucial for economic recovery.

7. International Collaboration and Trade

Collaboration and cooperation among nations were vital in the recovery and rebuilding process. Governments engaged in international partnerships, trade agreements, and knowledge sharing to promote economic recovery.

Global cooperation in areas such as vaccine distribution, supply chain resilience, and sustainable development goals contributed to a more resilient and interconnected global economy.

The recovery and rebuilding phase following the economic crash required a multifaceted approach that prioritized sustainable growth, social inclusivity, and technological advancement.

Long-Term Effects And Structural Changes Of The Economic Crash Of 2020

The economic crash of 2020 left a lasting impact on global economies, triggering a series of long-term effects and structural changes.

The magnitude of the crisis prompted a reevaluation of existing systems and practices, leading to shifts in various aspects of society and the economy.

1. Acceleration of Digital Transformation

The economic crash has accelerated the adoption of digital technologies across industries. Remote work, e-commerce, online education, and telemedicine have become more prevalent.

This shift towards digitalization and automation transformed business operations and highlighted the importance of digital infrastructure, connectivity, and cybersecurity.

2. Changes in Consumer Behavior

The economic crash altered consumer behavior, leading to lasting changes in preferences and spending patterns.

Note

The emphasis on essential goods and services increased online shopping, and the demand for contactless experiences became more pronounced.

Businesses had to adapt to these shifts by reevaluating their strategies, improving their digital presence, and enhancing customer engagement.

3. Increased Focus on Resilience and Risk Management

The economic crash underscored the need for resilience and risk management in both the public and private sectors.

Businesses and governments recognized the importance of diversifying supply chains, enhancing financial buffers, and improving crisis preparedness. Risk assessment and mitigation strategies became essential components of decision-making processes.

4. Heightened Awareness of Health and Safety

The pandemic associated with the economic crash brought health and safety to the forefront of public consciousness. Individuals and organizations became more conscious of hygiene practices, workplace safety measures, and public health considerations.

Note

The heightened awareness led to the implementation of stricter health and safety protocols and increased investments in healthcare infrastructure.

5. Shift towards Sustainable Practices

The economic crash highlighted the interdependence between economic activity and environmental sustainability. As a result, there was a greater emphasis on sustainability and responsible practices across sectors.

Businesses integrated sustainability into their operations, governments implemented stricter environmental regulations, and consumers increasingly preferred eco-friendly products and services.

6. Evolution of Work Dynamics

The economic crash accelerated changes in work dynamics, challenging traditional employment models. Remote work, flexible arrangements, and the gig economy gained prominence.

Note

The pandemic-induced remote work experiment provided valuable insights into the feasibility and benefits of remote work, leading to a more flexible and hybrid approach to work in the long term.

7. Redefining Globalization and Trade

The economic crash prompted a reevaluation of globalization and trade dynamics. Governments and businesses reconsidered their reliance on global supply chains and explored regional or domestic alternatives to enhance resilience.

Trade policies and agreements were revisited to strike a balance between economic integration and self-sufficiency in critical sectors.

8. Reimagining Social Safety Nets

The economic crash exposed vulnerabilities in social safety nets and highlighted the need for comprehensive social protection systems.

Note

Governments recognized the importance of strengthening social safety nets to provide a cushion for individuals and families during times of crisis. This led to discussions on a universal basic income, healthcare reforms, and equitable access to education and social services.

9. Enhanced Focus on Preparedness and Crisis Response

The economic crash served as a wake-up call for governments, organizations, and individuals regarding the importance of preparedness and crisis response.

There was an increased emphasis on proactive measures, including early warning systems, contingency plans, and investments in research and development. The goal was to build resilience and be better equipped to handle future crises.

10. Shifting Geopolitical Landscape

The economic crash had geopolitical implications, reshaping global power dynamics. It influenced diplomatic relations, trade alliances, and regional cooperation.

Note

The crisis highlighted the importance of international collaboration and coordination in addressing global challenges, leading to potential shifts in geopolitical alliances and priorities.

The long-term effects and structural changes resulting from the economic crash of 2020 have far-reaching implications. They have transformed the way we work, consume, prioritize sustainability, and approach risk management.

Governments, businesses, and individuals have learned valuable lessons and are adapting to the new normal, striving to build more resilient, inclusive, and sustainable societies in the post-crash era.

or Want to Sign up with your social account?