Vasicek Interest Rate Model

The model is used for developing predictive analysis on how interest rates in the economy will change

What is The Vasicek Interest Rate Model?

Vasicek's interest rate model is used for developing predictive analysis on how interest rates in the economy will change.The model is a purely mathematical result of interest rates. It is a single-factor short-rate model.

Such models are based on the assumption that the evolution of interest rates depends on only one stochastic variable.The conserved for such is a multiple-factor short rate model that considers more than one stochastic variable for interest rate evolution analysis.

This model has been helping economists, investors, and businesses to predict the direction of interest rates in the economy for a set time frame.The primary valuation of interest rates is done by considering the market risk. The model is also known as the stochastic investment model.

Goldrich Vasicek framed the model in 1977. Since then, it has been prominently used in knowing the span of interest rates, even if other factors affect it.

This model has been of great importance to the financial markets in the world. The specialty of the Vasicek interest rate model is that it also accounts for negative interest rates.

These negative rates are beneficial for central monetary authorities to look forward to uncertain economic disturbances.It uses the approach where the interest rate's direction is predicted by considering market risk, time, and equilibrium value.

The model considers a few factors to show where interest rates will go at the end of a given period:

- Market volatility

- Long-run mean interest rate

- Market risk factors

The model states that interest rates tend to move towards the mean of all the factors considered in the equation.Vasicek also develops explicit character for term structure in an efficiently working market.

The Vasicek model is also known as the Ornstein–Uhlenbeck process.

Key Takeaways

- Vasicek's interest rate model is a purely mathematical result of interest rates, framed by Goldrich Vasicek in 1977.

- It is a single-factor short-rate model based on the assumption that the evolution of interest rates depends on only one stochastic variable.

- The model states that interest rates tend to move towards the mean of all the factors considered in the equation.

- This model has been of great importance to the financial markets in the world.

- The specialty of the Vasicek interest rate model is that it accounts for negative interest rates.

Underlying Assumptions of the short rate Vasicek model

This model is again an economic model that does propose some assumptions to be met for a hypothesis to work efficiently.

These assumptions are based on the following:

- Changes in interest rates

It assumes that changes in interest rates in the economy are continuous. This mainly means that interest rates will follow a set pattern and move along all the points before reaching their final position. - Arbitrage

The Ornstein-Uhlenbeck model assumes no arbitrage. Arbitrage is buying or selling currencies, securities, or goods by taking advantage of different market prices.

It happens when a good sold at a lower price is bought to be sold at a higher price in a different market where its cost is higher to gain profits. - Z random term

To simplify the model and calculations, the equation has a z-random term. This random term is assumed to be normally distributed with mean zero and variance σ2. - Mean reversion

The most critical assumption of the model is that interest rates follow a process of mean reversion. Mean reversion observes that if interest rates become too high compared to their historical levels, they tend to fall short.

Conversely, if interest rates drop too low from their historical value, they will tend to rise now. Therefore, the model assumes that interest rates do not fall or rise to their extreme values to eliminate such repercussions.

The model structure

The model works in a very mathematical manner, with constants and variables working hand in hand.

To understand the model of instantaneous interest rates, the Vasicek model provides a general equation:

dr = a ( b - r ) dt + σ dz

Where

- dr: is the instantaneous interest rate,

- a: is the speed of reversion to the mean or a proportional factor to the deviation of the process of the standard. Also, a needs to be favorable to ensure stability around long-term value. Therefore larger the faster the interest rates revert to their mean values.

- b: here is the risk-adjusted long-term level of mean.

- The term a ( b - r ) dt implies a force that pulls back the process towards its risk-adjusted long-term mean or simply the variable b. Also, the process volatility is measured implicitly in the model by σ.it is also known as the standard deviation of interest rates.

- z here signifies a random risk term normally distributed by assumption.

The central part of the process explains that a fast rate at a given time in the future at a given level of current rates would be normally distributed.

The model specification is such that the drift term is adjusted by the market price of risk that is b is constant across different interest rates securities in the model. This is a consequence of the no-arbitrage assumption.

The model specifies that when the market is free from any shocks, the random term derivative, dz, is equal to 0, and the interest rates remain constant.The interest rate will also reflect constant consistency if markets work at equilibrium without disturbances.

The other cases can be when the drift factor is positive and sometimes negative. When the drift factor is positive, when r is less than the risk-adjusted long-term mean, interest rates will increase toward the equilibrium.

The converse is when the drift factor is negative; b is less than r. In this case, interest rates will move towards equilibrium while decreasing.

However, in a situation where markets are disturbed by any shocks or unusual patterns, the change in interest rates will be very much affected by not only the drift factor but also the random term, which can prove to have a more significant effect on instantaneous interest rates.

The fundamental equation for interest rates dependent securities is given by:

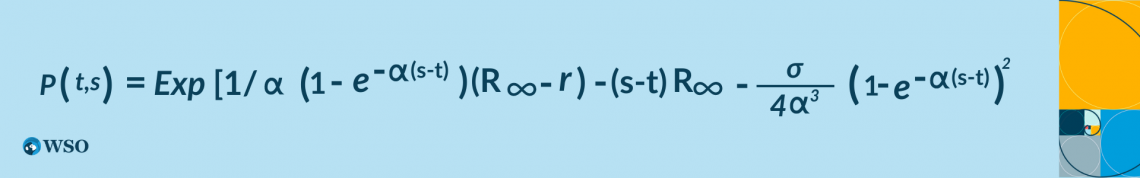

The equation gives the intelligent solution for bond pricing:

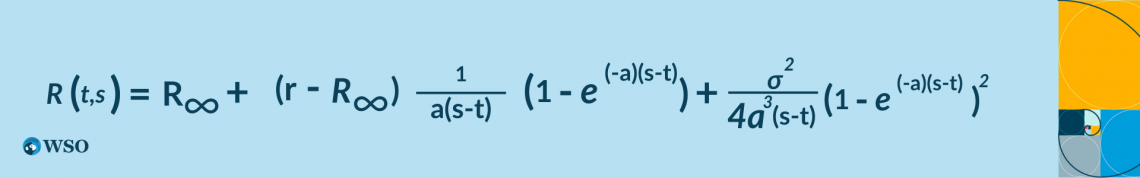

Now, by using these equations, we obtain the term structure of spot rates.

That is:

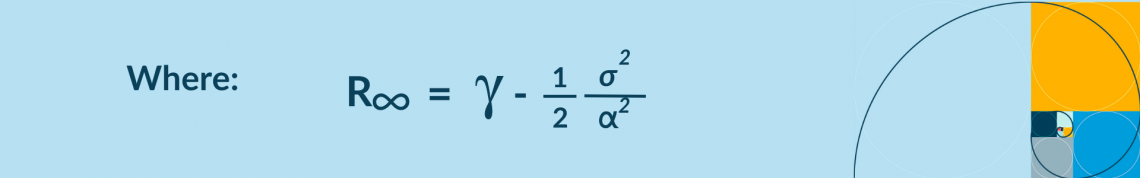

Here the R is a determinant of yield from long-term bonds.

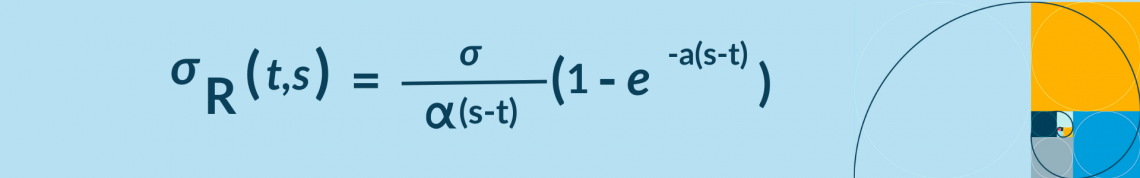

We also can derive the phenomenon that states the volatility of spot rates differs for the time of maturities. This is given by:

The model is precisely aligned with the risk direction and does not individually reflect the actual value or market price.

Limitations of the Vasicek interest rate model

Vasicek's interest rate model seems very dignified and on-point, but it still undergoes criticism due to its unrealistic assumptions.

Let us now look at the negative aspects of each assumption:

1. Only single factors affect the interest rate

It's the very first and foremost self-exploratory assumption. This means that only market volatility or market risk affects the interest rates.

But in the practical world, this is not true. Since the economy runs on solid and extensive indicators, interest rates may depend on several factors other than risk.

2. Introduction of a drift term

The drift term suggests that interest rates in the economy can go below zero or, in other words, can become harmful. This is a highly considerable situation and is a very extreme phenomenon.

This phenomenon is used by monetary authorities as a tool to revamp economic stability but in a very conscious manner.

3. Continuous interest rates

It is another vague assumption when we assume that interest rates are continuous. In a real-world scenario, this is hardly true since it is widely observed that interest rates are frequently changing distinctly.

Just like a jumping game, it is okay that they move point by point in a path, but they can have extreme unpredicted movements.

4. No arbitrage

In a dynamic set-up of investment and savings in every economy, it is doubtful that arbitrage is not present.

The globalizing world has seen vast and huge potential in integrating the global capital market and mobility. Therefore assuming no secondary market becomes unviable.

5. Z follows a normal distribution

The Vasicek model also assumes that Z (Normal distributed random term) follows a normal distribution without any stringent reason. Therefore this can be untrue in the real sense where variables are so exploratory and time-changing.

If the assumption is violated, the Vasicek interest model may become too complicated to be used as a decision-making criterion for investment.

Cox-Ingersoll-Ross Model Vs. Vasicek Model

There are many other models as well by some other economists who have added a factor or removed two, but their ideas somewhat reflect the same ideology.

Let's discuss the Cox-Ingersoll-Ross Model below to study how interest rates can be calculated for future prediction.

This model also helps predict the future direction of interest rates. This model is also a one-factor short-rate model. It takes into account current volatility, the mean rate, and spreads.

The equation is as follows:

dr = a(b − r)dt + σ √ r dz

The Cox-Ingersoll-Ross model differs from Vasicek as it does not create any room for negative interest rates since volatility is multiplied by √ r dz.

A fixed amount of change in σ affects the short-rate simulation more in the Vasicek model than in the Cox-Ingersoll-ross model.

Therefore, having the desired property that when interest rates are high, volatility is also high. However, the drift factor remains the same and thus exhibits that long-run means will be b and the reversion factor will be a. The drift factor helps to describe the long-run behavior of the process.

Hull While Model Vs. Vasicek Model

Now, let's discuss the Hull-White Model to study a different method to calculate interest rates for future prediction.

The hull while the model is just a similar case to the Vasicek model.

It assumes that volatility will be low when short-term interest rates are near zero. This is used to price interest rate derivatives.

Both models follow a usual distribution assumption and therefore suffer from the same drawbacks as negative interest rates. The equation for the hull-while model is

dr = a(b(t) − r)dt + σ r dz

The only significant difference in both models is that the long-term level means are dependent upon the time factor in the hull's model.

Also, Vasicek is an equilibrium model, whereas the hull while interest rate model is an arbitrage-free model. Also, the hull's model can fit a given term structure of volatility, but the Vasicek interest model cannot capture it.

Vasicek's model is relevant when we want to examine the impact of one variable, like a market risk at a given time, on interest rates.

However, it is insignificant or can give misleading results when we assume that only one factor affects the economic interest rates.This will, in turn, lead to wrong or biased investing decisions since bond yields and return on savings all depend on interest rate predictions.

Any investor will surely want to predict the future concerning market uncertainty; therefore, the model plays a vital role in classifying market risk. The model also inculcates the long-term interest rate value and defines a clear distinction between short-run and long-run working interest rates.

The model does not support the relevance of extreme interest rate variations due to exogenous variables and therefore neglects the possibilities of explicit predictable market inconsistencies.

These inconsistencies may also result in observation ambiguities and lead to biased decision-making.

The model cannot withstand any purpose if the normal distribution is removed from the variables. Since this case can prove to be ignorance of natural factors, the model insists more on theory relevance rather than instant usage.

Whereas other models of interest rates discussed above can be used with the same criteria of fast pace but with more clear conclusions.

The cox-Ingersoll-ross model gives a more unambiguous indication of interest rates with more on-the-guard specifications and eliminates severe assumptions.

The case with the hull while the model is that it is more dignified concerning time constraints and therefore makes a clearer picture of term structure than the Vasicek model.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?