Corporate Fraud

The term is used to describe any unethical, unlawful, or deceitful acts carried out by a company or by a person working for the firm.

What Is Corporate Fraud?

Corporate fraud is the term used to describe unlawful actions carried out dishonestly or unethically by an individual or organization. This type of commercial fraud is frequently intended to benefit the person or corporation committing it.

Corporate fraud schemes are characterized by their intricacy and financial impact on the company, other employees, and external parties. They extend beyond the purported limits of an employee's job description.

When businesses participate in deceptive or unethical acts, such as fabricating accounting records or deliberately influencing commodities, products, and services, they are said to violate the law.

The illicit and ethically questionable operations that are conducted by anybody, person, group, or corporation, with the paramount aim of obtaining a competitive edge over other companies or individuals, is Corporate Fraud.

Fraud is a pervasive issue that undermines the integrity and trust within the business world.

Deliberate manipulation, misrepresentation, or concealment of financial or non-financial information are key areas for fraud to emerge from. This could stem from an individual or a corporation for personal gain or mislead stakeholders.

These frauds can take on various forms, each characterized by its unique methods and intentions.

Some common types include

- Financial statement fraud, where financial records are falsified to mislead investors and regulators

- Insider Trading

- Embezzlement

- Bribery and Corruption

These fraudulent activities can severely affect the organization, its stakeholders, and the overall economy. The pursuit of excessive profits, pressure to meet financial targets, and a culture of greed and entitlement within an organization can encourage fraudulent behavior.

Key Takeaways

- Corporate Fraud refers to deceptive or unethical acts committed by individuals, groups, or corporations to gain a competitive advantage over others.

- Fraud can take on different forms, such as financial statement fraud, insider trading, embezzlement, bribery, and corruption. Each form has its unique methods and intentions.

- Corporate fraud can be driven by a desire to attract investors, inflate stock prices, cover up negligence or negative outcomes, and retain or attract investors with the perception of growth and profitability.

- These frauds can be accomplished through harassment, bribery, embezzlement, counterfeiting, forgery, accounting swindles, insider trading, corruption, money laundering, and selling bogus items.

- Corporate fraud has severe implications for organizations, stakeholders, and the overall economy. It can lead to financial losses, bankruptcy, loss of trust, legal penalties, and reputational damage.

Why Does Corporate Fraud Happen?

There are various reasons why a company/individual might choose to undertake fraud.

Various reasons are presented below:

- Present a more favorable image of the company in the market to attract investors

- To artificially inflate the stock price of the company, which employees might have an incentive to increase with employee stock options

- Cover negligent practices/negative outcomes attributed to products used

Corporate fraud schemes are sometimes exceedingly intricate and, as a result, difficult to detect. In many cases, it takes months for a team of forensic accountants to dismantle a fraud scheme in its entirety completely.

Generally speaking, white-collar crimes are criminal activities undertaken by high-ranking members of society to make money in an unethical manner. The primary reason for fraud is to make the company appear more profitable than it currently actually is.

This will allow for greater retention of investors in the business if they believe that the business has growth potential and prospects. Likewise, new investors would be attracted to join the business as the business would be seen as growing and profiting with smudged numbers.

This fraud could also help to inflate the stock price of outstanding shares the business owns in the market. When the business grows, be it through fraud or genuine means, investors would price an individual outstanding share higher in the market.

Therefore, employees with common equity in the business that might be paid out to them through employee stock options (ESOs) would see their pay increase owing to the increase in stock price. There is an incentive for the common employee to overreport numbers, therefore.

Lastly, products that might be deemed dangerous with uses that compromise the safety of their users might have business cover-ups to minimize fines levied on the company for breaching certain health or safety regulations.

How Is Corporate Fraud Accomplished?

The various means by which corporate fraud is accomplished are numerous and plentiful. Here is a list of common methods by which corporate fraud is accomplished.

As regulatory laws and frameworks strengthen, corporate fraud techniques might become more developed, and new techniques emerge:

- Harassment

- Bribery

- Embezzlement

- Counterfeiting

- Forgery (money, products, data, intellectual property, etc.)

- Accounting swindle (Evasion of taxes, non-payment, shell companies)

- Insider Trading

- Corruption or bribery

- Money laundering

- Selling bogus items under the guise of a genuine article

Attempts to go beyond the extent of an employee's abilities, may have a complicated and economic effect not only on the company but also on workers and other third parties outside of the organization.

Theft of assets, fake expenditures, corruption, information theft, fraudulent applications, abuse of assets, dishonest business partners, and fraudulent billings are all examples of dishonest acts resulting in income loss.

There are occasions when scapegoats are lower in seniority or experience. In 2019, RCBC bank, the central bank of Bangladesh, had its accounts hacked and over US$81 million siphoned to external accounts. Investigators suspected insider information fed to the hackers.

However, branch manager Maia Deguito was penalized and found guilty by the courts for fraud. Critics claim that whether or not she was found guilty was not contingent as the only thing that mattered was her head on the chopping block, regardless of the ruling.

Victims of corporate fraud include customers or clients, creditors, investors, and other companies, as well as, in the long run, the corporation that is the source of the fraudulent activity and its personnel.

When the fraud is ultimately detected, the firm that committed it is often left in ruins and forced to file for bankruptcy as a result.

Much of the money gained unlawfully via corporate fraud is never recovered because criminals have squandered it long before the money was received.

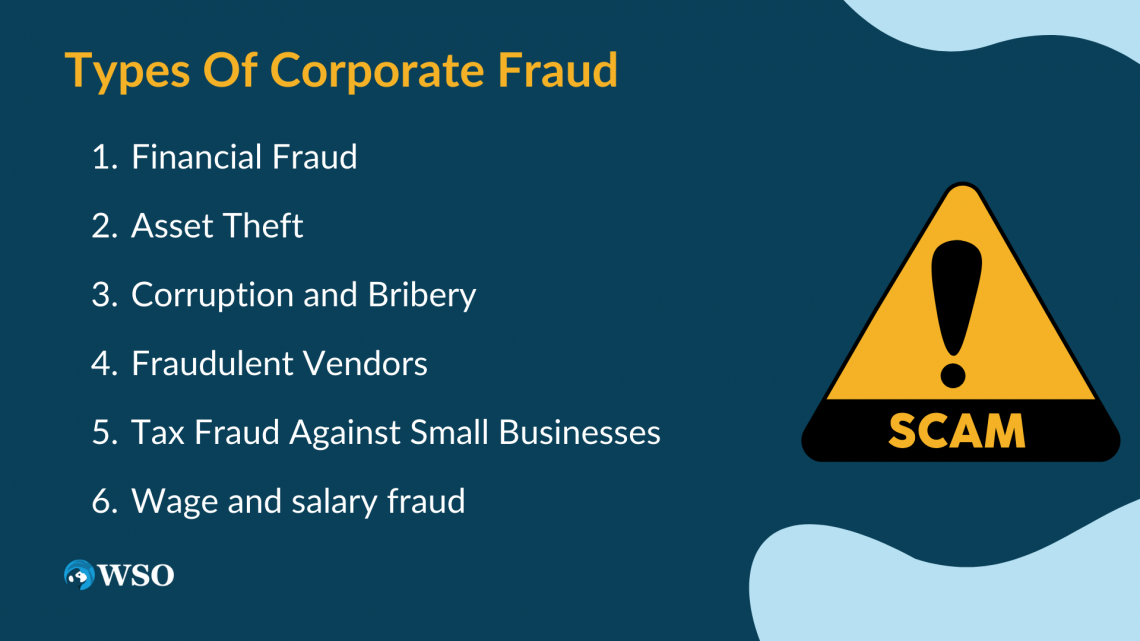

Types of Corporate Fraud

Corporate fraud encompasses various types of fraudulent activities, including financial fraud, asset theft, corruption and bribery, fraudulent vendors, tax fraud against small businesses, and wage and salary fraud.

Financial fraud involves manipulating accounts to conceal embezzlement and other illegal actions. Asset theft refers to stealing merchandise or misusing business assets.

Corruption and bribery damage a company's reputation and may involve soliciting bribes or establishing shell companies. Fraudulent vendors collaborate with employees to engage in overbilling and price manipulation.

Tax fraud against small businesses involves underreporting cash transactions to evade tax obligations. Wage and salary fraud includes timesheet manipulation and fictitious employee schemes.

Note

Preventing corporate fraud requires implementing internal controls, conducting audits, establishing ethical guidelines, promoting transparency, and providing anti-fraud training.

Going in greater depth into the various types of fraud that individuals can possibly undertake:

1. Financial Fraud

Accounting fraud is when an individual or an entire accounting staff manipulates your accounts payable or receivables to conceal their crime; Multiple check payments, fraud, lapping, false sales, and skimming are all examples of embezzlement.

2. Asset Theft

It is considered financial fraud when a single individual or the entire accounting department in charge partakes in adjusting your accounts payable or receivables to disguise their larceny.

Note

The embankment, various check transactions, misappropriation of funds, lapping, unfounded sales, skimming, asset misappropriation when they steal merchandise, misuse of business assets, or tampering with checks and invoices to exaggerate spending and procurements.

3. Corruption and Bribery

Bribery and corruption not only constitute criminal activity, but they also have a negative impact on the image of the firm.

It includes instances when an employee demands a bribe from an outsider in exchange for a service or undermines the company's position to get personal gain, as well as the establishment of shell companies to redirect the company's finances and assets.

4. Fraudulent Vendors

Vendor fraud may occur when staff conspires with suppliers to allow for overbilling to gain an additional profit via fraudulent charging schemes, bribery, overbilling, and price manipulation.

Note

Workers may collaborate with your suppliers to facilitate overbilling to gain an additional profit via fraud.

5. Tax Fraud Against Small Businesses

Small enterprises often do the majority of their operations in cash. Small firms often fail to disclose all money produced or paid to workers illegally in order to avoid complying with payroll tax obligations and other legal employment requirements.

Note

Maintaining two sets of books is a frequently used practice by small enterprises to commit tax fraud. Excessive loss or cost reporting is another kind of small company tax fraud.

6. Wage and salary fraud

Payroll fraud is the most common sort of employee fraud. It includes timesheet fraud, in which workers falsify their work hours or conspire with the payroll department to perpetrate fictitious employee schemes, forgery of employee advances, and so on.

When an employee defrauds the firm of its assets, this is referred to as asset misappropriation. This might involve stealing merchandise, abusing corporate assets, or tampering with checks and invoices to exaggerate costs and purchases.

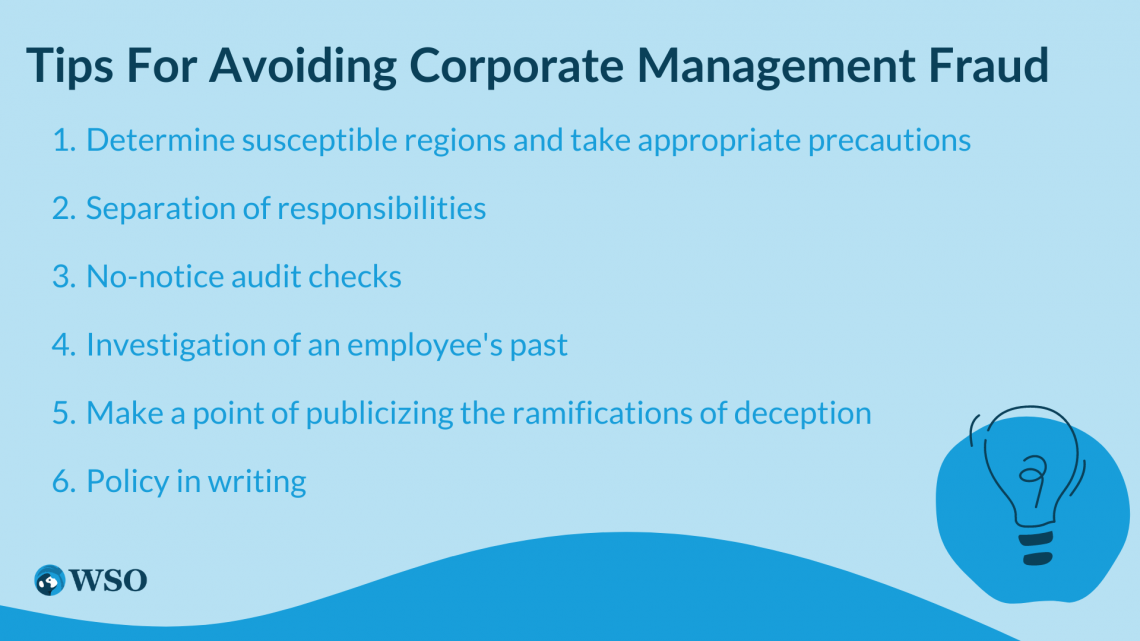

Tips for Avoiding Corporate Management Fraud

To prevent corporate management fraud, organizations can take key precautions. Firstly, they should identify vulnerable areas and establish appropriate measures. This involves assembling a team of compliance specialists to analyze processes and develop technology solutions.

Separating responsibilities is crucial, ensuring that no single person has complete control over critical transactions. Surprise audits without notice help detect and deter fraud by preventing the concealment of evidence.

Conducting background checks and engaging in one-on-one discussions can reveal potential vulnerabilities in employees.

Note

Raising awareness about the consequences of fraud within the organization, particularly among top executives, creates a culture of accountability. Implementing a well-documented policy with a code of conduct outlines ethical standards and repercussions for violations.

Strengthening IT controls and data security, such as restricted access and clear desk policies, prevents data theft. By following these precautions, organizations can significantly reduce the risk of corporate management fraud and foster integrity and transparency within the company.

There are definitive ways to mitigate fraud on the part of employers and frameworks the corporation at large can adopt.

1. Determine susceptible regions and take appropriate precautions

Only when the source of an issue is identified can a solution be created. Organize a team of compliance specialists capable of identifying these flaws and initiating work on technology solutions to eliminate the possibility of fraud.

2. Separation of responsibilities

The approval or execution of transactions, particularly those with financial consequences, should not be the responsibility of a single individual.

Note

Multiple persons participating in a sequence of transactions with rotation and division of roles discourages any one person from assuming control and makes them more conscious of their activities.

3. No-notice audit checks

With no time to conceal, delete, or amend evidence of fraud, conduct surprise audits periodically without prior warning.

4. Investigation of an employee's past

When confronted with a personal crisis, an employee may succumb to the temptation to make the incorrect decision.

Note

Conduct a background check, have a one-on-one discussion to understand better the individual's position, particularly during a pandemic, and attempt to discover weak places where one may be tempted to commit fraud.

5. Make a point of publicizing the ramifications of deception

It is necessary to raise awareness inside the company about the implications of fraud. Employees, particularly top executives, should be fearful that unethical behavior will be penalized if detected.

6. Policy in writing

A well-documented policy addressing business ethics should be established, together with a systematic code of conduct outlining the workers' roles and responsibilities, the do's and don'ts while performing their jobs, and the repercussions of breaching their code of conduct.

Note

Data theft may be avoided by adopting IT controls, restricting access to essential places with solid passwords, and creating a clear desk policy for workers, ensuring that no data on the table is visible to passers-by.

Corporate Fraud Penalties

The penalties for commercial fraud vary significantly according to the nature of the act. A company established solely for the purpose of money laundering or operating an unauthorized credit card scheme may face accusations of money laundering, bank fraud, and identity theft.

Computer fraud offenses might be added to the list of charges for a firm that engages in online scams. Tax, securities and commodities, accounting, larceny, and embezzlement accusations are frauds commonly seen.

If the commercial crime includes an attempt to deceive the government, you may potentially face prosecution under the False Claims Act.

Numerous kinds of commercial fraud entail wire or postal fraud as well. Each of these charges has a maximum sentence of twenty years in prison or thirty years if the fraud involves financial institutions. Fines sometimes go to a total fee of upwards of a million.

Individuals and businesses accused of corporate fraud may have their assets taken by criminal or civil forfeiture and may be obliged to pay restitution charges in addition to additional penalties. This is called asset seizure.

In these instances, the bank accounts of the affected parties are sometimes frozen, property confiscated, and valuable assets (such as jewelry) might get confiscated by the government.

Mitigation of Corporate Fraud

Based on this evaluation, you develop rules to foster an accountability culture to mitigate fraud risks.

The rules may require rigorous employee training, promoting whistleblowers, performing background checks on new recruits working in high-risk areas, and doing due diligence on potential partners.

1. Maintain a healthy skepticism

All should be thoroughly questioned: deals, opportunities, documents, transactions, information, and even people.

2. Be intimately familiar with your industry

Understand how the company functions, its employees, goods and services, target markets, and any other legal and regulatory responsibilities. This will assist you in recognizing when anything is wrong instantly.

3. Become acquainted with your customers and suppliers

When you understand who you do business with, you may identify any business request or transaction that seems to be fraudulent for that customer or supplier

Note

Conduct due diligence using a risk-based strategy, which may include examining the information you have on file for customers or suppliers and doing web searches.

4. Determine which parts of your organization are susceptible to fraud

Consider how a fraudster may approach your firm internally and internationally, and evaluate the risk-reducing tools you currently employ. Ascertain that you and your personnel are familiar with and routinely examine those processes.

5. Create a plan and educate yourself on fraud

Consider the most appropriate fraud protection and detection approach for your business, including specific controls and processes. Owners and managers serve as role models for appropriate behavior. Discuss fraud with your employees, suppliers, and other relationships.

Note

Your employees must comprehend the risks and the impact of losses on the firm and on themselves.

6. Ensure that you take additional precautions against cyber assaults

With the danger of cybercrime rising, safeguard your business's technology against assaults. Ensure that you have a backup of your systems in case anything goes wrong.

7. Comprehend your financial situation

Recognize how money departs your firm, including payment methods, who has the authorization to make such payments, and who verifies the legitimacy of those payments. Always keep an eye on your bank statements.

8. Secure and safeguard your property

Laptops, computers, cell phones, and intellectual property are all included.

Note

Consider purchasing company insurance to protect against the loss or theft of these things. Inventories should be used and maintained.

9. Create a strategy of action

Consider the instances in which you may need professional or legal guidance. While prevention is always preferable to treatment, you and your organization must be prepared for the worst-case scenario. Having a strategy in place can assist you in limiting your fraud losses.

10. Always report fraud and seek assistance

You may learn about fraud and financially driven online crime. You may also contact the police to report fraud if you know the suspect or if they are still in the neighborhood. Contact the police and request to talk with an operator.

Telltale Signals A Company Is Engaged In Corporate Fraud

There are several telltale signals that can indicate a company's involvement in corporate fraud. One indicator is the presence of missing records, significant budget variances, misplaced assets, and the lack of proper audit trails.

These irregularities can raise suspicion and point towards fraudulent activities within the organization.

In cases of accounting fraud, it has been observed that individuals in leadership positions, who are well-liked and respected, are more likely to engage in falsifying corporate finances compared to employees at lower levels.

Their positions of authority and trust can provide them with the opportunity and means to manipulate financial records for personal gain.

When dealing with external parties attempting to scam a company, certain warning signs may be evident. These can include sudden changes in payment methods, such as insistence on using unconventional or untraceable payment channels.

Additionally, scammers may employ tactics such as making threats and applying pressure to force quick decisions, creating a sense of urgency and manipulation. Internal workers involved in fraud may display noticeable changes in behavior.

This can range from resistance to undergoing audits, being secretive or evasive when questioned about financial matters, living beyond their means without any apparent legitimate sources of income, or attempting to shift blame onto others for irregularities in billing.

It is important to remain vigilant and recognize these potential red flags as they can serve as warning signs of corporate fraud. Timely detection and appropriate action can help mitigate the impact of fraudulent activities on the organization.

Examples – Major Corporate Fraud Cases

Famous examples of fraud are always big news. They show up on the front pages of the news, and many people have heard about them.

Companies have toppled due to fraud, particularly because investors lose confidence in the company.

1. Enron

Probably the most famed example of corporate fraud, Enron was a business specializing in energy, commodities, and services. It was once the 7th largest company in the world before its collapse.

Enron also had much of its remuneration through employee stock options, which meant that employees, even those low on the hierarchy, had the incentive to fake its balance sheets to make Enron appear more profitable and make its common equity more attractive to investors.

Further, Enron used special-purpose vehicles to hide its debt. It created many SPVs where it put its debt, and since these SPVs were not accounted for in its balance sheets, Enron’s balance sheet was seen as inflated without the existence of such debt.

Note

Several things are attributable to Enron’s collapse; notably, it used mark-to-market accounting for its balance sheets.

Enron would, however, collateralize these SPVs entirely with Enron stock, which meant that Enron could effectively keep using these SPVs, and if they failed, Enron stock would be used to pay off. However, the collateral would stand since Enron’s stock was so high in value.

Enron’s fraud was finally found out after investors started questioning Enron’s outstanding stock price and its overpriced nature. With the rapid fall of Enron’s stock, all of Enron’s collateralized securities fell in value, and Enron faced margin calls to up its collateral.

As a result, when it could no longer further supplement collateral, Enron collapsed. Enron then saw stock fall rapidly, coupled with an SEC investigation shortly after, which saw its price fall even lower until the company was convicted of fraud.

2. Salomon brothers

In 1991, the Salomon brothers were investigated by the SEC for fraud on account of treasury bids. Paul Mozer, a trader on the fixed income trading desk, was guilty of submitting illegal bids on behalf of customers without their knowledge for 3 US treasury security auctions.

This was above the allocated limit of 35% share per single entity, and Paul Mozer was trying to accumulate large positions on individual treasury issues to manipulate prices in their favor.

Note

Upon investigation, it was found that his supervisor, John Meriwether, had knowledge of this activity but had not done anything. John Gutfreud, chairman and CEO, also had knowledge of this.

The SEC ordered then-CEO Gutfreud to send a letter to demand accountability from the board of the Salomon brothers. However, Gutfreud, who did not want to be sacked without a high recourse package, did not deliver this letter.

Shareholders, and the board, only found out about this letter after Gutfreud resigned; the Salomon brothers' crisis was only mitigated after Warren Buffet sought an extension from the SEC, brought the company out of the crisis, and forced a merger with Citigroup.

Conclusion

In conclusion, these kinds of fraud refer to deceptive or unethical practices carried out by individuals or groups within a corporation to gain a competitive advantage or personal gain.

This takes various forms, with its most common including financial statement fraud, insider trading, embezzlement, bribery, and corruption, but it is by no means an extensive list.

The pursuit of excessive profits, pressure to meet financial targets, and a culture of greed within an organization lead to fraud. Corporate fraud schemes can be complex and difficult to detect, often requiring the expertise of forensic accountants to unravel them.

Making the company appear more profitable than it actually is is usually the main reason behind the fraud, as it attracts investors and increases the stock price. It can also involve covering up negligent practices or product flaws to minimize legal consequences.

The implications of these frauds are severe, affecting the organization, its stakeholders, and the overall economy. Each type involves specific fraudulent activities aimed at personal gain or manipulating financial records.

To avoid fraud at a corporate level, companies can implement measures such as conducting regular audits, separating responsibilities, raising awareness about fraud consequences, and establishing clear policies and codes of conduct.

Mitigating fraud risks involves fostering an accountability culture, training employees, performing background checks, and implementing appropriate controls and processes.

Ethical business practices and the need for robust measures to prevent and detect corporate fraud are important. Organizations need to ensure a company is free from fraud to safeguard their reputation and maintain trust in the business community.

or Want to Sign up with your social account?