Federal Discount Rate

The rate at which the Federal Reserve of the United States collects interest on its short-term loans to banks and other institutions.

What Is the Federal Discount Rate?

The Federal Discount Rate is the rate at which the Federal Reserve of the United States collects interest on its short-term loans to banks and other institutions.

A bank has three main actions it can take when someone deposits money, which are:

-

Investing the money

-

Creating loans with the money

-

Holding onto the money

The Federal Reserve sets a reserve requirement: the amount of money they must hold. It is also known as the reserve ratio and is a percentage of the total deposit amount that a bank must have on hand.

If a bank cannot meet this requirement, it can borrow money overnight from another bank, but this lending bank will charge the borrowing bank an interest rate.

If a bank cannot borrow from another commercial bank, it can borrow from the central bank. This is seen as the last resort as the central bank has higher interest rates than other commercial banks.

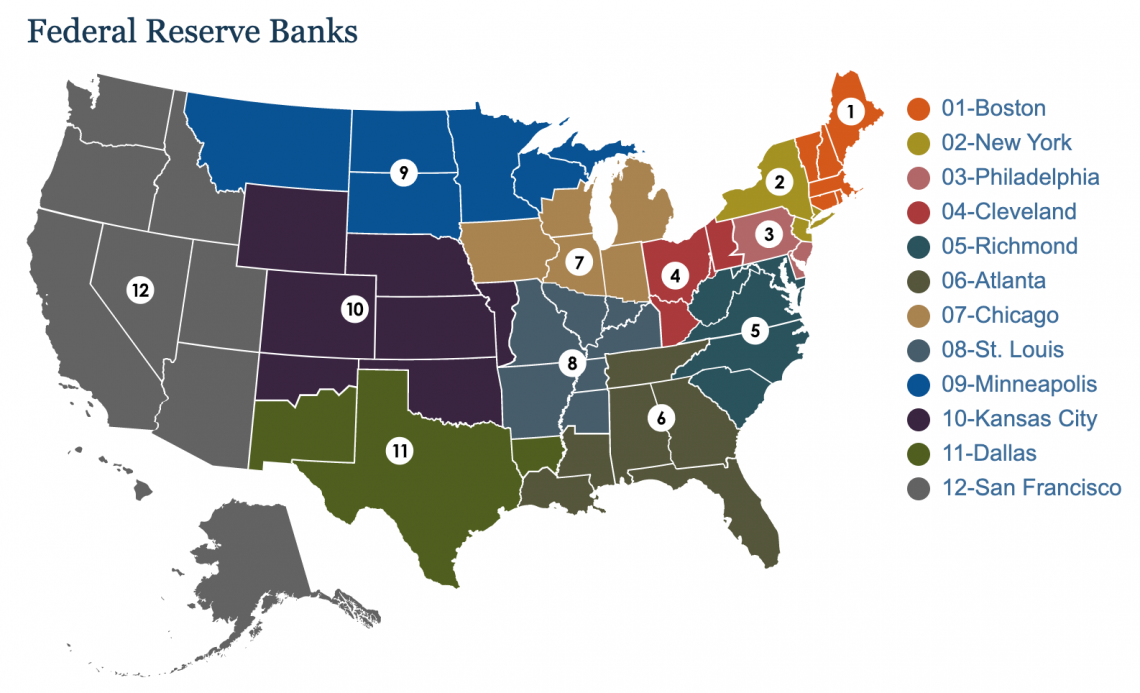

Central bank loans come from the federal discount window, which can be found at any of the 12 regional banks. Their district runs each bank, but they are all connected to the larger central banking system.

Key Takeaways

-

The federal discount rate is the interest rate the Federal Reserve charges commercial banks to borrow money.

-

Banks borrow money to meet the reserve requirement, which is the legal amount of money that a bank must hold.

-

There are three types of rates:

-

Primary for banks in good financial standing.

-

Secondary for banks struggling to be in good financial standing.

-

Seasonal banks have certain times of the year, “seasons,” when they need to borrow more money to meet the requirements of the public.

-

-

The Federal Open Market Committee has three ways to affect monetary policy:

-

Change open market operations

-

Change the reserve requirement

-

Change the discount rate

-

-

The discount rate is not the same as the fed funds rate

-

Discount rate interest a bank pays back when it takes out loans from the central bank.

-

Fed funds rate interest a bank pays back to a lender bank.

-

-

Currently, the discount rate is set to decrease to help guide the American economy away from a recession.

Three Types of Federal Discount Rates

The Federal Reserve has three rates: primary, secondary, and seasonal rates. These rates are explained below.

Primary Rate

Most banks are charged a basic interest rate known as the primary credit rate, which is typically greater than the federal funds rate.

Currently 2.50%

-

Most banks borrow at the primary rate for overnight loans.

-

These banks are in a good financial state.

-

This tends to be higher than the federal funds rate, which is why borrowing from the central bank is the last resort.

Secondary Rate

Charged to banks that don't fulfill the requirements for the primary rate, the secondary credit rate is higher and is usually half a point more.

Currently 3.00%

-

This rate is offered to banks that struggle to maintain a good financial status.

-

This rate is usually .50% higher (or 50 basis points higher) than the primary rate.

Seasonal Rate

Small community banks that require a short-term cash infusion to cover their local borrowing requirements—which could include loans to farmers, students, resorts, and other borrowing activities—are eligible for the seasonal discount rate.

Currently 2.60%

-

This rate is charged to community banks that need extra money to meet the needs of borrowers.

-

A bank with this rate often has an influx of borrowers at certain times of the year and extra money for the season, hence the name.

While the discount rate does not directly affect consumers, a higher discount rate could mean a higher interest rate a person has to pay when they take out loans. Banks do this to pass on the cost of a high interest rate to the customers.

This works as it reduces the number of loans people take out, thus reducing the amount of money available for the public to spend. Thus changing the discount rate can be a helpful tool for changing monetary policy.

The Federal Funds Rate vs. the Federal Discount Rate

The federal funds rate is often confused with the federal discount rate. The Fed Funds rate is the interest rate banks charge each other for overnight loans, whereas the federal discount rate is what the central bank charges commercial banks to take out loans.

As mentioned earlier, banks prefer to borrow money from each other as this comes at a lower cost; primary rates are typically higher than the federal funds rate.

Both of these rates can be used to change the money supply to help during inflationary and recessionary periods. We will explore this idea further in this article.

Currently, the primary rate is 2.50%, and the federal funds rate is 2.25% to 2.50%. Generally, the primary rate is 1%, also known as 100 basis points, higher than the federal funds rate.

While there is not a very large difference between the two, it makes sense. The federal funds rate was increased recently, and the primary rate is expected to increase soon.

The Discount Rate as Monetary Policy

The Federal Open Market Committee (FOMC) is a part of the Federal Reserve and controls the discount rate.

The U.S. is split into 12 geographical areas based on trade lines from the 1910s. Each district is overseen by a president who reports to the Federal Open Market Committee. In addition, each district has a Fed bank, which is where banks can borrow money.

The FOMC consists of twelve members; the Board of Governors, the president of the Federal Reserve Bank of New York, and four presidents of other Federal Reserve Districts that change yearly. This group meets eight times per year to discuss monetary policy.

The FOMC can affect monetary policies by changing three different things:

-

Open market operations

-

The reserve requirement

-

The federal discount rate

Open market operations are when the government buys or sells treasuries and securities to change the money supply. This is the most common type of monetary policy action.

The reserve requirement can be increased or decreased to help banks increase or decrease the number of loans they can make.

Lowering the reserve requirement can help during a recessionary period as it increases the number of loans a bank can make, which increases the money supply.

Conversely, increasing the reserve requirement can help during an inflationary period because it reduces the number of loans a bank can make, which contracts the money supply.

Changing the federal discount rate will also affect the money supply. During inflationary periods the FOMC may choose to increase the discount rate, which makes it more expensive for banks to borrow money. This reduces the amount of money they can lend out and decreases the monetary supply.

On the other hand, the FOMC can choose to decrease the discount rate to make borrowing money cheaper. This helps stimulate economic growth during a recessionary period because it increases the number of loans a bank can now make.

Example 1: Analyzing Pre-COVID-19 Rates and the Current Discount Rate

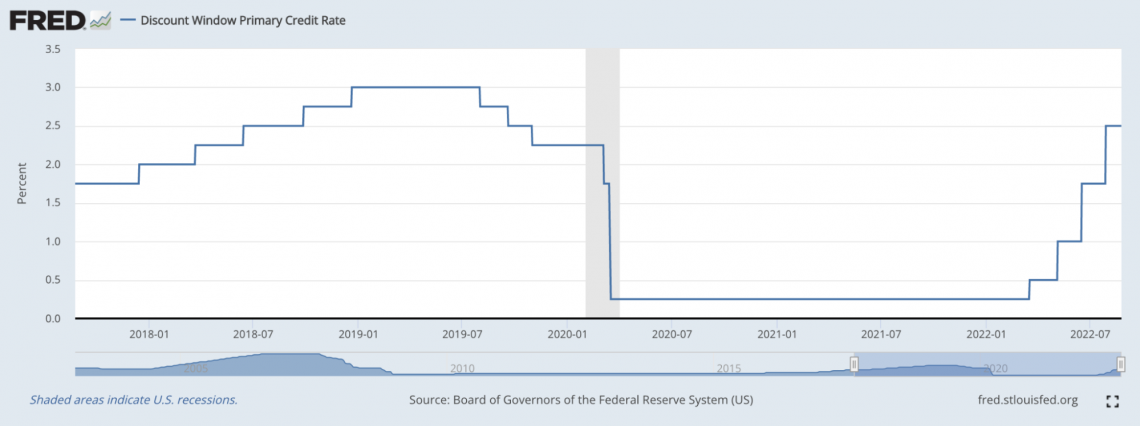

First, let us look at the primary credit rates from pre-COVID-19 times.

Before COVID-19, the federal discount rate was slowly increasing as there was appropriate economic growth, even as inflation was expected to rise.

By increasing the discount rate, banks are discouraged from borrowing money, so they will make sure they meet their reserve requirement. This means they will loan out less to ensure they do not have to pay for an overnight loan.

In the latter months of 2019, economic growth was not as strong as expected, so the FOMC decided to lower the discount rate. This reduction would encourage banks to make more loans and boost consumer spending.

During the COVID-19 recession, the discount rate dropped by 2% to near zero. This drop was necessary as, during the recession, consumer spending dropped greatly, and the economy was in turmoil.

By dropping the discount rate, banks made more loans, and people increased their spending. This helped consumers meet their needs and helped the economy suffer less.

When the economy returned to lower unemployment levels and began producing at pre-COVID-19 levels, the FOMC increased the discount rate.

The discount rate has been raised in high increments in the past few months as a contractionary policy to help curb inflation.

In January 2022, inflation was 7.5%, which led to a peak at 9.1% in June and has begun dropping since. These figures are high compared to the target inflation rate of 2%.

The Federal Open Market Committee has also increased the federal funds rate to help with inflation, which will also help reduce inflation.

Example 2: Analyzing Great Recession Discount Rates

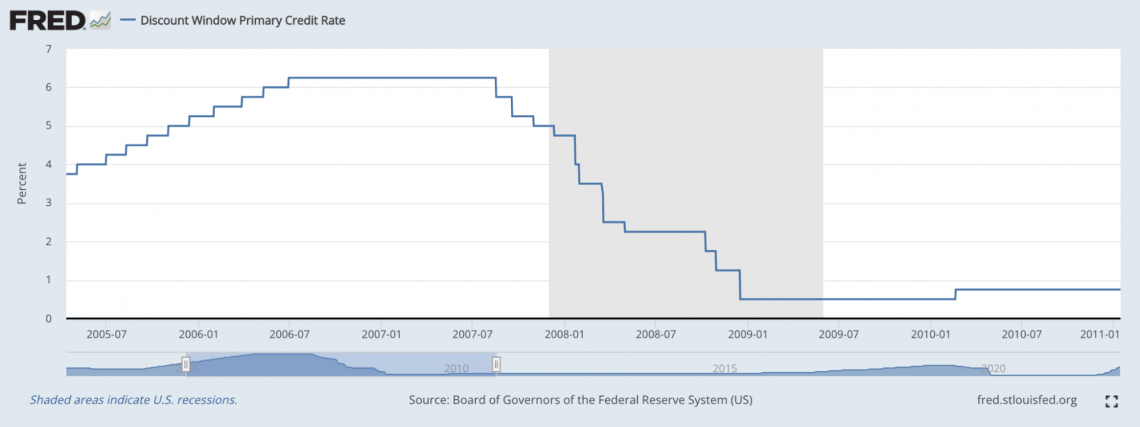

We can also analyze the discount rates surrounding the Great Recession.

This recession was caused by the housing bubble bursting. Before the recession, the economy was considered to be very strong. However, it was not strong as many people invested in bundles containing weak mortgages.

We can see the increase in the primary credit rate up to 6.25%, used to help slow economic growth. Then, it dropped to .5% during the Great Recession to help stimulate growth and help banks recover from the mess.

The American economy is said to have taken years to recover from the recession. For example, unemployment only returned to the pre-recessionary 5% in 2015, and the average American median income only recovered in 2016.

The discount rate stayed at .75% until the end of 2015 when it increased to 1.00% by the end of 2016. After that, the FOMC decided to keep the discount rates low to help bring the economy back to its pre-recession state.

The gradual discount rate increase during this time was important; as its name implies, the Great Recession was one of the worst recessions in American history, only second to the Great Depression from 1929 to 1939.

The United States got out of the Great Depression with big reforms from the New Deal and World War II, which created job opportunities for many Americans. However, one of the causes of the Great Depression was the gold standard, and the U.S. only abandoned this in 1971.

Researched and authored by Divya Ananth | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?