Financial Modelers’ Manifesto

A collection of concepts and suggestions to advance the financial modeling industry.

What is the Financial Modelers’ Manifesto?

The Financial Modelers Manifesto is a collection of concepts and suggestions to advance the financial modeling industry. Financial modelers can better improve their skills by sticking to the recommended requirements.

The policy was initially presented in response to the 2008 financial crisis. Before getting into the manifesto guidelines, reviewing the two authors, well-respected financial engineers in the quantitative finance industry is important.

Paul Wilmott and Emanuel Derman have written numerous articles on human error and its impact on financial models. Stating that as financial tools develop, so do how people respond to them.

Financial modeling is a very important tool used in the financial industry; it is used to make informed investment decisions and assess the potential risks and returns of financial instruments.

NOTE

The increasing reliance on these models makes it important to ensure they are accurate, reliable, and transparent.

The Financial Modelers Manifesto looks for ways to address the concerns regarding financial models, such as the lack of transparency, and is conducted ethically and responsibly. The manifesto consists of many principles and guidelines for financial modelers.

It is important to remember that the Financial Modelers Manifesto is voluntary, and its principles are not legally binding. However, the principles are recognized in finance and used as a checklist for best practices to help financial professionals create reliable models.

Key Takeaways

- The Financial Modelers Manifesto is a collection of concepts and suggestions to advance the financial modeling industry. Financial modelers can better improve their skills by sticking to the recommended requirements.

- In today's data-driven world, financial models help companies obtain valuable insight into their performance and the overall market. Financial models are used by both inside executives and outside parties who wish to analyze a business.

- Financial modeling is one of the most highly valued yet misunderstood skills in financial analysis.

- The main objective of financial modeling is to combine fundamental accounting and financial practices into metrics that can be used to project a company's future performance.

- Several best practices should be followed when creating and using financial models. Understanding these practices and the purpose of a model is the key to creating an optimal structure.

- The Financial Modelers Manifesto is sometimes called the “Hippocratic oath” of financial modeling because it sets forth principles for ethical behavior among financial modelers.

Before the financial Modelers’ Manifesto

Paul Wilmott is a successful individual in the quantitative finance industry. He holds a Ph.D. in mathematical finance from the University of Oxford. He is also the founder of Wilmott, a website and consulting company dedicated to helping people in quantitative finance.

In addition to his consulting and writing work, Wilmott is heavily known for his public speaking ability. He has given many presentations at financial press conferences. Furthermore, he has taught many courses regarding quantitative finance at several universities.

Wilmott’s articles are used within the mathematical finance industry, as they provide a great introduction to topics covered in quantitative finance, such as derivatives, risk management, and mathematical modeling.

Emanuel Derman is a South African physicist, financial engineer, and professor at Columbia University. He is also known for his work in the field of quantitative finance, more specifically in developing mathematical models used to price financial derivatives.

He is the co-author of a book called “Models.Behaving.Badly: Why Confusing Illusion with Reality Can Lead to Disaster, on Wall Street, and in Life.” He is a former quantitative analyst at Goldman Sachs and a co-creator of the Black-Derman-Toy Model.

NOTE

The Black-Derman-Toy model is one of the first interest rate models used in pricing interest rate derivatives.

Emanuel Derman is an important figure in quantitative finance. He has made significant contributions to the development of mathematical models, and his ability to explain complex concepts in an easy and accessible way has made him a much-needed author for the manifesto.

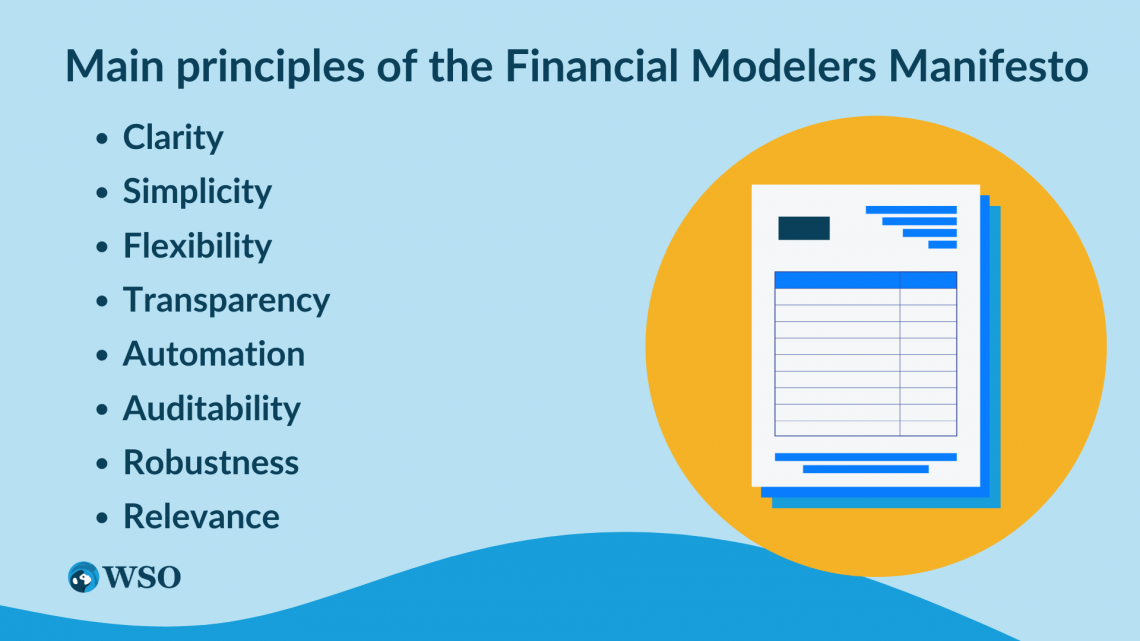

Main principles of the financial Modelers Manifesto

The financial modelers’ manifesto is a set of principles and guidelines used to create financial models that are accurate, transparent, and easy to use.

The main principles of the Manifesto include

- Clarity: The model must be easily understood and communicate the assumptions and calculations to forecast future projections. This can be done by color-coding the financial model.

- Simplicity: It should be as simple as possible while accurately representing the problem. This can take the form of how a modeler breaks down certain statements.

- Flexibility: It should be flexible and easy to update as new information becomes available. This can be done by linking statements so that when one thing changes that affects the other statements, they all change accordingly.

- Transparency: The model should be transparent and open to review, documenting all assumptions and calculations. This is usually done with spreadsheet software that shows any changes made to a spreadsheet.

- Automation: The model should be automated as much as possible to minimize errors and increase efficiency. This can be built using third-party data providers such as Capital IQ.

- Auditability: It should be auditable, with clear documentation and traceability of inputs, calculations, and outputs.

- Robustness: The model should be robust and handle different scenarios and sensitivities. The best way to test the robustness of a model is by using an Excel feature called sensitivity analysis.

- Relevance: The model should be relevant to the problem it is trying to solve and provide actionable insights. For example, a DCF model should not be used when a company’s leveraged buyout occurs.

- The manifesto mentions the importance of testing a model to add to the abovementioned main principles. As mentioned, this includes performing sensitivity analysis and running historical simulations to ensure the model’s outputs align with historical data.

NOTE

The modeler should strive to improve their skill set and knowledge through professional development and stay up-to-date with industry standards and best practices.

Lastly, the manifesto believes that it is important to seek continuous improvement. The model should always be improved, and the financial professionals who create the model should stay up to date with industry trends and modeling practices.

What is financial modeling?

Financial modeling is one of the most highly valued yet misunderstood skills in financial analysis. The main objective of financial modeling is to combine fundamental accounting and financial practices into metrics that can be used to project a company's future performance.

The financial modeling procedure usually involves using spreadsheet software, such as Microsoft Excel, and a large knowledge base of accounting, financial, and business techniques.

A financial model is a forecast of future performance based on historical data. It requires the preparation of the Income Statement, Balance Sheet, Cash Flow Statement, and supporting schedules.

NOTE

Financial models are used in several industries, such as investment banking, corporate finance, and financial analysis.

Financial models in investment banking depend highly on the industry being analyzed and the group managing the task. For example, the leveraged finance group within an investment bank will use LBO models, while an M&A group focuses on M&A models.

NOTE

Financial modeling requires an understanding of financial theory, accounting, and mathematics and the technical ability to use spreadsheet tools.

Why is financial modeling important?

In today's world, financial models are implemented to help companies better understand forecasted future cash flows, revenue, and expenses. In addition, financial models allow the management within a company, analysts, and investors to get a better picture of a company.

The most important factor regarding financial modeling is the ability to use scenario analysis. This way, companies can test the different macro and microeconomic scenarios to see better how they should deal with such issues should they arise.

Example

For instance, a company will utilize a financial model to test how a change in interest rate decisions issued by the Federal Reserve will affect the company's bottom line. This analysis will help companies take advantage of opportunities and avoid unnecessary risks.

Financial modeling is beneficial for capital budgeting. It helps companies determine the cost of capital and the best financing choice for the business's future. This can include debt or equity financing or a mixture of both.

Lastly, financial modeling can help companies navigate the complicated mergers and acquisitions process. This is done by forecasting the value of assets and liabilities while simultaneously evaluating the returns from those assets to give a fair value to a business.

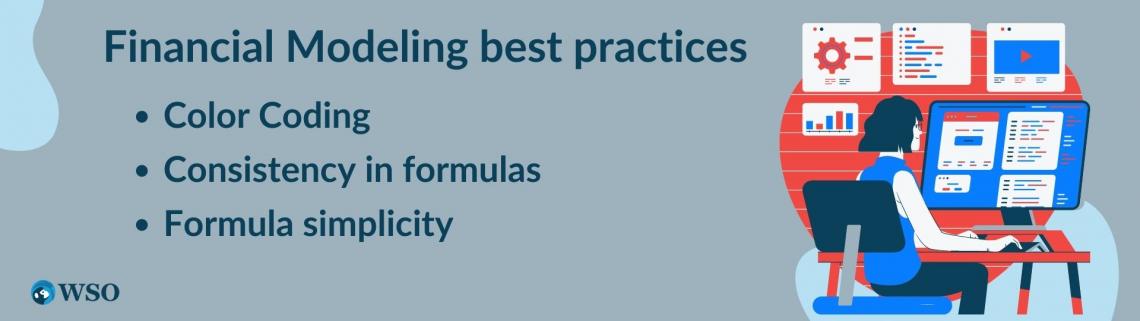

Financial modeling best practices

Several best practices should be followed when creating and using financial models. Understanding these practices and the purpose of a model is the key to creating an optimal structure.

Before speaking of the best practices, it is important to become familiar with the overall structure of a financial model. These structures include:

- Granularity: Granularity refers to how detailed a model needs to be. The more granular a model needs to be, the more complex it will be, making it more difficult to understand.

- Flexibility: A model's flexibility is based on how often it will be used, how many people will use it, and for how many uses. For example, a model created for a single transaction will be far less flexible than a model used repeatedly, such as a template.

- Presentability: Regardless of the previous two, a model is primarily used to aid decision-making. That said, all models must have clearly defined inputs and presentable outputs. An effective model will allow individuals to present information in various ways.

- Now that we have described the overall structure of a financial model, let us look into the best practices regarding financial models.

- Color Coding: Financial models are typically divided into multiple color schemes based on formulas, hard-coded numbers, and links. It can be a time-consuming task. However, third-party software can make the process much easier.

- Consistency in formulas: A financial professional should look to avoid partial inputs. Partial inputs are when a hard-coded number is embedded into a cell reference. This is dangerous because, most of the time, you will forget that there is an assumption inside a formula.

- Furthermore, each row should have its separate calculation. Like most models, they are started with historical information on the left and estimates on the right. The formulas across the forecasted columns should be consistent along the rows.

- Formula simplicity: While many may have the temptation to create a complex formula, it is far better to keep it simple. The reason is that no one will understand it, even the author, after some time away. Furthermore, a complicated formula can usually be broken down using more cells.

- Now that we have described the overall structure of a financial model, let us look into the best practices regarding financial models.

NOTE

Organizations need a team of financial professionals skilled in financial modeling and understanding the best practices for creating and using financial models.

The modelers' Hippocratic Oath

The Financial Modelers Manifesto is sometimes called the “Hippocratic oath” of financial modeling because it sets forth principles for ethical behavior among financial modelers.

The Hippocratic Oath is a code of ethics for medical pros, in which they pledge to “do no harm” and to use their skills to benefit their patients. Similarly, the manifesto is a code of ethics for financial pros to using their skills to benefit their clients and the financial system.

The comparison to the Hippocratic Oath emphasizes the importance of ethics in financial modeling and that financial modelers must use their skills and knowledge responsibly and ethically.

In the Financial Modelers Manifesto, Wilmott and Derman outline a Hippocratic Oath that they believe will encourage financial modelers to use as a guide to help prevent misunderstandings. The Modelers’ Hippocratic Oath reads:

- “I will remember that I didn’t make the world, which doesn’t satisfy my equations.”

- “Though I will use models boldly to estimate value, I will not be overly impressed by mathematics.”

- “I understand that my work may have enormous effects on society and the economy, many beyond my comprehension.”

- “Nor will I give the people who use my model false comfort about its accuracy. Instead, I will make explicit its assumptions and oversights.”

- “I will never sacrifice reality for elegance without explaining why I have done so.”

Reviewed and edited by Parul Gupta | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?