Profitability Ratios

Financial metrics that analysts and accountants use for analysis to help measure and analyze the company’s ability to generate returns for its shareholders.

What Are Profitability Ratios?

Profitability ratios refer to those financial metrics that analysts and accountants use for ratio analysis that help measure and analyze the company’s ability to generate returns for its shareholders during a specific accounting period.

Generally, the returns generated for the shareholders are measured against the income generated from revenues from the sale of goods, assets on the firm's balance sheet, operating expenses, and the changes in shareholder's equity.

These ratios help to indicate how well the company has used its assets and other financial resources to generate profits and positive returns for its shareholders.

A high ratio is desired by the firm and its shareholders, as a higher ratio indicates that the firm is performing well in the market and is generating significant value and return to its investors.

Professionals can thoroughly use these ratios to analyze the firm's performance, as these ratios are most valuable when they compare the firm's current and past performance against the competitor's performance.

Higher ratios than the competitor's ratio or a stable ratio for the past few years indicate that the firm is financially sound and is performing well in the market.

Accountants' most common profitability ratios are gross profit margin, EBITDA margin ratio, operating and net profit margin ratio, return on assets, return on equity, and investment capital.

Categories of Profitability Ratios

Accountants use different profitability ratios to measure the organization's financial performance and financial stability.

These ratios can be classified into two categories which are explained as follows:

1. Margin Ratios:

Margin ratios are those kinds of profitability ratios that aim to measure the organization's ability to convert its revenue generated from the sale of goods into profits at different intervals in an accounting year.

The most commonly used margin ratios to measure a firm's profitability are gross margin, operating profit margin, net profit margin, operating expense ratio, EBITDA and EBIT ratio, and cash flow margin ratio.

2. Return Ratios:

Return ratios are those kinds of profitability ratios that aim to measure the ability of the company to generate returns and value for the shareholders in a given accounting year.

Some of the most commonly used return ratios to measure the company's profitability are return on assets, return on equity, return on debt, return on invested capital, return on capital employed, and risk-adjusted return.

Accountants use more than one type of ratio, i.e., a mixture of margin and return ratios, to analyze a company's profitability while preparing the financial statements at the end of the accounting year.

Profitability Ratio: Gross Margin Ratio

The gross margin ratio, commonly known as the gross profit margin ratio, is a profitability ratio that measures the firm's gross margin in relation to its sales. This ratio indicates the firm's income from sales after deducting the cost of goods sold.

The gross profit ratio yields the percentage or the dollar amount that the firm retains as its gross profit after deducting the value of the cost of goods sold from the revenues.

This ratio also reflects the ability of the firm to sell its inventory at a profit. Thus the ratio should be high to be favorable for the company. In addition, a higher ratio implies that the firm can sell its inventory at a higher margin than its competitors.

The formula for the ratio can be expressed as follows:

![]()

The firm can achieve a higher ratio if it purchases the inventory at a meager cost. This implies that the firm receives a purchase discount, leading to a lower value of the cost of goods sold, or the firm's selling price is high, thereby increasing the total revenue.

For example, let us consider Company X, which acquired goods worth $150,000 from Company Y. At the end of the accounting period, Company X sold the goods for $245,000. Therefore, the gross profit margin ratio at the end of the year can be calculated as follows:

![]()

Profitability Ratio: Net Profit Margin Ratio

Net profit margin, also referred to as net margin, is one of the profitability ratios that aims to measure the percentage of revenues converted into profit after deducting all expenses and taxes.

In simple words, this ratio measures the amount of net income the business generates per dollar revenue. Accountants mainly use this ratio to forecast the predicted profitability of future years based on the current year's results.

This ratio helps to see the percentage of revenues used by operating expenses and the portion of funds remaining for the shareholders to receive or be reinvested in the business.

A company should always aim for a higher net margin as a higher ratio indicates that the firm can convert its sales amounts into profits.

A lower profit margin indicates that the firm faces extensive competition in the market, has lower bargaining power, and has an inefficient cost base used in the organization.

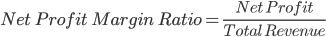

The formula for the ratio can be expressed as follows:

Consider Company X, which reported a net profit (after making all deductions) of $75,000. The company generated a revenue of $200,000. In this case, the ratio at the end of the year can be calculated as follows:

Profitability Ratio: Operating Expense Ratio

The operating expense ratio is a profitability ratio used by accountants to measure the ratio between the firm's operating expenses and revenues. Operating expenses are those the firm incurs to conduct day-to-day activities.

This profitability ratio is most commonly used in the real estate industry, where analysts try to judge a property's operating costs by analyzing the income generated from the particular property.

A higher operating expense ratio implies that the firm has more operating expenses in relation to revenue generated by the firm. Thus, a lower operating expense ratio is always preferred by investors as it implies that the firm incurs fewer costs and is more efficient.

The formula for the ratio can be expressed as follows:

For example, let us consider Company X with operating expenses totaling up to $20,000 and total revenue for the year to be $180,000. The operating expense ratio, in this case, can be calculated as follows:

![]()

The operating expense ratio should be as low as possible since a lower ratio implies that the company is performing well and that no significant portion of revenue is used to pay the expenses. As a result, investors always prefer a lower ratio in the long run.

Profitability Ratio: EBITDA Margin Ratio

EBITDA refers to the firm's earnings before interest, tax, depreciation, and amortization expenses. The EBITDA margin ratio measures the efficiency with which the company converts its revenue to EBITDA.

Analysts use this ratio to compare the current year's performance with the performance of preceding years and also to draw comparisons of the firm's performance with the performance of its competitors.

Investors always prefer a higher EBITDA margin, as companies with higher ratios tend to be more efficient. This significantly increases the company's chances to gain competitive advantages and earn higher profits in the long run.

A lower ratio can negatively influence investors as this implies that the firm's business model is flawed. For example, the firm's business model comprises inefficient sales and promotional techniques, a wrong target market, and inefficient use of resources.

The formula for the ratio can be expressed as follows:

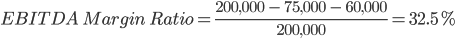

For example, let us consider Company X reported revenue of $200,000, cost of goods sold of $75,000, and operating expenses worth $60,000. The EBITDA margin ratio, in this case, will be calculated as follows:

However, one should know how to distinguish the EBITDA margin ratio from the operating ratio, as the operating ratio considers the earnings before interest and tax (EBIT). In contrast, this ratio measures the effect of depreciation and amortization expenses.

Profitability Ratio: Return on Equity

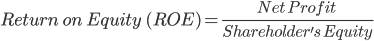

Return on equity, also known as ROE, is one of the most widely used profitability ratios by investors and analysts. This ratio indicates the ability of the firm to generate return and value for its shareholders.

In simple words, this ratio measures the amount of profit generated per dollar of common equity. It also helps indicate the effectiveness of the management in dealing with equity finances to fund regular operations and thereby instill growth in the company.

Since this ratio is based on the investor's point of view, a higher ratio value is always preferred. A higher ratio indicates that the firm uses its funds efficiently and effectively, whereas a lower ratio suggests lower returns for the investor.

Moreover, these ratios can also be used to see how the firm has progressed over the years. As a result, the ratio helps to draw comparisons with past performances and can also be used to compare the performance of firms operating in similar industries.

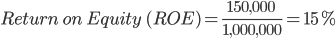

Company X reported a net profit of $150,000, and the value of shareholders' equity at the end of the accounting period was $1,000,000.

You can calculate the return on equity at the end of the reporting period as follows:

Profitability Ratio: Return on Assets Ratio

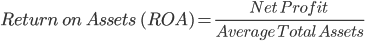

Return on assets, often known as return on total assets, is one of the profitability ratios that help measure the total net income generated by utilizing all organization assets.

This ratio, in simple words, measures how efficiently the firm can use its assets to generate profits and returns for the investors. The firm's accountants and investors use this ratio to see how efficiently it uses its assets.

A higher return on assets ratio is always preferred by investors as it shows that the company is more efficient and effective in utilizing its assets to generate income for the shareholders. In addition, a positive ratio also indicates an upward-sloping curve for the firm's profit.

Moreover, analysts and accountants can use this ratio to draw comparisons between the performance of firms that are engaged in the same industry and also helps to see the performance progress of the firm from previous years.

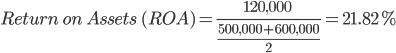

The formula of the ratio can be expressed as follows:

For example, consider Company X reported a net profit of $120,000, an opening balance of assets worth $500,000, and a closing balance of $600,000. Return on assets, in this case, is equal to:

Profitability Ratio: Return on Capital Employed

Return on capital employed is a crucial profitability ratio that analysts use to indicate how efficiently the firm can generate returns for its investors by utilizing its employed capital. This ratio thus compares the net income with the capital employed.

This ratio indicates the dollar profits generated per dollar value of capital employed. This ratio is mainly used for long-term analysis as it shows the efficiency with which the firm uses assets and financial sources.

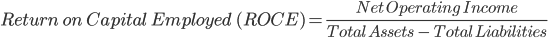

The formula for the ratio can be expressed as follows:

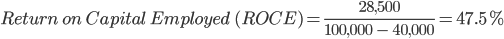

Let us consider Company X, with assets worth $100,000 and liabilities worth $40,000. The company reported a net operating profit of $28,500. Therefore, you can calculate the return on capital Employed in this case as follows:

All players in the market always favor a higher ratio as a higher ratio indicates that the firm uses its resources efficiently and thereby generates higher returns per dollar value of capital employed.

On the other hand, a lower return on capital employed indicates inefficiency in the organization's functioning. It implies that the firm needs to use its resources more efficiently to generate returns for the investors.

Researched and authored by Mehul Taparia | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?