The Importance of Cash Flow Optimization

Cash flow optimization maximizes the free cash flow of your business

What Is Cash Flow Optimization?

The process of boosting cash inflows, decreasing cash outflows, and optimizing the timing of financial flows is known as cash flow optimization. It is a crucial component of financial management that enables companies to keep a healthy cash flow balance and make sure they have enough cash on hand to cover their obligations and achieve their objectives.

The goal of cash flow optimization is to make sure a company has the money it needs to run effectively and expand. To find areas where cash flow can be improved, it entails analyzing the cash inflow and outflow from operating activities, investment activities, and financing activities.

For organizations to manage their cash flows, cash flow optimization is a crucial procedure.

No business model works without cash. It’s what pays a company’s bills, supports its employees, and provides a safety net against liquidation crises. This is why efficient cash management and cash flow optimization are essential for all businesses.

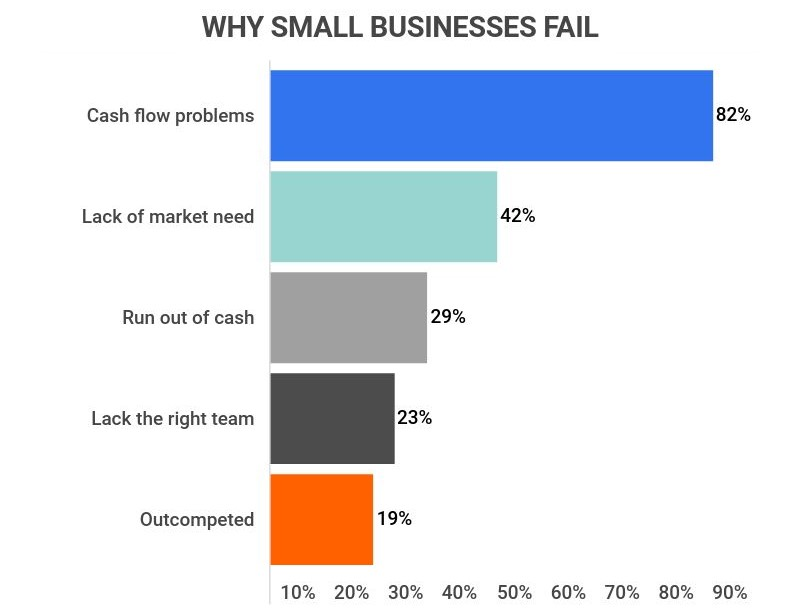

Small businesses form a huge section of the US economy and provide 61.2 million jobs, which is almost half the nation’s total workforce. So it may surprise you to hear that the most significant factor in why a small business fails is due to cash (see chart below).

It’s clear that misunderstanding cash flow can have serious consequences for a business. This is why we’ve made this guide explaining the importance of cash flow optimization—by the end of this article, you’ll know how to calculate cash flow and manage it effectively.

What is cash flow?

Cash flow is all the money moving in and out of your business. Positive cash flow means you’re making more money than you’re putting in, and vice versa for negative cash flow.

Sudden shortages can cause an unexpected hit to your business’s financial health, while a windfall can provide a helpful boost. However, even a windfall can lead to financial disaster if that cash isn’t managed properly.

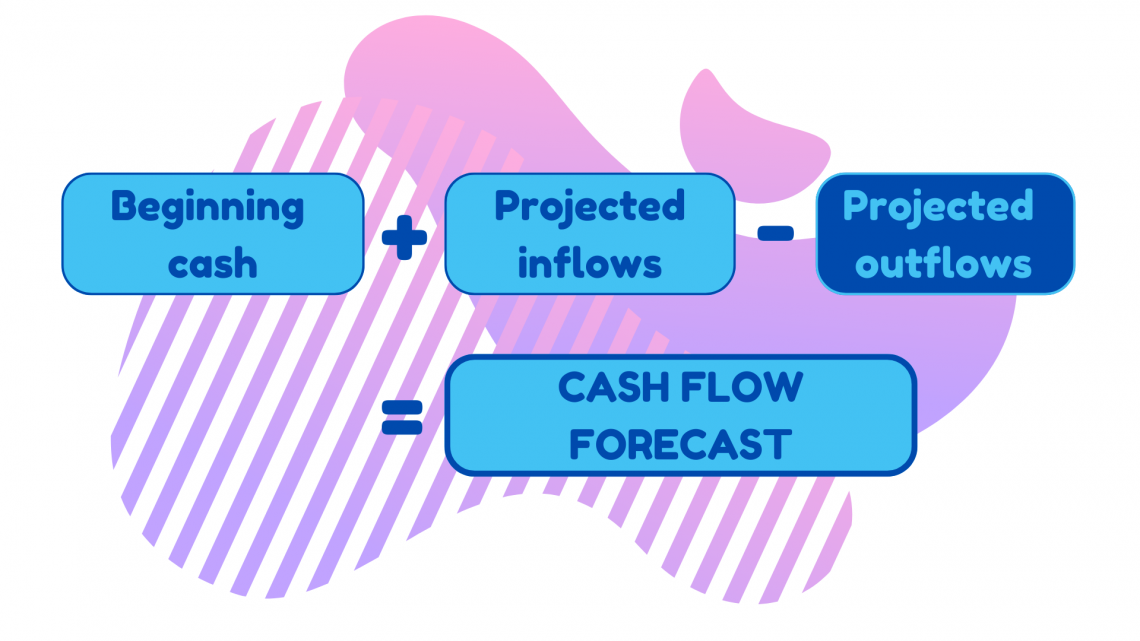

A cash flow forecast sets out all your regular income and outgoing cash amounts, along with exactly when they’re due. They provide knowledge and security in the face of unexpected challenges and help you form a roadmap back to normality.

Case study

For example, let’s say your company just signed up for a new small business phone system - the bill for this service is due in 10 days. But unfortunately, there isn’t enough liquid cash in the company account to cover it.

However, by looking at your cash flow forecast, you find that you have a client invoice coming in just five days. This incoming cash will be in your account by the time the phone bill arrives, which keeps your account out of the red. You can then put the next bill in the cash flow forecast so that it is anticipated in your outgoings for that month.

Cash vs. Capital

When people talk about company finances, both the terms’ cash’ and ‘capital’ get thrown around a lot, and learning what accounting terms mean is always tricky. But what is the difference between them, and why does it matter?

Working capital indicates a company’s short-term financial health, whereas cash and cash equivalents are what the company uses to pay its bills. Capital also includes assets like office buildings and technology (e.g., servers) that have value but aren’t liquidated.

This means that a company can have a high net worth (made up of its non-liquidated assets) but have relatively little cash, which often leads to financial mistakes. Cash flow management ensures that you have enough liquid cash to cover expenses and separates cash from other assets.

How cash flow optimization can help your business

Cash flow optimization maximizes the free cash flow of your business, which gives you more capital to reinvest in the company and distribute to stakeholders.

Effective cash management ensures that there is enough liquid capital to cover company expenses. The most successful businesses use cash flow forecasting to anticipate changes in their company’s financial health and adapt their strategy accordingly.

Keeping track of where your cash is going and, most importantly, when you’re getting paid back is the best practice to prevent business bankruptcy.

Best practices for managing cash

Cash flow optimization relies on several different cash management strategies, all working together. We’ve selected five of the best practices for cash management to explain how they can help optimize cash flow and build a healthier cash flow forecast.

Track all bills and balance statements

Every incoming and outgoing payment will be tracked on your company’s bank statement, including money spent on your business credit card. Therefore, it is very important to download or print copies of these statements for your financial records.

After all, how can you optimize cash flow without knowing how much cash is coming in and out each month? Being able to view each and every transaction also makes it easier to spot any unusual or unauthorized activity.

Conduct regular reviews and audits

Regular audits check that your financial records accurately represent your business transactions. They are conducted by an external organization so that the audit comes from an objective, unbiased source.

Second opinions are always useful, so make use of audits to double-check that all the company finances are running smoothly. If you are a new business owner who hasn’t requested an audit before, it may be helpful to look at an audit proposal template so you know what to expect.

Reviews, on the other hand, can be done internally. Make time every week for a meeting with your finance/accounting team so that everyone stays updated on the company’s cash flow. If you’re unsure of any accounting terminology used by your accounting team, it’s advisable to search “what accounting terms mean” online to find out more.

A small business VoIP phone system can make the process of having a meeting with your finance/accounting team more straightforward by allowing team members to join the meeting remotely.

Make use of FinOps

Your financial strategies need to keep up with technological changes in the current digital landscape. Financial Operations (known as FinOps) is a groundbreaking new way of applying cloud technology to help businesses scale their financial processes.

FinOps and other cloud services are fantastic tools for optimizing cash flow if you are a small business looking to expand or a company that is currently growing rapidly.

Have a watertight invoicing process

Invoices act like receipts or bills for clients that show how much they need to pay for your services. There are two types of invoicing: before payment and after payment. ‘Before payment’ invoices are a request for payment by a certain deadline, while ‘after payment’ invoices are proof that a payment has been made.

Both types can benefit from an automated invoice process. Automation reduces operating costs, minimizes errors, and frees up employee time for other essential tasks.

Shop around to find the best deals

Business cash flow is much more likely to hit negative values if you’re paying more than you need to for a service. Even a small business relies on various services (rented office space, a phone system, broadband, etc.) that can add up to a large chunk of your outgoing cash flow.

Shopping around is generally good practice, but especially for optimizing cash flow. For example, let’s say you currently use Phone.com as your business communications system. If you need to cut costs, try looking for a Phone.com alternative that is better suited to your budget. Little changes here and there can make a big difference in reducing operating costs!

The cash flow forecast

Now that we’ve established what cash flow is and why it’s important, it’s time to discuss how to forecast it. The first step is deciding how far ahead you want the forecast to go; the further ahead you predict, the less accurate it may be. Most cash flow forecasts cover 12 or 18-month periods.

A cash flow forecast can be just one part of a company’s financial management. The cash flow statement is considered alongside balance sheets and income statements to form what’s known as the 3-Statement Financial Model.

Direct and indirect methods

All cash flow forecasts have the same goal, but there are two ways to make one: the direct and indirect methods. Both have advantages and disadvantages, but part of cash flow optimization is knowing which is best for your business.

The direct method of forecasting predicts cash flow from known income and outgoings. Simply subtract cash payments from cash receipts, and that’s all you need for a direct cash flow forecast. These values will come from your profit and loss statements, so ensure you keep track of those.

This method is highly accurate in the short term but mostly uses guesswork for further in the future. Direct cash flow forecasts include tax and interest amounts and can sometimes group credit and cash together.

These downsides mean that most businesses use the indirect method for cash flow forecasting instead. The indirect method is the better choice for long-term insights, as it shows cash variance over time.

Calculating cash flow

The calculation needed for a cash flow forecast is vital to get right but, luckily, very simple to learn. You don’t need any analytics and data science qualifications to get started, just a calculator. It’s as easy as subtracting the outgoing cash from your existing liquid capital and projected earnings:

If you end up with a positive value, the business has a positive cash flow for the forecast period, which means you have the free cash flow to reinvest. However, a negative value might mean that you have to take a loan or liquidate assets to cover the remaining costs.

Track these values in a spreadsheet using software like Microsoft Excel or Google Sheets. There are even Excel financial modeling templates available online to make the process easier.

Summary

Cash flow optimization is an essential skill for businesses of any size. It contributes to overall financial health and means that you’re better prepared for any unexpected events (good or bad!) that come your way.

In summary, these are the best practices for managing cash and optimizing cash flow:

- Use a cash flow forecast

- Keep records of all balance statements

- Integrate FinOps to help your finances scale up

- Automate the invoicing process

- Conduct regular reviews and audits

These strategies will promote positive cash flow and help protect your business from bankruptcy and shortages. Good luck!

Grace Lau - Director of Growth Content, Dialpad

Grace Lau is the Director of Growth Content at Dialpad, an AI-powered communication platform providing cloud collaboration solutions for better and easier team collaboration through products like Dialpad’s virtual call center software. She has over 10 years of experience in content writing and strategy. Currently, she is responsible for leading branded and editorial content strategies and partnering with SEO and Ops teams to build and nurture content. Grace has also written for other domains, such as VMblog and nTask. Here is her LinkedIn.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?